| From | Tax the Ultra Wealthy (via MoveOn) <[email protected]> |

| Subject | Tax the rich! (petition) |

| Date | April 15, 2024 3:17 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

[ [link removed] ]IT'S TAX DAY. Sign the petition to finally make the ultrawealthy pay

what they owe!

Dear MoveOn member,

Republicans and Donald Trump passed a tax scheme in 2017 to benefit the

ultrawealthy and corporations—and now everyday Americans are paying the

price, literally. While 78% of Americans struggle living paycheck to

paycheck, the 400 richest people added another $500 BILLION to their $4.5

TRILLION net worth last year alone.^1,2 All while shifting the burden onto

the rest of us and underfunding education, health, jobs, infrastructure,

and other critical social safety nets.

[ [link removed] ]We're done letting billionaires and the ultrawealthy cut corners and

evade paying what they owe. It's time we fix our broken tax system and

demand that the wealthy pay up, like the rest of us.

Billionaires like Jeff Bezos exploit the already rigged tax system to pay

a lower tax rate than the rest of us. In fact, Bezos—one of the richest

men in the world—used tax loopholes to avoid paying federal income taxes

altogether not just once but twice! And Elon Musk and Michael Bloomberg

have also evaded paying taxes in the past.^3^ It's clear: The system is

set up to benefit the wealthy at the expense of the rest of us. But there

is a solution to unrig it and make our tax system—and our country—more

fair and equitable: a wealth tax.

[ [link removed] ][IMG]

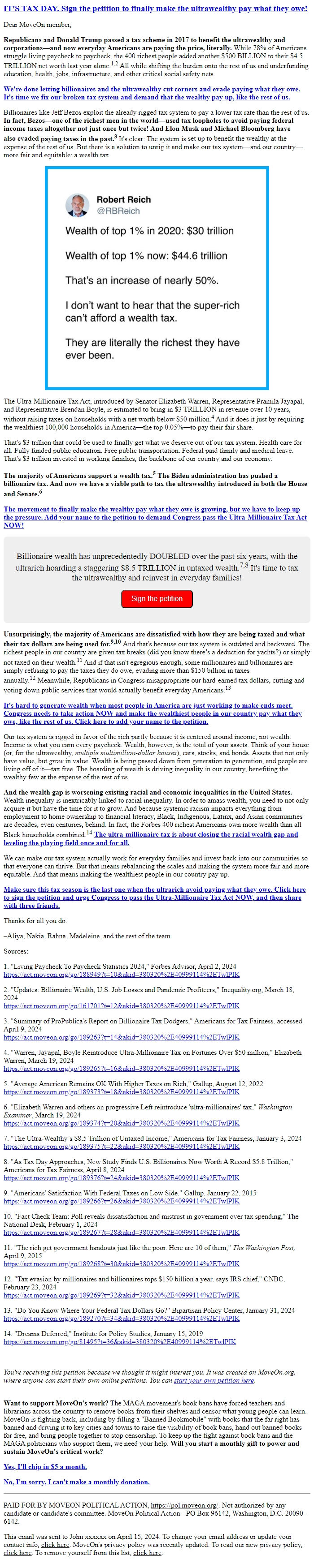

The Ultra-Millionaire Tax Act, introduced by Senator Elizabeth Warren,

Representative Pramila Jayapal, and Representative Brendan Boyle, is

estimated to bring in $3 TRILLION in revenue over 10 years, without

raising taxes on households with a net worth below $50 million.^4 And it

does it just by requiring the wealthiest 100,000 households in America—the

top 0.05%—to pay their fair share.

That's $3 trillion that could be used to finally get what we deserve out

of our tax system. Health care for all. Fully funded public education.

Free public transportation. Federal paid family and medical leave. That's

$3 trillion invested in working families, the backbone of our country and

our economy.

The majority of Americans support a wealth tax.^5 The Biden administration

has pushed a billionaire tax. And now we have a viable path to tax the

ultrawealthy introduced in both the House and Senate.^6

[ [link removed] ]The movement to finally make the wealthy pay what they owe is growing,

but we have to keep up the pressure. Add your name to the petition to

demand Congress pass the Ultra-Millionaire Tax Act NOW!

Billionaire wealth has unprecedentedly DOUBLED over the past six years,

with the ultrarich hoarding a staggering $8.5 TRILLION in untaxed

wealth.^7,8 It's time to tax the ultrawealthy and reinvest in everyday

families!

[5]Sign the petition

Unsurprisingly, the majority of Americans are dissatisfied with how they

are being taxed and what their tax dollars are being used for.^9,10 And

that's because our tax system is outdated and backward. The richest people

in our country are given tax breaks (did you know there’s a deduction for

yachts?) or simply not taxed on their wealth.^11 And if that isn't

egregious enough, some millionaires and billionaires are simply refusing

to pay the taxes they do owe, evading more than $150 billion in taxes

annually.^12 Meanwhile, Republicans in Congress misappropriate our

hard-earned tax dollars, cutting and voting down public services that

would actually benefit everyday Americans.^13

[ [link removed] ]It's hard to generate wealth when most people in America are just

working to make ends meet. Congress needs to take action NOW and make the

wealthiest people in our country pay what they owe, like the rest of us.

Click here to add your name to the petition.

Our tax system is rigged in favor of the rich partly because it is

centered around income, not wealth. Income is what you earn every

paycheck. Wealth, however, is the total of your assets. Think of your

house (or, for the ultrawealthy, multiple multimillion-dollar houses),

cars, stocks, and bonds. Assets that not only have value, but grow in

value. Wealth is being passed down from generation to generation, and

people are living off of it—tax free. The hoarding of wealth is driving

inequality in our country, benefiting the wealthy few at the expense of

the rest of us.

And the wealth gap is worsening existing racial and economic inequalities

in the United States. Wealth inequality is inextricably linked to racial

inequality. In order to amass wealth, you need to not only acquire it but

have the time for it to grow. And because systemic racism impacts

everything from employment to home ownership to financial literacy, Black,

Indigenous, Latinx, and Asian communities are decades, even centuries,

behind. In fact, the Forbes 400 richest Americans own more wealth than all

Black households combined.^14 [ [link removed] ]The ultra-millionaire tax is about

closing the racial wealth gap and leveling the playing field once and for

all.

We can make our tax system actually work for everyday families and invest

back into our communities so that everyone can thrive. But that means

rebalancing the scales and making the system more fair and more equitable.

And that means making the wealthiest people in our country pay up.

[ [link removed] ]Make sure this tax season is the last one when the ultrarich avoid

paying what they owe. Click here to sign the petition and urge Congress to

pass the Ultra-Millionaire Tax Act NOW, and then share with three friends.

Thanks for all you do.

–Aliya, Nakia, Rahna, Madeleine, and the rest of the team

Sources:

1. "Living Paycheck To Paycheck Statistics 2024," Forbes Advisor, April 2,

2024

[ [link removed] ][link removed]

2. "Updates: Billionaire Wealth, U.S. Job Losses and Pandemic Profiteers,"

Inequality.org, March 18, 2024

[ [link removed] ][link removed]

3. "Summary of ProPublica's Report on Billionaire Tax Dodgers," Americans

for Tax Fairness, accessed April 9, 2024

[ [link removed] ][link removed]

4. "Warren, Jayapal, Boyle Reintroduce Ultra-Millionaire Tax on Fortunes

Over $50 million," Elizabeth Warren, March 19, 2024

[ [link removed] ][link removed]

5. "Average American Remains OK With Higher Taxes on Rich," Gallup, August

12, 2022

[ [link removed] ][link removed]

6. "Elizabeth Warren and others on progressive Left reintroduce

'ultra-millionaires' tax," Washington Examiner, March 19, 2024

[ [link removed] ][link removed]

7. "The Ultra-Wealthy’s $8.5 Trillion of Untaxed Income," Americans for

Tax Fairness, January 3, 2024

[ [link removed] ][link removed]

8. "As Tax Day Approaches, New Study Finds U.S. Billionaires Now Worth A

Record $5.8 Trillion," Americans for Tax Fairness, April 8, 2024

[link removed]

9. "Americans' Satisfaction With Federal Taxes on Low Side," Gallup,

January 22, 2015

[ [link removed] ][link removed]

10. "Fact Check Team: Poll reveals dissatisfaction and mistrust in

government over tax spending," The National Desk, February 1, 2024

[ [link removed] ][link removed]

11. "The rich get government handouts just like the poor. Here are 10 of

them," The Washington Post, April 9, 2015

[ [link removed] ][link removed]

12. "Tax evasion by millionaires and billionaires tops $150 billion a

year, says IRS chief," CNBC, February 23, 2024

[ [link removed] ][link removed]

13. "Do You Know Where Your Federal Tax Dollars Go?" Bipartisan Policy

Center, January 31, 2024

[link removed]

14. "Dreams Deferred," Institute for Policy Studies, January 15, 2019

[ [link removed] ][link removed]

You're receiving this petition because we thought it might interest you.

It was created on MoveOn.org, where anyone can start their own online

petitions. You can [ [link removed] ]start your own petition here.

Want to support MoveOn's work? The MAGA movement's book bans have forced

teachers and librarians across the country to remove books from their

shelves and censor what young people can learn. MoveOn is fighting back,

including by filling a "Banned Bookmobile" with books that the far right

has banned and driving it to key cities and towns to raise the visibility

of book bans, hand out banned books for free, and bring people together to

stop censorship. To keep up the fight against book bans and the MAGA

politicians who support them, we need your help. Will you start a monthly

gift to power and sustain MoveOn's critical work?

[ [link removed] ]Yes, I'll chip in $5 a month.

[ [link removed] ]No, I'm sorry, I can't make a monthly donation.

--------------------------------------------------------------------------

PAID FOR BY MOVEON POLITICAL ACTION, [ [link removed] ][link removed]?.

Not authorized by any candidate or candidate's committee. MoveOn Political

Action - PO Box 96142, Washington, D.C. 20090-6142.

You can unsubscribe from this mailing list at any time:

[link removed]

what they owe!

Dear MoveOn member,

Republicans and Donald Trump passed a tax scheme in 2017 to benefit the

ultrawealthy and corporations—and now everyday Americans are paying the

price, literally. While 78% of Americans struggle living paycheck to

paycheck, the 400 richest people added another $500 BILLION to their $4.5

TRILLION net worth last year alone.^1,2 All while shifting the burden onto

the rest of us and underfunding education, health, jobs, infrastructure,

and other critical social safety nets.

[ [link removed] ]We're done letting billionaires and the ultrawealthy cut corners and

evade paying what they owe. It's time we fix our broken tax system and

demand that the wealthy pay up, like the rest of us.

Billionaires like Jeff Bezos exploit the already rigged tax system to pay

a lower tax rate than the rest of us. In fact, Bezos—one of the richest

men in the world—used tax loopholes to avoid paying federal income taxes

altogether not just once but twice! And Elon Musk and Michael Bloomberg

have also evaded paying taxes in the past.^3^ It's clear: The system is

set up to benefit the wealthy at the expense of the rest of us. But there

is a solution to unrig it and make our tax system—and our country—more

fair and equitable: a wealth tax.

[ [link removed] ][IMG]

The Ultra-Millionaire Tax Act, introduced by Senator Elizabeth Warren,

Representative Pramila Jayapal, and Representative Brendan Boyle, is

estimated to bring in $3 TRILLION in revenue over 10 years, without

raising taxes on households with a net worth below $50 million.^4 And it

does it just by requiring the wealthiest 100,000 households in America—the

top 0.05%—to pay their fair share.

That's $3 trillion that could be used to finally get what we deserve out

of our tax system. Health care for all. Fully funded public education.

Free public transportation. Federal paid family and medical leave. That's

$3 trillion invested in working families, the backbone of our country and

our economy.

The majority of Americans support a wealth tax.^5 The Biden administration

has pushed a billionaire tax. And now we have a viable path to tax the

ultrawealthy introduced in both the House and Senate.^6

[ [link removed] ]The movement to finally make the wealthy pay what they owe is growing,

but we have to keep up the pressure. Add your name to the petition to

demand Congress pass the Ultra-Millionaire Tax Act NOW!

Billionaire wealth has unprecedentedly DOUBLED over the past six years,

with the ultrarich hoarding a staggering $8.5 TRILLION in untaxed

wealth.^7,8 It's time to tax the ultrawealthy and reinvest in everyday

families!

[5]Sign the petition

Unsurprisingly, the majority of Americans are dissatisfied with how they

are being taxed and what their tax dollars are being used for.^9,10 And

that's because our tax system is outdated and backward. The richest people

in our country are given tax breaks (did you know there’s a deduction for

yachts?) or simply not taxed on their wealth.^11 And if that isn't

egregious enough, some millionaires and billionaires are simply refusing

to pay the taxes they do owe, evading more than $150 billion in taxes

annually.^12 Meanwhile, Republicans in Congress misappropriate our

hard-earned tax dollars, cutting and voting down public services that

would actually benefit everyday Americans.^13

[ [link removed] ]It's hard to generate wealth when most people in America are just

working to make ends meet. Congress needs to take action NOW and make the

wealthiest people in our country pay what they owe, like the rest of us.

Click here to add your name to the petition.

Our tax system is rigged in favor of the rich partly because it is

centered around income, not wealth. Income is what you earn every

paycheck. Wealth, however, is the total of your assets. Think of your

house (or, for the ultrawealthy, multiple multimillion-dollar houses),

cars, stocks, and bonds. Assets that not only have value, but grow in

value. Wealth is being passed down from generation to generation, and

people are living off of it—tax free. The hoarding of wealth is driving

inequality in our country, benefiting the wealthy few at the expense of

the rest of us.

And the wealth gap is worsening existing racial and economic inequalities

in the United States. Wealth inequality is inextricably linked to racial

inequality. In order to amass wealth, you need to not only acquire it but

have the time for it to grow. And because systemic racism impacts

everything from employment to home ownership to financial literacy, Black,

Indigenous, Latinx, and Asian communities are decades, even centuries,

behind. In fact, the Forbes 400 richest Americans own more wealth than all

Black households combined.^14 [ [link removed] ]The ultra-millionaire tax is about

closing the racial wealth gap and leveling the playing field once and for

all.

We can make our tax system actually work for everyday families and invest

back into our communities so that everyone can thrive. But that means

rebalancing the scales and making the system more fair and more equitable.

And that means making the wealthiest people in our country pay up.

[ [link removed] ]Make sure this tax season is the last one when the ultrarich avoid

paying what they owe. Click here to sign the petition and urge Congress to

pass the Ultra-Millionaire Tax Act NOW, and then share with three friends.

Thanks for all you do.

–Aliya, Nakia, Rahna, Madeleine, and the rest of the team

Sources:

1. "Living Paycheck To Paycheck Statistics 2024," Forbes Advisor, April 2,

2024

[ [link removed] ][link removed]

2. "Updates: Billionaire Wealth, U.S. Job Losses and Pandemic Profiteers,"

Inequality.org, March 18, 2024

[ [link removed] ][link removed]

3. "Summary of ProPublica's Report on Billionaire Tax Dodgers," Americans

for Tax Fairness, accessed April 9, 2024

[ [link removed] ][link removed]

4. "Warren, Jayapal, Boyle Reintroduce Ultra-Millionaire Tax on Fortunes

Over $50 million," Elizabeth Warren, March 19, 2024

[ [link removed] ][link removed]

5. "Average American Remains OK With Higher Taxes on Rich," Gallup, August

12, 2022

[ [link removed] ][link removed]

6. "Elizabeth Warren and others on progressive Left reintroduce

'ultra-millionaires' tax," Washington Examiner, March 19, 2024

[ [link removed] ][link removed]

7. "The Ultra-Wealthy’s $8.5 Trillion of Untaxed Income," Americans for

Tax Fairness, January 3, 2024

[ [link removed] ][link removed]

8. "As Tax Day Approaches, New Study Finds U.S. Billionaires Now Worth A

Record $5.8 Trillion," Americans for Tax Fairness, April 8, 2024

[link removed]

9. "Americans' Satisfaction With Federal Taxes on Low Side," Gallup,

January 22, 2015

[ [link removed] ][link removed]

10. "Fact Check Team: Poll reveals dissatisfaction and mistrust in

government over tax spending," The National Desk, February 1, 2024

[ [link removed] ][link removed]

11. "The rich get government handouts just like the poor. Here are 10 of

them," The Washington Post, April 9, 2015

[ [link removed] ][link removed]

12. "Tax evasion by millionaires and billionaires tops $150 billion a

year, says IRS chief," CNBC, February 23, 2024

[ [link removed] ][link removed]

13. "Do You Know Where Your Federal Tax Dollars Go?" Bipartisan Policy

Center, January 31, 2024

[link removed]

14. "Dreams Deferred," Institute for Policy Studies, January 15, 2019

[ [link removed] ][link removed]

You're receiving this petition because we thought it might interest you.

It was created on MoveOn.org, where anyone can start their own online

petitions. You can [ [link removed] ]start your own petition here.

Want to support MoveOn's work? The MAGA movement's book bans have forced

teachers and librarians across the country to remove books from their

shelves and censor what young people can learn. MoveOn is fighting back,

including by filling a "Banned Bookmobile" with books that the far right

has banned and driving it to key cities and towns to raise the visibility

of book bans, hand out banned books for free, and bring people together to

stop censorship. To keep up the fight against book bans and the MAGA

politicians who support them, we need your help. Will you start a monthly

gift to power and sustain MoveOn's critical work?

[ [link removed] ]Yes, I'll chip in $5 a month.

[ [link removed] ]No, I'm sorry, I can't make a monthly donation.

--------------------------------------------------------------------------

PAID FOR BY MOVEON POLITICAL ACTION, [ [link removed] ][link removed]?.

Not authorized by any candidate or candidate's committee. MoveOn Political

Action - PO Box 96142, Washington, D.C. 20090-6142.

You can unsubscribe from this mailing list at any time:

[link removed]

Message Analysis

- Sender: MoveOn.org

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- ActionKit