|

John,

Congressional Republicans like to claim that we can’t afford critical investments in human needs. Instead, they introduce so-called fiscal commissions, which Speaker Mike Johnson has said won’t be allowed to raise any new revenue, and just seek to slash programs like Medicaid, SNAP, and housing vouchers.1

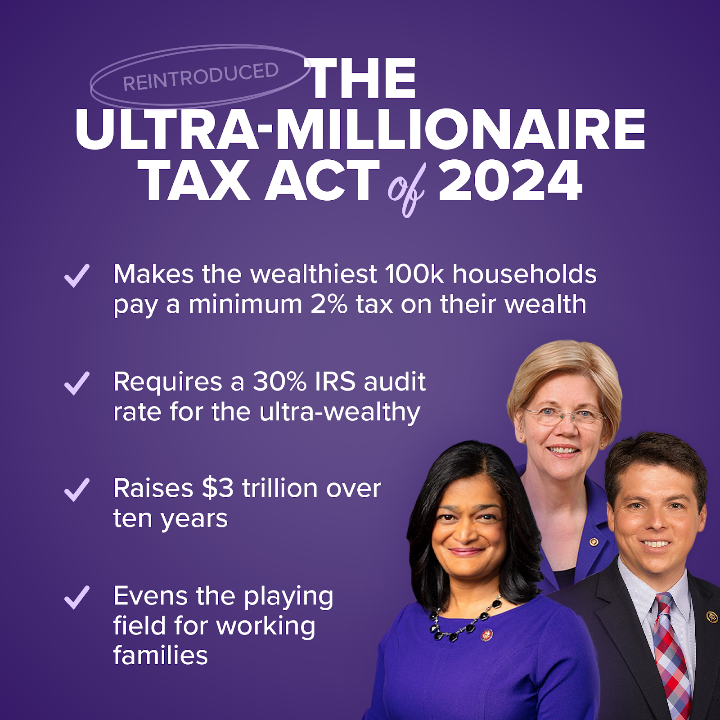

But we know, if the wealthy pay their fair share in taxes, we can afford critical investments in vulnerable communities. That’s why we’re proud to support Senator Elizabeth Warren’s new bill, the Ultra-Millionaire Tax Act, which has a companion bill in the House sponsored by Representatives Pramila Jayapal and Brendan Boyle.2

This critical legislation would apply a 2% tax on the wealth of households and trusts worth between $50 million and $1 billion and a 3% tax on fortunes exceeding $1 billion―the wealthiest 0.05% of Americans, or 100,000 households.

It would bring in at least $3 trillion in revenue over 10 years without raising taxes on the remaining 99.95% of households. That’s $3 trillion that we could use to address rising levels of income and wealth inequality, close the racial wealth gap, and invest in critical public services for our communities.

Help build support for Elizabeth Warren’s Ultra-Millionaire Tax Act by adding your name as a grassroots co-sponsor today!

ADD YOUR NAME

Forbes recently reported that in the U.S., the number of billionaires has grown to a record 813 who, combined, hold $5.7 trillion in wealth.3 That’s an outrageous amount of wealth in the hands of a very few―and most of it goes completely untaxed because most of that wealth is in the form of investments that aren’t taxed unless they’re sold. And, since ultra-millionaires and billionaires can live off of low-cost loans, backed up by their immense wealth, they never need to sell their assets in order to live a lavish lifestyle.

We need Elizabeth Warren’s new bill in order to unrig our tax code and finally require the very wealthiest households to pay their fair share.

Click here to add your name and become a grassroots co-sponsor the Ultra-Millionaire Tax Act today!

Together, we’re keeping the pressure on Congress to invest in our future―paid for by making billionaires and ultra-millionaire pay their fair share in taxes.

Thank you for taking action today,

Deborah Weinstein

Executive Director, Coalition on Human Needs

1 https://www.youtube.com/watch?v=WPrRpB6v2H0&t=437s

2 Ultra-Millionaire Tax Act

3 Forbes World’s Billionaires List 2024: The Top 200

|