| From | City Limits <[email protected]> |

| Subject | New York Lawmakers Consider Tax Reforms to Aid ITIN-Filers |

| Date | March 26, 2024 12:05 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

In case you missed it

[link removed]

Second Time’s the Charm? NY Legislature Angles For Broad Housing Deal

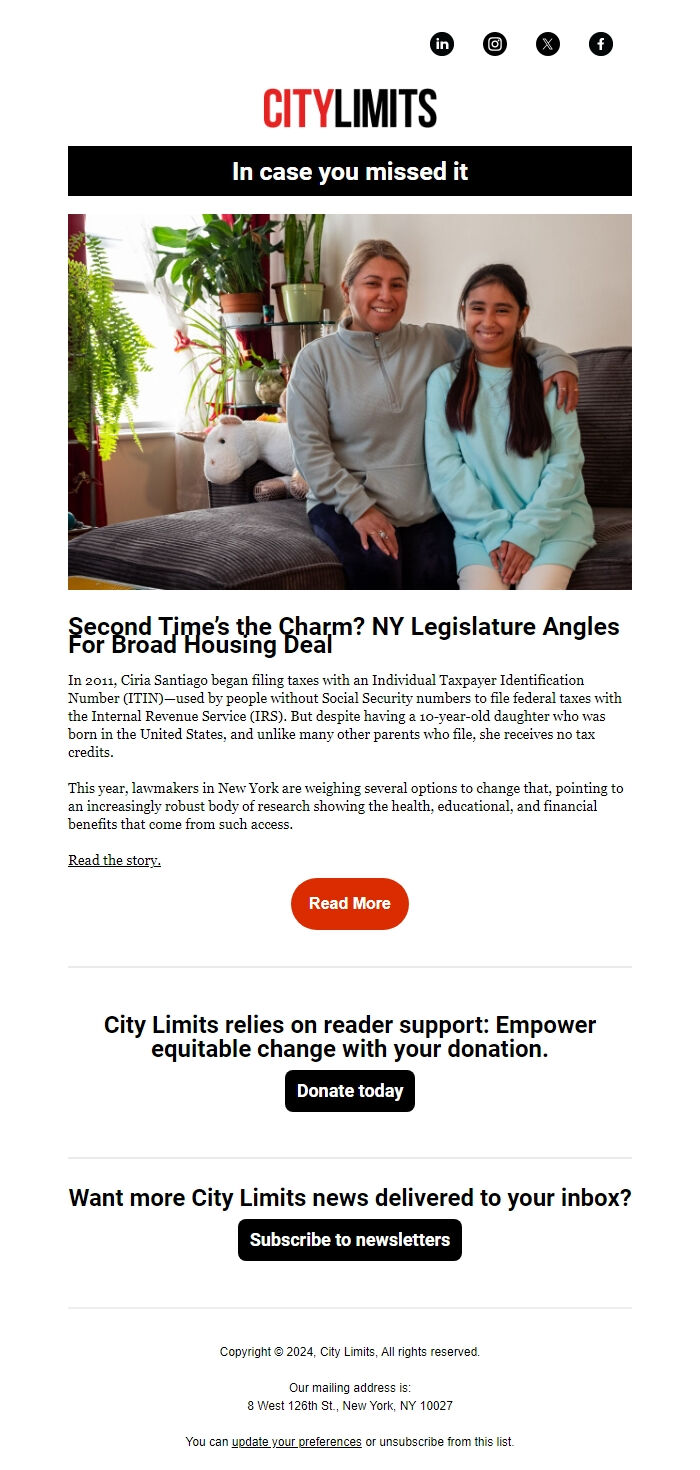

In 2011, Ciria Santiago began filing taxes with an Individual Taxpayer Identification Number (ITIN)—used by people without Social Security numbers to file federal taxes with the Internal Revenue Service (IRS). But despite having a 10-year-old daughter who was born in the United States, and unlike many other parents who file, she receives no tax credits.

This year, lawmakers in New York are weighing several options to change that, pointing to an increasingly robust body of research showing the health, educational, and financial benefits that come from such access.

Read the story. ([link removed])

Read More ([link removed])

City Limits relies on reader support: Empower equitable change with your donation.

Donate today ([link removed])

Want more City Limits news delivered to your inbox?

Subscribe to newsletters ([link removed])

============================================================

Copyright © 2024, City Limits, All rights reserved.

Our mailing address is:

8 West 126th St., New York, NY 10027

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

[link removed]

[link removed]

[link removed]

[link removed]

In case you missed it

[link removed]

Second Time’s the Charm? NY Legislature Angles For Broad Housing Deal

In 2011, Ciria Santiago began filing taxes with an Individual Taxpayer Identification Number (ITIN)—used by people without Social Security numbers to file federal taxes with the Internal Revenue Service (IRS). But despite having a 10-year-old daughter who was born in the United States, and unlike many other parents who file, she receives no tax credits.

This year, lawmakers in New York are weighing several options to change that, pointing to an increasingly robust body of research showing the health, educational, and financial benefits that come from such access.

Read the story. ([link removed])

Read More ([link removed])

City Limits relies on reader support: Empower equitable change with your donation.

Donate today ([link removed])

Want more City Limits news delivered to your inbox?

Subscribe to newsletters ([link removed])

============================================================

Copyright © 2024, City Limits, All rights reserved.

Our mailing address is:

8 West 126th St., New York, NY 10027

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Message Analysis

- Sender: City Limits

- Political Party: n/a

- Country: United States

- State/Locality: New York New York City

- Office: n/a

-

Email Providers:

- MailChimp