| From | American Energy Alliance <[email protected]> |

| Subject | Will we ever run out? |

| Date | May 13, 2024 6:05 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 05/13/2024

Subscribe Now ([link removed])

** The more we use, the more we discover.

------------------------------------------------------------

Just the News ([link removed]) (5/12/24) reports: "For years, activists argued for an energy transition away from fossil fuels because, they said, we were hitting 'peak oil,' the point at which we can no longer produce oil because there’s little left in the ground or it’s too expensive to recover. Tom Pyle, president of the Institute for Energy Research (IER), a free market think tank focusing on energy, told Just the News that anti-fossil fuel activists latched onto 'peak oil' to push for alternatives, and with the U.S. leading the world’s production, their rhetoric has evolved... In 2011, IER produced its first North American Energy Inventory. 'It was really for the purpose of shattering this myth of energy scarcity. To my knowledge, prior to that, nobody had taken the effort to compile, using government data the amount of energy that we have in North America,' Pyle said. In that

2011 report, Pyle stated: 'Thanks to new and continuing innovations in exploration and production technology, there’s every reason to believe that today’s estimates of reserves are only a fraction of what will be produced and delivered tomorrow.' The statement turned out to be accurate. The Shale Revolution, which combined technologies in horizontal drilling and hydraulic fracturing, made available large deposits of previously unrecoverable oil throughout the U.S... If all the oil in North America’s technically recoverable reserves was devoted exclusively to gasoline production, according to the report, the North American transportation sector would have enough energy for 539 years at 2023 usage rates. There are 4.03 quadrillion cubic feet of technically recoverable natural gas reserves, which is a 47% increase in the 2011 estimate. At current rates of consumption, there’s enough gas for 130 years. Proved reserves of coal, arguably the most abundant fossil fuel, can satisfy 485 years of

demand at 2022 consumption rates, and the U.S. has 53% more proven coal reserves than Russia, the country with the next largest coal reserves."

[link removed]

** "If climate change means we will face more extreme weather in the years ahead — hotter, colder, and/or more severe temperatures for extended periods — it’s Total Bonkers Crazytown^TM to make our electric grid dependent on the weather. But by lavishing staggering amounts of money on wind and solar energy, and in many cases, mandating wind and solar, that’s precisely what we are doing."

------------------------------------------------------------

– R ([link removed]) obert Bryce, Substack ([link removed])

============================================================

We are rich in resources, but poor in leadership.

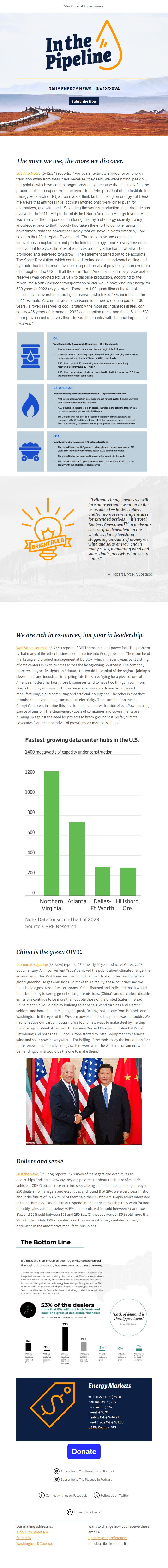

** Wall Street Journal ([link removed])

(5/12/24) reports: "Bill Thomson needs power fast. The problem is that many of the other businesspeople racing into Georgia do too. Thomson heads marketing and product management at DC Blox, which in recent years built a string of data centers in midsize cities across the fast-growing Southeast. The company more recently set its sights on Atlanta—the would-be capital of the region—joining a slew of tech and industrial firms piling into the state. Vying for a piece of one of America’s hottest markets, those businesses tend to have two things in common. One is that they represent a U.S. economy increasingly driven by advanced manufacturing, cloud computing and artificial intelligence. The other is that they promise to hoover up huge amounts of electricity. That combination means Georgia’s success in luring this development comes with a side effect: Power is a big source of tension. The clean-energy goals of companies and governments are running up against the need for projects to break

ground fast. So far, climate advocates fear the imperatives of growth mean more fossil fuels."

China is the green OPEC.

** Discourse Magazine ([link removed])

(5/13/24) reports: "For nearly 20 years, since Al Gore’s 2006 documentary 'An Inconvenient Truth' panicked the public about climate change, the economies of the West have been wringing their hands about the need to reduce global greenhouse gas emissions. To make this a reality, these countries say, we must build a** ([link removed])

post-fossil-fuels economy. China listened and indicated that it would help, but not by lowering greenhouse gas emissions. (China’s** ([link removed])

annual carbon dioxide emissions continue to be more than double those of the United States.) Instead, China meant it would help by building solar panels, wind turbines and electric vehicles and batteries. In making this push, Beijing took its cue from Brussels and Washington. In the eyes of the Western power centers, the planet was in trouble. We had to reduce our carbon footprint. We found new ways to make steel by melting metal scraps instead of iron ore; BP became Beyond Petroleum instead of British Petroleum; and both the U.S. and Europe started to install equipment to harness wind and solar power everywhere. For Beijing, if the tools to lay the foundation for a more renewables-friendly energy system were what the Western consumers were demanding, China would be the one to make them."

Dollars and sense.

** Just the News ([link removed])

(5/11/24) reports: "A survey of managers and executives at dealerships finds that 65% say they are pessimistic about the future of electric vehicles. CDK Global, a research firm specializing in data for dealerships, surveyed 250 dealership managers and executives and found that 29% were very pessimistic about the future of EVs. A third of them said their customers simply aren’t interested in the technology. One-fourth of respondents said the dealership they work for had monthly sales volumes below 50 EVs per month. A third sold between 51 and 100 EVs, and 29% sold between 101 and 250 EVs. Of those surveyed, 13% sold more than 251 vehicles. Only 13% of dealers said they were extremely confident or very optimistic in the automotive manufacturers’ plans."

Energy Markets

WTI Crude Oil: ↑ $78.58

Natural Gas: ↑ $2.27

Gasoline: ↑ $3.62

Diesel: ↓ $3.93

Heating Oil: ↑ $244.91

Brent Crude Oil: ↑ $83.05

** US Rig Count ([link removed])

: ↓ 625

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

DAILY ENERGY NEWS | 05/13/2024

Subscribe Now ([link removed])

** The more we use, the more we discover.

------------------------------------------------------------

Just the News ([link removed]) (5/12/24) reports: "For years, activists argued for an energy transition away from fossil fuels because, they said, we were hitting 'peak oil,' the point at which we can no longer produce oil because there’s little left in the ground or it’s too expensive to recover. Tom Pyle, president of the Institute for Energy Research (IER), a free market think tank focusing on energy, told Just the News that anti-fossil fuel activists latched onto 'peak oil' to push for alternatives, and with the U.S. leading the world’s production, their rhetoric has evolved... In 2011, IER produced its first North American Energy Inventory. 'It was really for the purpose of shattering this myth of energy scarcity. To my knowledge, prior to that, nobody had taken the effort to compile, using government data the amount of energy that we have in North America,' Pyle said. In that

2011 report, Pyle stated: 'Thanks to new and continuing innovations in exploration and production technology, there’s every reason to believe that today’s estimates of reserves are only a fraction of what will be produced and delivered tomorrow.' The statement turned out to be accurate. The Shale Revolution, which combined technologies in horizontal drilling and hydraulic fracturing, made available large deposits of previously unrecoverable oil throughout the U.S... If all the oil in North America’s technically recoverable reserves was devoted exclusively to gasoline production, according to the report, the North American transportation sector would have enough energy for 539 years at 2023 usage rates. There are 4.03 quadrillion cubic feet of technically recoverable natural gas reserves, which is a 47% increase in the 2011 estimate. At current rates of consumption, there’s enough gas for 130 years. Proved reserves of coal, arguably the most abundant fossil fuel, can satisfy 485 years of

demand at 2022 consumption rates, and the U.S. has 53% more proven coal reserves than Russia, the country with the next largest coal reserves."

[link removed]

** "If climate change means we will face more extreme weather in the years ahead — hotter, colder, and/or more severe temperatures for extended periods — it’s Total Bonkers Crazytown^TM to make our electric grid dependent on the weather. But by lavishing staggering amounts of money on wind and solar energy, and in many cases, mandating wind and solar, that’s precisely what we are doing."

------------------------------------------------------------

– R ([link removed]) obert Bryce, Substack ([link removed])

============================================================

We are rich in resources, but poor in leadership.

** Wall Street Journal ([link removed])

(5/12/24) reports: "Bill Thomson needs power fast. The problem is that many of the other businesspeople racing into Georgia do too. Thomson heads marketing and product management at DC Blox, which in recent years built a string of data centers in midsize cities across the fast-growing Southeast. The company more recently set its sights on Atlanta—the would-be capital of the region—joining a slew of tech and industrial firms piling into the state. Vying for a piece of one of America’s hottest markets, those businesses tend to have two things in common. One is that they represent a U.S. economy increasingly driven by advanced manufacturing, cloud computing and artificial intelligence. The other is that they promise to hoover up huge amounts of electricity. That combination means Georgia’s success in luring this development comes with a side effect: Power is a big source of tension. The clean-energy goals of companies and governments are running up against the need for projects to break

ground fast. So far, climate advocates fear the imperatives of growth mean more fossil fuels."

China is the green OPEC.

** Discourse Magazine ([link removed])

(5/13/24) reports: "For nearly 20 years, since Al Gore’s 2006 documentary 'An Inconvenient Truth' panicked the public about climate change, the economies of the West have been wringing their hands about the need to reduce global greenhouse gas emissions. To make this a reality, these countries say, we must build a** ([link removed])

post-fossil-fuels economy. China listened and indicated that it would help, but not by lowering greenhouse gas emissions. (China’s** ([link removed])

annual carbon dioxide emissions continue to be more than double those of the United States.) Instead, China meant it would help by building solar panels, wind turbines and electric vehicles and batteries. In making this push, Beijing took its cue from Brussels and Washington. In the eyes of the Western power centers, the planet was in trouble. We had to reduce our carbon footprint. We found new ways to make steel by melting metal scraps instead of iron ore; BP became Beyond Petroleum instead of British Petroleum; and both the U.S. and Europe started to install equipment to harness wind and solar power everywhere. For Beijing, if the tools to lay the foundation for a more renewables-friendly energy system were what the Western consumers were demanding, China would be the one to make them."

Dollars and sense.

** Just the News ([link removed])

(5/11/24) reports: "A survey of managers and executives at dealerships finds that 65% say they are pessimistic about the future of electric vehicles. CDK Global, a research firm specializing in data for dealerships, surveyed 250 dealership managers and executives and found that 29% were very pessimistic about the future of EVs. A third of them said their customers simply aren’t interested in the technology. One-fourth of respondents said the dealership they work for had monthly sales volumes below 50 EVs per month. A third sold between 51 and 100 EVs, and 29% sold between 101 and 250 EVs. Of those surveyed, 13% sold more than 251 vehicles. Only 13% of dealers said they were extremely confident or very optimistic in the automotive manufacturers’ plans."

Energy Markets

WTI Crude Oil: ↑ $78.58

Natural Gas: ↑ $2.27

Gasoline: ↑ $3.62

Diesel: ↓ $3.93

Heating Oil: ↑ $244.91

Brent Crude Oil: ↑ $83.05

** US Rig Count ([link removed])

: ↓ 625

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

Message Analysis

- Sender: American Energy Alliance (AEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp