|

John,

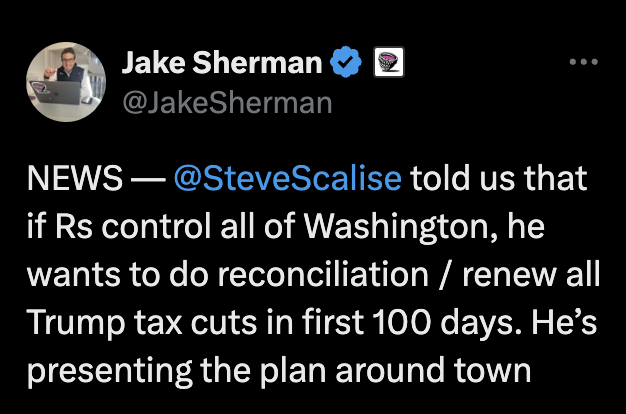

This presidential election is about many things. Defending democracy. Protecting the rights of marginalized communities and working people. And, according to House Majority Leader Steve Scalise (R-LA), this election is 100% about tax cuts for the rich and corporations:

In 2017, Republicans used a legislative maneuver called reconciliation to pass the Trump-GOP tax scam through the Senate with a simple majority vote. Now they’ve told us that’s their plan again in 2025. And they’re looking to do more for their wealthy donors than renew the tax cuts for the rich in the Trump tax law.

In 2017, congressional Republicans cut the corporate tax rate from 35% to just 21%. They made this portion of the tax scam permanent because they recognized how unpopular it was with the American people, and how difficult it would be to renew at a later date. But that isn’t stopping them from seeking even deeper corporate tax cuts.

One Republican member of the House Ways and Means Committee, Rep. Vern Buchanan (R-FL) said:[1]

“In terms of the corporate rate, that doesn’t sunset, but they might try to take that down at some point.”

According to the Congressional Budget Office (CBO), in the first year of the Trump-GOP tax scam, the gross domestic product (GDP) grew by only 0.3%. And, the CBO projects that an extension of the tax scam would cost $4.6 trillion over the next decade.[1] So much for fiscal responsibility!

In order to create an economy that works for everyone—not just those at the top—we’re fighting for a tax code that makes corporations pay their fair share and that taxes the extreme wealth gains of billionaires and ultra-millionaires.

Donate today to power our advocacy during this critical election year as we fight for an economy and a tax code that works for working people, not just the rich and powerful.

In addition to cutting the corporate tax rate even further, congressional Republicans are seeking to renew some of the most egregious parts of the Trump law—ones that exclusively or mostly benefit the rich: weakening of the estate tax, maintaining a low top individual tax rate, and keeping open a tax loophole for “pass-through” businesses.[2]

Donate today to fight back against the GOP plan to renew and expand tax cuts for the rich and corporations.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Together, we’re reminding the American people that when the rich and corporations pay their fair share in taxes, we can lower costs for working people on everything from healthcare to housing and more.

Thank you for your continued support.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] Republicans prepare to fast-track tax cuts in reconciliation

[2] What Kind of Country Do You Want? Start With Taxes.

|