|

|

Milton Friedman famously said, “I am in favour of cutting taxes under any circumstances and for any excuse, for any reason, whenever it's possible.” The Conservative Party’s general election manifesto has certainly tested my own adherence to that maxim.

The headline measures – a higher personal allowance for pensioners, (much) lower national insurance for the self-employed, a higher stamp duty land tax threshold for first-time buyers, and capital gains tax relief for landlords who sell to their tenants – all violate one of the most important principles of taxation: neutrality. Instead, they target tax breaks at favoured groups of voters, in an effort to buy their electoral support.

Such measures make the tax system less efficient and more distortionary. In the long run, all else being equal, they mean everyone else paying more tax than otherwise would have been the case. It is depressing to see tax policies formulated in such a short-sighted and uneconomic way.

There may, alas, be more of this to come, just from the other direction. Like the Tories, the Labour Party has ruled out raising income tax, national insurance, and VAT. But neither they nor any other potential government looks ready to reduce the scope of the state, or make a concerted effort to circumvent the spending pressures that come with an ageing population. And if you need more revenue, but can’t get it from the main, broad-based taxes, you inevitably start looking at targeted taxes on particular industries and activities.

The Liberal Democrat manifesto points that way, proposing higher taxes specifically for banks, big tech, tobacco companies, the oil and gas industry, share buybacks, and some capital gains. You can argue about each individual policy – and I think there are good reasons to oppose all of them – but it is the overall approach, and the fact that other parties are likely to follow suit, that worries me most. Simple, broad-based, neutral taxation looks to have been jettisoned altogether.

There is a particular issue around the way we tax savings and investment. It is widely assumed that the next government may look to reform pension tax relief, ISAs, and capital gains tax to raise more revenue. There are some sensible ways to do that, but the danger is that we end up exacerbating and entrenching one of the most damaging distortions in the current tax system – its bias towards immediate consumption over capital accumulation. Doing so might yield more money now, but it would impoverish us in the long run.

It is entirely possible to design a tax system that generates as much revenue as the current one – or more, even – while also promoting stronger economic growth. It is just a shame that, as this election campaign shows, politics very often gets in the way.

‘Saving £12,000 into a Help to Buy Isa was pointless’, Tom Clougherty quoted in The Times

If you want to support the IEA’s charitable mission, our offer to new subscribers (which includes a copy of Steve Davies’ new book Apocalypse Next: The Economics of Global Catastrophic Risks) is still available:

Manifestos create new costing conundrums

The three main parties all released their General Election manifestos this week. Despite pledging to spend more while not increasing major revenue-generating taxes, they have all managed to find a way to ‘fully cost and full fund’ their promises to the electorate…

It’s boom time for the lazy public sector – and we’ll all pay the price, Director of Public Policy and Communications Matthew Lesh, The Daily Telegraph

Matthew also discussed the creative accounting employed by the major parties in City AM, writing that “no party has attempted to even begin to calculate the real-world effects of their proposals.”

Economics Fellow Julian Jessop highlighted this problem in The i, arguing that “it is hard for any party to credibly rule out tax rises…”

Julian emphasised the need to tackle the root causes of Britain’s economic stagnation in The Daily Express and The Sun this week, after new data showed zero GDP growth in the three months to April.

Over the next week, the IEA will be publishing analysis of the major parties’ commitments across a range of policy areas, here on IEA Insider. First up is Editorial Director Kristian Niemietz on healthcare…

Manifestos offer more of the same on healthcare, Kristian Niemietz, IEA Insider

News, Views & Upcoming Events

WHO do they think they are?, Head of Lifestyle Economics Christopher Snowdon, The Daily Mail, The Critic, The Independent & The Daily Telegraph

Don’t let private schools stand in the way of simpler taxes, Managing Editor Daniel Freeman, CapX

Should Private Education Be VAT Exempt?, Daniel Freeman debates Adam Smith Institute Director of Research Maxwell Marlow, IEA YouTube

Is Europe Being Left Behind in the Technology Revolution? | IEA Podcast, Matthew Lesh interviews venture capitalist David Galbraith, IEA YouTube

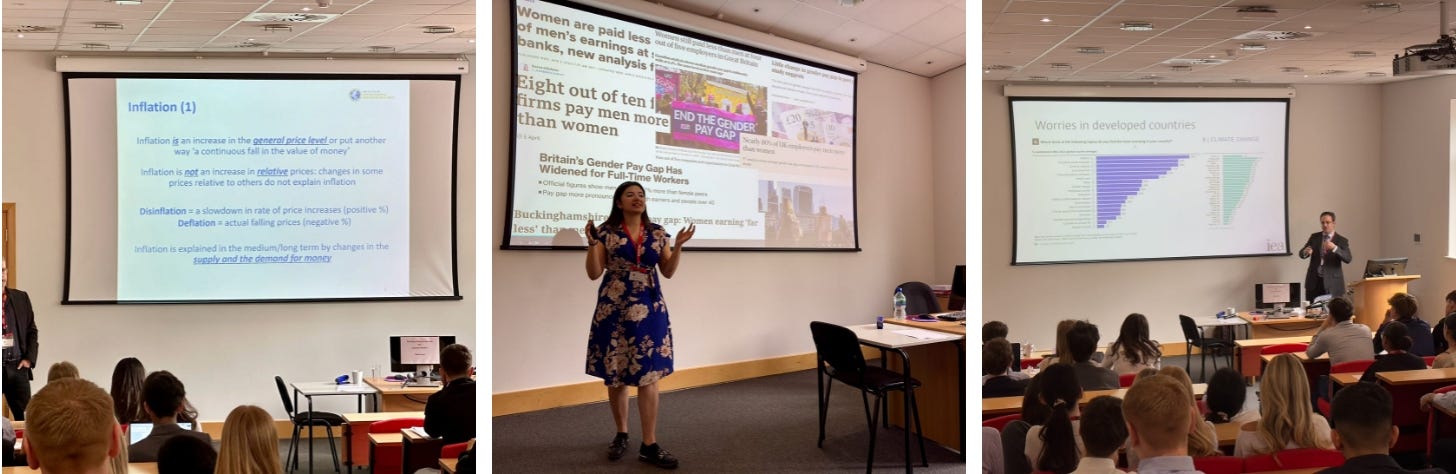

IEA Sixth-Form Conference with Lingfield College

This week the IEA hosted a Sixth-Form Conference at Lingfield College. Students heard from our Energy Analyst Andy Mayer about free market solutions to climate change, Reem Ibrahim on the gender pay gap, and Institute of International Monetary Research Director Damian Pudner about inflation and financial stability.

For students who want to learn more about prices, inflation, regulation, and much more, sign up to the 2024 Vinson Centre Conference in the Classical Liberal Tradition which takes place on 17th July:

You’re currently a free subscriber to Insider. For the full experience, upgrade your subscription.

Paid subscribers support the IEA's charitable mission and receive special invites to exclusive events, including the thought-provoking IEA Book Club.

We are offering all new subscribers a special offer. For a limited time only, you will receive 15% off and a complimentary copy of Dr Stephen Davies’ latest book, Apocalypse Next: The Economics of Global Catastrophic Risks.