May 9, 2024

Permission to republish original opeds and cartoons granted.

As Trump lead in polls continues into May, Biden and Democrats are in panic mode as popular vote appears in play

By Robert Romano

Former President Donald Trump has extended his lead in polls against incumbent President Joe Biden into the month of May, according to the latest average of national polls compiled by RealClearPolling.com, with 46.1 percent to Biden’s 44.9 percent in the head-to-head matchup.

In fact, since the beginning of the cycle, of the 302 national polls taken, Trump has led 156 of them, or 51.6 percent of them. Biden has led 104 of them, or 34.4 percent, and 42 of them were tied, or 13.9 percent.

Compared to the 2020 cycle, when 293 polls were taken, Biden led 285 of them, or 97 percent.

And in 2016, Hillary Clinton led 219 out of 259 polls taken, or 85 percent of them.

Both predicted the Democratic candidates would win the popular vote in 2020 and 2016, respectively.

The implication is that the popular vote is in play in 2024 — in favor of Trump — a feat no Republican candidate has managed in 20 years since George W. Bush was reelected in 2004.

That year, Bush led John Kerry in 130 out of 233 polls, or 55.7 percent of them. Kerry led 76 of the polls, or 32.6 percent. 27 of the polls were tied, or 11.6 percent.

Is history repeating itself?

It is worth noting that no Republican who has won the popular vote has ever lost the national election for the Electoral College, but that has happened to Democrats more than once, including Al Gore in 2000 and Hillary Clinton in 2016 most recently, who both won the popular vote but lost the election via the Electoral College.

Biden’s situation does not improve by adding Robert Kennedy, Jr., Cornell West and Jill Stein to the polls. In the five-way race, Trump is leading the average of recent polls, 41.5 percent to Biden’s 38.8 percent, Kennedy’s 10.8 percent, West’s 2 percent and Stein’s 1 percent.

And, of the 57 national polls taken in the five-way race, Trump has led 40 of them, or 70 percent of them. Biden has led seven of them, or just 12.3 percent. Nine were tied, or 15.7 percent.

The reasons are not mysterious. Since Feb. 2021, consumer prices are up 18.5 percent, but personal income is still only up 17.6 percent, according to data compiled by the Bureau of Labor Statistics and the Bureau of Economic Analysis. Americans have not gotten ahead in the current economy after almost $7 trillion was printed, borrowed and spent for Covid. In fact, they are not better off than they were four years ago.

Add to that the botched military withdrawal from Afghanistan, Biden’s mandatory Covid vaccines for government employees (he even tried it for the private sector, too) and his Justice Department, and Democratic prosecutors in Georgia and New York, prosecuting Biden’s rival, Trump, with criminal charges, even attempting to throw him off the ballot.

The latter point cannot be overstated: Biden and Democrats are so afraid of Trump they want to lock him and throw away the key, and if that fails, disenfranchise his millions of supporters by barring him from running. That is panic personified.

And it appears to be backfiring. When the FBI raid on Mar-a-Lago occurred in Aug. 2022, Trump was surging in the national polls, and the speculation was that it would hurt Trump politically. It didn’t. Despite that, media outlets continue to poll what a conviction of Trump might do to the race.

The truth is, the prosecution of Trump defies the American people’s sense of fair play, and that it is they — not the Washington, D.C. establishment and not the media — who will decide who the President will be. As it should be.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2024/05/as-trump-lead-in-polls-continues-into-may-biden-and-democrats-are-in-panic-mode-as-popular-vote-appears-in-play/

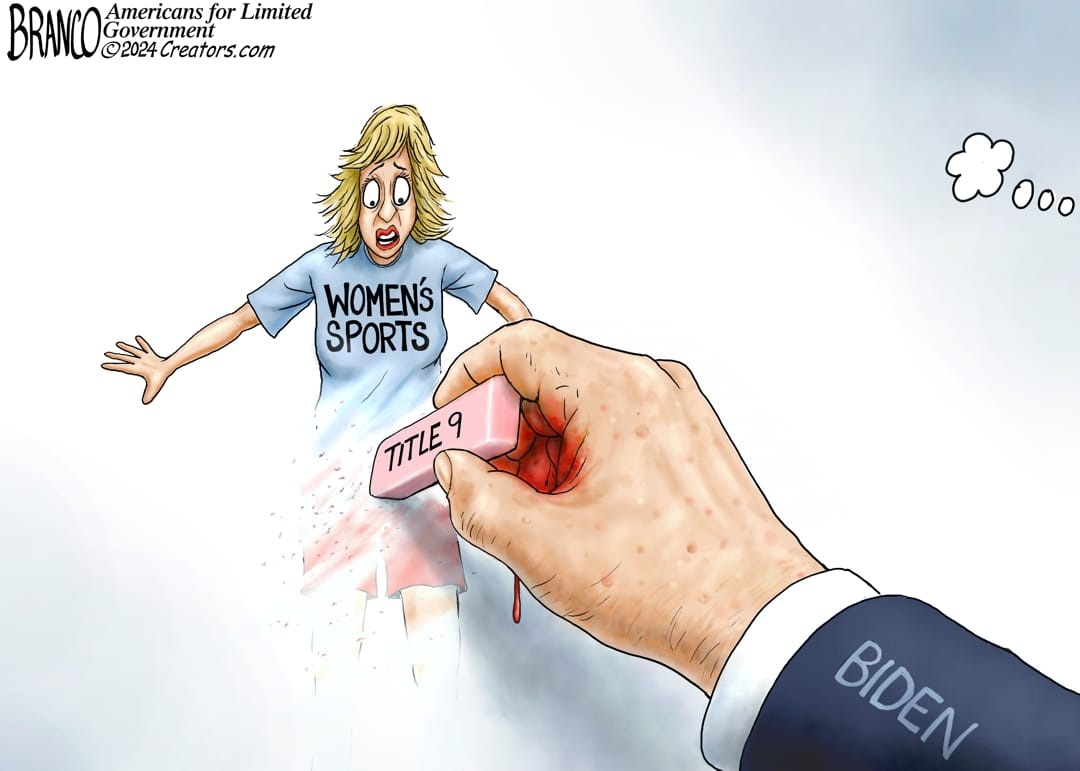

Cartoon: The Vanishing Woman

By A.F. Branco

Click here for a higher level resolution version.

To view online: https://dailytorch.com/2024/05/cartoon-the-vanishing-woman/

CFPB’s Credit Card Late Fee Rule Attacks Legitimate Payment Incentives

On March 5, 2024, the Consumer Financial Protection Bureau (CFPB) finalized its rule to cap credit card late fees – part of the Biden administration’s mislabeled “junk fees” campaign that seeks to lump legitimate, standard payment incentives in with the White House’s political efforts to bring down fees in other sectors.

The Facts:

While the Biden administration and their allies in Congress will attempt to portray the new rule as a benefit to consumers, here are the facts:

Lawful and contractually agreed upon payment incentives promote financial discipline and responsibility.

- Payment mechanisms encourage consumers to make responsible financial decisions, like balancing their checkbooks, and discourage consumers from paying their bills late.

- The new rule will increase the likelihood of late payments across the board – negatively impacting consumers’ credit scores and their ability to attain future lines of credit.

The CFPB’s rule will decrease the availability of credit card products for those who need it most.

- Companies utilize payment mechanisms to provide the financial products that people want and need, particularly to those who are financially vulnerable or trying to build credit.

- The new rule will likely raise rates for all borrowers, including many borrowers who carry a balance but pay on time.

While Americans struggle to keep pace with record inflation under President Biden, now is the wrong time to play political games that limit access to credit.

- More Americans are turning to credit cards to pay their bills, and the CFPB should abandon efforts that will put more even more pressure on consumers.

Ranking Member Scott on the CFPB’s Political “Junk Fees” Campaign:

Ranking Member Scott has been pushing back on CFPB Director Rohit Chopra’s efforts to prioritize progressive, political wish lists over sound economic practices for over a year. A quick recap:

APRIL 2023: Ranking Member Scott led eight Republicans on the Senate Banking Committee in a letter to CFPB Director Chopra criticizing the agency’s attempt to demonize commonsense incentives that promote financial responsibility while highlighting the harms the rule would have on the cost and availability of credit for American consumers.

JUNE 2023: Ranking Member Scott admonished Director Chopra’s public pressure campaign that mislabels legitimate payment incentives as “junk fees” or “illegal fees,” noting that, “this sweeping initiative lumps legitimate, standard credit card late fees in with the White House’s political efforts to bring down fees in other sectors.”

Click here … to watch the video.

MARCH 2024: After the CFPB issued its final rule on credit card late fees, Ranking Member Scott issued a statement opposing the rule and announcing his intent to use the Congressional Review Act (CRA) process to fight its implementation.

APRIL 2024: Ranking Member Scott introduced a CRA resolution to overturn the CFPB’s rule capping credit card late penalties. Senators John Thune, John Barrasso, Jerry Moran, John Boozman, Mike Lee, Steve Daines, Mike Rounds, Thom Tillis, Marsha Blackburn, Kevin Cramer, Mike Braun, Bill Hagerty, Tommy Tuberville, Katie Britt, and Ted Budd have all joined the Ranking Member on the resolution.

The senators argued the rule will decrease the availability of credit card products for those who need it most, raise rates for many borrowers who carry a balance but pay on time, and increase the likelihood of late payments across the board.

Click here or on the image above to read the article.

Ranking Member Scott’s CRA resolution has the support of the Consumer Bankers Association, America’s Credit Unions, Independent Community Bankers of America, Bank Policy Institute, American Bankers Association, Americans for Tax Reform, Competitive Enterprise Institute, and the U.S. Chamber of Commerce.

What They Are Saying:

The Wall Street Journal’s Editorial Board had this to say following the CFPB’s final rule: “The big picture here is that the Administration is playing whack-a-bank, hitting this and that revenue stream as another arises, and turning banks into regulated utilities. Consumers are the biggest losers, as we’ve learned from other such price controls.”

Click here or on the image above to read the editorial.

R Street Institute agreed, stating, “This rule is part of a larger effort to ban or forcibly reduce what the agency refers to as ‘junk fees,’ a catch-all term for financial institution fees. While the idea of capping late fees may sound appealing, the unintended consequences to consumers are wide-ranging and serious… A Congressional Review Act in the Senate, led by Sen. Tim Scott (R-S.C.), was introduced on April 8. Companion legislation, led by Andy Barr (R-Ky.), passed the House Financial Services Committee on April 17. The R Street Institute supports efforts to overturn the destructive and ill-advised rule, the ultimate outcome of which will be detrimental to consumers nationwide.”

Click here or on the image above to read the blog post.