|

John,

This Tax Day, Americans for Tax Fairness is out with a new report highlighting how neither the nation’s richest individuals, nor its biggest corporations, are paying their fair share in taxes.

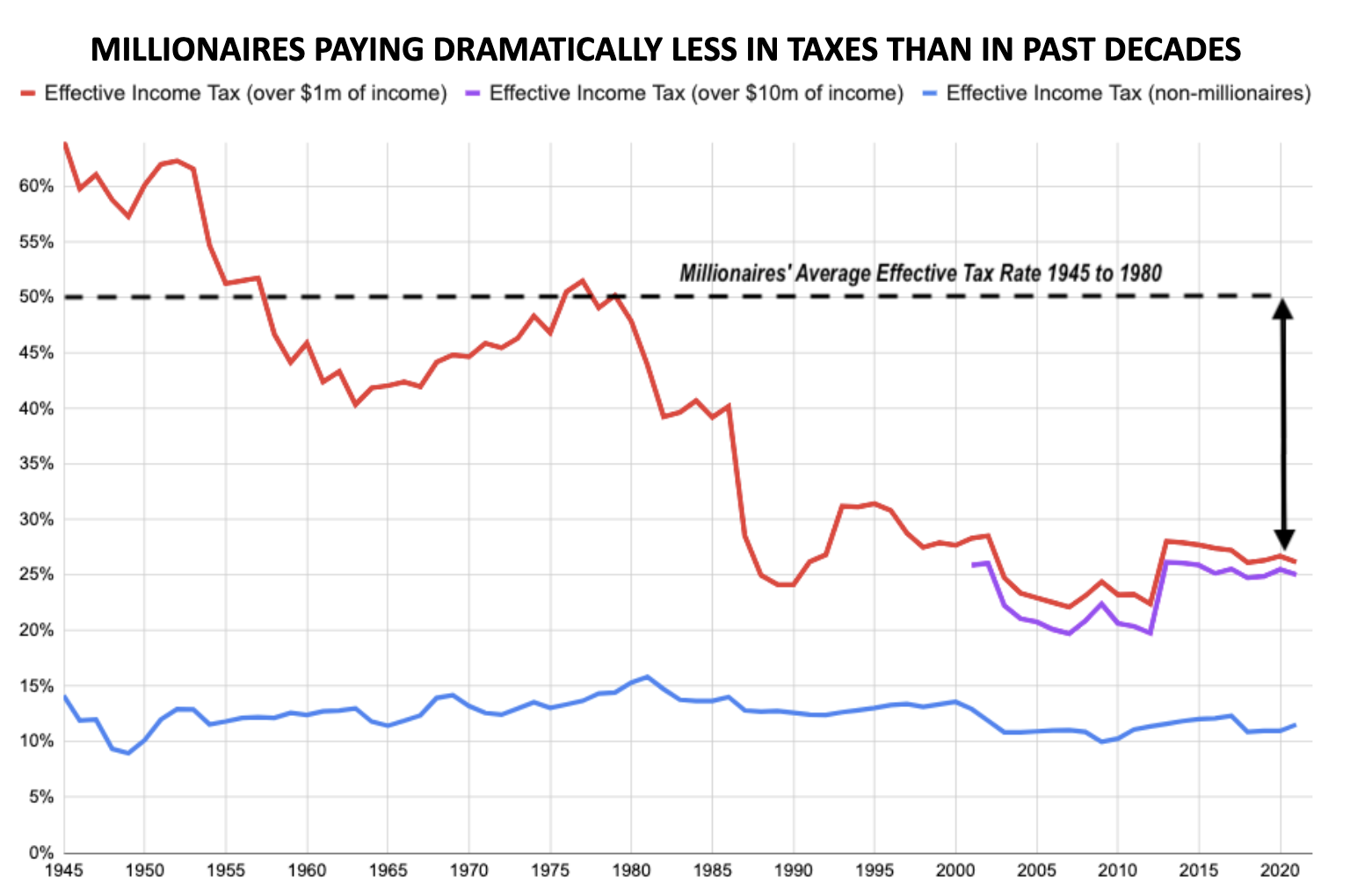

In the middle of the last century, Americans with annual incomes over $1 million were paying effective tax rates of 40-60%. Today, they’re paying half that. Just look at this chart:

At the same time, the corporate dividends paid to wealthy Wall Street investors are now taxed at roughly half the rate they used to be, while the wealthiest families can shield over $27 million in dynastic wealth from a weakened estate tax.

The Republican response to this collapse of high-end taxation? Make it worse by doubling down on tax cuts for the rich. They’re seeking to renew soon-to-expire provisions in the Trump-GOP tax scam that mostly benefit the ultra-wealthy, which will add almost $4 trillion to the national debt.[1]

President Biden and Democrats in Congress are pulling in the exact opposite direction. They want to tax the wealth gains of billionaires and ultra-millionaires, raise the corporate tax rate from 21% to at least 28%, close offshore loopholes to keep greedy corporations from offshoring profits and jobs, strengthen the estate tax to ensure the super-wealthy aren’t passing along their fortunes tax free, and equalize the tax code to ensure that wealth is taxed at the same rate as work.

This Tax Day, April 15th, donate $15 to power our research and activism, fighting for a tax code and an economy that puts working people first and makes the wealthy and corporations pay their fair share in taxes.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Together, we’re fighting to narrow inequality and create an economy that works for everyone, not just those on top.

Thank you for your continued support,

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] Tax Cut Extensions Cost Over $3.3 Trillion

|