|

John,

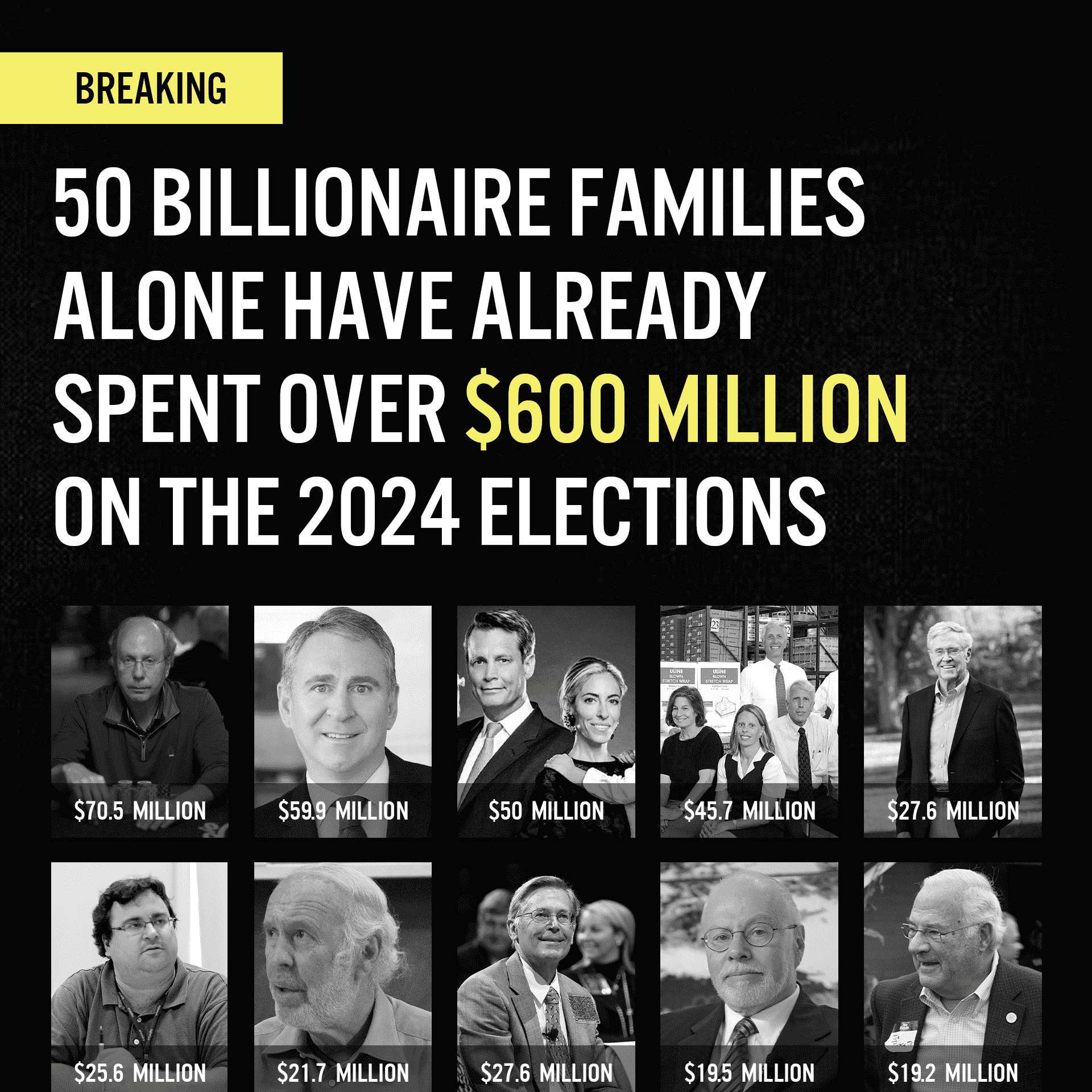

Through our advocacy and reporting, we’re combating billionaire greed and their influence on our democracy. This week, we released our latest report, “The Billionaire Family Business”―our first report on billionaires’ donations in the 2024 election.

We found that just 50 billionaire families have already spent $600 million to influence the 2024 presidential election. More than two-thirds of those donations (69%) were made to Republicans or conservative causes. Republicans advocate for lower taxes on the rich, on corporations, and on massive inheritances, so billionaire donors view these donations as an investment in maintaining their wealth and power.

Our reporting further finds that the collective worth of these 50 billionaire families is over $1 trillion, meaning that this $600 million in donations is equivalent to a donation of about $100 for the average U.S. household.

At a time when America’s 806 billionaires are worth a combined $5.8 trillion―and they’ve seen their wealth virtually double since the enactment of the 2017 Trump-GOP tax scam―we’re fighting for policies that rein in obscene wealth, such as the Billionaire Minimum Income Tax.

Proposed by President Biden and introduced in Congress by Representatives Steve Cohen (D-TN) and Don Beyer (D-VA), the Billionaire Minimum Income Tax would ensure that every household worth over $100 million is paying an effective tax rate of at least 25% on their full income each year, including their unrealized capital gains. It would raise more than $500 billion over the next decade—creating a fairer tax system while bringing in revenue to lower costs for working people.[1]

In this critical election year, help power our research and activism with a $5 donation today and fight for policies that ensure billionaires and ultra-millionaires pay their fair share in taxes.

In the Senate, Finance Committee Chairman Ron Wyden has also introduced a tax on billionaire wealth―the Billionaires Income Tax. It would raise a similar amount as President Biden’s plan while also holding the ultra-wealthy accountable.

Also in the Senate, Bernie Sanders has introduced legislation to strengthen the estate tax―lowering the amount per couple over which the tax is paid from more than $27 million to $7 million. That would still leave 99.5% of all estates tax-free.[2]

From ensuring that millionaires and billionaires pay their fair share of income taxes each year, to strengthening the estate tax to constrain family dynasties that are set to pass along $21 trillion to their heirs over the next two decades, we’re fighting to unrig our tax code and invest in our future.[3]

Donate today to power our research and activism that are critical to unrigging our tax code and creating an economy that works for everyone, not just the wealthy few.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Thank you for fighting by our side to demand the wealthy finally start paying their fair share in taxes.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] The Billionaire Minimum Income Tax

[2] For the 99.5% Act: Summary of Sen. Bernie Sanders’ legislation to tax the fortunes of the top 0.5%

[3] Dynasty Trusts: Giant Tax Loopholes that Supercharge Wealth Accumulation

|