|

John,

Tax cuts for the rich exacerbate income and wealth inequality. They also exacerbate the racial wealth gap.

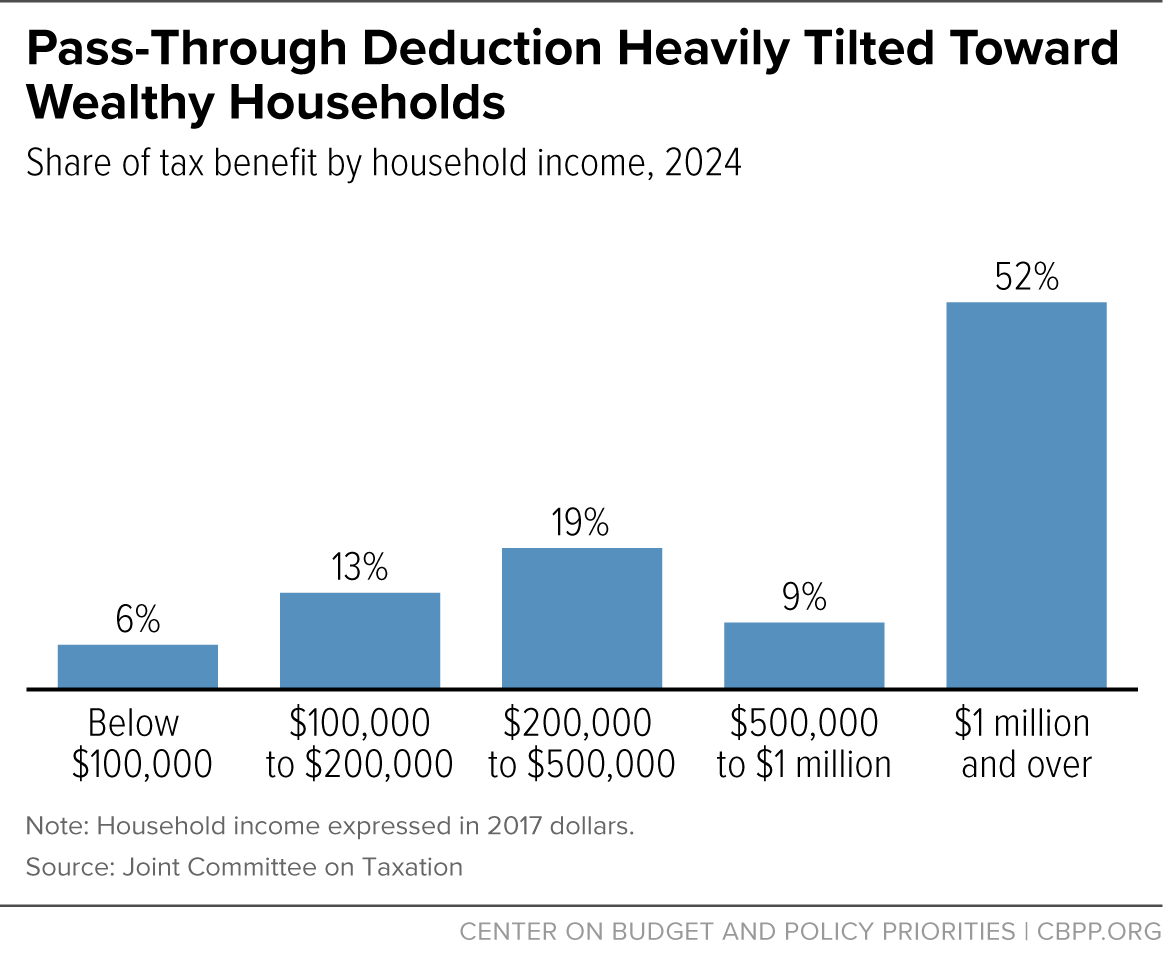

The U.S. Treasury Department estimates that 90% of one of the worst elements of the Trump-GOP tax scam―the pass-through loophole―goes to white households.[1] But that’s not all. More than 50% of that loophole goes to households earning $1 million or more in a single year.[2]

Thankfully, the pass-through loophole is set to expire next year. But Trump and congressional Republicans are seeking to renew the loophole, which would cost the federal government over $700 billion in lost tax revenue over the next decade. Thankfully, the pass-through loophole is set to expire next year. But Trump and congressional Republicans are seeking to renew the loophole, which would cost the federal government over $700 billion in lost tax revenue over the next decade.

That’s money that could be used to improve education and healthcare. Specifically, it’s enough money to provide free preschool for all 4-year-olds and expanded childcare for 16 million kids for 10 years.

Join our fight demanding Congress let the pass-through loophole expire in 2025. Add your name today!

Donald Trump and congressional Republicans are seeking to double-down on their 2017 tax scam, which benefits the rich and powerful at the expense of working families. We’re fighting back, demanding the wealthy and corporations pay their fair share in taxes.

Thank you for taking action today,

John Foti

Legislative Director

Americans for Tax Fairness Action Fund

[1] Trump-GOP Tax Law Closeup: Let The Skewed-To-The-Rich Pass-Through Loophole Expire

[2] The Pass-Through Deduction Is Skewed to the Rich, Costly, and Failed to Deliver on Its Promises

John,

With portions of the Trump-GOP tax scam set to expire next year, and Donald Trump promising his billionaire and corporate donors that he’ll keep their taxes low, we’re fighting to allow the worst portions of the tax scam expire.

One of the worst parts of the Trump-GOP tax scam is the “pass-through” loophole. This allows pass-through business owners to deduct up to 20% of their income before figuring their taxes. The GOP falsely calls this a “small business tax break,” but the reality is that more than half of the pass-through tax cuts go to households with over $1 million of annual income.[1]

In fact, seven billionaires, including Michael Bloomberg and Republican mega-donor and packaging king Richard Uihlein, were able to cut their collective tax bills by almost $200 million in a single year thanks to the pass-through loophole.

Sign now to demand Congress let the pass-through loophole expire so that wealthy business owners can’t game the system and avoid paying their fair share in taxes.

While Donald Trump’s Treasury Secretary Steven Mnuchin argued that the pass-through loophole would “be good for the economy; good for growth”,[2] the fact is the money from the loophole is just collecting at the top. Three-quarters of the loophole’s benefit goes to Big Business.

Permanently extending the pass-through loophole―as Donald Trump and congressional Republicans want to do―would cost over $700 billion in lost revenue in the first 10 years alone. That’s $700 billion that if we let the loophole expire we could instead invest in working families. For example, it’s enough to provide free preschool for all 4-year olds and expanded childcare for 16 million kids for 10 years.

Add your name to demand Congress let the pass-through loophole expire in 2025. Instead of allowing wealthy business owners to pocket hundreds of billions of dollars in tax breaks, we should be investing that tax revenue in programs and services for working families.

Together, we’re building the movement to scrap the worst elements of the Trump-GOP tax scam so we can invest in working people and our future.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] Trump-GOP Tax Law Closeup: Let The Skewed-To-The-Rich Pass-Through Loophole Expire

[2] Mnuchin: GOP tax reform would give small business owners the lowest rates ‘since the 1930s’

|