Email

POLL: Is the Stimulus Money Enough? - Recession ‘Worse than 2008’, Oil Stocks Soar, Shocking Jobs Data

| From | BearMarket.com <[email protected]> |

| Subject | POLL: Is the Stimulus Money Enough? - Recession ‘Worse than 2008’, Oil Stocks Soar, Shocking Jobs Data |

| Date | April 4, 2020 6:48 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bear MarketDaily Bear Market News

[link removed] ([link removed])

[link removed] ([link removed])

[link removed] ([link removed])

Saturday NewsIn today’s headlines, you will notice a couple of forecasts that are grim on a macro level. The U.S. Jobs numbers are staggering, and some experts now say this recession will be worse than 2008. However, down below, you will also want to check out some intriguing stories—like the rise of gold buying apps and how one app is seeing a rise of volume over 700 percent.

Here you go…

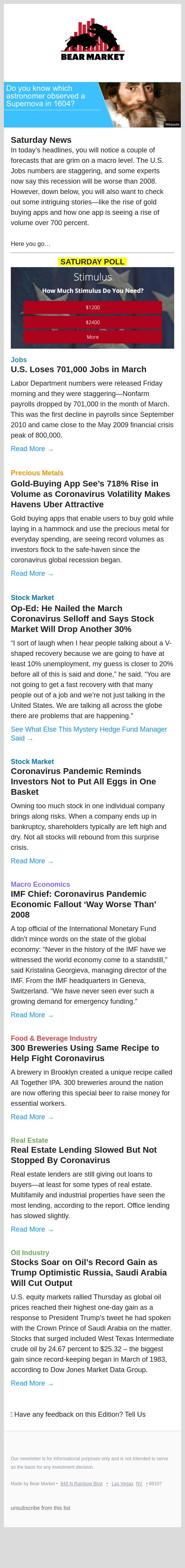

SATURDAY POLL

[link removed] ([link removed])

JobsU.S. Loses 701,000 Jobs in March

Labor Department numbers were released Friday morning and they were staggering—Nonfarm payrolls dropped by 701,000 in the month of March. This was the first decline in payrolls since September 2010 and came close to the May 2009 financial crisis peak of 800,000.

Read More → ([link removed])

Precious MetalsGold-Buying App See’s 718% Rise in Volume as Coronavirus Volatility Makes Havens Uber Attractive

Gold buying apps that enable users to buy gold while laying in a hammock and use the precious metal for everyday spending, are seeing record volumes as investors flock to the safe-haven since the coronavirus global recession began.

Read More → ([link removed])

Stock MarketOp-Ed: He Nailed the March Coronavirus Selloff and Says Stock Market Will Drop Another 30%

“I sort of laugh when I hear people talking about a V-shaped recovery because we are going to have at least 10% unemployment, my guess is closer to 20% before all of this is said and done,” he said. “You are not going to get a fast recovery with that many people out of a job and we’re not just talking in the United States. We are talking all across the globe there are problems that are happening.”

See What Else This Mystery Hedge Fund Manager Said → ([link removed])

Stock MarketCoronavirus Pandemic Reminds Investors Not to Put All Eggs in One Basket

Owning too much stock in one individual company brings along risks. When a company ends up in bankruptcy, shareholders typically are left high and dry. Not all stocks will rebound from this surprise crisis.

Read More → ([link removed])

Macro EconomicsIMF Chief: Coronavirus Pandemic Economic Fallout ‘Way Worse Than’ 2008

A top official of the International Monetary Fund didn’t mince words on the state of the global economy: “Never in the history of the IMF have we witnessed the world economy come to a standstill,” said Kristalina Georgieva, managing director of the IMF. From the IMF headquarters in Geneva, Switzerland. “We have never seen ever such a growing demand for emergency funding.”

Read More → ([link removed])

Food & Beverage Industry300 Breweries Using Same Recipe to Help Fight Coronavirus

A brewery in Brooklyn created a unique recipe called All Together IPA. 300 breweries around the nation are now offering this special beer to raise money for essential workers.

Read More → ([link removed])

Real EstateReal Estate Lending Slowed But Not Stopped By Coronavirus

Real estate lenders are still giving out loans to buyers—at least for some types of real estate. Multifamily and industrial properties have seen the most lending, according to the report. Office lending has slowed slightly.

Read More → ([link removed])

Oil IndustryStocks Soar on Oil’s Record Gain as Trump Optimistic Russia, Saudi Arabia Will Cut Output

U.S. equity markets rallied Thursday as global oil prices reached their highest one-day gain as a response to President Trump’s tweet he had spoken with the Crown Prince of Saudi Arabia on the matter. Stocks that surged included West Texas Intermediate crude oil by 24.67 percent to $25.32 – the biggest gain since record-keeping began in March of 1983, according to Dow Jones Market Data Group.

Read More → ([link removed])

💬 Have any feedback on this Edition? Tell Us

Our newsletter is for informational purposes only and is not intended to serve as the basis for any investment decision.

Made by Bear Market • 848 N Rainbow Blvd•Las VegasNV• 89107

unsubscribe from this list

Bear Market

[Conservative Buzz]

• 848 N Rainbow Blvd • Las Vegas NV • 89107

You are subscribed to this email as [email protected]. Click here to unsubscribe [link removed].

[link removed] ([link removed])

[link removed] ([link removed])

[link removed] ([link removed])

Saturday NewsIn today’s headlines, you will notice a couple of forecasts that are grim on a macro level. The U.S. Jobs numbers are staggering, and some experts now say this recession will be worse than 2008. However, down below, you will also want to check out some intriguing stories—like the rise of gold buying apps and how one app is seeing a rise of volume over 700 percent.

Here you go…

SATURDAY POLL

[link removed] ([link removed])

JobsU.S. Loses 701,000 Jobs in March

Labor Department numbers were released Friday morning and they were staggering—Nonfarm payrolls dropped by 701,000 in the month of March. This was the first decline in payrolls since September 2010 and came close to the May 2009 financial crisis peak of 800,000.

Read More → ([link removed])

Precious MetalsGold-Buying App See’s 718% Rise in Volume as Coronavirus Volatility Makes Havens Uber Attractive

Gold buying apps that enable users to buy gold while laying in a hammock and use the precious metal for everyday spending, are seeing record volumes as investors flock to the safe-haven since the coronavirus global recession began.

Read More → ([link removed])

Stock MarketOp-Ed: He Nailed the March Coronavirus Selloff and Says Stock Market Will Drop Another 30%

“I sort of laugh when I hear people talking about a V-shaped recovery because we are going to have at least 10% unemployment, my guess is closer to 20% before all of this is said and done,” he said. “You are not going to get a fast recovery with that many people out of a job and we’re not just talking in the United States. We are talking all across the globe there are problems that are happening.”

See What Else This Mystery Hedge Fund Manager Said → ([link removed])

Stock MarketCoronavirus Pandemic Reminds Investors Not to Put All Eggs in One Basket

Owning too much stock in one individual company brings along risks. When a company ends up in bankruptcy, shareholders typically are left high and dry. Not all stocks will rebound from this surprise crisis.

Read More → ([link removed])

Macro EconomicsIMF Chief: Coronavirus Pandemic Economic Fallout ‘Way Worse Than’ 2008

A top official of the International Monetary Fund didn’t mince words on the state of the global economy: “Never in the history of the IMF have we witnessed the world economy come to a standstill,” said Kristalina Georgieva, managing director of the IMF. From the IMF headquarters in Geneva, Switzerland. “We have never seen ever such a growing demand for emergency funding.”

Read More → ([link removed])

Food & Beverage Industry300 Breweries Using Same Recipe to Help Fight Coronavirus

A brewery in Brooklyn created a unique recipe called All Together IPA. 300 breweries around the nation are now offering this special beer to raise money for essential workers.

Read More → ([link removed])

Real EstateReal Estate Lending Slowed But Not Stopped By Coronavirus

Real estate lenders are still giving out loans to buyers—at least for some types of real estate. Multifamily and industrial properties have seen the most lending, according to the report. Office lending has slowed slightly.

Read More → ([link removed])

Oil IndustryStocks Soar on Oil’s Record Gain as Trump Optimistic Russia, Saudi Arabia Will Cut Output

U.S. equity markets rallied Thursday as global oil prices reached their highest one-day gain as a response to President Trump’s tweet he had spoken with the Crown Prince of Saudi Arabia on the matter. Stocks that surged included West Texas Intermediate crude oil by 24.67 percent to $25.32 – the biggest gain since record-keeping began in March of 1983, according to Dow Jones Market Data Group.

Read More → ([link removed])

💬 Have any feedback on this Edition? Tell Us

Our newsletter is for informational purposes only and is not intended to serve as the basis for any investment decision.

Made by Bear Market • 848 N Rainbow Blvd•Las VegasNV• 89107

unsubscribe from this list

Bear Market

[Conservative Buzz]

• 848 N Rainbow Blvd • Las Vegas NV • 89107

You are subscribed to this email as [email protected]. Click here to unsubscribe [link removed].

Message Analysis

- Sender: Conservative Buzz

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaigner

- MessageGears