| From | Jordan Williams <[email protected]> |

| Subject | Budget 2024: Cut through the media spin – what you need to know 🚨 |

| Date | May 30, 2024 3:56 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Dear Friend,

Mike Hosking put it well when he said this morning, "What New Zealand needs is a shock. A surprise. A blockbuster. A transformation. <[link removed]>"

I’m sorry to say, but Hosking isn’t going to be happy with what Nicola Willis has delivered today.

Nor should you.

Callum, Connor, and I have just arrived back at the office from the Beehive ‘Budget Lock-up’ where we have been poring over the fiscals, announcements, and economic projections.

Our summary is below, plus a list of our media releases listed at the bottom.

A friend of the Taxpayers’ Union sitting in the Parliamentary Gallery watching the speeches, just text to say that at least three Government Ministers were scrolling Taxpayers' Union social media pages while Nicola Willis was giving her speech! If you’re more of a pictures than words type a millennial, we’re over on F <[link removed]> <[link removed]>acebook <[link removed]>andX (once known as Twitter) <[link removed]> right now covering the Budget.You should give us a follow <[link removed]>😉

TL:DR – a summary of Budget 2024 📋

If you were looking forward to a bonfire of wasteful initiatives, you’ll be disappointed. Other than the already announced scrapping of the first home-buyer demand subsidy, nothing of material (from a fiscal, rather than a political point of view) is obvious in today’s Budget.

In her Budget Speech, <[link removed]> Ms Willis talked-the-talk, correctly pointing out that “Government spending has ballooned”, but the actual numbers fail to walk-the-walk.

Instead of popping Grant Robertson’s spending balloons, the more we got into the details, the clearer it became that Nicola Willis has added helium!

Willis’ 2024 Budget spends $13.8 billion more than Robertson’s 2023 Budget! That is $2,687 extra spending per household.

In response to Grant Robertson’s final budget, Christopher Luxon described spending $137 billion/year as an “addiction to spending” (he said it no less than 10 times in last year's Budget debate speech).

Wait til Luxon see what Nicola Willis is doing! As you’ll see on tables (see p 156 under “Core Crown expenses <[link removed]>) this year’s extra $13.8 billion (that's 13,800 million dollars) for this year coming is just the beginning.

If Grant was the addict, what does that make Nicola? 👀

The best the Government can claim is that they plan to increase spending but at a slightly lower rate than what Grant Robertson had set course on.

What will lead the news tonight: ‘Tax cuts are coming…’ 🤑

Nicola Willis has delivered a tax relief package almost identical to what National announced prior to the election. There is no sign ACT got any traction at all in terms of arguing for a flatter tax structure.

But to ensure there are ‘no losers’, Nicola Willis takes a leaf out of Labour’s book: tinkering with bureaucratic tax rebates and credits, rather than tackling the real issue of even those on modest incomes continuing to pay 30 cents in tax on every extra dollar earned.

But, let’s not be too negative – here at the Taxpayers’ Union, we’ll take tax relief any day of the week.

From 31 July (Willis claims IRD and payroll software delays mean it needs to be four weeks after than the start of the Government's fiscal year on 1 July) the following new tax rates will apply:

<[link removed]>

Click here for details of the tax changes. <[link removed]>

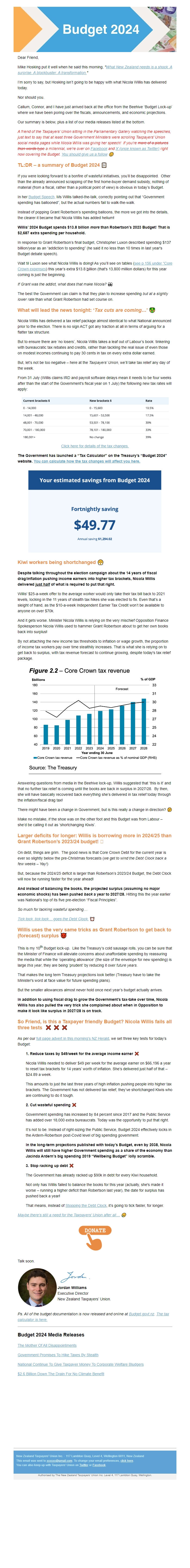

The Government has launched a “Tax Calculator” on the Treasury’s “Budget 2024” website. You can calculate how the tax changes will affect you here. <[link removed]>

<[link removed]>

Kiwi workers being shortchanged 😤

Despite talking throughout the election campaign about the 14 years of fiscal drag/inflation pushing income earners into higher tax brackets, Nicola Willis delivered just half of what is required to put that right.

Willis' $25-a-week offer to the average worker would only take their tax bill back to 2021 levels, locking in the 11 years of stealth tax hikes she was elected to fix. Even that’s a sleight of hand, as the $10-a-week Independent Earner Tax Credit won’t be available to anyone on over $70k.

And it gets worse. Minister Nicola Willis is relying on the very mischief Opposition Finance Spokesperson Nicola Willis used to hammer Grant Robertson about to get her own books back into surplus!

By not attaching the new income tax thresholds to inflation or wage growth, the proportion of income tax workers pay over time stealthily increases. That is what she is relying on to get back to surplus, with tax revenue forecast to continue growing, despite today's tax relief package.

Answering questions from media in the Beehive lock-up, Willis suggested that ‘this is it’ and that no further tax relief is coming until the books are back in surplus in 2027/28. By then, she will have basically recovered back everything she’s delivered in tax relief today through the inflation/fiscal drag tax!

There might have been a change in Government, but is this really a change in direction? 🤔

Make no mistake, if the shoe was on the other foot and this Budget was from Labour – she’d be calling it out as ‘shortchanging Kiwis’.

Larger deficits for longer: Willis is borrowing more in 2024/25 than Grant Robertson’s 2023/24 budget! 🤯

On debt, things are grim. The good news is that Core Crown Debt for the current year is ever so slightly below the pre-Christmas forecasts (we get to wind the Debt Clock back a few weeks – Yay!)

But, because the 2024/25 deficit is larger than Robertson’s 2023/24 Budget, the Debt Clock will now be running faster for the year ahead!

And instead of balancing the books, the projected surplus (assuming no major economic shocks) has been pushed back a year to 2027/28. Hitting this the year earlier was National’s top of its five pre-election “Fiscal Principles”.

So much for tackling wasteful spending…

Tick tock, tick tock… goes the Debt Clock. <[link removed]> ⏰

Willis uses the very same tricks as Grant Robertson to get back to (forecast) surplus 😈

This is my 10th Budget lock-up. Like the Treasury’s cold sausage rolls, you can be sure that the Minister of Finance will alleviate concerns about unaffordable spending by reassuring the media that while the ‘operating allowance’ (the size of the envelope for new spending) is large this year, they are being ‘prudent’ by reducing it over futureyears.

That makes the long term Treasury projections look better (Treasury have to take the Minister's word at face value for future spending plans).

But the smaller allowances almost never hold once next year’s budget actually arrives.

In addition to using fiscal drag to grow the Government’s tax-take over time, Nicola Willis has also pulled the very trick she complained about when in Opposition to make it look like surplus in 2027/28 is on track.

So Friend, is this a Taxpayer friendly Budget? Nicola Willis fails all three tests ❌ ❌ ❌

As per our full page advert in this morning’s NZ Herald <[link removed]>, we set three key tests for today’s Budget:

1. Reduce taxes by $49/week for the average income earner ❌

Nicola Willis needed to deliver $49 per week for the average earner on $66,196 a year to reset tax brackets for 14 years’ worth of inflation. She’s delivered just half of that – $24.89 a week.

This amounts to just the last three years of high inflation pushing people into higher tax brackets. The Government has not delivered tax relief, they’ve shortchanged Kiwis who are continuing to do it tough.

2. Cut wasteful spending❌

Government spending has increased by 84 percent since 2017 and the Public Service has added over 18,000 extra bureaucrats. Today was the opportunity to put that right.

It’s not to be. Instead of right-sizing the Public Service, Budget 2024 effectively locks in the Ardern-Robertson post-Covid level of big spending government.

In the long-term projections published with today’s Budget, even by 2038, Nicola Willis will still have higher Government spending as a share of the economy than Jacinda Ardern’s big spending 2019 “Wellbeing Budget” lolly scramble.

3. Stop racking up debt ❌

The Government has already racked up $90k in debt for every Kiwi household.

Not only has Willis failed to balance the books for this year (actually, she's made it worse – running a higher deficit than Robertson last year), the date for surplus has pushed back a year!

That means, instead of Stopping the Debt Clock <[link removed]>, it’s going to tick faster, for longer.

Maybe there’s still a need for the Taxpayers’ Union after all… <[link removed]>😢

<[link removed]>

Talk soon.

Jordan Williams

Executive Director

New Zealand Taxpayers’ Union.

Ps. All of the budget documentation is now released and online at Budget.govt.nz <[link removed]>. The tax calculator is here. <[link removed]>

Budget 2024 Media Releases

The Mother Of All Disappointments <[link removed]>

Government Promises To Hike Taxes By Stealth <[link removed]>

National Continue To Give Taxpayer Money To Corporate Welfare Bludgers <[link removed]>

$2.6 Billion Down The Drain For No Climate Benefit <[link removed]>

-=-=-

New Zealand Taxpayers' Union Inc. - 117 Lambton Quay, Level 4, Wellington 6011, New Zealand

This email was sent to [email protected]. To stop receiving emails: [link removed]

-=-=-

Created with NationBuilder - [link removed]

Mike Hosking put it well when he said this morning, "What New Zealand needs is a shock. A surprise. A blockbuster. A transformation. <[link removed]>"

I’m sorry to say, but Hosking isn’t going to be happy with what Nicola Willis has delivered today.

Nor should you.

Callum, Connor, and I have just arrived back at the office from the Beehive ‘Budget Lock-up’ where we have been poring over the fiscals, announcements, and economic projections.

Our summary is below, plus a list of our media releases listed at the bottom.

A friend of the Taxpayers’ Union sitting in the Parliamentary Gallery watching the speeches, just text to say that at least three Government Ministers were scrolling Taxpayers' Union social media pages while Nicola Willis was giving her speech! If you’re more of a pictures than words type a millennial, we’re over on F <[link removed]> <[link removed]>acebook <[link removed]>andX (once known as Twitter) <[link removed]> right now covering the Budget.You should give us a follow <[link removed]>😉

TL:DR – a summary of Budget 2024 📋

If you were looking forward to a bonfire of wasteful initiatives, you’ll be disappointed. Other than the already announced scrapping of the first home-buyer demand subsidy, nothing of material (from a fiscal, rather than a political point of view) is obvious in today’s Budget.

In her Budget Speech, <[link removed]> Ms Willis talked-the-talk, correctly pointing out that “Government spending has ballooned”, but the actual numbers fail to walk-the-walk.

Instead of popping Grant Robertson’s spending balloons, the more we got into the details, the clearer it became that Nicola Willis has added helium!

Willis’ 2024 Budget spends $13.8 billion more than Robertson’s 2023 Budget! That is $2,687 extra spending per household.

In response to Grant Robertson’s final budget, Christopher Luxon described spending $137 billion/year as an “addiction to spending” (he said it no less than 10 times in last year's Budget debate speech).

Wait til Luxon see what Nicola Willis is doing! As you’ll see on tables (see p 156 under “Core Crown expenses <[link removed]>) this year’s extra $13.8 billion (that's 13,800 million dollars) for this year coming is just the beginning.

If Grant was the addict, what does that make Nicola? 👀

The best the Government can claim is that they plan to increase spending but at a slightly lower rate than what Grant Robertson had set course on.

What will lead the news tonight: ‘Tax cuts are coming…’ 🤑

Nicola Willis has delivered a tax relief package almost identical to what National announced prior to the election. There is no sign ACT got any traction at all in terms of arguing for a flatter tax structure.

But to ensure there are ‘no losers’, Nicola Willis takes a leaf out of Labour’s book: tinkering with bureaucratic tax rebates and credits, rather than tackling the real issue of even those on modest incomes continuing to pay 30 cents in tax on every extra dollar earned.

But, let’s not be too negative – here at the Taxpayers’ Union, we’ll take tax relief any day of the week.

From 31 July (Willis claims IRD and payroll software delays mean it needs to be four weeks after than the start of the Government's fiscal year on 1 July) the following new tax rates will apply:

<[link removed]>

Click here for details of the tax changes. <[link removed]>

The Government has launched a “Tax Calculator” on the Treasury’s “Budget 2024” website. You can calculate how the tax changes will affect you here. <[link removed]>

<[link removed]>

Kiwi workers being shortchanged 😤

Despite talking throughout the election campaign about the 14 years of fiscal drag/inflation pushing income earners into higher tax brackets, Nicola Willis delivered just half of what is required to put that right.

Willis' $25-a-week offer to the average worker would only take their tax bill back to 2021 levels, locking in the 11 years of stealth tax hikes she was elected to fix. Even that’s a sleight of hand, as the $10-a-week Independent Earner Tax Credit won’t be available to anyone on over $70k.

And it gets worse. Minister Nicola Willis is relying on the very mischief Opposition Finance Spokesperson Nicola Willis used to hammer Grant Robertson about to get her own books back into surplus!

By not attaching the new income tax thresholds to inflation or wage growth, the proportion of income tax workers pay over time stealthily increases. That is what she is relying on to get back to surplus, with tax revenue forecast to continue growing, despite today's tax relief package.

Answering questions from media in the Beehive lock-up, Willis suggested that ‘this is it’ and that no further tax relief is coming until the books are back in surplus in 2027/28. By then, she will have basically recovered back everything she’s delivered in tax relief today through the inflation/fiscal drag tax!

There might have been a change in Government, but is this really a change in direction? 🤔

Make no mistake, if the shoe was on the other foot and this Budget was from Labour – she’d be calling it out as ‘shortchanging Kiwis’.

Larger deficits for longer: Willis is borrowing more in 2024/25 than Grant Robertson’s 2023/24 budget! 🤯

On debt, things are grim. The good news is that Core Crown Debt for the current year is ever so slightly below the pre-Christmas forecasts (we get to wind the Debt Clock back a few weeks – Yay!)

But, because the 2024/25 deficit is larger than Robertson’s 2023/24 Budget, the Debt Clock will now be running faster for the year ahead!

And instead of balancing the books, the projected surplus (assuming no major economic shocks) has been pushed back a year to 2027/28. Hitting this the year earlier was National’s top of its five pre-election “Fiscal Principles”.

So much for tackling wasteful spending…

Tick tock, tick tock… goes the Debt Clock. <[link removed]> ⏰

Willis uses the very same tricks as Grant Robertson to get back to (forecast) surplus 😈

This is my 10th Budget lock-up. Like the Treasury’s cold sausage rolls, you can be sure that the Minister of Finance will alleviate concerns about unaffordable spending by reassuring the media that while the ‘operating allowance’ (the size of the envelope for new spending) is large this year, they are being ‘prudent’ by reducing it over futureyears.

That makes the long term Treasury projections look better (Treasury have to take the Minister's word at face value for future spending plans).

But the smaller allowances almost never hold once next year’s budget actually arrives.

In addition to using fiscal drag to grow the Government’s tax-take over time, Nicola Willis has also pulled the very trick she complained about when in Opposition to make it look like surplus in 2027/28 is on track.

So Friend, is this a Taxpayer friendly Budget? Nicola Willis fails all three tests ❌ ❌ ❌

As per our full page advert in this morning’s NZ Herald <[link removed]>, we set three key tests for today’s Budget:

1. Reduce taxes by $49/week for the average income earner ❌

Nicola Willis needed to deliver $49 per week for the average earner on $66,196 a year to reset tax brackets for 14 years’ worth of inflation. She’s delivered just half of that – $24.89 a week.

This amounts to just the last three years of high inflation pushing people into higher tax brackets. The Government has not delivered tax relief, they’ve shortchanged Kiwis who are continuing to do it tough.

2. Cut wasteful spending❌

Government spending has increased by 84 percent since 2017 and the Public Service has added over 18,000 extra bureaucrats. Today was the opportunity to put that right.

It’s not to be. Instead of right-sizing the Public Service, Budget 2024 effectively locks in the Ardern-Robertson post-Covid level of big spending government.

In the long-term projections published with today’s Budget, even by 2038, Nicola Willis will still have higher Government spending as a share of the economy than Jacinda Ardern’s big spending 2019 “Wellbeing Budget” lolly scramble.

3. Stop racking up debt ❌

The Government has already racked up $90k in debt for every Kiwi household.

Not only has Willis failed to balance the books for this year (actually, she's made it worse – running a higher deficit than Robertson last year), the date for surplus has pushed back a year!

That means, instead of Stopping the Debt Clock <[link removed]>, it’s going to tick faster, for longer.

Maybe there’s still a need for the Taxpayers’ Union after all… <[link removed]>😢

<[link removed]>

Talk soon.

Jordan Williams

Executive Director

New Zealand Taxpayers’ Union.

Ps. All of the budget documentation is now released and online at Budget.govt.nz <[link removed]>. The tax calculator is here. <[link removed]>

Budget 2024 Media Releases

The Mother Of All Disappointments <[link removed]>

Government Promises To Hike Taxes By Stealth <[link removed]>

National Continue To Give Taxpayer Money To Corporate Welfare Bludgers <[link removed]>

$2.6 Billion Down The Drain For No Climate Benefit <[link removed]>

-=-=-

New Zealand Taxpayers' Union Inc. - 117 Lambton Quay, Level 4, Wellington 6011, New Zealand

This email was sent to [email protected]. To stop receiving emails: [link removed]

-=-=-

Created with NationBuilder - [link removed]

Message Analysis

- Sender: Taxpayers’ Union

- Political Party: n/a

- Country: New Zealand

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- NationBuilder