Email

Food & Power - Infant Formula Supply Chain Was Built to Break, FTC Report Reveals

| From | Claire Kelloway <[email protected]> |

| Subject | Food & Power - Infant Formula Supply Chain Was Built to Break, FTC Report Reveals |

| Date | March 21, 2024 12:48 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Did someone forward you this newsletter?

Get your own copy by subscribing here [[link removed]], and to share this story click here. [[link removed]]

Is Food & Power landing in your spam? Try adding [email protected] to your contacts.

Photo courtesy of iStock

Infant Formula Supply Chain Was Built to Break, FTC Report Reveals

Two years ago, parents across the country struggled to find infant formula amid a massive shortage, sparking an investigation by the Federal Trade Commission into how this essential supply chain became so fragile. The agency released its findings last week [[link removed]], highlighting the ways public procurement policies and food safety standards contribute to industry consolidation.

The baby formula crisis began in February 2022, when the largest powdered baby formula manufacturer, Abbott Nutrition, shut down a plant in Sturgis, Michigan, to look into bacteria contamination [[link removed]] that may have killed two infants ( Abbott denies responsibility [[link removed]]). Abbott makes popular formula brands Similac and EleCare, and the Sturgis plant processed as much as one-fifth of all U.S. baby formula and 75% of select specialized formulas, according to [[link removed]] sources for Politico [[link removed]]. The plant stopped production for nearly four months [[link removed]], creating widespread shortages.

The formula industry has been highly consolidated for decades. As early as the 1970s, just four companies sold two-thirds of all infant formula [[link removed]] around the world. In 1987, three companies controlled 99% of the U.S. market [[link removed]]. Today, four control 97% of the market [[link removed]], with Abbott and Mead Johnson commanding two-thirds of all sales.

With so little competition, Abbott felt confident that it could maintain high revenues and profits without reinvesting in the basic upkeep of its plants. According to a whistleblower [[link removed]] who worked in quality assurance at the Sturgis plant, company management was aware of broken and failing equipment that allegedly introduced bacteria contamination as many as seven years before the recall, yet Abbott didn’t invest in repairs.

The whistleblower, who sent a warning letter to the FDA in October 2021, also alleged [[link removed]] that Abbott falsified records related to formula seal tests, sold untested formula and formula that tested positive for microorganisms, and misled food safety auditors.

After the Sturgis plant closed, national out-of-stock rates for formula rose [[link removed]] from 11% in November 2021 to 40% in April. The crisis was more acute at the state level; by late May one in five states were 90% out of formula [[link removed]].

Some states are more reliant on Abbott for formula than others due to procurement policies for the WIC program. More than half of all infant formula is purchased by families in the supplemental nutrition program for Women, Infants, and Children (WIC) which gives low-income women with young children money to buy a limited selection of WIC-eligible foods, including baby formula.

When the WIC program began paying for formula in 1972, dominant baby formula manufacturers no longer had the incentive [[link removed]] to compete [[link removed]] for lower-income, price-sensitive customers. Prices rose dramatically: over the course of the 1980s formula prices rose more the 150% [[link removed]], far outpacing inflation in formula’s primary ingredients, milk and vitamins.

Rising formula prices hurt families that could not qualify for WIC and strained the WIC program itself. By the mid-1980s, formula made up nearly 40% of all WIC food costs [[link removed]]. State-level WIC administrators couldn’t afford to enroll more people, leaving many eligible families on waiting lists [[link removed]].

At the time, policymakers did not address the highly consolidated market structures and corporate profiteering at the root of the problem. Instead, they opted for a new procurement process with formula makers that would ultimately make monopolization worse.

Starting in 1989, state-level WIC agencies started to offer single-supplier formula contracts, meaning they’d work with just one company to provide all the WIC-approved formula in their state. In exchange, manufacturers had to bid for these contracts by offering the government rebates on all formula purchased through WIC. The bidder with the lowest net cost, factoring in rebates, would win the contract.

In a public comment [[link removed]] to the FTC, the CEO of Bobbie, a mid-sized formula company, said that “the WIC bidding process is stacked against small-medium manufacturers and allows for giant companies to consume the majority of the market.” Only three large formula manufacturers, Abbott, Mead Johnson, and Nestle, placed bids on WIC contracts between 2003 and 2013, according to the most recent public data [[link removed]].

Initially baby formula companies got in trouble for allegedly coordinating their bids, and Mead Johnson had to enter a consent decree [[link removed]]with the FTC to stop publicizing its maximum per can discount. Today, manufacturers offer massive rebates to win state WIC contracts. In 2013 the average rebate was 92% of formula’s wholesale price. In 2018 WIC state agencies received $1.72 billion worth of formula rebates, which helped WIC’s budget spread to more families.

Formula makers are willing to offer such steep discounts and even lose money on WIC sales [[link removed]] because they profit off formula mark-ups to non-WIC customers. Securing a state-wide WIC contract all but guarantees them a much larger share of non-WIC formula sales in that state.

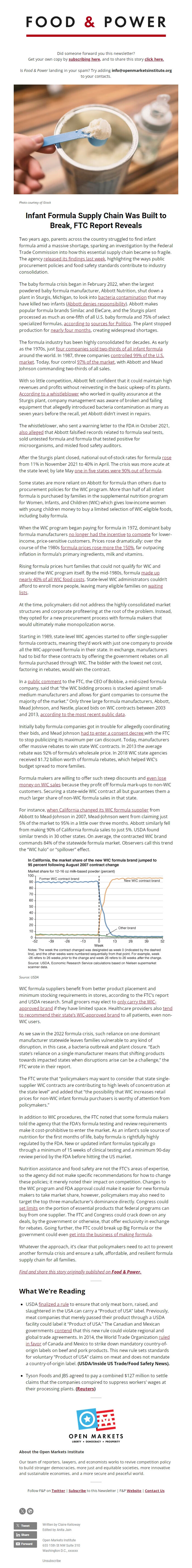

For instance, when California changed its WIC formula supplier [[link removed]] from Abbott to Mead-Johnson in 2007, Mead-Johnson went from claiming just 5% of the market to 95% in a little over three months. Abbott similarly fell from making 90% of California formula sales to just 5%. USDA found similar trends in 30 other states. On average, the contracted WIC brand commands 84% of the statewide formula market. Observers call this trend the “WIC halo” or “spillover” effect.

Source: USDA

WIC formula suppliers benefit from better product placement and minimum stocking requirements in stores, according to the FTC’s report and USDA research. Small grocers may elect to only carry the WIC-approved brand [[link removed]] if they have limited space. Healthcare providers also tend to recommend their state’s WIC-approved brand [[link removed]] to all patients, even non-WIC users.

As we saw in the 2022 formula crisis, such reliance on one dominant manufacturer statewide leaves families vulnerable to any kind of disruption, in this case, a bacteria outbreak and plant closure. “Each state’s reliance on a single manufacturer means that shifting products towards impacted states when disruptions arise can be a challenge,” the FTC wrote in their report.

The FTC wrote that “policymakers may want to consider that state single-supplier WIC contracts are contributing to high levels of concentration at the state level” and added that “the possibility that WIC increases retail prices for non-WIC infant formula purchasers is worthy of attention from policymakers.”

In addition to WIC procedures, the FTC noted that some formula makers told the agency that the FDA’s formula testing and review requirements make it cost-prohibitive to enter the market. As an infant’s sole source of nutrition for the first months of life, baby formula is rightfully highly regulated by the FDA. New or updated infant formulas typically go through a minimum of 15 weeks of clinical testing and a minimum 90-day review period by the FDA before hitting the US market.

Nutrition assistance and food safety are not the FTC’s areas of expertise, so the agency did not make specific recommendations for how to change these policies; it merely noted their impact on competition. Changes to the WIC program and FDA approval could make it easier for new formula makers to take market share, however, policymakers may also need to target the top three manufacturer’s dominance directly. Congress could set limits [[link removed]] on the portion of essential products that federal programs can buy from one supplier. The FTC and Congress could crack down on any deals, by the government or otherwise, that offer exclusivity in exchange for rebates. Going further, the FTC could break up Big Formula or the government could even get into the business of making formula [[link removed]].

Whatever the approach, it’s clear that policymakers need to act to prevent another formula crisis and ensure a safe, affordable, and resilient formula supply chain for all families.

Find and share this story originally published on [[link removed]] Food & Power [[link removed]] . [[link removed]]

What We're Reading

USDA finalized a rule [[link removed]] to ensure that only meat born, raised, and slaughtered in the USA can carry a “Product of USA” label. Previously, meat companies that merely passed their product through a USDA facility could label it “Product of USA.” The Canadian and Mexican governments contend [[link removed]] that this new rule could violate regional and global trade agreements. In 2014, the World Trade Organization ruled in favor [[link removed]] of Canada and Mexico to strike down mandatory country-of-origin labels on beef and pork products. This new rule sets standards for voluntary “Product of USA” claims on meat and does not mandate a country-of-origin label. (USDA/Inside US Trade/Food Safety News).

Tyson Foods and JBS agreed to pay a combined $127 million to settle claims that the companies conspired to suppress workers’ wages at their processing plants. ( Reuters [[link removed]])

About the Open Markets Institute

Our team of reporters, lawyers, and economists works to revive competition policy to build stronger democracies, more just and equitable societies, more innovative and sustainable economies, and a more secure and peaceful world.

Follow F&P on Twitter [[link removed]] | Subscribe [[link removed]] to this Newsletter | F&P Website [[link removed]] | Contact Us [[link removed]]

Tweet [link removed] Share [[link removed]] Forward [link removed]

Written by Claire Kelloway

Edited by Anita Jain

Open Markets Institute

655 15th St NW Suite 310

Washington D.C., xxxxxx

Unsubscribe [link removed]

Get your own copy by subscribing here [[link removed]], and to share this story click here. [[link removed]]

Is Food & Power landing in your spam? Try adding [email protected] to your contacts.

Photo courtesy of iStock

Infant Formula Supply Chain Was Built to Break, FTC Report Reveals

Two years ago, parents across the country struggled to find infant formula amid a massive shortage, sparking an investigation by the Federal Trade Commission into how this essential supply chain became so fragile. The agency released its findings last week [[link removed]], highlighting the ways public procurement policies and food safety standards contribute to industry consolidation.

The baby formula crisis began in February 2022, when the largest powdered baby formula manufacturer, Abbott Nutrition, shut down a plant in Sturgis, Michigan, to look into bacteria contamination [[link removed]] that may have killed two infants ( Abbott denies responsibility [[link removed]]). Abbott makes popular formula brands Similac and EleCare, and the Sturgis plant processed as much as one-fifth of all U.S. baby formula and 75% of select specialized formulas, according to [[link removed]] sources for Politico [[link removed]]. The plant stopped production for nearly four months [[link removed]], creating widespread shortages.

The formula industry has been highly consolidated for decades. As early as the 1970s, just four companies sold two-thirds of all infant formula [[link removed]] around the world. In 1987, three companies controlled 99% of the U.S. market [[link removed]]. Today, four control 97% of the market [[link removed]], with Abbott and Mead Johnson commanding two-thirds of all sales.

With so little competition, Abbott felt confident that it could maintain high revenues and profits without reinvesting in the basic upkeep of its plants. According to a whistleblower [[link removed]] who worked in quality assurance at the Sturgis plant, company management was aware of broken and failing equipment that allegedly introduced bacteria contamination as many as seven years before the recall, yet Abbott didn’t invest in repairs.

The whistleblower, who sent a warning letter to the FDA in October 2021, also alleged [[link removed]] that Abbott falsified records related to formula seal tests, sold untested formula and formula that tested positive for microorganisms, and misled food safety auditors.

After the Sturgis plant closed, national out-of-stock rates for formula rose [[link removed]] from 11% in November 2021 to 40% in April. The crisis was more acute at the state level; by late May one in five states were 90% out of formula [[link removed]].

Some states are more reliant on Abbott for formula than others due to procurement policies for the WIC program. More than half of all infant formula is purchased by families in the supplemental nutrition program for Women, Infants, and Children (WIC) which gives low-income women with young children money to buy a limited selection of WIC-eligible foods, including baby formula.

When the WIC program began paying for formula in 1972, dominant baby formula manufacturers no longer had the incentive [[link removed]] to compete [[link removed]] for lower-income, price-sensitive customers. Prices rose dramatically: over the course of the 1980s formula prices rose more the 150% [[link removed]], far outpacing inflation in formula’s primary ingredients, milk and vitamins.

Rising formula prices hurt families that could not qualify for WIC and strained the WIC program itself. By the mid-1980s, formula made up nearly 40% of all WIC food costs [[link removed]]. State-level WIC administrators couldn’t afford to enroll more people, leaving many eligible families on waiting lists [[link removed]].

At the time, policymakers did not address the highly consolidated market structures and corporate profiteering at the root of the problem. Instead, they opted for a new procurement process with formula makers that would ultimately make monopolization worse.

Starting in 1989, state-level WIC agencies started to offer single-supplier formula contracts, meaning they’d work with just one company to provide all the WIC-approved formula in their state. In exchange, manufacturers had to bid for these contracts by offering the government rebates on all formula purchased through WIC. The bidder with the lowest net cost, factoring in rebates, would win the contract.

In a public comment [[link removed]] to the FTC, the CEO of Bobbie, a mid-sized formula company, said that “the WIC bidding process is stacked against small-medium manufacturers and allows for giant companies to consume the majority of the market.” Only three large formula manufacturers, Abbott, Mead Johnson, and Nestle, placed bids on WIC contracts between 2003 and 2013, according to the most recent public data [[link removed]].

Initially baby formula companies got in trouble for allegedly coordinating their bids, and Mead Johnson had to enter a consent decree [[link removed]]with the FTC to stop publicizing its maximum per can discount. Today, manufacturers offer massive rebates to win state WIC contracts. In 2013 the average rebate was 92% of formula’s wholesale price. In 2018 WIC state agencies received $1.72 billion worth of formula rebates, which helped WIC’s budget spread to more families.

Formula makers are willing to offer such steep discounts and even lose money on WIC sales [[link removed]] because they profit off formula mark-ups to non-WIC customers. Securing a state-wide WIC contract all but guarantees them a much larger share of non-WIC formula sales in that state.

For instance, when California changed its WIC formula supplier [[link removed]] from Abbott to Mead-Johnson in 2007, Mead-Johnson went from claiming just 5% of the market to 95% in a little over three months. Abbott similarly fell from making 90% of California formula sales to just 5%. USDA found similar trends in 30 other states. On average, the contracted WIC brand commands 84% of the statewide formula market. Observers call this trend the “WIC halo” or “spillover” effect.

Source: USDA

WIC formula suppliers benefit from better product placement and minimum stocking requirements in stores, according to the FTC’s report and USDA research. Small grocers may elect to only carry the WIC-approved brand [[link removed]] if they have limited space. Healthcare providers also tend to recommend their state’s WIC-approved brand [[link removed]] to all patients, even non-WIC users.

As we saw in the 2022 formula crisis, such reliance on one dominant manufacturer statewide leaves families vulnerable to any kind of disruption, in this case, a bacteria outbreak and plant closure. “Each state’s reliance on a single manufacturer means that shifting products towards impacted states when disruptions arise can be a challenge,” the FTC wrote in their report.

The FTC wrote that “policymakers may want to consider that state single-supplier WIC contracts are contributing to high levels of concentration at the state level” and added that “the possibility that WIC increases retail prices for non-WIC infant formula purchasers is worthy of attention from policymakers.”

In addition to WIC procedures, the FTC noted that some formula makers told the agency that the FDA’s formula testing and review requirements make it cost-prohibitive to enter the market. As an infant’s sole source of nutrition for the first months of life, baby formula is rightfully highly regulated by the FDA. New or updated infant formulas typically go through a minimum of 15 weeks of clinical testing and a minimum 90-day review period by the FDA before hitting the US market.

Nutrition assistance and food safety are not the FTC’s areas of expertise, so the agency did not make specific recommendations for how to change these policies; it merely noted their impact on competition. Changes to the WIC program and FDA approval could make it easier for new formula makers to take market share, however, policymakers may also need to target the top three manufacturer’s dominance directly. Congress could set limits [[link removed]] on the portion of essential products that federal programs can buy from one supplier. The FTC and Congress could crack down on any deals, by the government or otherwise, that offer exclusivity in exchange for rebates. Going further, the FTC could break up Big Formula or the government could even get into the business of making formula [[link removed]].

Whatever the approach, it’s clear that policymakers need to act to prevent another formula crisis and ensure a safe, affordable, and resilient formula supply chain for all families.

Find and share this story originally published on [[link removed]] Food & Power [[link removed]] . [[link removed]]

What We're Reading

USDA finalized a rule [[link removed]] to ensure that only meat born, raised, and slaughtered in the USA can carry a “Product of USA” label. Previously, meat companies that merely passed their product through a USDA facility could label it “Product of USA.” The Canadian and Mexican governments contend [[link removed]] that this new rule could violate regional and global trade agreements. In 2014, the World Trade Organization ruled in favor [[link removed]] of Canada and Mexico to strike down mandatory country-of-origin labels on beef and pork products. This new rule sets standards for voluntary “Product of USA” claims on meat and does not mandate a country-of-origin label. (USDA/Inside US Trade/Food Safety News).

Tyson Foods and JBS agreed to pay a combined $127 million to settle claims that the companies conspired to suppress workers’ wages at their processing plants. ( Reuters [[link removed]])

About the Open Markets Institute

Our team of reporters, lawyers, and economists works to revive competition policy to build stronger democracies, more just and equitable societies, more innovative and sustainable economies, and a more secure and peaceful world.

Follow F&P on Twitter [[link removed]] | Subscribe [[link removed]] to this Newsletter | F&P Website [[link removed]] | Contact Us [[link removed]]

Tweet [link removed] Share [[link removed]] Forward [link removed]

Written by Claire Kelloway

Edited by Anita Jain

Open Markets Institute

655 15th St NW Suite 310

Washington D.C., xxxxxx

Unsubscribe [link removed]

Message Analysis

- Sender: Open Markets Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor