| From | California Business Roundtable <[email protected]> |

| Subject | SPECIAL REPORT on What WalletHub Got Wrong: State Taxes Rank |

| Date | March 18, 2024 8:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

The Center for Jobs and the Economy has released a special report that responds to WalletHub's assertion that California ranks low in state tax rates. The reality is clear: California is a high tax state, as demonstrated by its consistently high contribution to total state taxes and its ranking as the highest state tax state in both 2021 and 2022. For additional information and data about the California economy visit [[link removed].]

California is a High Tax State.

The extent to which this statement is true is often obfuscated by the approach taken in different comparisons that look at tax rates or only a select number of the many different taxes the state has chosen to impose. The results, however, are not so murky. At least part of the reasons the state now lags on job creation, especially private job creation, is the degree to which state and local taxes divert employer resources away from investment, wages, and jobs, and as employees face higher costs both through the taxes they pay directly as well as business taxes passed on through prices to the ultimate payers.

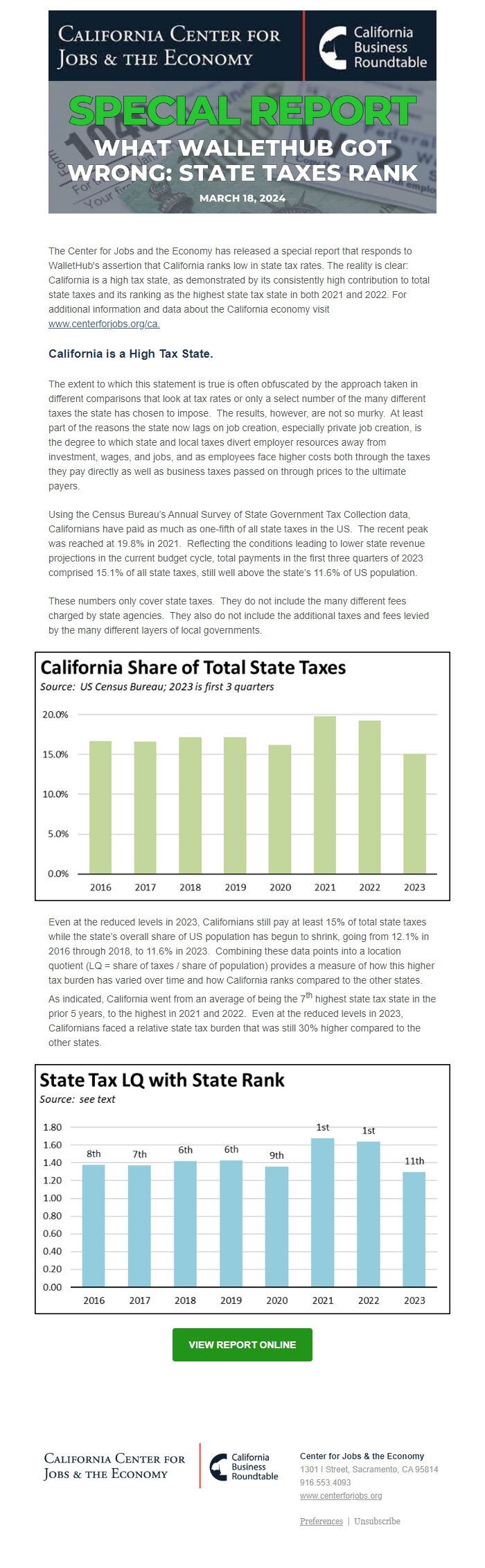

Using the Census Bureau’s Annual Survey of State Government Tax Collection data, Californians have paid as much as one-fifth of all state taxes in the US. The recent peak was reached at 19.8% in 2021. Reflecting the conditions leading to lower state revenue projections in the current budget cycle, total payments in the first three quarters of 2023 comprised 15.1% of all state taxes, still well above the state’s 11.6% of US population.

These numbers only cover state taxes. They do not include the many different fees charged by state agencies. They also do not include the additional taxes and fees levied by the many different layers of local governments.

Even at the reduced levels in 2023, Californians still pay at least 15% of total state taxes while the state’s overall share of US population has begun to shrink, going from 12.1% in 2016 through 2018, to 11.6% in 2023. Combining these data points into a location quotient (LQ = share of taxes / share of population) provides a measure of how this higher tax burden has varied over time and how California ranks compared to the other states. As indicated, California went from an average of being the 7th highest state tax state in the prior 5 years, to the highest in 2021 and 2022. Even at the reduced levels in 2023, Californians faced a relative state tax burden that was still 30% higher compared to the other states.

VIEW REPORT ONLINE [[link removed]]

Center for Jobs & the Economy

1301 I Street, Sacramento, CA 95814

916.553.4093

[[link removed]]

Preferences [link removed] | Unsubscribe [link removed]

California is a High Tax State.

The extent to which this statement is true is often obfuscated by the approach taken in different comparisons that look at tax rates or only a select number of the many different taxes the state has chosen to impose. The results, however, are not so murky. At least part of the reasons the state now lags on job creation, especially private job creation, is the degree to which state and local taxes divert employer resources away from investment, wages, and jobs, and as employees face higher costs both through the taxes they pay directly as well as business taxes passed on through prices to the ultimate payers.

Using the Census Bureau’s Annual Survey of State Government Tax Collection data, Californians have paid as much as one-fifth of all state taxes in the US. The recent peak was reached at 19.8% in 2021. Reflecting the conditions leading to lower state revenue projections in the current budget cycle, total payments in the first three quarters of 2023 comprised 15.1% of all state taxes, still well above the state’s 11.6% of US population.

These numbers only cover state taxes. They do not include the many different fees charged by state agencies. They also do not include the additional taxes and fees levied by the many different layers of local governments.

Even at the reduced levels in 2023, Californians still pay at least 15% of total state taxes while the state’s overall share of US population has begun to shrink, going from 12.1% in 2016 through 2018, to 11.6% in 2023. Combining these data points into a location quotient (LQ = share of taxes / share of population) provides a measure of how this higher tax burden has varied over time and how California ranks compared to the other states. As indicated, California went from an average of being the 7th highest state tax state in the prior 5 years, to the highest in 2021 and 2022. Even at the reduced levels in 2023, Californians faced a relative state tax burden that was still 30% higher compared to the other states.

VIEW REPORT ONLINE [[link removed]]

Center for Jobs & the Economy

1301 I Street, Sacramento, CA 95814

916.553.4093

[[link removed]]

Preferences [link removed] | Unsubscribe [link removed]

Message Analysis

- Sender: California Business Roundtable

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor