March 18, 2024

Permission to republish original opeds and cartoons granted.

There should be no corporate tax for small businesses that employ only American citizens or legal residents

By Rick Manning

There is an axiom of tax policy which states, “raise taxes on what you want to limit and cut taxes on what you want to encourage,” which synopsizes why some expenditures are allowed to be deducted, others get you credits, but most you just pay whatever the government decides.

We have wind tax credits, child tax credits and deductions on everything from home interest to the state taxes you pay.

These decisions are largely driven by interest groups lobbying for different outcomes, all with promises to make the system either fairer, or less immoral.

Corporate taxes are much the same with battles over the corporate tax rates and a bevy of different carve outs designed to reward certain behavior or business activity.

Presumably, creating good paying American-based jobs will be a primary goal of President Trump’s, and with this in mind, here is a modest suggestion.

End the corporate tax altogether for small businesses that employ only American citizens or legal residents.

You can leave the rest of the tax rate intact for the multinationals, whose representatives litter Washington, D.C. seeking ways to protect them from the onslaught of big government. Since too often the major corporations see themselves as partners of government or political advocacy groups known as stakeholders who demand the expansion of government in every aspect of our lives.

Let them fend for themselves. Most multi-nationals have long ago abandoned any pretense of supporting market based economics, instead adopting a Stockholm-syndrome-like love for using the regulatory state and the tax system as a cudgel against their competitors.

Small and medium sized businesses are the backbone of the American economy, and they oftentimes find themselves at the mercy of whatever the big boys negotiate with little firepower in the backrooms of DC.

According to the U.S. Small Business Administration, small businesses alone employ 45.9 percent of the entire U.S. workforce, about 61.6 million. Incredibly over 80 percent of these small businesses don’t have any employees at all. Meaning that those small businesses which have employees, have a lot of them and are the engines of job creation in towns all across America.

Zeroing out the current 21 percent corporate tax rate would positively impact approximately 6 million small businesses with one or more employees, totaling about 34 million.

If you want to encourage the continued growth of these small enterprises, cut their tax rate to zero. The pay received by the owners would still get taxed as income. If the owner sells the company, they would still have to pay capital gains tax and if the owner dies and transfers the company to heirs, they would pay inheritance taxes (although this should be ended.)

To tax a small business owner is the equivalent of taking money out of investment, expansion, hiring new employees, and yes, even giving themselves a pay raise.

Given that most small and mid-sized businesses only employ American citizens or legal residents, making this small change in tax law would put money directly into our economy so the market of millions of different decisions will be well-oiled to grow to meet the needs of the 21st century economy.

America does not need any more targeted tax cuts or other top down decisions from law-makers which oftentimes only serve to enrich the lawyers and accountants who implement them. What we need is for our tax system to encourage job growth in communities fueled by locally owned companies who see and are fulfilling a need.

Congress can do whatever they want with the tax code on the multi-nationals, with their ESG and DEI policies which make their Ivy League executives feel good about themselves while playing squash. If Congress really want to unleash the power of America’s economy, taking the simple step of exempting every company that only employs American and legal resident workers from the corporate tax code would do just that.

Hopefully, in Donald Trump’s second time around in the White House, he will throw his weight behind this simple change and unleash a rebirth of the thriving American market-based economy – making America great again.

Rick Manning is the President of Americans for Limited Government.

To view online: https://dailytorch.com/2024/03/there-should-be-no-corporate-tax-for-small-businesses-that-employ-only-american-citizens-or-legal-residents/

Better off? Prices up 18 percent since Feb. 2021, incomes still only up 16.6 percent as Trump, Biden square off

By Robert Romano

“ARE YOU BETTER OFF THAN YOU WERE FOUR YEARS AGO?”

That was former President Donald Trump’s question to his supporters on Truth Social on March 18. After locking up the Republican Party’s presidential nomination for 2024, now the American people are looking towards the general election where Trump will square off against incumbent President Joe Biden, who has also locked up the Democratic Party’s nomination.

It was the same question Ronald Reagan famously posed to the American people in 1980 when he defeated Jimmy Carter in his reelection bid amid a recession that saw high inflation and unemployment simultaneously.

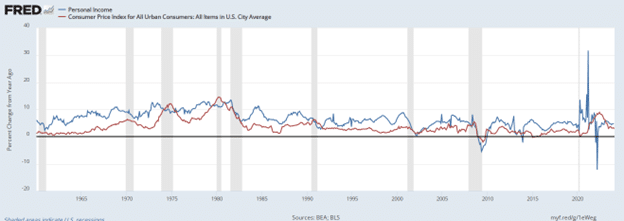

By the time the American people voted in Nov. 1980, consumer prices since Carter had taken office were up a whopping 45.8 percent, according to Bureau of Labor Statistics data. And personal income measured by the Bureau of Economic Analysis, including government transfer payments, was up 55.4 percent.

That was enough to defeat Carter, even though income outpaced consumer prices.

In contrast, since Feb. 2021 (starting at Jan. 2021 would include another round of stimulus that had passed at the end of the Trump administration and would not improve the Biden administration’s personal income number), consumer prices are up 18 percent, but personal income is still only up 16.6 percent.

While there are still seven months and change to go until the election, at the moment, their money still doesn’t go as far as it once did prior to Biden’s tenure in office, which is the first time this has happened, even with the inflation of the 1970s and 1980s, times when although prices were increasingly massively, so were incomes.

Under Richard Nixon and Gerald Ford, from Jan. 1973 to Jan. 1977, consumer prices grew a whopping 37.4 percent, but personal income kept pace, growing 44.8 percent.

Under Ronald Reagan’s first term, consumer prices still grew very quickly at 21.2 percent but personal income grew 37.8 percent from Jan. 1981 to Jan. 1985, a dramatic improvement.

Whenever inflation rises faster than income, for a short times during a presidency, politically, the result can be fatal. It impacted Gerald Ford in 1976, Jimmy Carter did in 1980 and George H.W. Bush did in 1992.

More recently, bouts of incomes sliding faster than prices early in the terms of George W. Bush and Barack Obama — a slightly different situation that occurs during recessions — however, invariably resulted in reelections as the recessions were over by the time the American people voted.

Usually, overall income still grows faster than inflation, even when prices are high. Except under President Biden. And even if incomes eventually catch up to prices, time will tell whether or not it was too late to make a difference. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2024/03/better-off-prices-up-18-percent-since-feb-2021-incomes-still-only-up-16-6-percent-as-trump-biden-square-off/