Email

Crucial Inflation Data Ahead: PPI and CPI Reports to Shape Market Outlook (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | Crucial Inflation Data Ahead: PPI and CPI Reports to Shape Market Outlook (Weekly Cheat Sheet) |

| Date | May 13, 2024 1:22 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good morning,

As the legendary investor Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” This week’s market action certainly tested investors’ patience, but those who stayed the course were rewarded with solid gains across the major indices.

The S&P 500 led the charge, registering a 1.9% gain and closing above the key 5,200 level for the first time since April 9. The Nasdaq Composite and Dow Jones Industrial Average also logged impressive gains of 1.1% and 2.2%, respectively. Notably, the S&P 500 and Nasdaq Composite are now less than 1% away from their record closing highs, a testament to the market’s resilience in the face of various challenges.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

**Table of Content**

* **[US Market Highlights]([link removed])**

* **[Global Highlights]([link removed])**

* **[Investor Takeaways]([link removed])**

* **[Commodities & Crypto]([link removed])**

* **[Calendar & Movers]([link removed])**

----------

Advertisement

----------### Steal our best value stock ideas.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

PayPal, Disney, and Nike all dropped 50-80% recently from all-time highs.

Are they undervalued? Can they turn around? What’s next? You don’t have time to track every stock, but should you be forced to miss all the best opportunities?

That’s why we scour hundreds of value stock ideas for you. Whenever we find something interesting, we send it straight to your inbox.

[Subscribe free to Value Investor Daily with one click]([link removed]) so you never miss out on our research again.

----------

## **LAST WEEK’S MARKET OVERVIEW**

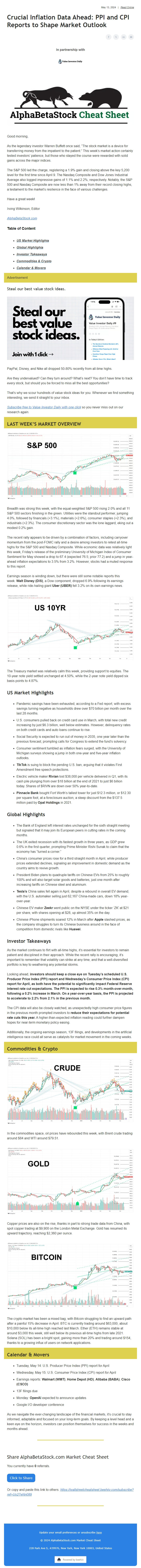

----------View image: ([link removed])

Caption:

Breadth was strong this week, with the equal-weighted S&P 500 rising 2.0% and all 11 S&P 500 sectors finishing in the green. Utilities were the standout performer, jumping 4.0%, followed by financials (+3.1%), materials (+2.6%), consumer staples (+2.3%), and industrials (+2.3%). The consumer discretionary sector was the lone laggard, eking out a modest 0.2% gain.

The recent rally appears to be driven by a combination of factors, including carryover momentum from the post-FOMC rally and a desire among investors to retest all-time highs for the S&P 500 and Nasdaq Composite. While economic data was relatively light this week, Friday’s release of the preliminary University of Michigan Index of Consumer Sentiment for May showed a drop to 67.4 (expected 76.5; prior 77.2) and a jump in year-ahead inflation expectations to 3.5% from 3.2%. However, stocks had a muted response to this report.

Earnings season is winding down, but there were still some notable reports this week. **Walt Disney (DIS)**, a Dow component, dropped 6.9% following its earnings release, while ride-hailing giant **Uber (UBER)** fell 3.2% on its own earnings news.

View image: ([link removed])

Caption:

The Treasury market was relatively calm this week, providing support to equities. The 10-year note yield settled unchanged at 4.50%, while the 2-year note yield dipped six basis points to 4.87%.

## **US Market Highlights**

* Pandemic savings have been exhausted, according to a Fed report, with excess savings turning negative as households drew over $70 billion per month over the last 28 months.

* U.S. consumers pulled back on credit card use in March, with total new credit increasing by just $6.3 billion, well below estimates. However, delinquency rates on both credit cards and auto loans continue to rise.

* Social Security is expected to run out of money in 2035, one year later than the previous forecast, prompting calls for Congress to extend the fund’s solvency.

* Consumer sentiment tumbled as inflation fears surged, with the University of Michigan surveys showing a jump in both one-year and five-year inflation outlooks.

* **TikTok** is suing to block the pending U.S. ban, arguing that it violates First Amendment free speech protections.

* Electric vehicle maker **Rivian** lost $38,000 per vehicle delivered in Q1, with its cash pile plunging from over $18 billion at the end of 2021 to just $6 billion today. Shares of $RIVN are down over 50% year-to-date.

* **Pinnacle Bank** bought Fort Worth’s tallest tower for just $12.3 million, or $12.30 per square foot, at a foreclosure auction, a steep discount from the $137.5 million paid by **Opal Holdings** in 2021.

## **Global Highlights**

* The Bank of England left interest rates unchanged for the sixth straight meeting but signaled that it may join its European peers in cutting rates in the coming months.

* The UK exited recession with its fastest growth in three years, as GDP grew 0.6% in the first quarter, prompting Prime Minister Rishi Sunak to claim that the economy has “turned a corner.”

* China’s consumer prices rose for a third straight month in April, while producer prices extended declines, signaling an improvement in domestic demand as the country aims to revive growth.

* President Biden plans to quadruple tariffs on Chinese EVs from 25% to roughly 100% and will also target solar goods and batteries, just one month after increasing tariffs on Chinese steel and aluminum.

* **Tesla’s** China sales fell again in April, despite a rebound in overall EV demand, with the U.S. automaker selling just 62,167 China-made cars, down 18% year-over-year.

* Chinese EV maker **Zeekr** went public on the NYSE under the ticker ‘ZK’ at $21 per share, with shares opening at $28, up almost 35% on the day.

* Chinese iPhone shipments soared 12% in March after **Apple** slashed prices, as the company struggles to turn its Chinese business around in the face of competition from domestic rivals like **Huawei**.

## **Investor Takeaways**

As the market continues to flirt with all-time highs, it’s essential for investors to remain patient and disciplined in their approach. While the recent rally is encouraging, it’s important to remember that volatility can strike at any time, and that a well-diversified portfolio is key to weathering any potential storms.

Looking ahead,** investors should keep a close eye on Tuesday’s scheduled U.S. Producer Price Index (PPI) report and Wednesday’s Consumer Price Index (CPI) report for April, as both have the potential to significantly impact Federal Reserve interest rate cut expectations. The PPI is expected to rise 0.3% month-over-month, following a 0.2% increase in March. On a year-over-year basis, the PPI is projected to accelerate to 2.2% from 2.1% in the previous month.**

The CPI data will also be closely watched, as unexpectedly high consumer price figures in the previous month prompted investors to **reduce their expectations for potential rate cuts this year.** A higher-than-expected inflation reading could further dampen hopes for near-term monetary policy easing.

Additionally, the ongoing earnings season, 13F filings, and developments in the artificial intelligence race could all serve as catalysts for market movement in the coming weeks.

----------

## **Commodities & Crypto**

----------View image: ([link removed])

Caption:

In the commodities space, oil prices have rebounded this week, with Brent crude trading around $84 and WTI around $79.51.

View image: ([link removed])

Caption:

Copper prices are also on the rise, thanks in part to strong trade data from China, with spot copper trading at $9,900 on the London Metal Exchange. Gold has resumed its upward trajectory, reaching $2,360 per ounce.

View image: ([link removed])

Caption:

The crypto market has been a mixed bag, with Bitcoin struggling to find an upward path after a painful 15% decrease in April. BTC is currently trading around $63,000, about $10,000 below its all-time high reached last March. Ether (ETH) remains stable at around $3,000 this week, still well below its previous all-time highs from late 2021. Solana (SOL) has been a bright spot, gaining more than 20% and trading around $154, thanks to a growing influx of users on network applications.

----------

## **Calendar & Movers**

----------* Tuesday, May 14: U.S. Producer Price Index (PPI) report for April

* Wednesday, May 15: U.S. Consumer Price Index (CPI) report for April

* Earnings reports: **Walmart (WMT)**, **Home Depot (HD)**, **Alibaba (BABA)**, **Cisco (CSCO)**

* 13F filings due

* Monday: **OpenAI** expected to announce updates

* Google I/O developer conference

As we navigate the ever-changing landscape of the financial markets, it’s crucial to stay informed, adaptable and focused on your long-term goals. By keeping a level head and a keen eye on the horizon, investors can position themselves for success in the weeks and months ahead.

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good morning,

As the legendary investor Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” This week’s market action certainly tested investors’ patience, but those who stayed the course were rewarded with solid gains across the major indices.

The S&P 500 led the charge, registering a 1.9% gain and closing above the key 5,200 level for the first time since April 9. The Nasdaq Composite and Dow Jones Industrial Average also logged impressive gains of 1.1% and 2.2%, respectively. Notably, the S&P 500 and Nasdaq Composite are now less than 1% away from their record closing highs, a testament to the market’s resilience in the face of various challenges.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

**Table of Content**

* **[US Market Highlights]([link removed])**

* **[Global Highlights]([link removed])**

* **[Investor Takeaways]([link removed])**

* **[Commodities & Crypto]([link removed])**

* **[Calendar & Movers]([link removed])**

----------

Advertisement

----------### Steal our best value stock ideas.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

PayPal, Disney, and Nike all dropped 50-80% recently from all-time highs.

Are they undervalued? Can they turn around? What’s next? You don’t have time to track every stock, but should you be forced to miss all the best opportunities?

That’s why we scour hundreds of value stock ideas for you. Whenever we find something interesting, we send it straight to your inbox.

[Subscribe free to Value Investor Daily with one click]([link removed]) so you never miss out on our research again.

----------

## **LAST WEEK’S MARKET OVERVIEW**

----------View image: ([link removed])

Caption:

Breadth was strong this week, with the equal-weighted S&P 500 rising 2.0% and all 11 S&P 500 sectors finishing in the green. Utilities were the standout performer, jumping 4.0%, followed by financials (+3.1%), materials (+2.6%), consumer staples (+2.3%), and industrials (+2.3%). The consumer discretionary sector was the lone laggard, eking out a modest 0.2% gain.

The recent rally appears to be driven by a combination of factors, including carryover momentum from the post-FOMC rally and a desire among investors to retest all-time highs for the S&P 500 and Nasdaq Composite. While economic data was relatively light this week, Friday’s release of the preliminary University of Michigan Index of Consumer Sentiment for May showed a drop to 67.4 (expected 76.5; prior 77.2) and a jump in year-ahead inflation expectations to 3.5% from 3.2%. However, stocks had a muted response to this report.

Earnings season is winding down, but there were still some notable reports this week. **Walt Disney (DIS)**, a Dow component, dropped 6.9% following its earnings release, while ride-hailing giant **Uber (UBER)** fell 3.2% on its own earnings news.

View image: ([link removed])

Caption:

The Treasury market was relatively calm this week, providing support to equities. The 10-year note yield settled unchanged at 4.50%, while the 2-year note yield dipped six basis points to 4.87%.

## **US Market Highlights**

* Pandemic savings have been exhausted, according to a Fed report, with excess savings turning negative as households drew over $70 billion per month over the last 28 months.

* U.S. consumers pulled back on credit card use in March, with total new credit increasing by just $6.3 billion, well below estimates. However, delinquency rates on both credit cards and auto loans continue to rise.

* Social Security is expected to run out of money in 2035, one year later than the previous forecast, prompting calls for Congress to extend the fund’s solvency.

* Consumer sentiment tumbled as inflation fears surged, with the University of Michigan surveys showing a jump in both one-year and five-year inflation outlooks.

* **TikTok** is suing to block the pending U.S. ban, arguing that it violates First Amendment free speech protections.

* Electric vehicle maker **Rivian** lost $38,000 per vehicle delivered in Q1, with its cash pile plunging from over $18 billion at the end of 2021 to just $6 billion today. Shares of $RIVN are down over 50% year-to-date.

* **Pinnacle Bank** bought Fort Worth’s tallest tower for just $12.3 million, or $12.30 per square foot, at a foreclosure auction, a steep discount from the $137.5 million paid by **Opal Holdings** in 2021.

## **Global Highlights**

* The Bank of England left interest rates unchanged for the sixth straight meeting but signaled that it may join its European peers in cutting rates in the coming months.

* The UK exited recession with its fastest growth in three years, as GDP grew 0.6% in the first quarter, prompting Prime Minister Rishi Sunak to claim that the economy has “turned a corner.”

* China’s consumer prices rose for a third straight month in April, while producer prices extended declines, signaling an improvement in domestic demand as the country aims to revive growth.

* President Biden plans to quadruple tariffs on Chinese EVs from 25% to roughly 100% and will also target solar goods and batteries, just one month after increasing tariffs on Chinese steel and aluminum.

* **Tesla’s** China sales fell again in April, despite a rebound in overall EV demand, with the U.S. automaker selling just 62,167 China-made cars, down 18% year-over-year.

* Chinese EV maker **Zeekr** went public on the NYSE under the ticker ‘ZK’ at $21 per share, with shares opening at $28, up almost 35% on the day.

* Chinese iPhone shipments soared 12% in March after **Apple** slashed prices, as the company struggles to turn its Chinese business around in the face of competition from domestic rivals like **Huawei**.

## **Investor Takeaways**

As the market continues to flirt with all-time highs, it’s essential for investors to remain patient and disciplined in their approach. While the recent rally is encouraging, it’s important to remember that volatility can strike at any time, and that a well-diversified portfolio is key to weathering any potential storms.

Looking ahead,** investors should keep a close eye on Tuesday’s scheduled U.S. Producer Price Index (PPI) report and Wednesday’s Consumer Price Index (CPI) report for April, as both have the potential to significantly impact Federal Reserve interest rate cut expectations. The PPI is expected to rise 0.3% month-over-month, following a 0.2% increase in March. On a year-over-year basis, the PPI is projected to accelerate to 2.2% from 2.1% in the previous month.**

The CPI data will also be closely watched, as unexpectedly high consumer price figures in the previous month prompted investors to **reduce their expectations for potential rate cuts this year.** A higher-than-expected inflation reading could further dampen hopes for near-term monetary policy easing.

Additionally, the ongoing earnings season, 13F filings, and developments in the artificial intelligence race could all serve as catalysts for market movement in the coming weeks.

----------

## **Commodities & Crypto**

----------View image: ([link removed])

Caption:

In the commodities space, oil prices have rebounded this week, with Brent crude trading around $84 and WTI around $79.51.

View image: ([link removed])

Caption:

Copper prices are also on the rise, thanks in part to strong trade data from China, with spot copper trading at $9,900 on the London Metal Exchange. Gold has resumed its upward trajectory, reaching $2,360 per ounce.

View image: ([link removed])

Caption:

The crypto market has been a mixed bag, with Bitcoin struggling to find an upward path after a painful 15% decrease in April. BTC is currently trading around $63,000, about $10,000 below its all-time high reached last March. Ether (ETH) remains stable at around $3,000 this week, still well below its previous all-time highs from late 2021. Solana (SOL) has been a bright spot, gaining more than 20% and trading around $154, thanks to a growing influx of users on network applications.

----------

## **Calendar & Movers**

----------* Tuesday, May 14: U.S. Producer Price Index (PPI) report for April

* Wednesday, May 15: U.S. Consumer Price Index (CPI) report for April

* Earnings reports: **Walmart (WMT)**, **Home Depot (HD)**, **Alibaba (BABA)**, **Cisco (CSCO)**

* 13F filings due

* Monday: **OpenAI** expected to announce updates

* Google I/O developer conference

As we navigate the ever-changing landscape of the financial markets, it’s crucial to stay informed, adaptable and focused on your long-term goals. By keeping a level head and a keen eye on the horizon, investors can position themselves for success in the weeks and months ahead.

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a