Email

Mega-Caps Pause, Small Caps Thrive (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | Mega-Caps Pause, Small Caps Thrive (Weekly Cheat Sheet) |

| Date | April 1, 2024 3:25 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good morning,

I hope you had a great Easter. This week, the major indices remained relatively stable, except for Russell 2000, which continued its recent outperformance, jumping by an impressive 2.5%. While there wasn’t a significant push to buy following last week’s solid gains, the lack of a substantial sell-off is equally noteworthy. The S&P 500 even logged another record-high close on Thursday, ahead of the extended holiday weekend.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

* _**[Week in Review]([link removed])**_

* **[US Market Highlights]([link removed])**

* **[Global Highlights]([link removed])**

* **[Investor Takeaways]([link removed])**

* **[Commodities & Crypto]([link removed])**

* **[Energy]([link removed])**

* **[Metals]([link removed])**

* **[Crypto]([link removed])**

* **[Calendar & Movers]([link removed])**

----------

## **LAST WEEK’S MARKET OVERVIEW**

----------## **Week In Review**

View image: ([link removed])

Caption:

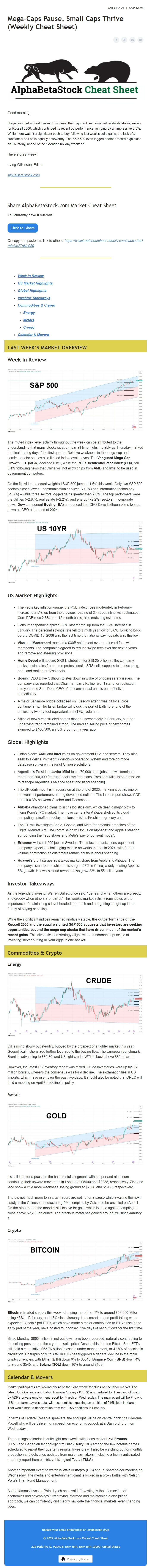

The muted index-level activity throughout the week can be attributed to the understanding that many stocks sit at or near all-time highs, notably as Thursday marked the final trading day of the first quarter. Relative weakness in the mega-cap and semiconductor spaces also limited index-level moves. The **Vanguard Mega Cap Growth ETF (MGK)** declined 0.8%, while the **PHLX Semiconductor Index (SOX)** fell 0.1% following news that China will not allow chips from **AMD** and **Intel** to be used in government computers.

On the flip side, the equal-weighted S&P 500 jumped 1.6% this week. Only two S&P 500 sectors closed lower – communication services (-0.8%) and information technology (-1.3%) – while three sectors logged gains greater than 2.0%. The top performers were the utilities (+2.8%), real estate (+2.2%), and energy (+2.2%) sectors. In corporate news, **Dow** component **Boeing (BA)** announced that CEO Dave Calhoun plans to step down as CEO at the end of 2024.

View image: ([link removed])

Caption:

## **US Market Highlights**

* The Fed’s key inflation gauge, the PCE index, rose moderately in February, increasing 2.5%, up from the previous reading of 2.4% but inline with estimates. Core PCE rose 2.8% on a 12-month basis, also matching estimates.

* Consumer spending spiked 0.8% last month, up from the 0.2% increase in January. The personal savings rate fell to a multi-year low of 3.6%. Looking back before COVID-19, 2008 was the last time the national savings rate was this low.

* **Visa** and **Mastercard** reached a $30B settlement over credit card fees with merchants. The companies agreed to reduce swipe fees over the next 5 years and remove anti-steering provisions.

* **Home Depot** will acquire SRS Distribution for $18.25 billion as the company seeks to win sales from home professionals. SRS sells supplies to landscaping, pool, and roofing professionals.

* **Boeing** CEO Dave Calhoun to step down in wake of ongoing safety issues. The company also reported that Chairman Larry Kellner won’t stand for reelection this year, and Stan Deal, CEO of the commercial unit, is out, effective immediately.

* A major Baltimore bridge collapsed on Tuesday after it was hit by a large container ship. The fallen bridge will block the port of Baltimore, one of the busiest by twenty-foot equivalent unit (TEU) volumes.

* Sales of newly constructed homes dipped unexpectedly in February, but the underlying trend remained strong. The median selling price of new homes slumped to $400,500, a 7.6% drop from a year ago.

## **Global Highlights**

* China blocks **AMD** and **Intel** chips on government PCs and servers. They also seek to sideline Microsoft’s Windows operating system and foreign-made database software in favor of Chinese solutions.

* Argentina’s President **Javier Milei** to cut 70,000 state jobs and will terminate more than 200,000 “corrupt” social welfare plans. President Milei is on a mission to reshape Argentina’s balance sheet and fiscal spending.

* The UK confirmed it is in recession at the end of 2023, marking it out as one of the weakest performers among developed nations. The latest report shows GDP shrank 0.3% between October and December.

* **Alibaba** abandoned plans to list its logistics arm, which dealt a major blow to Hong Kong’s IPO market. The move came after Alibaba shelved its cloud-computing spinoff and delayed plans to list its Freshippo grocery unit.

* The EU will investigate Apple, Google, and Meta for potential breaches of the Digital Markets Act. The commission will focus on Alphabet and Apple’s steering surrounding their app stores and Meta’s ‘pay or consent model’.

* **Ericsson** will cut 1,200 jobs in Sweden. The telecommunications-equipment company expects a challenging mobile networks market in 2024, with further volume contraction as customers remain cautious about spending.

* **Huawei’s** profit surges as it takes market share from Apple and Alibaba. The company’s smartphone shipments surged 47% in China, widely beating Apple’s 6% growth. Huawei’s cloud revenue also grew 22% to 55 billion yuan.

## **Investor Takeaways**

As the legendary investor Warren Buffett once said, “Be fearful when others are greedy, and greedy when others are fearful.” This week’s market activity reminds us of the importance of maintaining a level-headed approach and not getting caught up in the frenzy of buying or selling.

While the significant indices remained relatively stable,** the outperformance of the Russell 2000 and the equal-weighted S&P 500 suggests that investors are seeking opportunities beyond the mega-cap stocks that have driven much of the market’s recent gains. **This diversification strategy aligns with a fundamental principle of investing: never putting all your eggs in one basket.

----------

## **Commodities & Crypto**

----------### **Energy**

View image: ([link removed])

Caption:

Oil is rising slowly but steadily, buoyed by the prospect of a tighter market this year. Geopolitical frictions add further leverage to the buying flow. The European benchmark, Brent, is advancing to $86.30, and US light crude, WTI, is back above $82 a barrel.

However, the latest US inventory report was mixed. Crude inventories were up by 3.2 million barrels, whereas the consensus was for a decline. The explanation lies in US imports, which have risen over the past five days. It should also be noted that OPEC will hold a meeting on April 3 to define its policy.

### **Metals**

View image: ([link removed])

Caption:

It’s still time for a pause in the base metals segment, with copper and aluminum continuing their upward movement in London at $8690 and $2238, respectively. Zinc and lead show a little more weakness, losing ground at $2366 and $1968, respectively.

There’s not much more to say, as traders are opting for a pause while awaiting the next catalyst, the Chinese manufacturing PMI compiled by Caixin, to be unveiled on April 1. On the other hand, the mood is still festive for gold, which is once again attempting to close above $2,200 an ounce. The precious metal has gained around 7% since January 1.

### **Crypto**

View image: ([link removed])

Caption:

**Bitcoin** retreated sharply this week, dropping more than 7% to around $63,000. After rising 43% in February, and 48% since January 1, a correction and profit-taking were expected. Bitcoin Spot ETFs, which have made a major contribution to BTC’s rise in the early part of the year, have posted four consecutive days of net outflows for the first time.

Since Monday, $863 million in net outflows have been recorded, naturally contributing to the selling pressure on the crypto-asset’s price. Despite this, the ten Bitcoin Spot ETFs still hold a cumulative $53.76 billion in assets under management, or 4.18% of bitcoins in circulation. Unsurprisingly, this fall in BTC has triggered a general decline in the main cryptocurrencies, with **Ether (ETH)** down 9% to $3310, **Binance Coin (BNB)** down 4% to around $545, and **Solana (SOL)** down 16% to around $168.

----------

## **Calendar & Movers**

----------Market participants are looking ahead to the “jobs week” for clues on the labor market. The latest Job Openings and Labor Turnover Survey (JOLTS) is scheduled for Tuesday, followed by ADP’s private employment report for March on Wednesday. The main event will be Friday’s U.S. non-farm payrolls data, with economists expecting an addition of 216K jobs in March. That would mark a deceleration from the 275K additions in February.

In terms of Federal Reserve speakers, the spotlight will be on central bank chair Jerome Powell who will be delivering a speech on economic outlook at a Stanford forum on Wednesday.

The earnings calendar is quite light next week, with jeans maker **Levi Strauss (LEVI)** and Canadian technology firm **BlackBerry (BB)** among the few notable names scheduled to report their quarterly results. Investors will also be watching out for monthly production and deliveries updates from major carmakers, including a highly anticipated quarterly report from electric vehicle giant **Tesla (TSLA)**.

Another important event to watch is **Walt Disney’s (DIS)** annual shareholder meeting on Wednesday. The media and entertainment giant is locked in a proxy battle with Nelson Peltz’s Trian Fund Management.

As the famous investor Peter Lynch once said, “Investing is the intersection of economics and psychology.” By staying informed and maintaining a disciplined approach, we can confidently and clearly navigate the financial markets’ ever-changing tides.

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good morning,

I hope you had a great Easter. This week, the major indices remained relatively stable, except for Russell 2000, which continued its recent outperformance, jumping by an impressive 2.5%. While there wasn’t a significant push to buy following last week’s solid gains, the lack of a substantial sell-off is equally noteworthy. The S&P 500 even logged another record-high close on Thursday, ahead of the extended holiday weekend.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

* _**[Week in Review]([link removed])**_

* **[US Market Highlights]([link removed])**

* **[Global Highlights]([link removed])**

* **[Investor Takeaways]([link removed])**

* **[Commodities & Crypto]([link removed])**

* **[Energy]([link removed])**

* **[Metals]([link removed])**

* **[Crypto]([link removed])**

* **[Calendar & Movers]([link removed])**

----------

## **LAST WEEK’S MARKET OVERVIEW**

----------## **Week In Review**

View image: ([link removed])

Caption:

The muted index-level activity throughout the week can be attributed to the understanding that many stocks sit at or near all-time highs, notably as Thursday marked the final trading day of the first quarter. Relative weakness in the mega-cap and semiconductor spaces also limited index-level moves. The **Vanguard Mega Cap Growth ETF (MGK)** declined 0.8%, while the **PHLX Semiconductor Index (SOX)** fell 0.1% following news that China will not allow chips from **AMD** and **Intel** to be used in government computers.

On the flip side, the equal-weighted S&P 500 jumped 1.6% this week. Only two S&P 500 sectors closed lower – communication services (-0.8%) and information technology (-1.3%) – while three sectors logged gains greater than 2.0%. The top performers were the utilities (+2.8%), real estate (+2.2%), and energy (+2.2%) sectors. In corporate news, **Dow** component **Boeing (BA)** announced that CEO Dave Calhoun plans to step down as CEO at the end of 2024.

View image: ([link removed])

Caption:

## **US Market Highlights**

* The Fed’s key inflation gauge, the PCE index, rose moderately in February, increasing 2.5%, up from the previous reading of 2.4% but inline with estimates. Core PCE rose 2.8% on a 12-month basis, also matching estimates.

* Consumer spending spiked 0.8% last month, up from the 0.2% increase in January. The personal savings rate fell to a multi-year low of 3.6%. Looking back before COVID-19, 2008 was the last time the national savings rate was this low.

* **Visa** and **Mastercard** reached a $30B settlement over credit card fees with merchants. The companies agreed to reduce swipe fees over the next 5 years and remove anti-steering provisions.

* **Home Depot** will acquire SRS Distribution for $18.25 billion as the company seeks to win sales from home professionals. SRS sells supplies to landscaping, pool, and roofing professionals.

* **Boeing** CEO Dave Calhoun to step down in wake of ongoing safety issues. The company also reported that Chairman Larry Kellner won’t stand for reelection this year, and Stan Deal, CEO of the commercial unit, is out, effective immediately.

* A major Baltimore bridge collapsed on Tuesday after it was hit by a large container ship. The fallen bridge will block the port of Baltimore, one of the busiest by twenty-foot equivalent unit (TEU) volumes.

* Sales of newly constructed homes dipped unexpectedly in February, but the underlying trend remained strong. The median selling price of new homes slumped to $400,500, a 7.6% drop from a year ago.

## **Global Highlights**

* China blocks **AMD** and **Intel** chips on government PCs and servers. They also seek to sideline Microsoft’s Windows operating system and foreign-made database software in favor of Chinese solutions.

* Argentina’s President **Javier Milei** to cut 70,000 state jobs and will terminate more than 200,000 “corrupt” social welfare plans. President Milei is on a mission to reshape Argentina’s balance sheet and fiscal spending.

* The UK confirmed it is in recession at the end of 2023, marking it out as one of the weakest performers among developed nations. The latest report shows GDP shrank 0.3% between October and December.

* **Alibaba** abandoned plans to list its logistics arm, which dealt a major blow to Hong Kong’s IPO market. The move came after Alibaba shelved its cloud-computing spinoff and delayed plans to list its Freshippo grocery unit.

* The EU will investigate Apple, Google, and Meta for potential breaches of the Digital Markets Act. The commission will focus on Alphabet and Apple’s steering surrounding their app stores and Meta’s ‘pay or consent model’.

* **Ericsson** will cut 1,200 jobs in Sweden. The telecommunications-equipment company expects a challenging mobile networks market in 2024, with further volume contraction as customers remain cautious about spending.

* **Huawei’s** profit surges as it takes market share from Apple and Alibaba. The company’s smartphone shipments surged 47% in China, widely beating Apple’s 6% growth. Huawei’s cloud revenue also grew 22% to 55 billion yuan.

## **Investor Takeaways**

As the legendary investor Warren Buffett once said, “Be fearful when others are greedy, and greedy when others are fearful.” This week’s market activity reminds us of the importance of maintaining a level-headed approach and not getting caught up in the frenzy of buying or selling.

While the significant indices remained relatively stable,** the outperformance of the Russell 2000 and the equal-weighted S&P 500 suggests that investors are seeking opportunities beyond the mega-cap stocks that have driven much of the market’s recent gains. **This diversification strategy aligns with a fundamental principle of investing: never putting all your eggs in one basket.

----------

## **Commodities & Crypto**

----------### **Energy**

View image: ([link removed])

Caption:

Oil is rising slowly but steadily, buoyed by the prospect of a tighter market this year. Geopolitical frictions add further leverage to the buying flow. The European benchmark, Brent, is advancing to $86.30, and US light crude, WTI, is back above $82 a barrel.

However, the latest US inventory report was mixed. Crude inventories were up by 3.2 million barrels, whereas the consensus was for a decline. The explanation lies in US imports, which have risen over the past five days. It should also be noted that OPEC will hold a meeting on April 3 to define its policy.

### **Metals**

View image: ([link removed])

Caption:

It’s still time for a pause in the base metals segment, with copper and aluminum continuing their upward movement in London at $8690 and $2238, respectively. Zinc and lead show a little more weakness, losing ground at $2366 and $1968, respectively.

There’s not much more to say, as traders are opting for a pause while awaiting the next catalyst, the Chinese manufacturing PMI compiled by Caixin, to be unveiled on April 1. On the other hand, the mood is still festive for gold, which is once again attempting to close above $2,200 an ounce. The precious metal has gained around 7% since January 1.

### **Crypto**

View image: ([link removed])

Caption:

**Bitcoin** retreated sharply this week, dropping more than 7% to around $63,000. After rising 43% in February, and 48% since January 1, a correction and profit-taking were expected. Bitcoin Spot ETFs, which have made a major contribution to BTC’s rise in the early part of the year, have posted four consecutive days of net outflows for the first time.

Since Monday, $863 million in net outflows have been recorded, naturally contributing to the selling pressure on the crypto-asset’s price. Despite this, the ten Bitcoin Spot ETFs still hold a cumulative $53.76 billion in assets under management, or 4.18% of bitcoins in circulation. Unsurprisingly, this fall in BTC has triggered a general decline in the main cryptocurrencies, with **Ether (ETH)** down 9% to $3310, **Binance Coin (BNB)** down 4% to around $545, and **Solana (SOL)** down 16% to around $168.

----------

## **Calendar & Movers**

----------Market participants are looking ahead to the “jobs week” for clues on the labor market. The latest Job Openings and Labor Turnover Survey (JOLTS) is scheduled for Tuesday, followed by ADP’s private employment report for March on Wednesday. The main event will be Friday’s U.S. non-farm payrolls data, with economists expecting an addition of 216K jobs in March. That would mark a deceleration from the 275K additions in February.

In terms of Federal Reserve speakers, the spotlight will be on central bank chair Jerome Powell who will be delivering a speech on economic outlook at a Stanford forum on Wednesday.

The earnings calendar is quite light next week, with jeans maker **Levi Strauss (LEVI)** and Canadian technology firm **BlackBerry (BB)** among the few notable names scheduled to report their quarterly results. Investors will also be watching out for monthly production and deliveries updates from major carmakers, including a highly anticipated quarterly report from electric vehicle giant **Tesla (TSLA)**.

Another important event to watch is **Walt Disney’s (DIS)** annual shareholder meeting on Wednesday. The media and entertainment giant is locked in a proxy battle with Nelson Peltz’s Trian Fund Management.

As the famous investor Peter Lynch once said, “Investing is the intersection of economics and psychology.” By staying informed and maintaining a disciplined approach, we can confidently and clearly navigate the financial markets’ ever-changing tides.

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a