| From | IRS Newswire <[email protected]> |

| Subject | Tax Pros: Register now for the 2024 IRS Nationwide Tax Forum |

| Date | April 22, 2024 8:08 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &amp;lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&amp;gt;

IRS.gov Banner

IRS Newswire April 22, 2024

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia Center [ [link removed] ]

Noticias en Espa?ol [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News Home [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact My Local Office [ [link removed] ]

Filing Options [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

News [ [link removed] ]

Taxpayer Advocate [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Issue Number: ???IR-2024-117

Inside This Issue

________________________________________________________________________

*Tax Pros: Register now for the 2024 IRS Nationwide Tax Forum *

Attendees get up to 19 continuing education credits, networking opportunities, case resolution, advice on practice management and more

WASHINGTON ? The IRS encourages tax professionals to register now for the _2024 _IRS Nationwide Tax Forum [ [link removed] ], coming this summer to Chicago, Orlando, Baltimore, Dallas and San Diego.

The Nationwide Tax Forum is the IRS?s largest annual outreach event designed and produced for the tax professional community. This year?s agenda will feature more than 40 sessions on tax law and ethics as well as hot topics like beneficial ownership information, cybersecurity, tax scams and schemes, digital assets and clean energy credits.

Enrolled agents, certified public accountants, Annual Filing Season Program (AFSP) participants and other tax professionals can earn up to 19 continuing education (CE) credits. A complete listing of seminar courses will be available in May.

*IRS transformation: A historic time*

Attendees at the forums will also learn how the IRS is evolving to meet their needs and those of their clients. The IRS is continuing to make changes across the agency as part of its transformation work under the Strategic Operating Plan [ [link removed] ], which is made possible with funding from the Inflation Reduction Act.

?This is a historic time at the IRS, with change taking place across the agency with our ongoing transformation work,? said IRS Commissioner Danny Werfel. ?This summer you?ll have a chance to learn more about these changes. We encourage you to register soon. Some of these locations will fill up quickly.?

See Werfel?s YouTube video [ [link removed] ] inviting tax professionals to the 2024 forums.

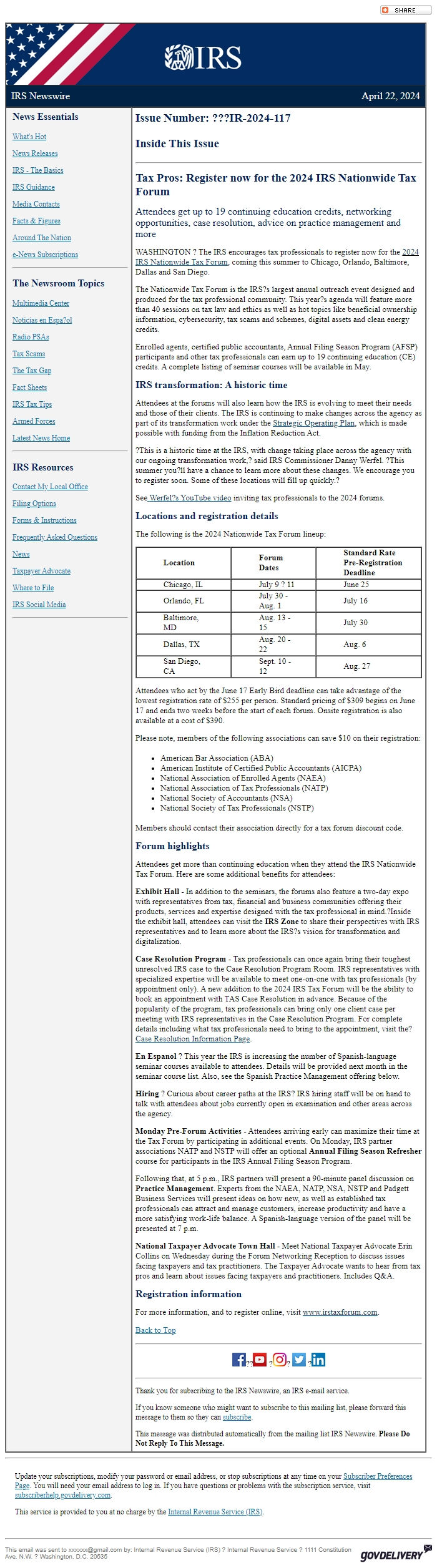

*Locations and registration details*

The following is the 2024 Nationwide Tax Forum lineup:

*Location*

*Forum Dates*

*Standard Rate Pre-Registration Deadline*

Chicago, IL

July 9 ? 11

June 25

Orlando, FL

July 30 - Aug. 1

July 16

Baltimore, MD

Aug. 13 - 15

July 30

Dallas, TX

Aug. 20 - 22

Aug. 6

San Diego, CA

Sept. 10 - 12

Aug. 27

Attendees who act by the June 17 Early Bird deadline can take advantage of the lowest registration rate of $255 per person. Standard pricing of $309 begins on June 17 and ends two weeks before the start of each forum. Onsite registration is also available at a cost of $390.

Please note, members of the following associations can save $10 on their registration:

* American Bar Association (ABA)

* American Institute of Certified Public Accountants (AICPA)

* National Association of Enrolled Agents (NAEA)

* National Association of Tax Professionals (NATP)

* National Society of Accountants (NSA)

* National Society of Tax Professionals (NSTP)

Members should contact their association directly for a tax forum discount code.

*Forum highlights*

Attendees get more than continuing education when they attend the IRS Nationwide Tax Forum. Here are some additional benefits for attendees:

*Exhibit Hall* - In addition to the seminars, the forums also feature a two-day expo with representatives from tax, financial and business communities offering their products, services and expertise designed with the tax professional in mind.?Inside the exhibit hall, attendees can visit the *IRS Zone* to share their perspectives with IRS representatives and to learn more about the IRS?s vision for transformation and digitalization.

*Case Resolution Program* - Tax professionals can once again bring their toughest unresolved IRS case to the Case Resolution Program Room. IRS representatives with specialized expertise will be available to meet one-on-one with tax professionals (by appointment only). A new addition to the 2024 IRS Tax Forum will be the ability to book an appointment with TAS Case Resolution in advance. Because of the popularity of the program, tax professionals can bring only one client case per meeting with IRS representatives in the Case Resolution Program. For complete details including what tax professionals need to bring to the appointment, visit the?Case Resolution Information Page [ [link removed] ].

*En Espanol* ? This year the IRS is increasing the number of Spanish-language seminar courses available to attendees. Details will be provided next month in the seminar course list. Also, see the Spanish Practice Management offering below.

*Hiring* ? Curious about career paths at the IRS? IRS hiring staff will be on hand to talk with attendees about jobs currently open in examination and other areas across the agency.

*Monday Pre-Forum Activities* - Attendees arriving early can maximize their time at the Tax Forum by participating in additional events. On Monday, IRS partner associations NATP and NSTP will offer an optional *Annual Filing Season Refresher* course for participants in the IRS Annual Filing Season Program.

Following that, at 5 p.m., IRS partners will present a 90-minute panel discussion on *Practice Management*. Experts from the NAEA, NATP, NSA, NSTP and Padgett Business Services will present ideas on how new, as well as established tax professionals can attract and manage customers, increase productivity and have a more satisfying work-life balance. A Spanish-language version of the panel will be presented at 7 p.m.

*National Taxpayer Advocate Town Hall* - Meet National Taxpayer Advocate Erin Collins on Wednesday during the Forum Networking Reception to discuss issues facing taxpayers and tax practitioners. The Taxpayer Advocate wants to hear from tax pros and learn about issues facing taxpayers and practitioners. Includes Q&A.

*Registration information*

For more information, and to register online, visit www.irstaxforum.com [ [link removed] ].

Back to Top [ #Fifteenth ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe [ [link removed] ].

This message was distributed automatically from the mailing list IRS Newswire. *Please Do Not Reply To This Message.*

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &amp;lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&amp;gt;

IRS.gov Banner

IRS Newswire April 22, 2024

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia Center [ [link removed] ]

Noticias en Espa?ol [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News Home [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact My Local Office [ [link removed] ]

Filing Options [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

News [ [link removed] ]

Taxpayer Advocate [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Issue Number: ???IR-2024-117

Inside This Issue

________________________________________________________________________

*Tax Pros: Register now for the 2024 IRS Nationwide Tax Forum *

Attendees get up to 19 continuing education credits, networking opportunities, case resolution, advice on practice management and more

WASHINGTON ? The IRS encourages tax professionals to register now for the _2024 _IRS Nationwide Tax Forum [ [link removed] ], coming this summer to Chicago, Orlando, Baltimore, Dallas and San Diego.

The Nationwide Tax Forum is the IRS?s largest annual outreach event designed and produced for the tax professional community. This year?s agenda will feature more than 40 sessions on tax law and ethics as well as hot topics like beneficial ownership information, cybersecurity, tax scams and schemes, digital assets and clean energy credits.

Enrolled agents, certified public accountants, Annual Filing Season Program (AFSP) participants and other tax professionals can earn up to 19 continuing education (CE) credits. A complete listing of seminar courses will be available in May.

*IRS transformation: A historic time*

Attendees at the forums will also learn how the IRS is evolving to meet their needs and those of their clients. The IRS is continuing to make changes across the agency as part of its transformation work under the Strategic Operating Plan [ [link removed] ], which is made possible with funding from the Inflation Reduction Act.

?This is a historic time at the IRS, with change taking place across the agency with our ongoing transformation work,? said IRS Commissioner Danny Werfel. ?This summer you?ll have a chance to learn more about these changes. We encourage you to register soon. Some of these locations will fill up quickly.?

See Werfel?s YouTube video [ [link removed] ] inviting tax professionals to the 2024 forums.

*Locations and registration details*

The following is the 2024 Nationwide Tax Forum lineup:

*Location*

*Forum Dates*

*Standard Rate Pre-Registration Deadline*

Chicago, IL

July 9 ? 11

June 25

Orlando, FL

July 30 - Aug. 1

July 16

Baltimore, MD

Aug. 13 - 15

July 30

Dallas, TX

Aug. 20 - 22

Aug. 6

San Diego, CA

Sept. 10 - 12

Aug. 27

Attendees who act by the June 17 Early Bird deadline can take advantage of the lowest registration rate of $255 per person. Standard pricing of $309 begins on June 17 and ends two weeks before the start of each forum. Onsite registration is also available at a cost of $390.

Please note, members of the following associations can save $10 on their registration:

* American Bar Association (ABA)

* American Institute of Certified Public Accountants (AICPA)

* National Association of Enrolled Agents (NAEA)

* National Association of Tax Professionals (NATP)

* National Society of Accountants (NSA)

* National Society of Tax Professionals (NSTP)

Members should contact their association directly for a tax forum discount code.

*Forum highlights*

Attendees get more than continuing education when they attend the IRS Nationwide Tax Forum. Here are some additional benefits for attendees:

*Exhibit Hall* - In addition to the seminars, the forums also feature a two-day expo with representatives from tax, financial and business communities offering their products, services and expertise designed with the tax professional in mind.?Inside the exhibit hall, attendees can visit the *IRS Zone* to share their perspectives with IRS representatives and to learn more about the IRS?s vision for transformation and digitalization.

*Case Resolution Program* - Tax professionals can once again bring their toughest unresolved IRS case to the Case Resolution Program Room. IRS representatives with specialized expertise will be available to meet one-on-one with tax professionals (by appointment only). A new addition to the 2024 IRS Tax Forum will be the ability to book an appointment with TAS Case Resolution in advance. Because of the popularity of the program, tax professionals can bring only one client case per meeting with IRS representatives in the Case Resolution Program. For complete details including what tax professionals need to bring to the appointment, visit the?Case Resolution Information Page [ [link removed] ].

*En Espanol* ? This year the IRS is increasing the number of Spanish-language seminar courses available to attendees. Details will be provided next month in the seminar course list. Also, see the Spanish Practice Management offering below.

*Hiring* ? Curious about career paths at the IRS? IRS hiring staff will be on hand to talk with attendees about jobs currently open in examination and other areas across the agency.

*Monday Pre-Forum Activities* - Attendees arriving early can maximize their time at the Tax Forum by participating in additional events. On Monday, IRS partner associations NATP and NSTP will offer an optional *Annual Filing Season Refresher* course for participants in the IRS Annual Filing Season Program.

Following that, at 5 p.m., IRS partners will present a 90-minute panel discussion on *Practice Management*. Experts from the NAEA, NATP, NSA, NSTP and Padgett Business Services will present ideas on how new, as well as established tax professionals can attract and manage customers, increase productivity and have a more satisfying work-life balance. A Spanish-language version of the panel will be presented at 7 p.m.

*National Taxpayer Advocate Town Hall* - Meet National Taxpayer Advocate Erin Collins on Wednesday during the Forum Networking Reception to discuss issues facing taxpayers and tax practitioners. The Taxpayer Advocate wants to hear from tax pros and learn about issues facing taxpayers and practitioners. Includes Q&A.

*Registration information*

For more information, and to register online, visit www.irstaxforum.com [ [link removed] ].

Back to Top [ #Fifteenth ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe [ [link removed] ].

This message was distributed automatically from the mailing list IRS Newswire. *Please Do Not Reply To This Message.*

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery