Email

📈 Nvidia Earnings: Will AI Hype Drive Wall Street to New Highs? (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | 📈 Nvidia Earnings: Will AI Hype Drive Wall Street to New Highs? (Weekly Cheat Sheet) |

| Date | May 20, 2024 2:12 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good morning,

The stock market rallied to new record highs this week, with the Dow Jones Industrial Average trading above 40,000 for the first time. This bullish sentiment was fueled by a series of economic reports that went the market’s way in terms of implications for Fed policy.

As the legendary investor Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” And patient investors were certainly rewarded this week.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

Advertisement

----------### Learn how to make AI work for you.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

AI breakthroughs happen every day. But where do you learn to actually apply the tech to your work? Join The Rundown — the world’s largest AI newsletter read by over 600,000 early adopters staying ahead of the curve.

1. The Rundown’s expert research team spends all day learning what’s new in AI

2. They send you daily emails on impactful AI tools and how to apply it

3. You learn how to become 2x more productive by leveraging AI

[Subscribe with one click]([link removed]).

----------

## **LAST WEEK’S MARKET OVERVIEW**

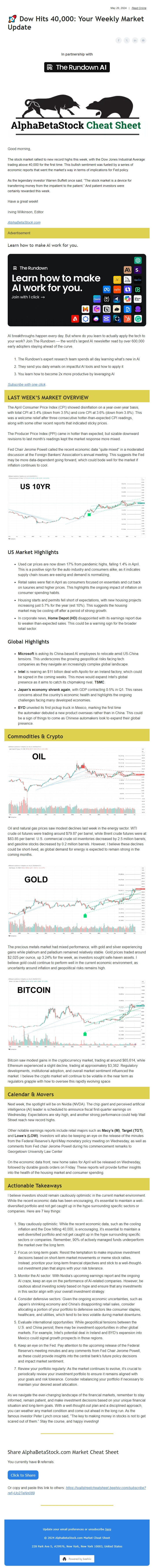

----------The April Consumer Price Index (CPI) showed disinflation on a year-over-year basis, with total CPI at 3.4% (down from 3.5%) and core CPI at 3.6% (down from 3.8%). This was a welcome relief after three consecutive hotter-than-expected CPI readings, along with some other recent reports that indicated sticky prices.

The Producer Price Index (PPI) came in hotter than expected, but sizable downward revisions to last month’s readings kept the market response more mixed.

Fed Chair Jerome Powell called the recent economic data “quite mixed” in a moderated discussion at the Foreign Bankers’ Association’s annual meeting. This suggests the Fed may be more data-dependent going forward, which could bode well for the market if inflation continues to cool.

View image: ([link removed])

Caption:

## **US Market Highlights**

* Used car prices are now down 17% from pandemic highs, falling 1.4% in April. This is a positive sign for the auto industry and consumers alike, as it indicates supply chain issues are easing and demand is normalizing.

* Retail sales were flat in April as consumers focused on essentials and cut back on luxuries amid higher prices. This highlights the ongoing impact of inflation on consumer spending habits.

* Housing starts and permits fell short of expectations, with new housing projects increasing just 5.7% for the year (est 10%). This suggests the housing market may be cooling off after a period of strong growth.

* In corporate news, **Home Depot (HD)** disappointed with its earnings report due to weaker-than-expected sales. This could be a warning sign for the broader retail sector.

## **Global Highlights**

* **Microsoft** is asking its China-based AI employees to relocate amid US-China tensions. This underscores the growing geopolitical risks facing tech companies as they navigate an increasingly complex global landscape.

* **Intel** is nearing an $11 billion deal with Apollo for an Ireland factory, which could be signed in the coming weeks. This move would expand Intel’s global presence as it aims to catch its chipmaking rival, **TSMC**.

* **Japan’s economy shrank again**, with GDP contracting 0.5% in Q1. This raises concerns about the country’s economic health and highlights the ongoing challenges facing many developed economies.

* **BYD** unveiled its first pickup truck in Mexico, marking the first time the automaker debuted a new product overseas rather than in China. This could be a sign of things to come as Chinese automakers look to expand their global presence.

----------

## **Commodities & Crypto**

----------View image: ([link removed])

Caption:

Oil and natural gas prices saw modest declines last week in the energy sector. WTI crude oil futures were trading around $79.87 per barrel, while Brent crude futures were at $83.85 per barrel. U.S. commercial crude oil inventories decreased by 2.5 million barrels, and gasoline stocks decreased by 0.2 million barrels. However, I believe these declines could be short-lived, as global demand for energy is expected to remain strong in the coming months.

View image: ([link removed])

Caption:

The precious metals market had mixed performance, with gold and silver experiencing gains while platinum and palladium remained relatively stable. Gold prices traded around $2,025 per ounce, up 3.24% for the week, as investors sought safe-haven assets. I believe gold could continue to perform well in the current economic environment, as uncertainty around inflation and geopolitical risks remains high.

View image: ([link removed])

Caption:

Bitcoin saw modest gains in the cryptocurrency market, trading at around $65,614, while Ethereum experienced a slight decline, trading at approximately $3,382. Regulatory developments, institutional adoption, and overall market sentiment influenced the market. I believe the crypto market will continue to be volatile in the near term as regulators grapple with how to oversee this rapidly evolving space.

----------

## **Calendar & Movers**

----------Next week, the spotlight will be on Nvidia (NVDA). The chip giant and perceived artificial intelligence (AI) leader is scheduled to announce fiscal first-quarter earnings on Wednesday. Expectations are sky-high, and another strong performance could help Wall Street reach new record highs.

Other notable earnings reports include retail majors such as **Macy’s (M)**, **Target (TGT)**, and **Lowe’s (LOW)**. Investors will also be keeping an eye on the release of the minutes from the Federal Reserve’s April/May monetary policy meeting on Wednesday, as well as comments from Fed chair Jerome Powell during his commencement remarks to Georgetown University Law Center

On the economic data front, new home sales for April will be released on Wednesday, followed by durable goods orders on Friday. These reports will provide further insights into the health of the housing market and consumer spending.

----------

## **Actionable Takeaways**

----------I believe investors should remain cautiously optimistic in the current market environment. While the recent economic data has been encouraging, it’s essential to maintain a well-diversified portfolio and not get caught up in the hype surrounding specific sectors or companies. Here are 7 key things:

1. Stay cautiously optimistic: While the recent economic data, such as the cooling inflation and the Dow hitting 40,000, is encouraging, it’s essential to maintain a well-diversified portfolio and not get caught up in the hype surrounding specific sectors or companies. Remember, 90% of actively managed funds underperform the market over the long term.

2. Focus on long-term goals: Resist the temptation to make impulsive investment decisions based on short-term market movements or meme stock rallies. Instead, prioritize your long-term financial objectives and stick to a well-thought-out investment plan that aligns with your risk tolerance.

3. Monitor the AI sector: With Nvidia’s upcoming earnings report and the ongoing AI craze, keep an eye on the performance of AI-related companies. However, be cautious about investing solely based on hype and ensure that any investments in this sector align with your overall investment strategy.

4. Consider defensive sectors: Given the ongoing economic uncertainties, such as Japan’s shrinking economy and China’s disappointing retail sales, consider allocating a portion of your portfolio to defensive sectors like consumer staples, healthcare, and utilities, which tend to be less volatile during market downturns.

5. Evaluate international opportunities: While geopolitical tensions between the U.S. and China persist, there may be investment opportunities in other global markets. For example, Intel’s potential deal in Ireland and BYD’s expansion into Mexico could signal growth prospects in those regions.

6. Keep an eye on the Fed: Pay attention to the upcoming release of the Federal Reserve’s meeting minutes and any comments from Fed Chair Jerome Powell, as these could provide insights into the central bank’s future policy decisions and impact market sentiment.

7. Review your portfolio regularly: As the market continues to evolve, it’s crucial to periodically review your investment portfolio to ensure it remains aligned with your goals and risk tolerance. Consider rebalancing your portfolio if necessary to maintain your desired asset allocation.

As we navigate the ever-changing landscape of the financial markets, remember to stay informed, remain patient, and make investment decisions based on your unique financial situation and long-term goals. With a well-thought-out plan and a disciplined approach, you can weather any market condition and come out ahead in the long run. As the famous investor Peter Lynch once said, “The key to making money in stocks is not to get scared out of them.” Stay the course, and happy investing!

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good morning,

The stock market rallied to new record highs this week, with the Dow Jones Industrial Average trading above 40,000 for the first time. This bullish sentiment was fueled by a series of economic reports that went the market’s way in terms of implications for Fed policy.

As the legendary investor Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” And patient investors were certainly rewarded this week.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

Advertisement

----------### Learn how to make AI work for you.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

AI breakthroughs happen every day. But where do you learn to actually apply the tech to your work? Join The Rundown — the world’s largest AI newsletter read by over 600,000 early adopters staying ahead of the curve.

1. The Rundown’s expert research team spends all day learning what’s new in AI

2. They send you daily emails on impactful AI tools and how to apply it

3. You learn how to become 2x more productive by leveraging AI

[Subscribe with one click]([link removed]).

----------

## **LAST WEEK’S MARKET OVERVIEW**

----------The April Consumer Price Index (CPI) showed disinflation on a year-over-year basis, with total CPI at 3.4% (down from 3.5%) and core CPI at 3.6% (down from 3.8%). This was a welcome relief after three consecutive hotter-than-expected CPI readings, along with some other recent reports that indicated sticky prices.

The Producer Price Index (PPI) came in hotter than expected, but sizable downward revisions to last month’s readings kept the market response more mixed.

Fed Chair Jerome Powell called the recent economic data “quite mixed” in a moderated discussion at the Foreign Bankers’ Association’s annual meeting. This suggests the Fed may be more data-dependent going forward, which could bode well for the market if inflation continues to cool.

View image: ([link removed])

Caption:

## **US Market Highlights**

* Used car prices are now down 17% from pandemic highs, falling 1.4% in April. This is a positive sign for the auto industry and consumers alike, as it indicates supply chain issues are easing and demand is normalizing.

* Retail sales were flat in April as consumers focused on essentials and cut back on luxuries amid higher prices. This highlights the ongoing impact of inflation on consumer spending habits.

* Housing starts and permits fell short of expectations, with new housing projects increasing just 5.7% for the year (est 10%). This suggests the housing market may be cooling off after a period of strong growth.

* In corporate news, **Home Depot (HD)** disappointed with its earnings report due to weaker-than-expected sales. This could be a warning sign for the broader retail sector.

## **Global Highlights**

* **Microsoft** is asking its China-based AI employees to relocate amid US-China tensions. This underscores the growing geopolitical risks facing tech companies as they navigate an increasingly complex global landscape.

* **Intel** is nearing an $11 billion deal with Apollo for an Ireland factory, which could be signed in the coming weeks. This move would expand Intel’s global presence as it aims to catch its chipmaking rival, **TSMC**.

* **Japan’s economy shrank again**, with GDP contracting 0.5% in Q1. This raises concerns about the country’s economic health and highlights the ongoing challenges facing many developed economies.

* **BYD** unveiled its first pickup truck in Mexico, marking the first time the automaker debuted a new product overseas rather than in China. This could be a sign of things to come as Chinese automakers look to expand their global presence.

----------

## **Commodities & Crypto**

----------View image: ([link removed])

Caption:

Oil and natural gas prices saw modest declines last week in the energy sector. WTI crude oil futures were trading around $79.87 per barrel, while Brent crude futures were at $83.85 per barrel. U.S. commercial crude oil inventories decreased by 2.5 million barrels, and gasoline stocks decreased by 0.2 million barrels. However, I believe these declines could be short-lived, as global demand for energy is expected to remain strong in the coming months.

View image: ([link removed])

Caption:

The precious metals market had mixed performance, with gold and silver experiencing gains while platinum and palladium remained relatively stable. Gold prices traded around $2,025 per ounce, up 3.24% for the week, as investors sought safe-haven assets. I believe gold could continue to perform well in the current economic environment, as uncertainty around inflation and geopolitical risks remains high.

View image: ([link removed])

Caption:

Bitcoin saw modest gains in the cryptocurrency market, trading at around $65,614, while Ethereum experienced a slight decline, trading at approximately $3,382. Regulatory developments, institutional adoption, and overall market sentiment influenced the market. I believe the crypto market will continue to be volatile in the near term as regulators grapple with how to oversee this rapidly evolving space.

----------

## **Calendar & Movers**

----------Next week, the spotlight will be on Nvidia (NVDA). The chip giant and perceived artificial intelligence (AI) leader is scheduled to announce fiscal first-quarter earnings on Wednesday. Expectations are sky-high, and another strong performance could help Wall Street reach new record highs.

Other notable earnings reports include retail majors such as **Macy’s (M)**, **Target (TGT)**, and **Lowe’s (LOW)**. Investors will also be keeping an eye on the release of the minutes from the Federal Reserve’s April/May monetary policy meeting on Wednesday, as well as comments from Fed chair Jerome Powell during his commencement remarks to Georgetown University Law Center

On the economic data front, new home sales for April will be released on Wednesday, followed by durable goods orders on Friday. These reports will provide further insights into the health of the housing market and consumer spending.

----------

## **Actionable Takeaways**

----------I believe investors should remain cautiously optimistic in the current market environment. While the recent economic data has been encouraging, it’s essential to maintain a well-diversified portfolio and not get caught up in the hype surrounding specific sectors or companies. Here are 7 key things:

1. Stay cautiously optimistic: While the recent economic data, such as the cooling inflation and the Dow hitting 40,000, is encouraging, it’s essential to maintain a well-diversified portfolio and not get caught up in the hype surrounding specific sectors or companies. Remember, 90% of actively managed funds underperform the market over the long term.

2. Focus on long-term goals: Resist the temptation to make impulsive investment decisions based on short-term market movements or meme stock rallies. Instead, prioritize your long-term financial objectives and stick to a well-thought-out investment plan that aligns with your risk tolerance.

3. Monitor the AI sector: With Nvidia’s upcoming earnings report and the ongoing AI craze, keep an eye on the performance of AI-related companies. However, be cautious about investing solely based on hype and ensure that any investments in this sector align with your overall investment strategy.

4. Consider defensive sectors: Given the ongoing economic uncertainties, such as Japan’s shrinking economy and China’s disappointing retail sales, consider allocating a portion of your portfolio to defensive sectors like consumer staples, healthcare, and utilities, which tend to be less volatile during market downturns.

5. Evaluate international opportunities: While geopolitical tensions between the U.S. and China persist, there may be investment opportunities in other global markets. For example, Intel’s potential deal in Ireland and BYD’s expansion into Mexico could signal growth prospects in those regions.

6. Keep an eye on the Fed: Pay attention to the upcoming release of the Federal Reserve’s meeting minutes and any comments from Fed Chair Jerome Powell, as these could provide insights into the central bank’s future policy decisions and impact market sentiment.

7. Review your portfolio regularly: As the market continues to evolve, it’s crucial to periodically review your investment portfolio to ensure it remains aligned with your goals and risk tolerance. Consider rebalancing your portfolio if necessary to maintain your desired asset allocation.

As we navigate the ever-changing landscape of the financial markets, remember to stay informed, remain patient, and make investment decisions based on your unique financial situation and long-term goals. With a well-thought-out plan and a disciplined approach, you can weather any market condition and come out ahead in the long run. As the famous investor Peter Lynch once said, “The key to making money in stocks is not to get scared out of them.” Stay the course, and happy investing!

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a