Email

Caught in patchwork of policies and pledges, some utility customers may still be awaiting electricity restoration or racking up fees

| From | Energy and Policy Institute <[email protected]> |

| Subject | Caught in patchwork of policies and pledges, some utility customers may still be awaiting electricity restoration or racking up fees |

| Date | April 15, 2020 12:02 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

** Caught in patchwork of policies and pledges, some utility customers may still be awaiting electricity restoration or racking up fees ([link removed])

------------------------------------------------------------

By David Pomerantz on Apr 14, 2020 05:41 pm

As unemployment skyrockets due to the coronavirus pandemic, the nation’s utility customers face an uneven patchwork of state policies and voluntary pledges that determine what will happen if they struggle to pay their bills.

The most basic question – whether people are at risk of being disconnected for non-payment – is still unclear for many Americans.

Twenty-five states and the District of Columbia ([link removed]) have issued orders of some type mandating that utilities do not disconnect customers for non-payment.

For customers in the other 25 states, the answer depends on whether their utility has voluntarily pledged to suspend disconnections for non-payment. Most, but not all, utilities have made such a pledge. The trade associations for investor-owned electric ([link removed]) and gas ([link removed]) providers have said that all of their members have suspended disconnections. Still, questions remain: Michigan’s largest investor-owned utilities pledged to extend their winter moratoria on disconnections, but those apply only to a specific class of low-income customers.

Many municipal and cooperative utilities have pledged to suspend disconnections. Still, some have not, which has led to a rash of stories about families who are at risk of losing electric service over an unpaid bill in small towns and rural communities in states like North Carolina ([link removed]) , Tennessee ([link removed]) and South Dakota ([link removed]) . (Investor-owned utilities served 72% of U.S. electricity customers in 2017; municipal utilities and cooperatives serve the rest.)

In a bid to end the patchwork nature of the orders and pledges, over 800 advocacy groups signed a letter ([link removed]) to Congressional leaders yesterday asking for federal relief legislation to suspend utility disconnections for non-payment through the end of the state of emergency, plus an additional six months to allow for families to recover financially. Language along those lines in an earlier House-drafted relief bill was not included in the bill that passed, which originated in the Senate, despite support ([link removed]) from Democratic senators.

The advocates’ letter, which also applied to water and broadband utilities, called for the reconnection of customers who were disconnected prior to the onset of coronavirus, for the suspension of late fees, and for policies that would address the underlying issue of utility disconnections due to high energy cost burdens, such as distributed and community solar energy programs.

** Customers disconnected before mandates and pledges may still be without power

------------------------------------------------------------

Most of the state executive orders and voluntary utility pledges took effect in the middle of March, but many customers may have been disconnected for non-payment just prior to that. Based on the 25 state orders and an EPI survey of utilities, it seems likely that some of those customers are still without power.

State orders in Colorado and Wisconsin direct utilities to “make reasonable efforts” to restore service for customers who are currently disconnected for nonpayment, assuming they can do so safely. Other states like Minnesota and North Carolina have requested that utilities reconnect any disconnected customers, but are not mandating it.

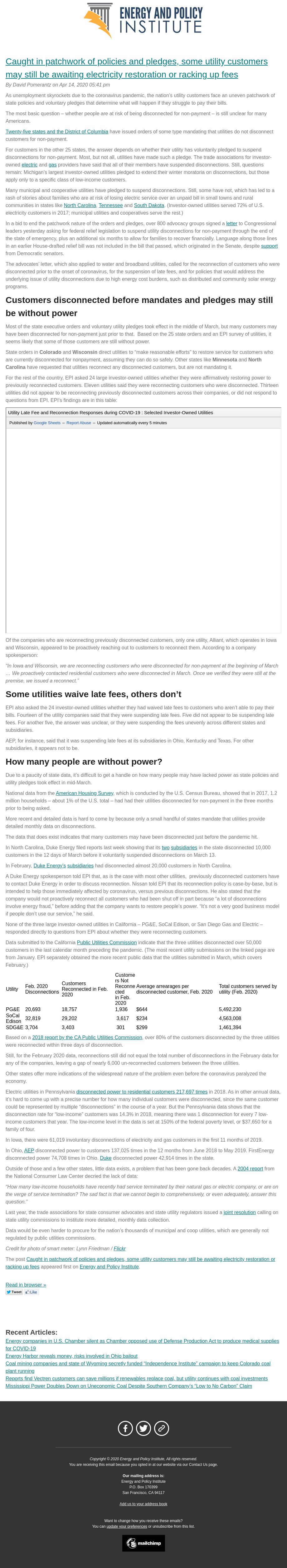

For the rest of the country, EPI asked 24 large investor-owned utilities whether they were affirmatively restoring power to previously reconnected customers. Eleven utilities said they were reconnecting customers who were disconnected. Thirteen utilities did not appear to be reconnecting previously disconnected customers across their companies, or did not respond to questions from EPI. EPI’s findings are in this table:

IFRAME: [1][link removed]

Of the companies who are reconnecting previously disconnected customers, only one utility, Alliant, which operates in Iowa and Wisconsin, appeared to be proactively reaching out to customers to reconnect them. According to a company spokesperson:

“In Iowa and Wisconsin, we are reconnecting customers who were disconnected for non-payment at the beginning of March … We proactively contacted residential customers who were disconnected in March. Once we verified they were still at the premise, we issued a reconnect.”

** Some utilities waive late fees, others don’t

------------------------------------------------------------

EPI also asked the 24 investor-owned utilities whether they had waived late fees to customers who aren’t able to pay their bills. Fourteen of the utility companies said that they were suspending late fees. Five did not appear to be suspending late fees. For another five, the answer was unclear, or they were suspending the fees unevenly across different states and subsidiaries.

AEP, for instance, said that it was suspending late fees at its subsidiaries in Ohio, Kentucky and Texas. For other subsidiaries, it appears not to be.

** How many people are without power?

------------------------------------------------------------

Due to a paucity of state data, it’s difficult to get a handle on how many people may have lacked power as state policies and utility pledges took effect in mid-March.

National data from the American Housing Survey ([link removed]) , which is conducted by the U.S. Census Bureau, showed that in 2017, 1.2 million households – about 1% of the U.S. total – had had their utilities disconnected for non-payment in the three months prior to being asked.

More recent and detailed data is hard to come by because only a small handful of states mandate that utilities provide detailed monthly data on disconnections.

The data that does exist indicates that many customers may have been disconnected just before the pandemic hit.

In North Carolina, Duke Energy filed reports last week showing that its two ([link removed]) subsidiaries ([link removed]) in the state disconnected 10,000 customers in the 12 days of March before it voluntarily suspended disconnections on March 13.

In February, Duke Energy’s ([link removed]) subsidiaries ([link removed]) had disconnected almost 20,000 customers in North Carolina.

A Duke Energy spokesperson told EPI that, as is the case with most other utilities, previously disconnected customers have to contact Duke Energy in order to discuss reconnection. Nissan told EPI that its reconnection policy is case-by-base, but is intended to help those immediately affected by coronavirus, versus previous disconnections. He also stated that the company would not proactively reconnect all customers who had been shut off in part because “a lot of disconnections involve energy fraud,” before adding that the company wants to restore people’s power. “It’s not a very good business model if people don’t use our service,” he said.

None of the three large investor-owned utilities in California – PG&E, SoCal Edison, or San Diego Gas and Electric – responded directly to questions from EPI about whether they were reconnecting customers.

Data submitted to the California Public Utilities Commission ([link removed]) indicate that the three utilities disconnected over 50,000 customers in the last calendar month preceding the pandemic. (The most recent utility submissions on the linked page are from January. EPI separately obtained the more recent public data that the utilities submitted in March, which covers February.)

Utility Feb. 2020 Disconnections Customers Reconnected in Feb. 2020 Customers Not

Reconnected

in Feb. 2020 Average arrearages per disconnected customer, Feb. 2020 Total customers served by utility (Feb. 2020)

PG&E 20,693 18,757 1,936 $644 5,492,230

SoCal Edison 32,819 29,202 3,617 $234 4,563,008

SDG&E 3,704 3,403 301 $299 1,461,394

Based on a 2018 report by the CA Public Utilities Commission ([link removed]) , over 80% of the customers disconnected by the three utilities were reconnected within three days of disconnection.

Still, for the February 2020 data, reconnections still did not equal the total number of disconnections in the February data for any of the companies, leaving a gap of nearly 6,000 un-reconnected customers between the three utilities.

Other states offer more indications of the widespread nature of the problem even before the coronavirus paralyzed the economy.

Electric utilities in Pennsylvania disconnected power to residential customers 217,697 times ([link removed]) in 2018. As in other annual data, it’s hard to come up with a precise number for how many individual customers were disconnected, since the same customer could be represented by multiple “disconnections” in the course of a year. But the Pennsylvania data shows that the disconnection rate for “low-income” customers was 14.3% in 2018, meaning there was 1 disconnection for every 7 low-income customers that year. The low-income level in the data is set at 150% of the federal poverty level, or $37,650 for a family of four.

In Iowa, there were 61,019 involuntary disconnections of electricity and gas customers in the first 11 months of 2019.

In Ohio, AEP ([link removed]) disconnected power to customers 137,025 times in the 12 months from June 2018 to May 2019. FirstEnergy disconnected power 74,708 times in Ohio. Duke ([link removed]) disconnected power 42,914 times in the state.

Outside of those and a few other states, little data exists, a problem that has been gone back decades. A 2004 report ([link removed]) from the National Consumer Law Center decried the lack of data:

“How many low-income households have recently had service terminated by their natural gas or electric company, or are on the verge of service termination? The sad fact is that we cannot begin to comprehensively, or even adequately, answer this question.”

Last year, the trade associations for state consumer advocates and state utility regulators issued a joint resolution ([link removed]) calling on state utility commissions to institute more detailed, monthly data collection.

Data would be even harder to procure for the nation’s thousands of municipal and coop utilities, which are generally not regulated by public utilities commissions.

Credit for photo of smart meter: Lynn Friedman / Flickr ([link removed])

The post Caught in patchwork of policies and pledges, some utility customers may still be awaiting electricity restoration or racking up fees ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

References

1. [link removed]

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** Energy companies in U.S. Chamber silent as Chamber opposed use of Defense Production Act to produce medical supplies for COVID-19 ([link removed])

** Energy Harbor reveals money, risks involved in Ohio bailout ([link removed])

** Coal mining companies and state of Wyoming secretly funded “Independence Institute” campaign to keep Colorado coal plant running ([link removed])

** Reports find Vectren customers can save millions if renewables replace coal, but utility continues with coal investments ([link removed])

** Mississippi Power Doubles Down on Uneconomic Coal Despite Southern Company’s “Low to No Carbon” Claim ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2020 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

------------------------------------------------------------

By David Pomerantz on Apr 14, 2020 05:41 pm

As unemployment skyrockets due to the coronavirus pandemic, the nation’s utility customers face an uneven patchwork of state policies and voluntary pledges that determine what will happen if they struggle to pay their bills.

The most basic question – whether people are at risk of being disconnected for non-payment – is still unclear for many Americans.

Twenty-five states and the District of Columbia ([link removed]) have issued orders of some type mandating that utilities do not disconnect customers for non-payment.

For customers in the other 25 states, the answer depends on whether their utility has voluntarily pledged to suspend disconnections for non-payment. Most, but not all, utilities have made such a pledge. The trade associations for investor-owned electric ([link removed]) and gas ([link removed]) providers have said that all of their members have suspended disconnections. Still, questions remain: Michigan’s largest investor-owned utilities pledged to extend their winter moratoria on disconnections, but those apply only to a specific class of low-income customers.

Many municipal and cooperative utilities have pledged to suspend disconnections. Still, some have not, which has led to a rash of stories about families who are at risk of losing electric service over an unpaid bill in small towns and rural communities in states like North Carolina ([link removed]) , Tennessee ([link removed]) and South Dakota ([link removed]) . (Investor-owned utilities served 72% of U.S. electricity customers in 2017; municipal utilities and cooperatives serve the rest.)

In a bid to end the patchwork nature of the orders and pledges, over 800 advocacy groups signed a letter ([link removed]) to Congressional leaders yesterday asking for federal relief legislation to suspend utility disconnections for non-payment through the end of the state of emergency, plus an additional six months to allow for families to recover financially. Language along those lines in an earlier House-drafted relief bill was not included in the bill that passed, which originated in the Senate, despite support ([link removed]) from Democratic senators.

The advocates’ letter, which also applied to water and broadband utilities, called for the reconnection of customers who were disconnected prior to the onset of coronavirus, for the suspension of late fees, and for policies that would address the underlying issue of utility disconnections due to high energy cost burdens, such as distributed and community solar energy programs.

** Customers disconnected before mandates and pledges may still be without power

------------------------------------------------------------

Most of the state executive orders and voluntary utility pledges took effect in the middle of March, but many customers may have been disconnected for non-payment just prior to that. Based on the 25 state orders and an EPI survey of utilities, it seems likely that some of those customers are still without power.

State orders in Colorado and Wisconsin direct utilities to “make reasonable efforts” to restore service for customers who are currently disconnected for nonpayment, assuming they can do so safely. Other states like Minnesota and North Carolina have requested that utilities reconnect any disconnected customers, but are not mandating it.

For the rest of the country, EPI asked 24 large investor-owned utilities whether they were affirmatively restoring power to previously reconnected customers. Eleven utilities said they were reconnecting customers who were disconnected. Thirteen utilities did not appear to be reconnecting previously disconnected customers across their companies, or did not respond to questions from EPI. EPI’s findings are in this table:

IFRAME: [1][link removed]

Of the companies who are reconnecting previously disconnected customers, only one utility, Alliant, which operates in Iowa and Wisconsin, appeared to be proactively reaching out to customers to reconnect them. According to a company spokesperson:

“In Iowa and Wisconsin, we are reconnecting customers who were disconnected for non-payment at the beginning of March … We proactively contacted residential customers who were disconnected in March. Once we verified they were still at the premise, we issued a reconnect.”

** Some utilities waive late fees, others don’t

------------------------------------------------------------

EPI also asked the 24 investor-owned utilities whether they had waived late fees to customers who aren’t able to pay their bills. Fourteen of the utility companies said that they were suspending late fees. Five did not appear to be suspending late fees. For another five, the answer was unclear, or they were suspending the fees unevenly across different states and subsidiaries.

AEP, for instance, said that it was suspending late fees at its subsidiaries in Ohio, Kentucky and Texas. For other subsidiaries, it appears not to be.

** How many people are without power?

------------------------------------------------------------

Due to a paucity of state data, it’s difficult to get a handle on how many people may have lacked power as state policies and utility pledges took effect in mid-March.

National data from the American Housing Survey ([link removed]) , which is conducted by the U.S. Census Bureau, showed that in 2017, 1.2 million households – about 1% of the U.S. total – had had their utilities disconnected for non-payment in the three months prior to being asked.

More recent and detailed data is hard to come by because only a small handful of states mandate that utilities provide detailed monthly data on disconnections.

The data that does exist indicates that many customers may have been disconnected just before the pandemic hit.

In North Carolina, Duke Energy filed reports last week showing that its two ([link removed]) subsidiaries ([link removed]) in the state disconnected 10,000 customers in the 12 days of March before it voluntarily suspended disconnections on March 13.

In February, Duke Energy’s ([link removed]) subsidiaries ([link removed]) had disconnected almost 20,000 customers in North Carolina.

A Duke Energy spokesperson told EPI that, as is the case with most other utilities, previously disconnected customers have to contact Duke Energy in order to discuss reconnection. Nissan told EPI that its reconnection policy is case-by-base, but is intended to help those immediately affected by coronavirus, versus previous disconnections. He also stated that the company would not proactively reconnect all customers who had been shut off in part because “a lot of disconnections involve energy fraud,” before adding that the company wants to restore people’s power. “It’s not a very good business model if people don’t use our service,” he said.

None of the three large investor-owned utilities in California – PG&E, SoCal Edison, or San Diego Gas and Electric – responded directly to questions from EPI about whether they were reconnecting customers.

Data submitted to the California Public Utilities Commission ([link removed]) indicate that the three utilities disconnected over 50,000 customers in the last calendar month preceding the pandemic. (The most recent utility submissions on the linked page are from January. EPI separately obtained the more recent public data that the utilities submitted in March, which covers February.)

Utility Feb. 2020 Disconnections Customers Reconnected in Feb. 2020 Customers Not

Reconnected

in Feb. 2020 Average arrearages per disconnected customer, Feb. 2020 Total customers served by utility (Feb. 2020)

PG&E 20,693 18,757 1,936 $644 5,492,230

SoCal Edison 32,819 29,202 3,617 $234 4,563,008

SDG&E 3,704 3,403 301 $299 1,461,394

Based on a 2018 report by the CA Public Utilities Commission ([link removed]) , over 80% of the customers disconnected by the three utilities were reconnected within three days of disconnection.

Still, for the February 2020 data, reconnections still did not equal the total number of disconnections in the February data for any of the companies, leaving a gap of nearly 6,000 un-reconnected customers between the three utilities.

Other states offer more indications of the widespread nature of the problem even before the coronavirus paralyzed the economy.

Electric utilities in Pennsylvania disconnected power to residential customers 217,697 times ([link removed]) in 2018. As in other annual data, it’s hard to come up with a precise number for how many individual customers were disconnected, since the same customer could be represented by multiple “disconnections” in the course of a year. But the Pennsylvania data shows that the disconnection rate for “low-income” customers was 14.3% in 2018, meaning there was 1 disconnection for every 7 low-income customers that year. The low-income level in the data is set at 150% of the federal poverty level, or $37,650 for a family of four.

In Iowa, there were 61,019 involuntary disconnections of electricity and gas customers in the first 11 months of 2019.

In Ohio, AEP ([link removed]) disconnected power to customers 137,025 times in the 12 months from June 2018 to May 2019. FirstEnergy disconnected power 74,708 times in Ohio. Duke ([link removed]) disconnected power 42,914 times in the state.

Outside of those and a few other states, little data exists, a problem that has been gone back decades. A 2004 report ([link removed]) from the National Consumer Law Center decried the lack of data:

“How many low-income households have recently had service terminated by their natural gas or electric company, or are on the verge of service termination? The sad fact is that we cannot begin to comprehensively, or even adequately, answer this question.”

Last year, the trade associations for state consumer advocates and state utility regulators issued a joint resolution ([link removed]) calling on state utility commissions to institute more detailed, monthly data collection.

Data would be even harder to procure for the nation’s thousands of municipal and coop utilities, which are generally not regulated by public utilities commissions.

Credit for photo of smart meter: Lynn Friedman / Flickr ([link removed])

The post Caught in patchwork of policies and pledges, some utility customers may still be awaiting electricity restoration or racking up fees ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

References

1. [link removed]

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** Energy companies in U.S. Chamber silent as Chamber opposed use of Defense Production Act to produce medical supplies for COVID-19 ([link removed])

** Energy Harbor reveals money, risks involved in Ohio bailout ([link removed])

** Coal mining companies and state of Wyoming secretly funded “Independence Institute” campaign to keep Colorado coal plant running ([link removed])

** Reports find Vectren customers can save millions if renewables replace coal, but utility continues with coal investments ([link removed])

** Mississippi Power Doubles Down on Uneconomic Coal Despite Southern Company’s “Low to No Carbon” Claim ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2020 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: Energy and Policy Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp