| From | Fraser Institute <[email protected]> |

| Subject | Costs of waiting for treatment, and Tax compliance costs |

| Date | May 4, 2024 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email.

=============

FRASER UPDATE

A weekly digest of our latest research and commentaries

=============

Latest Research

--------

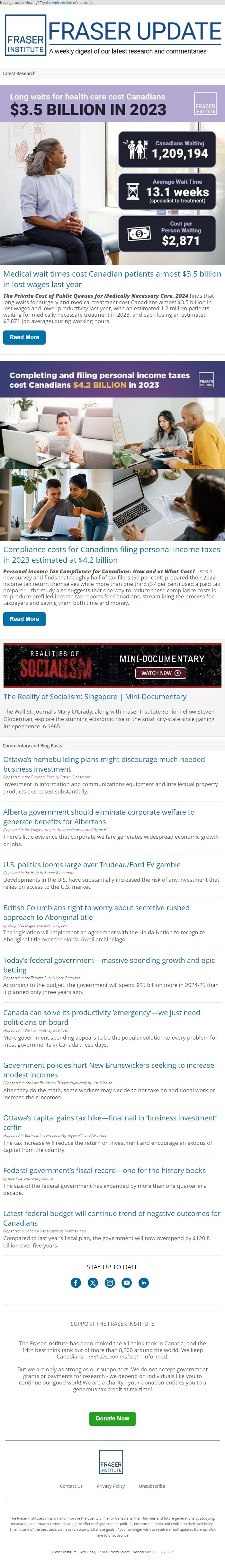

Medical wait times cost Canadian patients almost $3.5 billion in lost wages last year

The Private Cost of Public Queues for Medically Necessary Care, 2024 finds that long waits for surgery and medical treatment cost Canadians almost $3.5 billion in lost wages and lower productivity last year, with an estimated 1.2 million patients waiting for medically necessary treatment in 2023, and each losing an estimated $2,871 (on average) during working hours.

Read More [[link removed]]

Compliance costs for Canadians filing personal income taxes in 2023 estimated at $4.2 billion

Personal Income Tax Compliance for Canadians: How and at What Cost? uses a new survey and finds that roughly half of tax filers (50 per cent) prepared their 2022 income tax return themselves while more than one third (37 per cent) used a paid tax preparer—the study also suggests that one way to reduce these compliance costs is to produce prefilled income tax reports for Canadians, streamlining the process for taxpayers and saving them both time and money.

Read More [[link removed]]

Realities of Socialism Mini-Documentaries

--------

The Reality of Socialism: Singapore | Mini-Documentary [[link removed]]

The Wall St. Journal’s Mary O’Grady, along with Fraser Institute Senior Fellow Steven Globerman, explore the stunning economic rise of the small city-state since gaining independence in 1965.

Commentary and Blog Posts

--------

Ottawa’s homebuilding plans might discourage much-needed business investment [[link removed]]

(Appeared in the Financial Post) by Steven Globerman

Investment in information and communications equipment and intellectual property products decreased substantially.

Alberta government should eliminate corporate welfare to generate benefits for Albertans [[link removed]]

(Appeared in the Calgary Sun) by Spencer Gudewill and Tegan Hill

There’s little evidence that corporate welfare generates widespread economic growth or jobs.

U.S. politics looms large over Trudeau/Ford EV gamble [[link removed]]

(Appeared in the Hub) by Steven Globerman

Developments in the U.S. have substantially increased the risk of any investment that relies on access to the U.S. market.

British Columbians right to worry about secretive rushed approach to Aboriginal title [[link removed]]

by Mary MacGregor and Jock Finlayson

The legislation will implement an agreement with the Haida Nation to recognize Aboriginal title over the Haida Gwaii archipelago.

Today’s federal government—massive spending growth and epic betting [[link removed]]

(Appeared in the Toronto Sun) by Jock Finlayson

According to the budget, the government will spend $95 billion more in 2024-25 than it planned only three years ago.

Canada can solve its productivity ‘emergency’—we just need politicians on board [[link removed]]

(Appeared in the Hill Times) by Jake Fuss

More government spending appears to be the popular solution to every problem for most governments in Canada these days.

Government policies hurt New Brunswickers seeking to increase modest incomes [[link removed]]

( Appeared in the New Brunswick Telegraph-Journal) by Alex Whalen

After they do the math, some workers may decide to not take on additional work or increase their incomes.

Ottawa’s capital gains tax hike—final nail in ‘business investment’ coffin [[link removed]]

(Appeared in Business in Vancouver) by Tegan Hill and Jake Fuss

The tax increase will reduce the return on investment and encourage an exodus of capital from the country.

Federal government’s fiscal record—one for the history books [[link removed]]

by Jake Fuss and Grady Munro

The size of the federal government has expanded by more than one quarter in a decade.

Latest federal budget will continue trend of negative outcomes for Canadians [[link removed]]

(Appeared in National Newswatch) by Matthew Lau

Compared to last year’s fiscal plan, the government will now overspend by $120.8 billion over five years.

SUPPORT THE FRASER INSTITUTE

--------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] | Privacy Policy [[link removed]] | Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

=============

FRASER UPDATE

A weekly digest of our latest research and commentaries

=============

Latest Research

--------

Medical wait times cost Canadian patients almost $3.5 billion in lost wages last year

The Private Cost of Public Queues for Medically Necessary Care, 2024 finds that long waits for surgery and medical treatment cost Canadians almost $3.5 billion in lost wages and lower productivity last year, with an estimated 1.2 million patients waiting for medically necessary treatment in 2023, and each losing an estimated $2,871 (on average) during working hours.

Read More [[link removed]]

Compliance costs for Canadians filing personal income taxes in 2023 estimated at $4.2 billion

Personal Income Tax Compliance for Canadians: How and at What Cost? uses a new survey and finds that roughly half of tax filers (50 per cent) prepared their 2022 income tax return themselves while more than one third (37 per cent) used a paid tax preparer—the study also suggests that one way to reduce these compliance costs is to produce prefilled income tax reports for Canadians, streamlining the process for taxpayers and saving them both time and money.

Read More [[link removed]]

Realities of Socialism Mini-Documentaries

--------

The Reality of Socialism: Singapore | Mini-Documentary [[link removed]]

The Wall St. Journal’s Mary O’Grady, along with Fraser Institute Senior Fellow Steven Globerman, explore the stunning economic rise of the small city-state since gaining independence in 1965.

Commentary and Blog Posts

--------

Ottawa’s homebuilding plans might discourage much-needed business investment [[link removed]]

(Appeared in the Financial Post) by Steven Globerman

Investment in information and communications equipment and intellectual property products decreased substantially.

Alberta government should eliminate corporate welfare to generate benefits for Albertans [[link removed]]

(Appeared in the Calgary Sun) by Spencer Gudewill and Tegan Hill

There’s little evidence that corporate welfare generates widespread economic growth or jobs.

U.S. politics looms large over Trudeau/Ford EV gamble [[link removed]]

(Appeared in the Hub) by Steven Globerman

Developments in the U.S. have substantially increased the risk of any investment that relies on access to the U.S. market.

British Columbians right to worry about secretive rushed approach to Aboriginal title [[link removed]]

by Mary MacGregor and Jock Finlayson

The legislation will implement an agreement with the Haida Nation to recognize Aboriginal title over the Haida Gwaii archipelago.

Today’s federal government—massive spending growth and epic betting [[link removed]]

(Appeared in the Toronto Sun) by Jock Finlayson

According to the budget, the government will spend $95 billion more in 2024-25 than it planned only three years ago.

Canada can solve its productivity ‘emergency’—we just need politicians on board [[link removed]]

(Appeared in the Hill Times) by Jake Fuss

More government spending appears to be the popular solution to every problem for most governments in Canada these days.

Government policies hurt New Brunswickers seeking to increase modest incomes [[link removed]]

( Appeared in the New Brunswick Telegraph-Journal) by Alex Whalen

After they do the math, some workers may decide to not take on additional work or increase their incomes.

Ottawa’s capital gains tax hike—final nail in ‘business investment’ coffin [[link removed]]

(Appeared in Business in Vancouver) by Tegan Hill and Jake Fuss

The tax increase will reduce the return on investment and encourage an exodus of capital from the country.

Federal government’s fiscal record—one for the history books [[link removed]]

by Jake Fuss and Grady Munro

The size of the federal government has expanded by more than one quarter in a decade.

Latest federal budget will continue trend of negative outcomes for Canadians [[link removed]]

(Appeared in National Newswatch) by Matthew Lau

Compared to last year’s fiscal plan, the government will now overspend by $120.8 billion over five years.

SUPPORT THE FRASER INSTITUTE

--------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] | Privacy Policy [[link removed]] | Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor