June 12, 2024

Permission to republish original opeds and cartoons granted.

The FTC Claims to be Here to Help, Don’t Believe Them

By Rick Manning

The Federal Trade Commission’s (FTC) virtually unfettered power to make edicts impacting large sectors of the American economy and business community is one of the best examples of the dangerous and coercive power of government.

The FTC’s most recent expansion of their reach and power is their proposed rule which the Agency contends will “ban businesses from running up the bills with hidden and bogus fees, ensure consumers know exactly how much they are paying and what they are getting, and help spur companies to compete on offering the lower price.”

If ever there was false advertising by an Agency, this would be it.

First, the best way to spur companies to compete on offering the lower price is for the government to quit putting their fingers on the scale and end their inflation driving fiscal policies, not putting out another regulation that will increase legal compliance costs which do nothing to help anyone but the lawyers who represent the government and businesses.

To put this on a practical level, let’s take just one example of what the FTC would consider a junk fee. When you order from a prominent pizza chain and have the food delivered, there is a delivery charge which the company states should be considered separate from a tip to the driver. If a customer wants to avoid the fee and tip, they have the option of picking up the pizza, costing them time, but in my household saving between eight and ten dollars per order.

However, if this federal agency’s rule goes into effect, the same pizza company would have a couple of options: incorporate those delivery costs into the price of every pizza driving the cost up for those who don’t use the service, or eliminate their delivery service altogether and force customers who want delivery to utilize an expensive third party delivery service.

No money is saved. The costs are just shifted and for most people the cost of the pizza goes up. Thanks FTC.

The reality is that in many cases, the separate fees which are charged effectively shift costs to those who use the service rather than socializing the cost over the entire cost of the product or service.

This isn’t hard to understand. Let me provide another example. Some businesses offer a cash discount, meaning they are charging an additional fee for using a credit card. Why would a business do this? Because processing credit cards cost the business up to three percent of the price of the charge.The cash transaction eliminates this cost, so some companies choose to provide a discount for cash. But using the FTC’s regulatory logic, this discount effectively imposes an unseen premium or a junk fee to pay for the service of using a credit card. This is just plain dumb.

On a macro-economic level, it is no secret that the combination of increased labor costs (both due to government driven increased wage costs as well as more competition for workers) have put small businesses under the gun. The American Bankruptcy Institute reports that small business bankruptcy filings were up 60 percent in April 2024 over the number of filings in April 2023. On an individual level, there were 28 percent more bankruptcies over the same time period. While it is impossible to gauge the impact of the FTC regulation on increasing bankruptcy rates, it is reasonable to assume that a federal mandate that effects the price points of their products can only work against those struggling the hardest to survive.

It is possible that the Biden bureaucrats at the FTC might believe that getting rid of fees that are not directly related to paying the government more money is good policy, the truth is that the effect of the rulemaking will either be to shift the cost to the bottom line price which everyone pays creating less transparency and choice, or the ending of the service altogether.

As for me, I’d rather have the choice on whether I wanted to pay for the convenience of having my pizza delivered or to save money by picking it up myself. A simple cost savings choice that would likely be eliminated through the FTC’s politically motivated meddling.

Everyone knows the old joke about the three most common lies: The check's in the mail, I gave at the office, and I’m from the government and I’m here to help.

When it comes to the FTC’s misguided rulemaking on fees, in spite of their rhetoric, they are not here to help. If only there was someone empowered to punish false statements and promises by politically motivated federal government agencies.

Rick Manning is the President of Americans for Limited Government.

To view online: https://townhall.com/columnists/rickmanning/2024/06/12/the-ftc-claims-to-be-here-to-help-dont-believe-them-n2640343

Cartoon: Humpty Biden

By A.F. Branco

Click here for a higher level resolution version.

To view online: https://dailytorch.com/2024/06/cartoon-humpty-biden/

As inflation remains unchanged in May, Biden administration projects unemployment benefits to surge 75 percent in 2024 to $52.5 billion

By Robert Romano

Consumer prices were unchanged at 0 percent in May after a 2 percent drop in energy prices, with annual inflation the past 12 months now down to 3.3 percent from its June 2022 peak of 9.1 percent, according to the latest data from the Bureau of Labor Statistics.

Overall, the 0 percent reading is not unexpected when taken in the context of the economy overheating. The unemployment rate has surged from its April 2023 low of 3.4 percent to 4 percent in May, its highest level since Nov. 2021. That is what usually happens when inflation slows down as consumers constrain purchases.

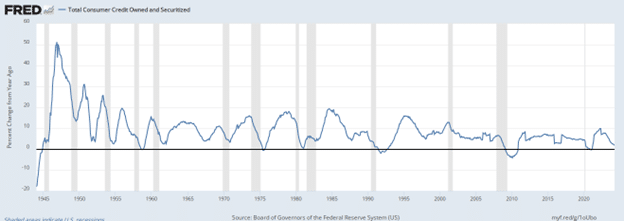

Another good proxy for that is consumer credit expansion, which peaked at 9.9 percent annual increase in April 2022 and now is all the way down to 1.9 percent in April 2024. During every recession in modern history, the growth of consumer credit always slows down and sometimes it even contracts, and so the current weakening is definitely worrisome from an economic standpoint.

Even the Biden administration is prepared for an economic slowdown, with the Federal Reserve projecting unemployment to continue rising to 4.1 percent, although some of their estimates have unemployment getting as high as 4.5 percent in 2024 and 4.7 percent in 2025.

As a result, the White House Office of Management and Budget (OMB) is projecting that unemployment claims will surge 75 percent this year to almost $52.5 billion in 2024, up from $29.9 billion in 2023. That is because in its economic assumptions, OMB had unemployment rising from 3.6 in 2023 to 4 percent in 2024.

So, if unemployment is rising, while consumer credit is slowing down significantly—both worrisome economic signals—then naturally prices will tend to come down.

Food at home was unchanged at 0 percent, while food away from home still came in at a hot 0.4 percent.

Meanwhile, gasoline was down 3.6 percent and fuel oil was down 0.4 percent.

Electricity was unchanged at 0 percent and piped gas service was down 0.8 percent.

With food and energy excluded, prices did increase at 0.2 percent in May, with new vehicles down 0.5 percent, offset by used vehicles increasing by 0.6 percent.

Apparel was down 0.3 percent and medical care commodities were up 1.3 percent.

Shelter was up 0.4 percent, transportation services were down 0.5 percent and medical care services were up 0.3 percent.

On Aug. 9, 2023, President Joe Biden had promised that inflation could be reduced without increasing unemployment, stating, “unemployment is down and so is inflation. Remember all the experts, including some that worked for me, told us that to get inflation under control we needed to lower wages and reduce the number of people working. No, I’m — that — that’s been sort of gospel… Not a joke. Seriously. Some of you here in the audience are economists. You know that.”

Biden added, “But I never bought it — the problem was too many people are working or working people are working — making too much money. That’s not the problem.”

But now we know that was false, with unemployment already up to 6.6 million from its April 2023 low of 5.7 million, an increase of more than 900,000, as the unemployment rate rose from 3.6 percent to 4 percent so far. That includes an increase of 157,000 more unemployed in the past month. At this point, Biden’s best hope might be that whatever further increases in unemployment there might be on the horizon don’t occur until after the election. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.