April 8, 2024

Permission to republish original opeds and cartoons granted.

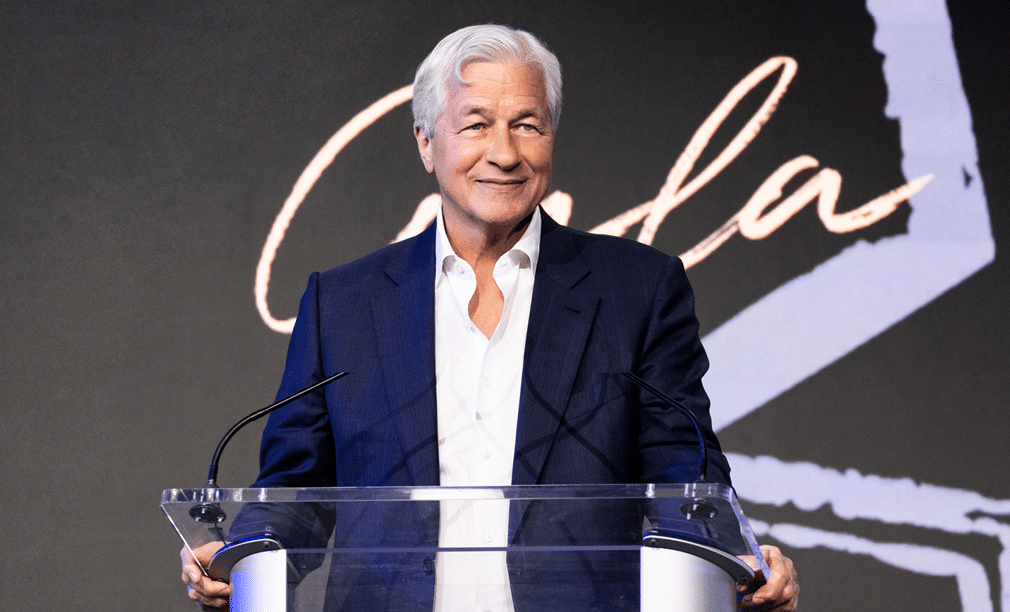

Could the soft landing complacency lead to resurgent inflation? Jamie Dimon is worried

By Robert Romano

Don’t look now, but inflation might not automatically return to below 2 percent before it starts going up again, and it could lead to much higher interest rates, JP Morgan Chase CEO Jamie Dimon is warning in a letter to his company’s shareholders.

In the letter, Dimon said that inflation and therefore interest rates could normalize, but warned that 10-year treasuries, now at 4.4 percent, could get as high as 8 percent if inflation comes back: “we are prepared for a very broad range of interest rates, from 2% to 8% or even more…”

The worst case scenario would be resurgent inflation and a recession, Dimon said, warning, there might be “a recession with inflation; i.e., stagflation. Economically, the worst-case scenario would be stagflation, which would not only come with higher interest rates but also with higher credit losses, lower business volumes and more difficult markets.”

Dimon added, “If long-end rates go up over 6% and this increase is accompanied by a recession, there will be plenty of stress — not just in the banking system but with leveraged companies and others.”

Inflation peaked at an annual rate of 9.1 percent in June 2022 and is now down to 3.2 percent in February, according to the Bureau of Labor Statistics, with the Federal Reserve’s current economic projections showing inflation continuing to drop throughout 2024 and the central bank lowering its own interest rates.

Dimon warned that this could be complacency setting in, stating, “markets seem to be pricing in at a 70% to 80% chance of a soft landing — modest growth along with declining inflation and interest rates. I believe the odds are a lot lower than that.”

Also worrying Dimon is the rate of monetary tightening, who stated, “Quantitative tightening is draining more than $900 billion in liquidity from the system annually — and we have never truly experienced the full effect of quantitative tightening on this scale.”

To be sure, the M2 money supply measured by the Fed has dropped more than $1.1 trillion from its peak of $22 trillion in April 2022, to its current level of $20.9 trillion — a 5 percent drop, the greatest in modern history, coming off the greatest increase in modern history.

But that if there is resurgent inflation, there might not be much that can be done about it in the near-term: “the die may be cast — interest rates looking out a year or two may be predetermined by all of the factors I mentioned” including the inflation: “All of the following factors appear to be inflationary: ongoing fiscal spending, remilitarization of the world, restructuring of global trade, capital needs of the new green economy, and possibly higher energy costs in the future (even though there currently is an oversupply of gas and plentiful spare capacity in oil) due to a lack of needed investment in the energy infrastructure.”

Of those, the one thing you can count on is massive spending out of Washington, D.C. wherein on the current baseline spending projected by the White House Office of Management and Budget set to grow from $6.8 trillion in 2024 to $10.2 trillion in 2034, as Social Security spending rises from $1.45 trillion to $2.43 trillion, Medicare from $839 billion to $1.76 trillion and Medicaid from $567 billion to $996 billion.

In the meantime, economic growth and therefore revenues won’t keep up, with total receipts to the Treasury rising from $4.9 trillion today to $8 trillion in 2034.

As a result, the budget deficit will swell from $1.9 trillion today to $2.2 trillion in 2034, and the national debt is set to rise to a gargantuan $52.7 trillion by 2034. That’s with interest rates peaking at 4.4 percent in 2024 and down to 3.7 percent for much of the rest of the decade. Inflation 2.9 percent this year and completely normalized by 2025. Unemployment never gets above 4 percent. No recessions.

And that might be an optimistic scenario, if Dimon is to be believed, with his worst-case scenario showing interest rates skyrocketing. All the other numbers look much worse if that’s the case.

The truth is, the national debt has grown on average about 8 percent a year since 1980 once recessions and wars are factored in. If it just continues at that rate, the debt will be more like $69 trillion in 10 years and $100 trillion in 15 years or less. Who’s going to buy all those treasuries — and how will that tie up resources for more productive ends?

Meaning the projections for the soft landing today, and its inherent complacency, might be looked back upon as having been mere happy talk as America’s fiscal reckoning was at hand.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.