| From | USAFacts <[email protected]> |

| Subject | How many people are earning the minimum wage in the US? |

| Date | March 19, 2024 1:31 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

[View in Your Browser]([link removed])

[USAFacts]([link removed])

What’s the minimum wage? And who earns it?

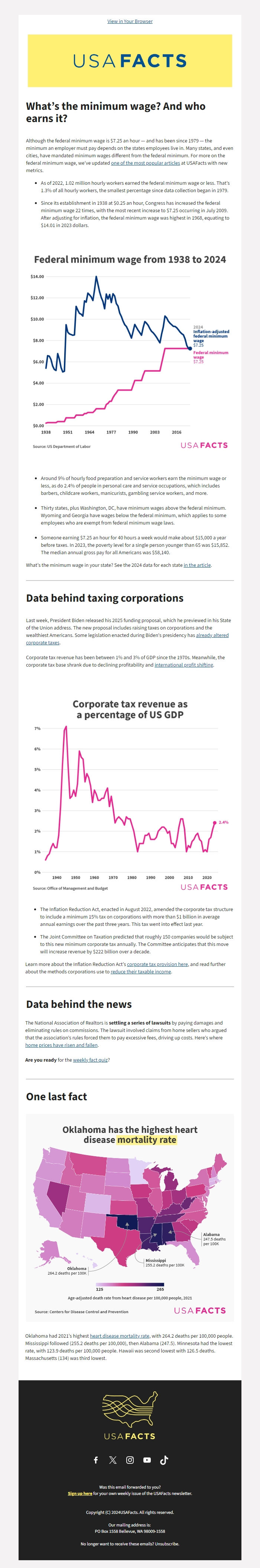

Although the federal minimum wage is $7.25 an hour — and has been since 1979 — the minimum an employer must pay depends on the states employees live in. Many states, and even cities, have mandated minimum wages different from the federal minimum. For more on the federal minimum wage, we’ve updated [one of the most popular articles]([link removed]) at USAFacts with new metrics.

-

As of 2022, 1.02 million hourly workers earned the federal minimum wage or less. That’s 1.3% of all hourly workers, the smallest percentage since data collection began in 1979.

-

Since its establishment in 1938 at $0.25 an hour, Congress has increased the federal minimum wage 22 times, with the most recent increase to $7.25 occurring in July 2009. After adjusting for inflation, the federal minimum wage was highest in 1968, equating to $14.01 in 2023 dollars.

[Federal minimum wage from 1938 to 2024]([link removed])

- Around 9% of hourly food preparation and service workers earn the minimum wage or less, as do 2.4% of people in personal care and service occupations, which includes barbers, childcare workers, manicurists, gambling service workers, and more.

- Thirty states, plus Washington, DC, have minimum wages above the federal minimum. Wyoming and Georgia have wages below the federal minimum, which applies to some employees who are exempt from federal minimum wage laws.

- Someone earning $7.25 an hour for 40 hours a week would make about $15,000 a year before taxes. In 2023, the poverty level for a single person younger than 65 was $15,852. The median annual gross pay for all Americans was $58,140.

What’s the minimum wage in your state? See the 2024 data for each state [in the article]([link removed]).

Data behind taxing corporations

Last week, President Biden released his 2025 funding proposal, which he previewed in his State of the Union address. The new proposal includes raising taxes on corporations and the wealthiest Americans. Some legislation enacted during Biden's presidency has [already altered corporate taxes]([link removed]).

Corporate tax revenue has been between 1% and 3% of GDP since the 1970s. Meanwhile, the corporate tax base shrank due to declining profitability and [international profit shifting]([link removed]).

[Corporate tax revenue as a percentage of US GDP]([link removed])

-

The Inflation Reduction Act, enacted in August 2022, amended the corporate tax structure to include a minimum 15% tax on corporations with more than $1 billion in average annual earnings over the past three years. This tax went into effect last year.

-

The Joint Committee on Taxation predicted that roughly 150 companies would be subject to this new minimum corporate tax annually. The Committee anticipates that this move will increase revenue by $222 billion over a decade.

Learn more about the Inflation Reduction Act’s [corporate tax provision here]([link removed]), and read further about the methods corporations use to [reduce their taxable income]([link removed]).

Data behind the news

The National Association of Realtors is settling a series of lawsuits by paying damages and eliminating rules on commissions. The lawsuit involved claims from home sellers who argued that the association’s rules forced them to pay excessive fees, driving up costs. Here’s where [home prices have risen and fallen]([link removed]).

Are you ready for the [weekly fact quiz]([link removed])?

One last fact

[Oklahoma has the highest heart disease mortality rate]([link removed])

Oklahoma had 2021’s highest [heart disease mortality rate]([link removed]), with 264.2 deaths per 100,000 people. Mississippi followed (255.2 deaths per 100,000), then Alabama (247.5). Minnesota had the lowest rate, with 123.9 deaths per 100,000 people. Hawaii was second lowest with 126.5 deaths. Massachusetts (134) was third lowest.

[USAFacts]([link removed])

[Facebook]([link removed])

[X]([link removed])

[Instagram]([link removed])

[YouTube]([link removed])

[Tiktok]([link removed])

Was this email forwarded to you?

[Sign up here]([link removed]) for your own weekly issue of the USAFacts newsletter.

Copyright (C) 2024USAFacts. All rights reserved.

Our mailing address is:

PO Box 1558 Bellevue, WA 98009-1558

No longer want to receive these emails? [Unsubscribe]([link removed]).

[USAFacts]([link removed])

What’s the minimum wage? And who earns it?

Although the federal minimum wage is $7.25 an hour — and has been since 1979 — the minimum an employer must pay depends on the states employees live in. Many states, and even cities, have mandated minimum wages different from the federal minimum. For more on the federal minimum wage, we’ve updated [one of the most popular articles]([link removed]) at USAFacts with new metrics.

-

As of 2022, 1.02 million hourly workers earned the federal minimum wage or less. That’s 1.3% of all hourly workers, the smallest percentage since data collection began in 1979.

-

Since its establishment in 1938 at $0.25 an hour, Congress has increased the federal minimum wage 22 times, with the most recent increase to $7.25 occurring in July 2009. After adjusting for inflation, the federal minimum wage was highest in 1968, equating to $14.01 in 2023 dollars.

[Federal minimum wage from 1938 to 2024]([link removed])

- Around 9% of hourly food preparation and service workers earn the minimum wage or less, as do 2.4% of people in personal care and service occupations, which includes barbers, childcare workers, manicurists, gambling service workers, and more.

- Thirty states, plus Washington, DC, have minimum wages above the federal minimum. Wyoming and Georgia have wages below the federal minimum, which applies to some employees who are exempt from federal minimum wage laws.

- Someone earning $7.25 an hour for 40 hours a week would make about $15,000 a year before taxes. In 2023, the poverty level for a single person younger than 65 was $15,852. The median annual gross pay for all Americans was $58,140.

What’s the minimum wage in your state? See the 2024 data for each state [in the article]([link removed]).

Data behind taxing corporations

Last week, President Biden released his 2025 funding proposal, which he previewed in his State of the Union address. The new proposal includes raising taxes on corporations and the wealthiest Americans. Some legislation enacted during Biden's presidency has [already altered corporate taxes]([link removed]).

Corporate tax revenue has been between 1% and 3% of GDP since the 1970s. Meanwhile, the corporate tax base shrank due to declining profitability and [international profit shifting]([link removed]).

[Corporate tax revenue as a percentage of US GDP]([link removed])

-

The Inflation Reduction Act, enacted in August 2022, amended the corporate tax structure to include a minimum 15% tax on corporations with more than $1 billion in average annual earnings over the past three years. This tax went into effect last year.

-

The Joint Committee on Taxation predicted that roughly 150 companies would be subject to this new minimum corporate tax annually. The Committee anticipates that this move will increase revenue by $222 billion over a decade.

Learn more about the Inflation Reduction Act’s [corporate tax provision here]([link removed]), and read further about the methods corporations use to [reduce their taxable income]([link removed]).

Data behind the news

The National Association of Realtors is settling a series of lawsuits by paying damages and eliminating rules on commissions. The lawsuit involved claims from home sellers who argued that the association’s rules forced them to pay excessive fees, driving up costs. Here’s where [home prices have risen and fallen]([link removed]).

Are you ready for the [weekly fact quiz]([link removed])?

One last fact

[Oklahoma has the highest heart disease mortality rate]([link removed])

Oklahoma had 2021’s highest [heart disease mortality rate]([link removed]), with 264.2 deaths per 100,000 people. Mississippi followed (255.2 deaths per 100,000), then Alabama (247.5). Minnesota had the lowest rate, with 123.9 deaths per 100,000 people. Hawaii was second lowest with 126.5 deaths. Massachusetts (134) was third lowest.

[USAFacts]([link removed])

[Facebook]([link removed])

[X]([link removed])

[Instagram]([link removed])

[YouTube]([link removed])

[Tiktok]([link removed])

Was this email forwarded to you?

[Sign up here]([link removed]) for your own weekly issue of the USAFacts newsletter.

Copyright (C) 2024USAFacts. All rights reserved.

Our mailing address is:

PO Box 1558 Bellevue, WA 98009-1558

No longer want to receive these emails? [Unsubscribe]([link removed]).

Message Analysis

- Sender: USAFacts

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Klaviyo

- MessageGears