|

John,

I wanted to make sure you saw David’s email from yesterday.

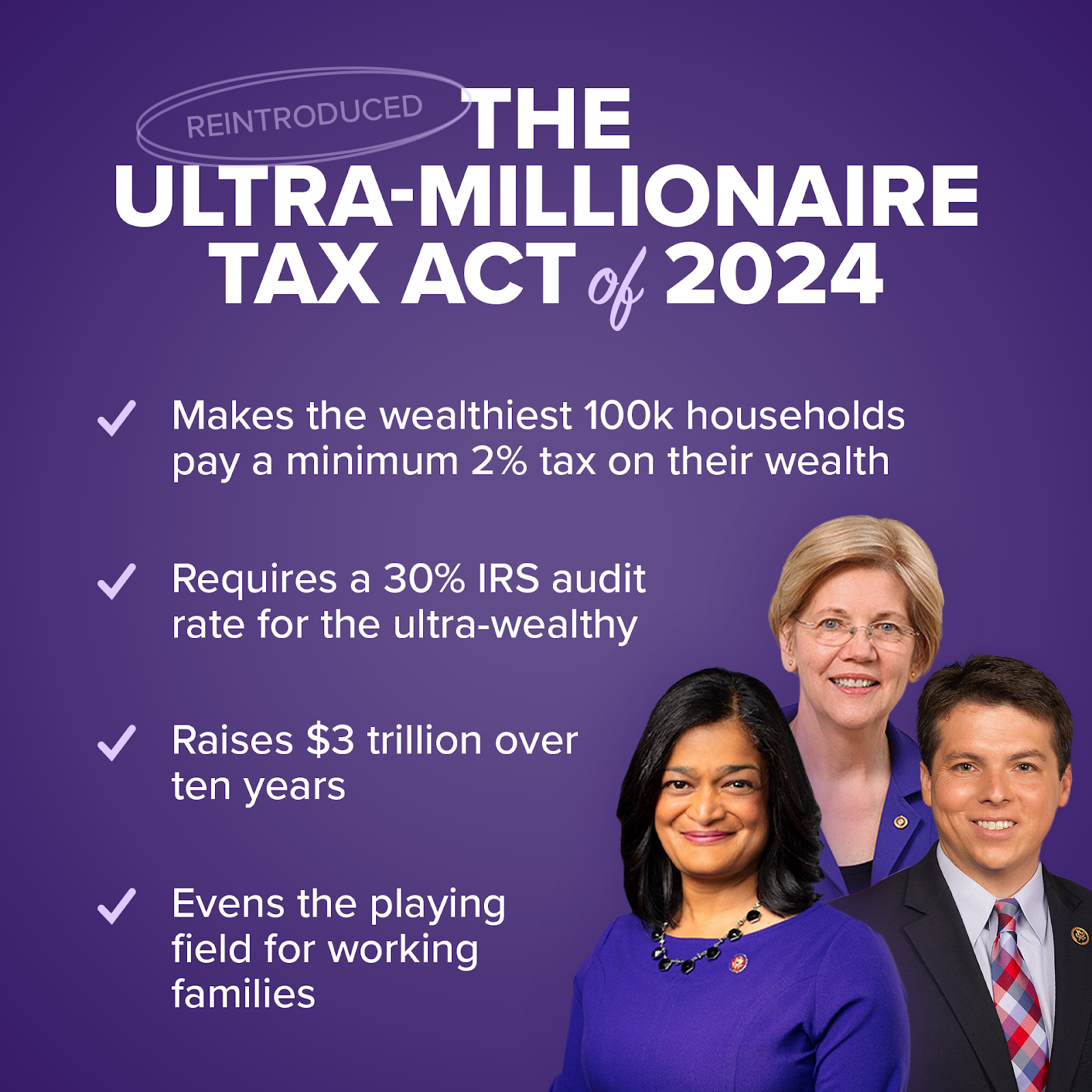

Sen. Elizabeth Warren and Reps. Pramila Jayapal and Brendan Boyle have just introduced the Ultra-Millionaire Tax Act of 2024, which would unrig our economy and our tax code by taxing households and trusts worth over $50 million―the wealthiest 0.05% of Americans.

With the $3 trillion in revenue generated from taxing billionaires and ultra-millionaires, we could invest in public services for the remaining 99.95% of people―creating an economy that works for everyone, not just the wealthy few.

Click here to add your name as a grassroots co-sponsor of Senator Elizabeth Warren’s Ultra-Millionaire Tax Act to unrig our tax code and require the very wealthiest households to pay their fair share.

The bill would also mandate a minimum 30% audit rate on the wealthiest 100,000 households. Because Congressional Republicans systematically gutted the IRS budget between 2010 and 2020, the audits of millionaires and billionaires dropped by 92%. Senator Warren’s bill would provide the IRS with an additional $100 billion in funding to crack down on ultra-wealthy tax cheats.

Together with our champions in Congress, we’re demanding an economy that works for working people, not just the billionaires and ultra-millionaires.

Thank you,

Maura Quint

Campaign Director

Americans for Tax Fairness Action Fund

-- David's email --

John,

America’s 741 billionaires saw their fortunes grow by 78%―or $2.3 trillion―over the first five years of the Trump-GOP tax scam.[1] And they’re paying tax rates that are roughly half that of regular Americans, when you account for their massive untaxed investment gains.

What do billionaires do with their untaxed fortunes? In the 2022 midterm elections, they spent more than $1 billion in an attempt to maintain our rigged economy and elect mostly right-wing candidates who agree with their vision for America: limited taxes for the wealthy and limited rights for everyone else.[2]

Now, Sen. Elizabeth Warren and Reps. Pramila Jayapal and Brendan Boyle have introduced the Ultra-Millionaire Tax Act of 2024. This new legislation would apply a 2% tax on the wealth of households and trusts worth between $50 million and $1 billion and a 3% tax on fortunes exceeding $1 billion.

It would also provide the IRS with an additional $100 billion in resources to adequately enforce this new tax and mandate that at least 30% of these ultra-wealthy households be audited every year. That’s the only way to ensure the nation’s very richest households don’t get away with cheating on their taxes.

The bill would bring in at least $3 trillion in revenue over 10 years without raising taxes on the 99.95% of households with net worths under $50 million. That’s $3 trillion we could use to invest in public services for working families.

Click here to add your name as a grassroots co-sponsor of Elizabeth Warren’s new Ultra-Millionaire Tax Act of 2024 to fight for an economy and a tax system that holds the ultra-wealthy accountable.

As recently as 2020, 400 of the richest Americans held more wealth than all 10 million Black U.S. households combined.[3] The Ultra-Millionaire Tax Act is a critical tool for addressing our nation’s destabilizing wealth gap, particularly helping low-income Black, Latino, and Native households.

When we finally tax the wealth of billionaires and ultra-millionaires, we’ll be able to invest in working families and communities―and build an economy that works for everyone, not just those at the top.

Add your name now as a grassroots co-sponsor of Elizabeth Warren’s new bill, the Ultra-Millionaire Tax Act, to demand the very wealthiest households finally start paying their fair share.

Thank you for all that you do to create an economy that works for everyone, not just the wealthy few.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] U.S. Billionaires Now Worth a Record $5.2 Trillion

[2] Billionaire Spending Topped $1 Billion For the First Time in 2022 Elections

[3] Black wealth is increasing, but so is the racial wealth gap

|