June 11, 2024

Permission to republish original opeds and cartoons granted.

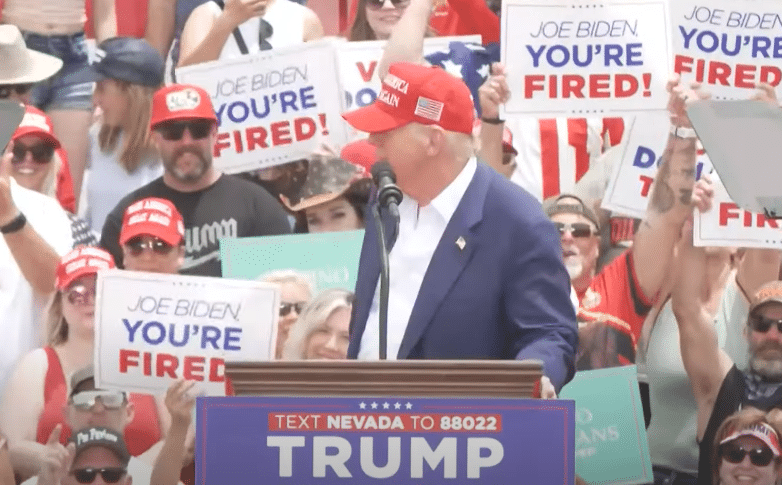

Trump in Nevada: ‘[W]hen I get to office, we are going to not charge taxes on tips!’

By Robert Romano

“[W]hen I get to office, we are going to not charge taxes on tips — people making tips. We're not going to do it. And we're going to do that right away first thing in office because it's been a point of contention for years and years and years, and you do a great job of service.”

That was former President Donald Trump at a campaign rally in Las Vegas, Nev. on June 9, making the case for eliminating taxation tips received by waiters, waitresses, bartenders and so forth.

Clearly the appeal is to workers in Las Vegas, many of whom work at bars, restaurants and other establishments where collecting tips is a significant portion of a person’s annual income.

In 2018, the IRS reported that there was $38.2 billion of taxable tips reported by individuals. Assuming the lowest bracket of taxation at 12 percent, the Trump proposal would amount to $4.6 billion less revenue collected.

That’s out of $4.4 trillion the government collected in total revenues in 2023, according to the White House Office of Management and Budget. That’s a mere 0.1 percent of revenue — and that could make Trump’s pitch for tax-free tips to be quite compelling to the more than 4.4 million tip workers nationwide in the 2024 election.

In other words, it’s a smart political move, and one which the government in the great scheme of things won’t really miss in the way of revenue — although members of Congress will undoubtedly quibble about any loss of their tax powers, especially when their pinching lower income Americans who often lack a voice in government.

Trump’s pitch comes as he is attempting build on his current lead in the polls of swing states like Nevada, where Trump leads incumbent President Joe Biden 48.3 percent to 43 percent, according to the latest average compiled by RealClearPolling.com.

In other states, the situation isn’t much improved for Biden.

In Arizona, Trump leads Biden 48.3 percent to 44.1 percent.

In Pennsylvania, Trump leads Biden 47.8 percent to 45.5 percent.

In Georgia, Trump leads Biden 48.5 percent to 43.7 percent.

Meanwhile, Michigan and Wisconsin are closely contested, both with Trump having a slight edge: 47 percent to 46.7 percent and 47.4 percent to 47.3 percent, respectively.

The implication is that if the election were held today, Trump might win the Electoral College 312 to Biden’s 226, and given Trump’s persistent lead in national polls, might even win the popular vote.

Meaning, Trump’s push for further in-roads in Democratic states like Nevada — which Republicans have not carried since 2004 — are done with the intent of building on that lead, attempting to take a somewhat sizeable lead and engineer a landslide, with potential down-ballot benefits for Republicans running for House and Senate seats, as well as state races, everywhere.

Whether it works or not remains to be seen, but Trump so far as the presumptive Republican nominee appears to not be taking anything for granted in 2024, including by increasing take-home pay for tip workers. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2024/06/trump-in-nevada-when-i-get-to-office-we-are-going-to-not-charge-taxes-on-tips/

Competitive Enterprise Institute: Coalition Letter Supporting CRA Resolution of Disapproval on EPA Power Plant Rule

Dear Members of Congress,

The Environmental Protection Agency’s (EPA) recently finalized powerplant rule will kill America’s existing supply of baseload generation from coal. At the same time, the rule will deter investment in new baseload generation from natural gas. That means the rule will drive up consumer energy costs, impair grid reliability, and chill economic growth. The rule is also an unlawful power grab that defies the Supreme Court’s decision in West Virginia v. EPA.

Sen. Shelley Moore Capito (R-WV) and Rep. Troy Balderson (R-OH) are expected to introduce Congressional Review Act resolutions of disapproval to overturn the EPA’s rule. We, the undersigned organizations, urge you to support those resolutions.

The EPA’s rule sets various requirements that will quickly drive coal generation out of the nation’s electricity fuel mix. If a coal powerplant intends to produce power after 2039, it must, by January 1, 2032, install equipment capable of capturing 90-percent of its carbon dioxide (CO2) emissions. Carbon capture is an energy- and water-intensive system that adds significantly to power generation costs. Moreover, carbon capture powerplants do not reduce emissions unless connected to networks of CO2 pipelines and storage facilities that may never be built.

Unsurprisingly, despite decades of R&D and billions of dollars in ratepayer and taxpayer subsidies, only two carbon capture powerplants currently operate in North America—Petra Nova in Texas, and Boundary Dam in Saskatchewan. Both were built with hefty subsidies and plagued with technical difficulties. Note, too, that central to the business model of each project is a partnership whereby the powerplant sells its captured CO2 to companies engaged in enhanced oil recovery (EOR). Thirty-eight states (more than three-quarters) do not have EOR operations.

PJM Interconnection, the regional transmission organization that coordinates wholesale electricity and manages grid reliability in all or parts of 13 states and the District of Columbia, observes in its statement on the rule: “There is very little evidence, other than some limited CCS [carbon capture and storage] projects, that this technology and associated transportation infrastructure would be widely available throughout the country in time to meet the compliance deadlines under the Rule.”

The bottom line is that, for coal powerplants, 90-percent carbon capture is not an “adequately demonstrated” “best system of emission reduction” (BSER), taking “cost” and “energy requirements” into account, and thus is not a lawful basis for setting emission standards under Section 111 of the Clean Air Act (CAA).

The EPA’s rule provides two alternative compliance options. A coal powerplant can avoid the expense of installing a carbon capture system if it (a) commits to shut down by January 1, 2032, or (b) commits to shut down by December 31, 2039, and repowers with 40 percent natural gas by January 1, 2030. PJM Interconnection cautions:

The present gas pipeline system is largely fully subscribed. Moreover, given local opposition, it has proven extremely difficult to site new pipelines just to meet today’s needs, let alone a significantly increased need for natural gas in the future. The Final Rule, which is premised, in part, on the availability of natural gas for co-firing or full conversion, does not sufficiently take into account these limitations on the development of new pipeline infrastructure.

It could not be clearer that the rule aims to drive coal generation out of U.S. electricity markets. Indeed, the EPA itself estimates that, by 2045, coal generation will decline by 94 percent compared to the prior policy baseline (Regulatory Impact Analysis, Table D-10).

As in the Clean Power Plan, the EPA is promulgating “emission performance standards” that are, in fact, non-performance mandates. ‘Perform less or not at all’ is not a valid performance standard under CAA Section 111.

The EPA’s new rule also establishes a 90-percent carbon capture requirement for new baseload natural gas powerplants. Far from being “adequately demonstrated,” no utility scale natural gas CCS plant exists today. Only one small-scale facility was ever built—Florida Power & Light’s 40 MW CCS gas plant in Bellingham, Massachusetts. It closed in 2005. That is nowhere near an adequate technological basis on which to predicate an industry-wide 90 percent carbon capture requirement.

The EPA could not have picked a worse time to attack affordable, reliable, coal- and gas-fired generation. Electricity demand is projected to grow substantially due to the proliferation of data centers, expansion of Artificial Intelligence, onshoring of chip production, and the EPA’s and California’s policies to forcibly electrify U.S. motor vehicle fleets.

PJM Interconnection warns: “The future demand for electricity cannot be met simply through renewables given their intermittent nature. Yet in the very years when we are projecting significant increases in the demand for electricity, the Final Rule may work to drive premature retirement of coal units that provide essential reliability services and dissuade new gas resources from coming online.”

In West Virginia v. EPA, the Supreme Court made it clear that CAA Section 111 does not authorize the EPA to act as the nation’s grid manager or resolve the national debate on climate policy with respect to a fundamental industrial sector. If Congress wanted the agency to possess such authority, it would have said so in clear terms. Congress has not done so, yet the EPA is still trying to assert an expansive transformation of its regulatory power. As in the CPP, the EPA ignores the separation of powers that is vital to the nation’s republican form of government.

For those reasons, our organizations urge legislators to overturn this rule.

To view online: https://cei.org/coalition_letters/cei-leads-coalition-letter-supporting-cra-resolution-of-disapproval-on-epa-power-plant-rule/