Email

– Tax Professional Tip #14 – Qualified Retirement Benefit Subtraction

| From | Minnesota Department of Revenue <[email protected]> |

| Subject | – Tax Professional Tip #14 – Qualified Retirement Benefit Subtraction |

| Date | April 4, 2024 7:41 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

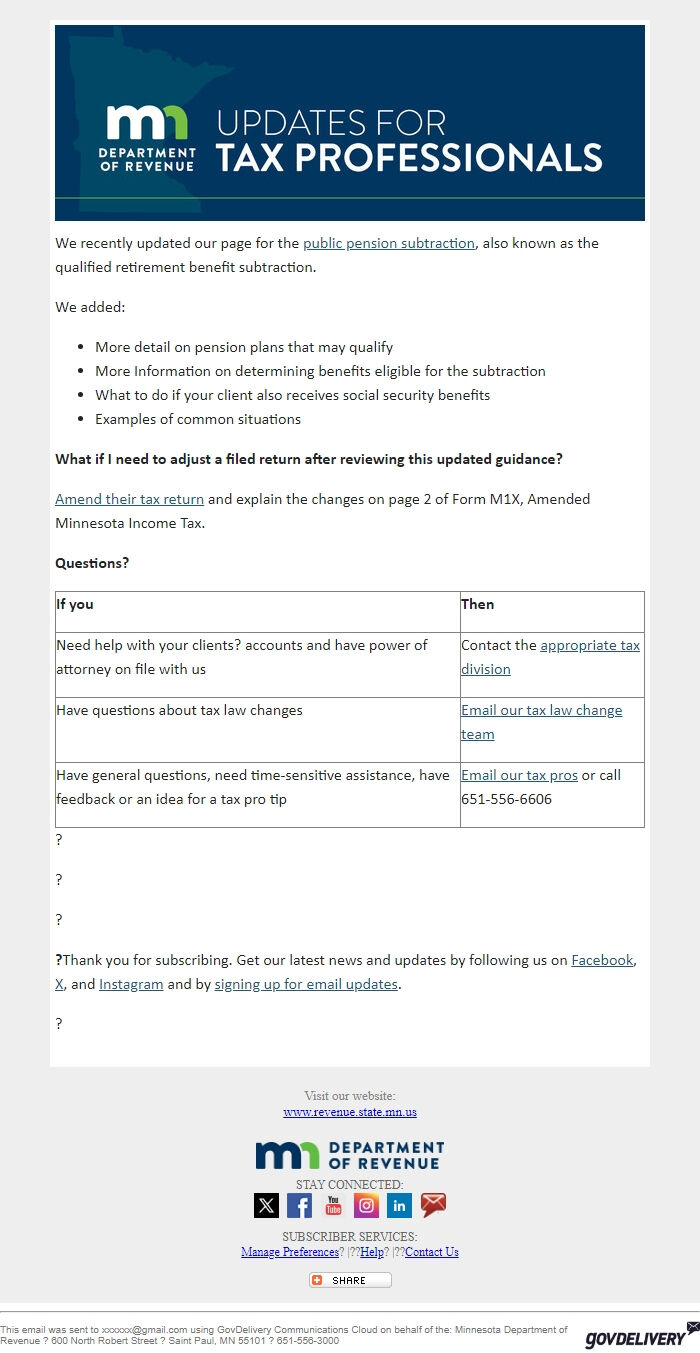

We recently updated our page for the public pension subtraction [ [link removed] ], also known as the qualified retirement benefit subtraction.

We added:

* More detail on pension plans that may qualify

* More Information on determining benefits eligible for the subtraction

* What to do if your client also receives social security benefits

* Examples of common situations

*What if I need to adjust a filed return after reviewing this updated guidance?*

Amend their tax return [ [link removed] ] and explain the changes on page 2 of Form M1X, Amended Minnesota Income Tax.

*Questions?*

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate tax division [ [link removed] ]

Have questions about tax law changes

Email our tax law change team <[email protected]>

Have general questions, need time-sensitive assistance, have feedback or an idea for a tax pro tip

Email our tax pros <[email protected]> or call 651-556-6606

?

?

?

*?*Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ], X [ [link removed] ], and Instagram [ [link removed] ] and by signing up for email updates [ [link removed] ].

?

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Instagram [ [link removed] ] LinkedIn [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

We recently updated our page for the public pension subtraction [ [link removed] ], also known as the qualified retirement benefit subtraction.

We added:

* More detail on pension plans that may qualify

* More Information on determining benefits eligible for the subtraction

* What to do if your client also receives social security benefits

* Examples of common situations

*What if I need to adjust a filed return after reviewing this updated guidance?*

Amend their tax return [ [link removed] ] and explain the changes on page 2 of Form M1X, Amended Minnesota Income Tax.

*Questions?*

*If you*

*Then*

Need help with your clients? accounts and have power of attorney on file with us

Contact the appropriate tax division [ [link removed] ]

Have questions about tax law changes

Email our tax law change team <[email protected]>

Have general questions, need time-sensitive assistance, have feedback or an idea for a tax pro tip

Email our tax pros <[email protected]> or call 651-556-6606

?

?

?

*?*Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ], X [ [link removed] ], and Instagram [ [link removed] ] and by signing up for email updates [ [link removed] ].

?

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Instagram [ [link removed] ] LinkedIn [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery