| From | Center for Jobs and the Economy <[email protected]> |

| Subject | California Energy Price Data for March 2020 |

| Date | April 6, 2020 9:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] California Energy Price Data

for March 2020

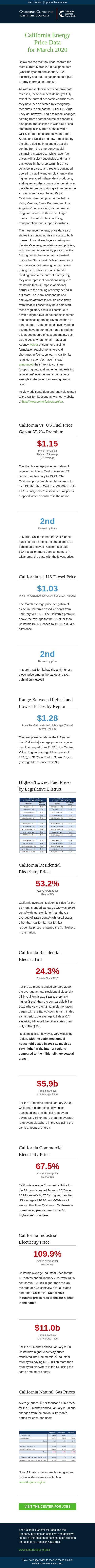

Below are the monthly updates from the most current March 2020 fuel price data (GasBuddy.com) and January 2020 electricity and natural gas price data (US Energy Information Agency).

As with most other recent economic data releases, these numbers do not yet fully reflect the current economic conditions as they have been affected by emergency measures to combat the COVID-19 virus. They do, however, begin to reflect changes coming from another source of economic disruption, the collapse in world oil prices stemming initially from a battle within OPEC for market share between Saudi Arabia and Russia and now intensified by the sharp decline in economic activity coming from the emergency social distancing measures. While lower fuel prices will assist households and many employers in the short term, this price collapse in particular threatens continued operating viability and employment within higher leveraged independent producers, adding yet another source of uncertainty as the affected regions struggle to move to the economic recovery phase. Within California, direct employment is led by Kern, Ventura, Santa Barbara, and Los Angeles Counties along with a broader range of counties with a much larger number of related jobs in refining, transportation, and support industries.

The most recent energy price data also shows the continuing rise in costs to both households and employers coming from the state’s energy regulations and policies, with commercial electricity prices now the 3rd highest in the nation and industrial prices the 5th highest. While these costs were a source of growing concern even during the positive economic trends existing prior to the current emergency, they now represent conditions unique to California that will impose additional barriers to the coming recovery period in our state. As many households and employers attempt to rebuild cash flows from what will essentially be a cold start, these regulatory costs will continue to divert a higher level of household incomes and business operating revenues than in other states. At the national level, various actions have begun to be made to reduce this added source of cost uncertainty such as the US Environmental Protection Agency waiver [[link removed]] of summer gasoline formulation requirements to avoid shortages in fuel supplies. In California, regulatory agencies have instead announced [[link removed]] their intent to continue “proposing new and implementing existing regulations” even as many households struggle in the face of a growing cost of living.

To view additional data and analysis related to the California economy visit our website at [[link removed]].

California vs. US Fuel Price Gap at 55.2% Premium $1.15 Price Per Gallon

Above US Average

(CA Average)

The March average price per gallon of regular gasoline in California eased 27 cents from February to $3.23. The California premium above the average for the US other than California ($2.08) rose to $1.15 cents, a 55.2% difference, as prices dropped faster elsewhere in the nation.

2nd Ranked by Price

In March, California had the 2nd highest gasoline price among the states and DC, behind only Hawaii. Californians paid $1.44 a gallon more than consumers in Oklahoma, the state with the lowest price.

California vs. US Diesel Price $1.03 Price Per Gallon Above US Average (CA Average)

The March average price per gallon of diesel in California eased 20 cents from February to $3.66. The California premium above the average for the US other than California ($2.63) eased to $1.03, a 39.4% difference.

2nd Ranked by price

In March, California had the 2nd highest diesel price among the states and DC, behind only Hawaii.

Range Between Highest and Lowest Prices by Region $1.28 Price Per Gallon Above US Average (Central Sierra Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $1.02 in the Central Valley Region (average March price of $3.10), to $1.28 in Central Sierra Region (average March price of $3.36).

Highest/Lowest Fuel Prices by Legislative District: California Residential Electricity Price 53.2% Above Average for

Rest of US

California average Residential Price for the 12 months ended January 2020 was 19.36 cents/kWh, 53.2% higher than the US average of 12.64 cents/kWh for all states other than California. California's residential prices remained the 7th highest in the nation.

California Residential Electric Bill 24.3% Growth Since 2010

For the 12 months ended January 2020, the average annual Residential electricity bill in California was $1236, or 24.3% higher ($242) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 1.9% ($26).

Residential bills, however, vary widely by region, with the estimated annual household usage in 2018 as much as 59% higher in the interior regions compared to the milder climate coastal areas.

$5.9b Premium Above

US Average Price

For the 12 months ended January 2020, California's higher electricity prices translated into Residential ratepayers paying $5.9 billion more than the average ratepayers elsewhere in the US using the same amount of energy.

California Commercial Electricity Price 67.5% Above Average for

Rest of US

California average Commercial Price for the 12 months ended January 2020 was 16.92 cents/kWh, 67.5% higher than the US average of 10.10 cents/kWh for all states other than California. California's commercial prices rose to the 3rd highest in the nation.

California Industrial Electricity Price 109.9% Above Average for

Rest of US

California average Industrial Price for the 12 months ended January 2020 was 13.56 cents/kWh, 109.9% higher than the US average of 6.46 cents/kWh for all states other than California. California's industrial prices rose to the 5th highest in the nation.

$11.0b Premium Above

US Average Price

For the 12 months ended January 2020, California's higher electricity prices translated into Commercial & Industrial ratepayers paying $11.0 billion more than ratepayers elsewhere in the US using the same amount of energy.

California Natural Gas Prices

Average prices ($ per thousand cubic feet) for the 12 months ended January 2020 and changes from the previous 12-month period for each end user:

Note: All data sources, methodologies and historical data series available at [[link removed]]

Visit the center for jobs [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

for March 2020

Below are the monthly updates from the most current March 2020 fuel price data (GasBuddy.com) and January 2020 electricity and natural gas price data (US Energy Information Agency).

As with most other recent economic data releases, these numbers do not yet fully reflect the current economic conditions as they have been affected by emergency measures to combat the COVID-19 virus. They do, however, begin to reflect changes coming from another source of economic disruption, the collapse in world oil prices stemming initially from a battle within OPEC for market share between Saudi Arabia and Russia and now intensified by the sharp decline in economic activity coming from the emergency social distancing measures. While lower fuel prices will assist households and many employers in the short term, this price collapse in particular threatens continued operating viability and employment within higher leveraged independent producers, adding yet another source of uncertainty as the affected regions struggle to move to the economic recovery phase. Within California, direct employment is led by Kern, Ventura, Santa Barbara, and Los Angeles Counties along with a broader range of counties with a much larger number of related jobs in refining, transportation, and support industries.

The most recent energy price data also shows the continuing rise in costs to both households and employers coming from the state’s energy regulations and policies, with commercial electricity prices now the 3rd highest in the nation and industrial prices the 5th highest. While these costs were a source of growing concern even during the positive economic trends existing prior to the current emergency, they now represent conditions unique to California that will impose additional barriers to the coming recovery period in our state. As many households and employers attempt to rebuild cash flows from what will essentially be a cold start, these regulatory costs will continue to divert a higher level of household incomes and business operating revenues than in other states. At the national level, various actions have begun to be made to reduce this added source of cost uncertainty such as the US Environmental Protection Agency waiver [[link removed]] of summer gasoline formulation requirements to avoid shortages in fuel supplies. In California, regulatory agencies have instead announced [[link removed]] their intent to continue “proposing new and implementing existing regulations” even as many households struggle in the face of a growing cost of living.

To view additional data and analysis related to the California economy visit our website at [[link removed]].

California vs. US Fuel Price Gap at 55.2% Premium $1.15 Price Per Gallon

Above US Average

(CA Average)

The March average price per gallon of regular gasoline in California eased 27 cents from February to $3.23. The California premium above the average for the US other than California ($2.08) rose to $1.15 cents, a 55.2% difference, as prices dropped faster elsewhere in the nation.

2nd Ranked by Price

In March, California had the 2nd highest gasoline price among the states and DC, behind only Hawaii. Californians paid $1.44 a gallon more than consumers in Oklahoma, the state with the lowest price.

California vs. US Diesel Price $1.03 Price Per Gallon Above US Average (CA Average)

The March average price per gallon of diesel in California eased 20 cents from February to $3.66. The California premium above the average for the US other than California ($2.63) eased to $1.03, a 39.4% difference.

2nd Ranked by price

In March, California had the 2nd highest diesel price among the states and DC, behind only Hawaii.

Range Between Highest and Lowest Prices by Region $1.28 Price Per Gallon Above US Average (Central Sierra Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $1.02 in the Central Valley Region (average March price of $3.10), to $1.28 in Central Sierra Region (average March price of $3.36).

Highest/Lowest Fuel Prices by Legislative District: California Residential Electricity Price 53.2% Above Average for

Rest of US

California average Residential Price for the 12 months ended January 2020 was 19.36 cents/kWh, 53.2% higher than the US average of 12.64 cents/kWh for all states other than California. California's residential prices remained the 7th highest in the nation.

California Residential Electric Bill 24.3% Growth Since 2010

For the 12 months ended January 2020, the average annual Residential electricity bill in California was $1236, or 24.3% higher ($242) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 1.9% ($26).

Residential bills, however, vary widely by region, with the estimated annual household usage in 2018 as much as 59% higher in the interior regions compared to the milder climate coastal areas.

$5.9b Premium Above

US Average Price

For the 12 months ended January 2020, California's higher electricity prices translated into Residential ratepayers paying $5.9 billion more than the average ratepayers elsewhere in the US using the same amount of energy.

California Commercial Electricity Price 67.5% Above Average for

Rest of US

California average Commercial Price for the 12 months ended January 2020 was 16.92 cents/kWh, 67.5% higher than the US average of 10.10 cents/kWh for all states other than California. California's commercial prices rose to the 3rd highest in the nation.

California Industrial Electricity Price 109.9% Above Average for

Rest of US

California average Industrial Price for the 12 months ended January 2020 was 13.56 cents/kWh, 109.9% higher than the US average of 6.46 cents/kWh for all states other than California. California's industrial prices rose to the 5th highest in the nation.

$11.0b Premium Above

US Average Price

For the 12 months ended January 2020, California's higher electricity prices translated into Commercial & Industrial ratepayers paying $11.0 billion more than ratepayers elsewhere in the US using the same amount of energy.

California Natural Gas Prices

Average prices ($ per thousand cubic feet) for the 12 months ended January 2020 and changes from the previous 12-month period for each end user:

Note: All data sources, methodologies and historical data series available at [[link removed]]

Visit the center for jobs [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor