|

|

Wisconsin Alliance Members Hit the Road to Save Social Security |

|

On Tuesday the Wisconsin Alliance took its statewide “Save Social Security” tour to preserve, expand, and modernize the Social Security Administration (SSA) to Kenosha, bringing attention to the fight to provide hardworking SSA personnel with the resources they need to deliver for the American people. The chapter and its allies have nine stops planned over the next month.

During the tour, members of the Wisconsin Alliance and the American Federation of Government Employees (AFGE) are warning that staffing issues at the SSA could lead to closures of the agency's field offices across the country. |

|

|

Members and supporters of the Wisconsin Alliance and AFGE gathered at the Social Security office in Milwaukee on April 4. |

|

Ross Winklbauer, president of Wisconsin Alliance, told NBC's local NBC affiliate in Milwaukee, TMJ4, that the tour aims to protect and enhance Social Security as well as Medicare, while also supporting union members.

“Adequately funding the SSA is crucial,” said Robert Roach, Jr., President of the Alliance. “The American people deserve an SSA that is fully staffed so they can get faster responses to applications and questions.” |

|

Reuters: Donald Trump Considers Plan to Gut Social Security if Elected |

|

Advisers have presented former president Donald Trump with a plan that would cut Social Security’s dedicated funding, the federal payroll tax, if he wins a second term. A cut in the federal payroll tax would drastically reduce the Social Security trust fund and could torpedo the program.

According to a staffer, Trump signaled that he is open to the idea.

At the end of his first term in office, Trump delayed the collection of Social Security payroll taxes paid by workers and their employers, temporarily halting the system’s funding stream. He said at that time that if he is re-elected he would make permanent cuts to the payroll tax.

By law, Social Security can only pay benefits it has sufficient revenue to cover. Any shortfall would trigger benefit cuts.

“The very last thing we need is to cut Social Security and give millionaires and billionaires more tax cuts, but that’s exactly what Donald Trump will do,” said Richard Fiesta, Executive Director of the Alliance. “President Biden and the Democrats, on the other hand, will expand Social Security by requiring millionaires and billionaires to pay their fair share. It is a very stark contrast.” |

|

Alliance’s 2024 Regional Meetings Are Fast Approaching |

|

You’re invited!

Join us at our regional meetings and strengthen your skills as a retiree activist. Make sure you’re ready to help elect pro-retiree candidates this November and win the fight for retirement security.

Attendees will elect regional Alliance Executive Board members, hear from local labor leaders and elected officials, and participate in interactive workshops and training sessions. The meetings and dates are: Midwest, May 15-16, 2024; Western, June 5-6, 2024; Southern, June 11-12, 2024; and Northeast, July 30-31, 2024. Click to see what region you are in and register.

All meeting attendees will participate in four interactive workshops with fellow retiree activists.

For more information, please contact Joni Jones by calling 202-637-5377 or e-mail [email protected]. |

|

House Social Security Subcommittee Holds Hearing on Social Security Provisions that Harm Public Servants and their Families |

|

The House Ways and Means Social Security Subcommittee heard testimony Tuesday from Social Security experts about how the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) unfairly harm many public servants and their families. Witnesses identified how the outdated formulas used to calculate the WEP and GPO create unfair outcomes for beneficiaries affected by one or both policies.

The Alliance provided a statement for the record, stating that the Windfall Elimination Provision (WEP) affects over two million public sector retirees with public pensions from a job not covered by Social Security, while the Government Pension Offset (GPO) reduces by two-thirds the spousal or survivor benefits of nearly 800,000 retirees who collect a public pension from a job not covered by Social Security.

“The WEP and GPO are outdated provisions that deprive public employees of the benefits they have earned and the secure retirement they deserve,” said Joseph Peters, Jr., Secretary-Treasurer of the Alliance. “Moreover, the WEP and GPO disproportionately affect lower-income workers. 83% of those subject to the GPO are women. We must repeal the WEP and the GPO.”

The Alliance continues to urge Congress to pass H.R. 82, the Social Security Fairness Act introduced by Reps. Garret Graves (R-LA) and Abigail Spanberger (D-VA), and H.R. 4583, the Social Security Sacred Trust Act, introduced by Rep. John Larson (D-CT). Both of the bills repeal the WEP and the GPO. |

|

KFF Health News: Nearly 1 in 4 Adults Dumped From Medicaid Are Now Uninsured, Survey Finds |

|

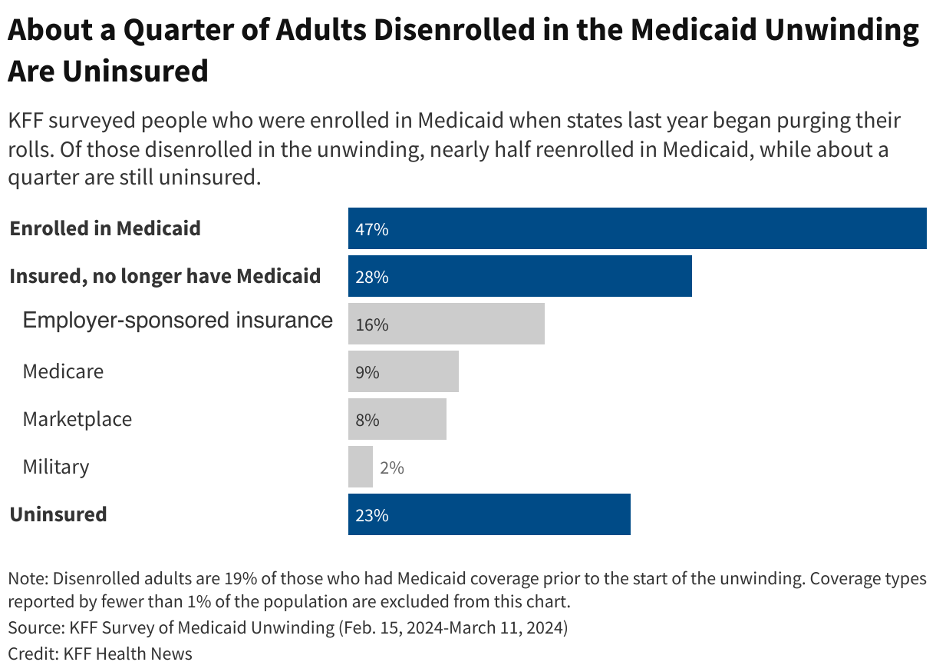

Nearly a quarter of adults disenrolled from Medicaid in the past year say they are now uninsured, according to a survey released Friday that details how tens of millions of Americans struggled to retain coverage in the government insurance program for low-income people after pandemic-era protections began expiring last spring. |

|

|

The first national survey of adults whose Medicaid eligibility was reviewed during the unwinding found nearly half of people who lost their government coverage signed back up weeks or months later — suggesting they should never have been dropped in the first place.

While 23% reported being uninsured, an additional 28% found other coverage — through an employer, Medicare, the Affordable Care Act’s insurance marketplace, or health care for members of the military, the survey by KFF found.

“Twenty-three percent is a striking number especially when you think about the number of people who lost Medicaid coverage,” said Chima Ndumele, an associate professor of health policy at the Yale University School of Public Health.

Going without insurance even for a short period of time can lead people to delay seeking care and leave them at financial risk when they do.

Seven in 10 adults who were disenrolled during the unwinding process say they became uninsured at least temporarily when they lost their Medicaid coverage.

Read more here. |

|

Thanks for reading. Every day, we're fighting to lower prescription drug prices and protect retirees' earned benefits and health care. But we can't do it without your help. Please support our work by donating below. |

|

|

|

|

Alliance for Retired Americans | 815 16th Street, NW | Washington, DC 20006 | www.retiredamericans.org