|

John,

Today, the House Appropriations Committee will vote on a funding package that cuts more than $2 billion from the IRS and blocks the agency from implementing Direct File nationwide.

Direct File is the IRS’s new, free, online tax filing system, that saves taxpayers time and money when filing their taxes. The pilot program was a huge success with 12 states participating―saving 140,000 taxpayers roughly $5.6 million.1

Now, just as the IRS has announced that it will make Direct File available in all 50 states next year, congressional Republicans are rushing to block it in order to protect the profits of TurboTax, H&R Block, and other corporate tax preparers.

We’re fighting back! Already, we’ve sent more than 16,000 messages to members of Congress to reject attacks on the IRS. Rush a donation today to fight back against right-wing and corporate attacks.

RUSH A DONATION

In addition to blocking the implementation of Direct File, congressional Republicans are seeking to unwind the increased enforcement targeted at wealthy and corporate tax cheats. Unfortunately, this comes as no surprise.

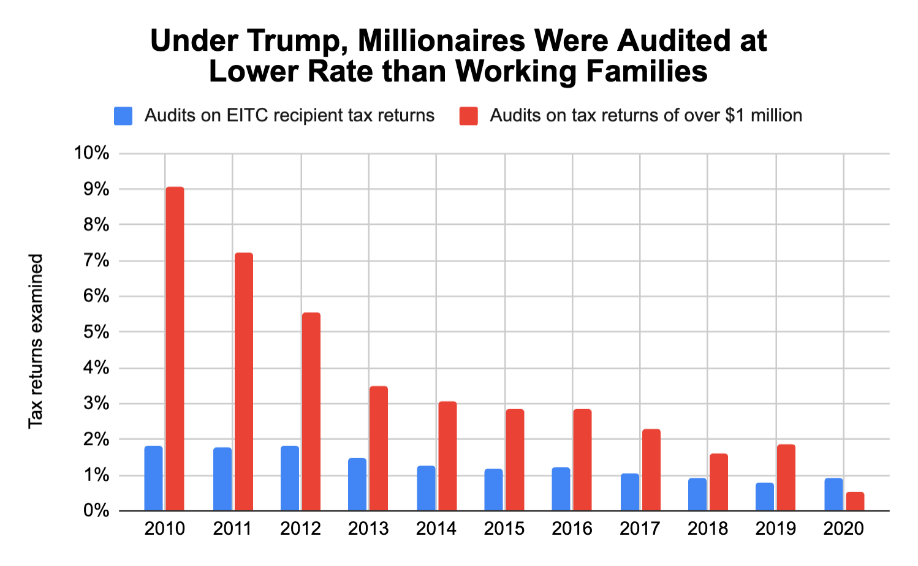

Prior to the historic $80 billion investment in the IRS that Democrats passed and President Biden signed into law in 2022, take a look at how the underfunding of the IRS had impacted audits of millionaires and billionaires over the previous decade:2

The enforcement staff at the IRS had been so depleted during that time that the IRS concentrated its audits on low-income Earned Income Tax Credit recipients, since enforcement on wealthy tax cheats is far more complex and time-consuming, even though it does generate far more in collections. But now, the investments that we helped secure are allowing the IRS to finally crack down on wealthy and corporate tax cheats.

In fact, shortly after hiring new tax enforcement staff, the IRS collected $500 million from millionaire tax cheats,3 notified Microsoft that it owes $29 billion in back taxes,4 and announced the audits of 60 giant corporations that together make more than $500 billion in profits each year.5 The Treasury Department told reporter Joseph Zeballos-Roig of Semafor that in FY 2023, the IRS collected $86 billion through tougher enforcement, amounting to a return on investment of about $7 to $1.6

Power our advocacy efforts to fight back against Republican and Wall Street attacks on the IRS. Rush a donation today and help remind Congress that the American people want a fully functioning IRS.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

When the wealthy and corporations pay the taxes that they owe, we can invest in critical programs that uplift families and communities.

Thank you for your support,

Deborah Weinstein

Executive Director, CHN Action

1 U.S. Department of the Treasury, IRS Announce Direct File as Permanent Free Tax Filing Option, All 50 States and D.C. Invited to Join in Filing Season 2025

2 New Analysis Shows Trump-Era IRS Audited Low-Income Workers at a Higher Rate Than Millionaires

3 The IRS crackdown on high-end taxpayers is already raking in millions in back taxes — here’s how much

4 IRS says Microsoft owes an additional $29 billion in back taxes

5 IRS Investment Update: Business Account Launches, Noncompliant US Subsidiaries Targeted

6 https://x.com/josephzeballos/status/1798179524267360623

|