|

John,

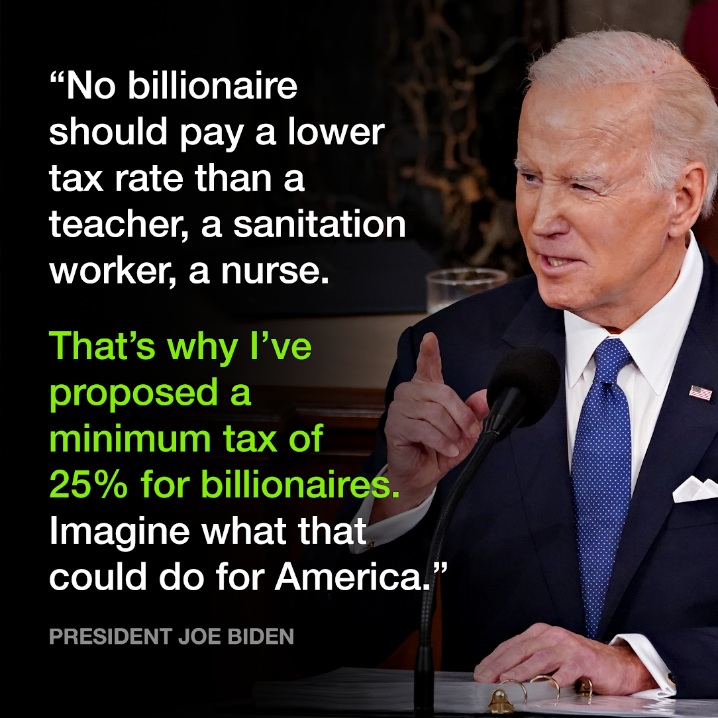

Polling shows that 74% of likely voters―including majorities of Democrats, Independents, and even Republicans―support a Billionaire Minimum Income Tax.[1] And that’s exactly what President Biden called for in this week’s State of the Union address!

The Billionaire Minimum Income Tax could raise at least $360 billion over the next decade[2]—creating a fairer tax system while lowering costs for working people. It has been introduced in the House by Representatives Steve Cohen (D-TN) and Don Beyer (D-VA). And, in the Senate, Finance Committee Chair Ron Wyden has introduced the Billionaires’ Income Tax, which would also tax the wealth gains of billionaires and ultra-millionaires.

Send a message to Congress now telling them to pass a tax on the unrealized wealth gains of the ultra-wealthy to invest in our future and level the playing field for working people.

Recent analyses show that the 400 richest Americans paid a tax rate of just 8.2% over a recent nine year period when you account for their untaxed wealth gains.[3] Compare that to the 13.6% tax rate that an average American household paid in a recent year.

As President Biden said, “No billionaire should pay a lower tax rate than a teacher, a sanitation workers, a nurse.”

Take action today and tell Congress to pass a tax on the wealth gains of billionaires and ultra-millionaires.

The American people are on our side. Congress just needs the political will to act.

Thank you,

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] Polling Compilation: Billionaires Income Tax Plans

[2] President’s Budget Rewards Work, Not Wealth with new Billionaire Minimum Income Tax

[3] What Is the Average Federal Individual Income Tax Rate on the Wealthiest Americans?

|