Email

Happening This Week: Tax Policy as Competition Policy

| From | Roosevelt Events <[email protected]> |

| Subject | Happening This Week: Tax Policy as Competition Policy |

| Date | April 15, 2024 4:29 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Join us on April 18

View this email in your browser ([link removed])

[link removed]

Tax Policy as Competition Policy: Reimagining How the US Tax Code Can Foster a More Equitable and Participatory Economy

Featuring Opening Remarks by Senator Elizabeth Warren

Thursday, April 18

12:00 pm - 1:00 pm ET

Zoom

Register Now ([link removed])

Dear John,

You are invited to an upcoming webinar the Roosevelt Institute is hosting on Tax Policy as Competition Policy: Reimagining how the US tax code can foster a more equitable and participatory economy ([link removed]) .

Excessive market power by dominant corporations is widely decried across the political divide. Federal and state antitrust agencies have begun to reclaim their rightful roles in checking the power of a few firms to control so much of the economy. Historically, tax policy complemented these antitrust enforcers by leveling the economic playing field. Yet today, taxation remains overlooked both as a driver of current levels of market concentration and as a tool to remedy the problem.

Roosevelt’s Taxing Monopolies series ([link removed]) explores how a rewriting of the tax code can work alongside other antimonopoly tools to curb the excessive economic and political power of large corporations and their owners.

Join us for a virtual roundtable discussion bringing together a multidisciplinary circle of authors to present their latest research on how the US tax code affects market concentration and how to reform the tax code in a way that levels the economic playing field.

We hope you will join us.

Register Now ([link removed])

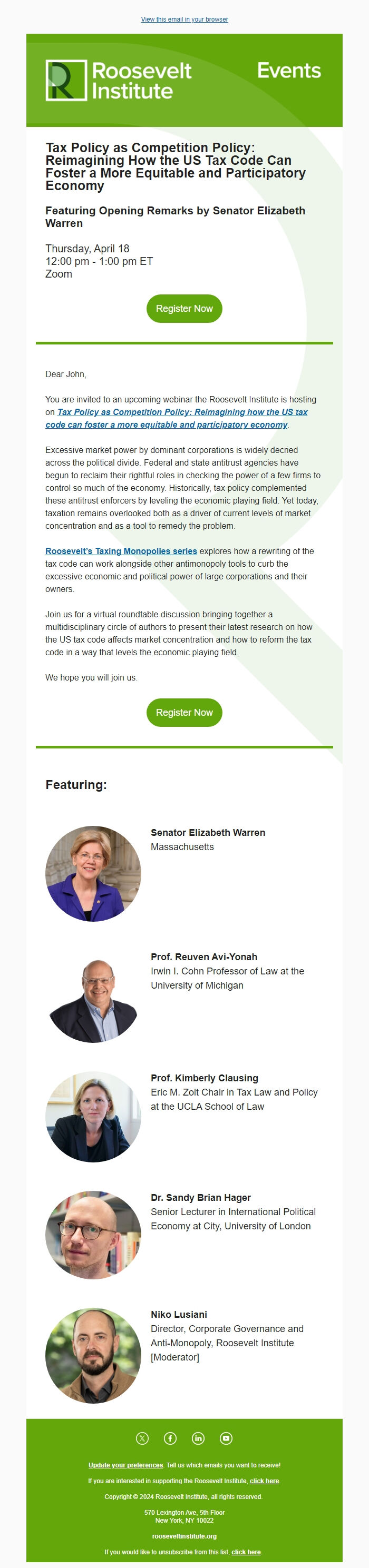

** Featuring:

------------------------------------------------------------

** Senator Elizabeth Warren

------------------------------------------------------------

Massachusetts

** Prof. Reuven Avi-Yonah

------------------------------------------------------------

Irwin I. Cohn Professor of Law at the University of Michigan

** Prof. Kimberly Clausing

------------------------------------------------------------

Eric M. Zolt Chair in Tax Law and Policy at the UCLA School of Law

** Dr. Sandy Brian Hager

------------------------------------------------------------

Senior Lecturer in International Political Economy at City, University of London

** Niko Lusiani

------------------------------------------------------------

Director, Corporate Governance and Anti-Monopoly, Roosevelt Institute [Moderator]

============================================================

** Twitter ([link removed])

** Facebook ([link removed])

** LinkedIn ([link removed])

** YouTube ([link removed])

** Update your preferences ([link removed])

. Tell us which emails you want to receive!

If you are interested in supporting the Roosevelt Institute, ** click here ([link removed])

.

Copyright © 2024 Roosevelt Institute, all rights reserved.

570 Lexington Ave, 5th Floor

New York, NY 10022

rooseveltinstitute.org

If you would like to unsubscribe from this list, ** click here ([link removed])

.

View this email in your browser ([link removed])

[link removed]

Tax Policy as Competition Policy: Reimagining How the US Tax Code Can Foster a More Equitable and Participatory Economy

Featuring Opening Remarks by Senator Elizabeth Warren

Thursday, April 18

12:00 pm - 1:00 pm ET

Zoom

Register Now ([link removed])

Dear John,

You are invited to an upcoming webinar the Roosevelt Institute is hosting on Tax Policy as Competition Policy: Reimagining how the US tax code can foster a more equitable and participatory economy ([link removed]) .

Excessive market power by dominant corporations is widely decried across the political divide. Federal and state antitrust agencies have begun to reclaim their rightful roles in checking the power of a few firms to control so much of the economy. Historically, tax policy complemented these antitrust enforcers by leveling the economic playing field. Yet today, taxation remains overlooked both as a driver of current levels of market concentration and as a tool to remedy the problem.

Roosevelt’s Taxing Monopolies series ([link removed]) explores how a rewriting of the tax code can work alongside other antimonopoly tools to curb the excessive economic and political power of large corporations and their owners.

Join us for a virtual roundtable discussion bringing together a multidisciplinary circle of authors to present their latest research on how the US tax code affects market concentration and how to reform the tax code in a way that levels the economic playing field.

We hope you will join us.

Register Now ([link removed])

** Featuring:

------------------------------------------------------------

** Senator Elizabeth Warren

------------------------------------------------------------

Massachusetts

** Prof. Reuven Avi-Yonah

------------------------------------------------------------

Irwin I. Cohn Professor of Law at the University of Michigan

** Prof. Kimberly Clausing

------------------------------------------------------------

Eric M. Zolt Chair in Tax Law and Policy at the UCLA School of Law

** Dr. Sandy Brian Hager

------------------------------------------------------------

Senior Lecturer in International Political Economy at City, University of London

** Niko Lusiani

------------------------------------------------------------

Director, Corporate Governance and Anti-Monopoly, Roosevelt Institute [Moderator]

============================================================

** Twitter ([link removed])

** Facebook ([link removed])

** LinkedIn ([link removed])

** YouTube ([link removed])

** Update your preferences ([link removed])

. Tell us which emails you want to receive!

If you are interested in supporting the Roosevelt Institute, ** click here ([link removed])

.

Copyright © 2024 Roosevelt Institute, all rights reserved.

570 Lexington Ave, 5th Floor

New York, NY 10022

rooseveltinstitute.org

If you would like to unsubscribe from this list, ** click here ([link removed])

.

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp