|

John,

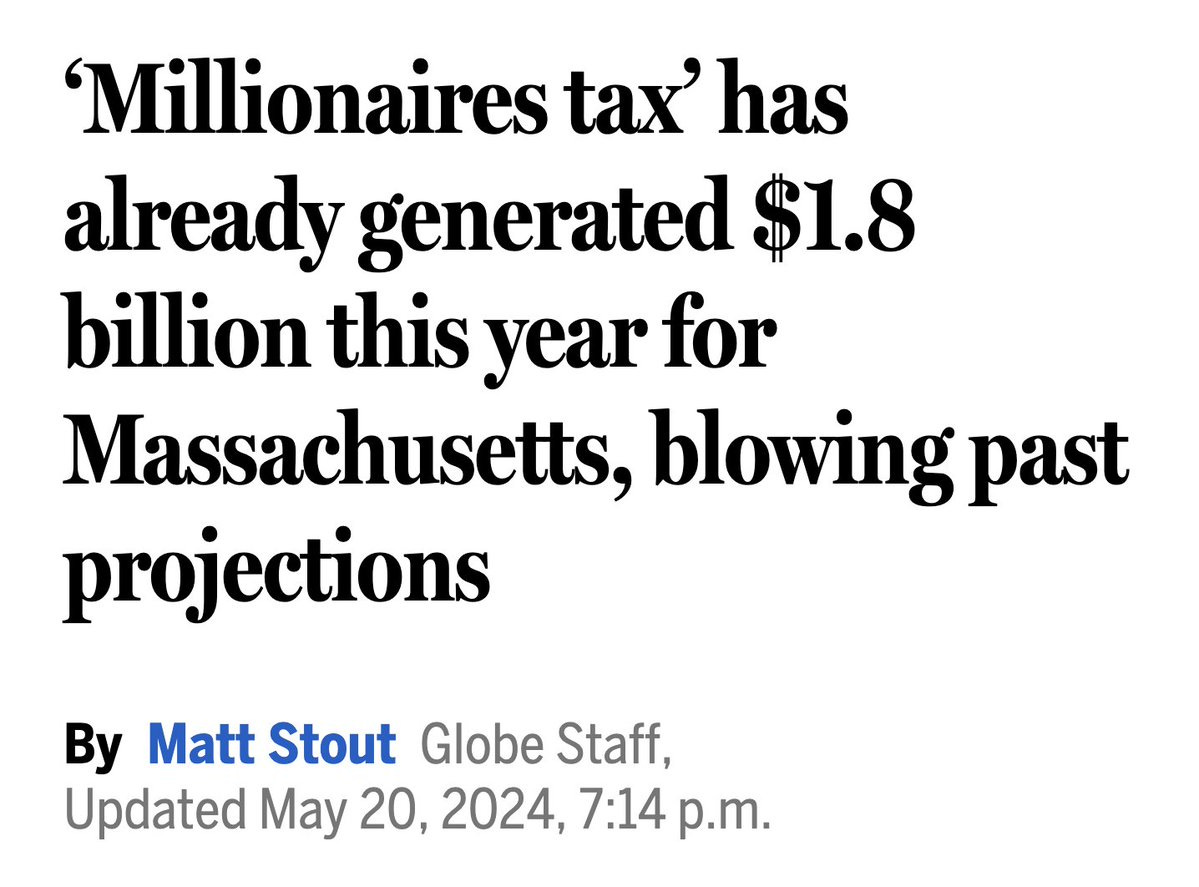

In 2022, Massachusetts voted to implement a 4% “millionaires tax” and it’s doing far better than anyone expected:

During the first three quarters of the fiscal year, the tax has brought in $800 million more than projected.[1] This is money that can be used to lower costs and improve services for working families, from education to transportation and more. During the first three quarters of the fiscal year, the tax has brought in $800 million more than projected.[1] This is money that can be used to lower costs and improve services for working families, from education to transportation and more.

Now, imagine if the U.S. was to implement a tax on the wealth gains of households worth $100 million or more. That’s the richest 0.05%―just 64,000 households―who largely avoid paying taxes on their wealth gains each year.

It’s estimated that the Billionaire Minimum Income Tax would raise more than $500 billion from the richest 0.05% over the next decade—creating a fairer tax system while bringing in revenue to lower costs for working people.[2] And it’s wildly popular with voters!

68% of voters, including majorities of Democrats, Independents, AND Republicans, support a billionaire tax.[3] There isn’t much, other than Social Security and Medicare, that have similar levels of support across party lines.

Taxes on the ultra-wealthy are popular and effective. Now we need to create the political will for Congress to act. Click here to demand Congress pass the Billionaire Minimum Income Tax to tax the wealth gains of billionaires and ultra-millionaires each year.

Our call to action comes at a critical time: billionaires are spending record sums to influence our democracy.

The latest Americans for Tax Fairness report, titled “The Billionaire Family Business,” highlights how just 50 billionaire families have already spent $600 million on the 2024 presidential election. And that’s just what’s being reported! Much more is undoubtedly being spent through the channel of “dark money”. Both publicly and privately, they’re using their wealth and influence to elect candidates who will push their ideology of fewer taxes on the rich and fewer rights for everyone else.

One of the most critical ways we can fight back against billionaire influence in our democracy is by taxing the wealth gains of the ultra-wealthy. Take action today! Add your name to demand Congress pass the Billionaire Minimum Income Tax.

Together, this is how we hold the richest 0.05% accountable and create an economy and a tax system that works for working people, not just billionaires and ultra-millionaires.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] Here’s how much the new ‘millionaires tax’ has raised this year (it’s a lot)

[2] The Billionaire Minimum Income Tax

[3] Biden’s Billionaire Tax and Budget Proposals Enjoy Widespread Voter Support

|