| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Tax Professional Tip #19 – What to do when a letter arrives |

| Date | May 9, 2024 3:05 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

Getting a letter from the Minnesota Department of Revenue can be stressful. If your clients receive a letter from us:

* *Read the entire letter carefully.* Most letters deal with a specific issue and provide instructions on what to do.

* *Compare it to the tax return.* If a letter indicates a changed or corrected tax return, review our changes and compare them with the original return.

* *Reply by the due date. *Reply to letters requesting information or action from your clients, or any letters you or your clients do not agree with. Replying by the due date could minimize penalties and interest and preserve appeal rights.

* *Pay what you can.* Remind your client to pay as much of their balance as they can to minimize penalties and interest.

* *Contact us, if needed.* Call the number on the letter and be prepared to offer the letter ID and proper authorization. You can get access to your client?s information through:

* A valid power of attorney

* The box checked for the third-party designee on your client?s return

* Having your client present when calling

* *Keep the letter.* You and your clients should keep copies of our letters for your records.

We will only call you or your client after we send a letter. If you believe the call is fraudulent, get the caller?s name and hang up. Then, call one of our published phone numbers and ask for that person.

*Questions?*

Contact us.

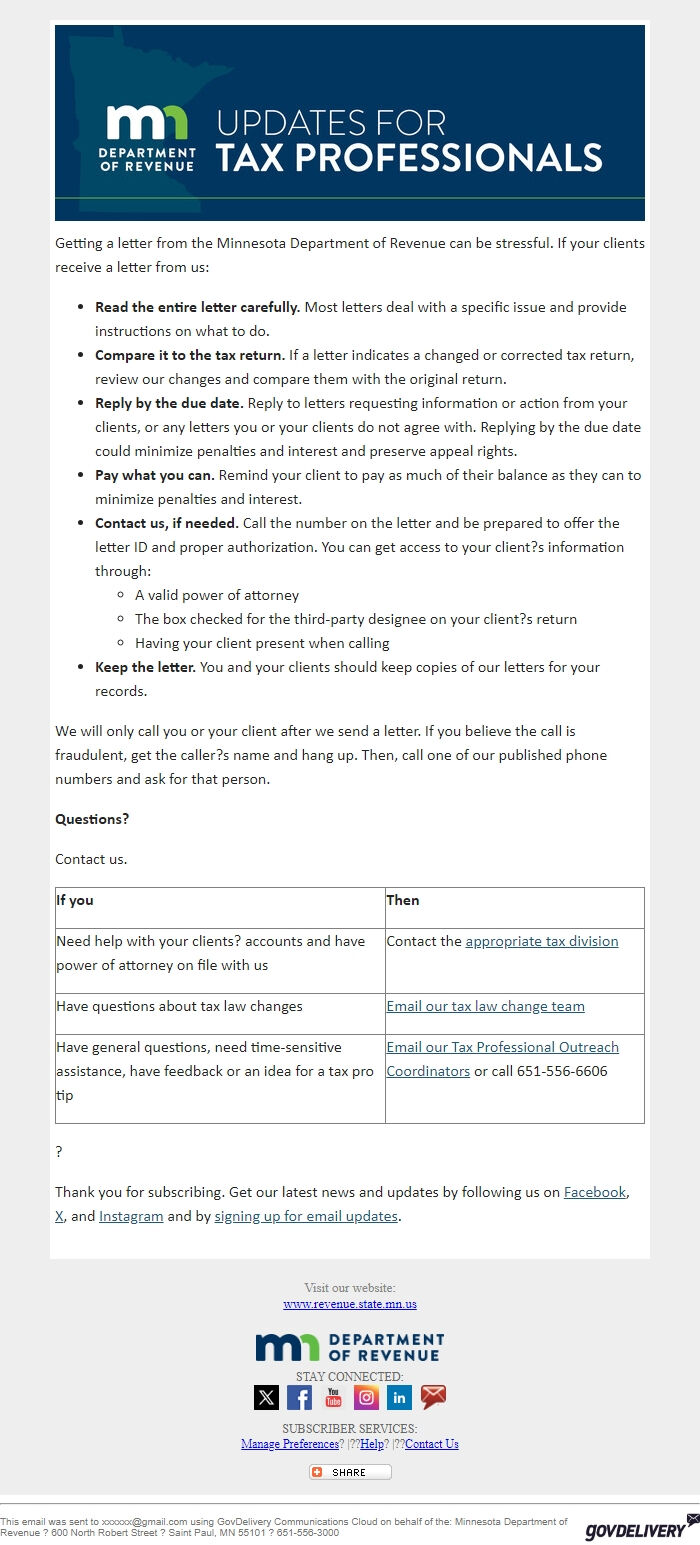

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate tax division [ [link removed] ]

Have questions about tax law changes

Email our tax law change team <[email protected]>

Have general questions, need time-sensitive assistance, have feedback or an idea for a tax pro tip

Email our Tax Professional Outreach Coordinators <[email protected]> or call 651-556-6606

?

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ], X [ [link removed] ], and Instagram [ [link removed] ] and by signing up for email updates [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Instagram [ [link removed] ] LinkedIn [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Getting a letter from the Minnesota Department of Revenue can be stressful. If your clients receive a letter from us:

* *Read the entire letter carefully.* Most letters deal with a specific issue and provide instructions on what to do.

* *Compare it to the tax return.* If a letter indicates a changed or corrected tax return, review our changes and compare them with the original return.

* *Reply by the due date. *Reply to letters requesting information or action from your clients, or any letters you or your clients do not agree with. Replying by the due date could minimize penalties and interest and preserve appeal rights.

* *Pay what you can.* Remind your client to pay as much of their balance as they can to minimize penalties and interest.

* *Contact us, if needed.* Call the number on the letter and be prepared to offer the letter ID and proper authorization. You can get access to your client?s information through:

* A valid power of attorney

* The box checked for the third-party designee on your client?s return

* Having your client present when calling

* *Keep the letter.* You and your clients should keep copies of our letters for your records.

We will only call you or your client after we send a letter. If you believe the call is fraudulent, get the caller?s name and hang up. Then, call one of our published phone numbers and ask for that person.

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate tax division [ [link removed] ]

Have questions about tax law changes

Email our tax law change team <[email protected]>

Have general questions, need time-sensitive assistance, have feedback or an idea for a tax pro tip

Email our Tax Professional Outreach Coordinators <[email protected]> or call 651-556-6606

?

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ], X [ [link removed] ], and Instagram [ [link removed] ] and by signing up for email updates [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Instagram [ [link removed] ] LinkedIn [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery