| From | American Energy Alliance <[email protected]> |

| Subject | The Left Coast |

| Date | April 29, 2024 3:02 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 04/29/2024

Subscribe Now ([link removed])

** Big Green Inc. isn't shy about what they want: higher gas prices.

------------------------------------------------------------

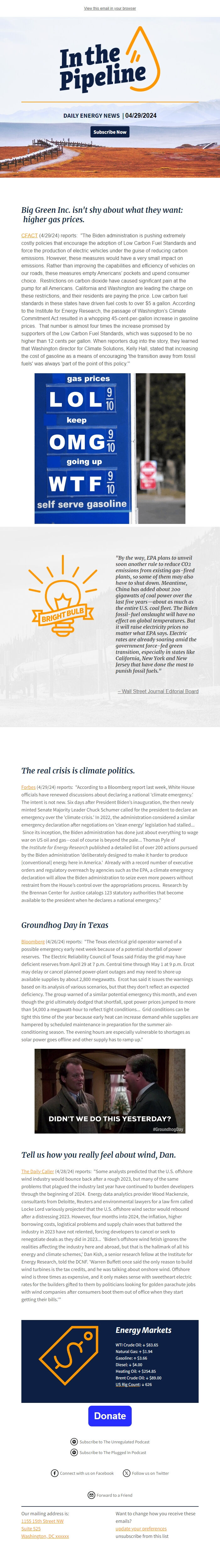

CFACT ([link removed]) (4/29/24) reports: "The Biden administration is pushing extremely costly policies that encourage the adoption of Low Carbon Fuel Standards and force the production of electric vehicles under the guise of reducing carbon emissions. However, these measures would have a very small impact on emissions. Rather than improving the capabilities and efficiency of vehicles on our roads, these measures empty Americans’ pockets and upend consumer choice. Restrictions on carbon dioxide have caused significant pain at the pump for all Americans. California and Washington are leading the charge on these restrictions, and their residents are paying the price. Low carbon fuel standards in these states have driven fuel costs to over $5 a gallon. According to the Institute for Energy Research,

the passage of Washington’s Climate Commitment Act resulted in a whopping 45-cent-per-gallon increase in gasoline prices. That number is almost four times the increase promised by supporters of the Low Carbon Fuel Standards, which was supposed to be no higher than 12 cents per gallon. When reporters dug into the story, they learned that Washington director for Climate Solutions, Kelly Hall, stated that increasing the cost of gasoline as a means of encouraging 'the transition away from fossil fuels' was always 'part of the point of this policy.'”

[link removed]

** "By the way, EPA plans to unveil soon another rule to reduce CO2 emissions from existing gas-fired plants, so some of them may also have to shut down. Meantime, China has added about 200 gigawatts of coal power over the last five years—about as much as the entire U.S. coal fleet. The Biden fossil-fuel onslaught will have no effect on global temperatures. But it will raise electricity prices no matter what EPA says. Electric rates are already soaring amid the government force-fed green transition, especially in states like California, New York and New Jersey that have done the most to punish fossil fuels."

------------------------------------------------------------

– Wall Street Journal Editorial Board ([link removed])

============================================================

The real crisis is climate politics.

** Forbes ([link removed])

(4/29/24) reports: "According to a Bloomberg report last week, White House officials have renewed discussions about declaring a national 'climate emergency.' The intent is not new. Six days after President Biden’s inauguration, the then newly minted Senate Majority Leader Chuck Schumer called for the president to declare an emergency over the 'climate crisis.' In 2022, the administration considered a similar emergency declaration after negotiations on 'clean energy' legislation had stalled... Since its inception, the Biden administration has done just about everything to wage war on US oil and gas—coal of course is beyond the pale... Thomas Pyle of the Institute for Energy Research published a detailed list of over 200 actions pursued by the Biden administration 'deliberately designed to make it harder to produce [conventional] energy here in America.' Already with a record number of executive orders and regulatory overreach by agencies such as the EPA, a climate emergency declaration

will allow the Biden administration to seize even more powers without restraint from the House’s control over the appropriations process. Research by the Brennan Center for Justice catalogs 123 statutory authorities that become available to the president when he declares a national emergency."

Groundhog Day in Texas

** Bloomberg ([link removed])

(4/26/24) reports: "The Texas electrical grid operator warned of a possible emergency early next week because of a potential shortfall of power reserves. The Electric Reliability Council of Texas said Friday the grid may have deficient reserves from April 29 at 7 p.m. Central time through May 1 at 9 p.m. Ercot may delay or cancel planned power-plant outages and may need to shore up available supplies by about 2,800 megawatts. Ercot has said it issues the warnings based on its analysis of various scenarios, but that they don’t reflect an expected deficiency. The group warned of a similar potential emergency this month, and even though the grid ultimately dodged that shortfall, spot power prices jumped to more than $4,000 a megawatt-hour to reflect tight conditions... Grid conditions can be tight this time of the year because early heat can increase demand while supplies are hampered by scheduled maintenance in preparation for the summer air-conditioning season. The evening hours are

especially vulnerable to shortages as solar power goes offline and other supply has to ramp up."

Tell us how you really feel about wind, Dan.

** The Daily Caller ([link removed])

(4/28/24) reports: "Some analysts predicted that the U.S. offshore wind industry would bounce back after a rough 2023, but many of the same problems that plagued the industry last year have continued to burden developers through the beginning of 2024. Energy data analytics provider Wood Mackenzie, consultants from Deloitte, Reuters and environmental lawyers for a law firm called Locke Lord variously projected that the U.S. offshore wind sector would rebound after a distressing 2023. However, four months into 2024, the inflation, higher borrowing costs, logistical problems and supply chain woes that battered the industry in 2023 have not relented, forcing developers to cancel or seek to renegotiate deals as they did in 2023... 'Biden’s offshore wind fetish ignores the realities affecting the industry here and abroad, but that is the hallmark of all his energy and climate schemes,' Dan Kish, a senior research fellow at the Institute for Energy Research, told the DCNF. 'Warren Buffett once

said the only reason to build wind turbines is the tax credits, and he was talking about onshore wind. Offshore wind is three times as expensive, and it only makes sense with sweetheart electric rates for the builders gifted to them by politicians looking for golden parachute jobs with wind companies after consumers boot them out of office when they start getting their bills.'”

Energy Markets

WTI Crude Oil: ↓ $83.65

Natural Gas: ↑ $1.94

Gasoline: ↑ $3.66

Diesel: ↓ $4.00

Heating Oil: ↑ $254.85

Brent Crude Oil: ↓ $89.00

** US Rig Count ([link removed])

: ↓ 626

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

DAILY ENERGY NEWS | 04/29/2024

Subscribe Now ([link removed])

** Big Green Inc. isn't shy about what they want: higher gas prices.

------------------------------------------------------------

CFACT ([link removed]) (4/29/24) reports: "The Biden administration is pushing extremely costly policies that encourage the adoption of Low Carbon Fuel Standards and force the production of electric vehicles under the guise of reducing carbon emissions. However, these measures would have a very small impact on emissions. Rather than improving the capabilities and efficiency of vehicles on our roads, these measures empty Americans’ pockets and upend consumer choice. Restrictions on carbon dioxide have caused significant pain at the pump for all Americans. California and Washington are leading the charge on these restrictions, and their residents are paying the price. Low carbon fuel standards in these states have driven fuel costs to over $5 a gallon. According to the Institute for Energy Research,

the passage of Washington’s Climate Commitment Act resulted in a whopping 45-cent-per-gallon increase in gasoline prices. That number is almost four times the increase promised by supporters of the Low Carbon Fuel Standards, which was supposed to be no higher than 12 cents per gallon. When reporters dug into the story, they learned that Washington director for Climate Solutions, Kelly Hall, stated that increasing the cost of gasoline as a means of encouraging 'the transition away from fossil fuels' was always 'part of the point of this policy.'”

[link removed]

** "By the way, EPA plans to unveil soon another rule to reduce CO2 emissions from existing gas-fired plants, so some of them may also have to shut down. Meantime, China has added about 200 gigawatts of coal power over the last five years—about as much as the entire U.S. coal fleet. The Biden fossil-fuel onslaught will have no effect on global temperatures. But it will raise electricity prices no matter what EPA says. Electric rates are already soaring amid the government force-fed green transition, especially in states like California, New York and New Jersey that have done the most to punish fossil fuels."

------------------------------------------------------------

– Wall Street Journal Editorial Board ([link removed])

============================================================

The real crisis is climate politics.

** Forbes ([link removed])

(4/29/24) reports: "According to a Bloomberg report last week, White House officials have renewed discussions about declaring a national 'climate emergency.' The intent is not new. Six days after President Biden’s inauguration, the then newly minted Senate Majority Leader Chuck Schumer called for the president to declare an emergency over the 'climate crisis.' In 2022, the administration considered a similar emergency declaration after negotiations on 'clean energy' legislation had stalled... Since its inception, the Biden administration has done just about everything to wage war on US oil and gas—coal of course is beyond the pale... Thomas Pyle of the Institute for Energy Research published a detailed list of over 200 actions pursued by the Biden administration 'deliberately designed to make it harder to produce [conventional] energy here in America.' Already with a record number of executive orders and regulatory overreach by agencies such as the EPA, a climate emergency declaration

will allow the Biden administration to seize even more powers without restraint from the House’s control over the appropriations process. Research by the Brennan Center for Justice catalogs 123 statutory authorities that become available to the president when he declares a national emergency."

Groundhog Day in Texas

** Bloomberg ([link removed])

(4/26/24) reports: "The Texas electrical grid operator warned of a possible emergency early next week because of a potential shortfall of power reserves. The Electric Reliability Council of Texas said Friday the grid may have deficient reserves from April 29 at 7 p.m. Central time through May 1 at 9 p.m. Ercot may delay or cancel planned power-plant outages and may need to shore up available supplies by about 2,800 megawatts. Ercot has said it issues the warnings based on its analysis of various scenarios, but that they don’t reflect an expected deficiency. The group warned of a similar potential emergency this month, and even though the grid ultimately dodged that shortfall, spot power prices jumped to more than $4,000 a megawatt-hour to reflect tight conditions... Grid conditions can be tight this time of the year because early heat can increase demand while supplies are hampered by scheduled maintenance in preparation for the summer air-conditioning season. The evening hours are

especially vulnerable to shortages as solar power goes offline and other supply has to ramp up."

Tell us how you really feel about wind, Dan.

** The Daily Caller ([link removed])

(4/28/24) reports: "Some analysts predicted that the U.S. offshore wind industry would bounce back after a rough 2023, but many of the same problems that plagued the industry last year have continued to burden developers through the beginning of 2024. Energy data analytics provider Wood Mackenzie, consultants from Deloitte, Reuters and environmental lawyers for a law firm called Locke Lord variously projected that the U.S. offshore wind sector would rebound after a distressing 2023. However, four months into 2024, the inflation, higher borrowing costs, logistical problems and supply chain woes that battered the industry in 2023 have not relented, forcing developers to cancel or seek to renegotiate deals as they did in 2023... 'Biden’s offshore wind fetish ignores the realities affecting the industry here and abroad, but that is the hallmark of all his energy and climate schemes,' Dan Kish, a senior research fellow at the Institute for Energy Research, told the DCNF. 'Warren Buffett once

said the only reason to build wind turbines is the tax credits, and he was talking about onshore wind. Offshore wind is three times as expensive, and it only makes sense with sweetheart electric rates for the builders gifted to them by politicians looking for golden parachute jobs with wind companies after consumers boot them out of office when they start getting their bills.'”

Energy Markets

WTI Crude Oil: ↓ $83.65

Natural Gas: ↑ $1.94

Gasoline: ↑ $3.66

Diesel: ↓ $4.00

Heating Oil: ↑ $254.85

Brent Crude Oil: ↓ $89.00

** US Rig Count ([link removed])

: ↓ 626

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

Message Analysis

- Sender: American Energy Alliance (AEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp