| From | Niels Veldhuis <[email protected]> |

| Subject | What is the “David Dodge rule” |

| Date | March 4, 2024 11:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Dear John,

Just like when a family takes out a mortgage, the government must pay interest on the debt it incurs.

These debt interest costs are taxpayer dollars that don’t go towards government programs such as health care, education, or national defence.

In other words, when the government spends money it doesn’t have – and when interest rates go up – the government has less money available to spend on important programs.

What’s worse: this creates pressure to take on additional debt to keep those programs fully funded!

In 2015, the Trudeau government came to power promising “small, temporary deficits”.

This promise was immediately broken because the Trudeau government lacks any sense of spending restraint and has chosen to run an uninterrupted series of deficits.

In just nine years this government has nearly doubled federal gross debt, increasing it by roughly $942 billion ($942,000,000,000.00).

Just last year, former Bank of Canada governor David Dodge warned that the federal government’s finances are on shaky ground and suggested the government should ensure debt interest costs stay below 10% of total revenues to keep its finances sustainable.

This became known as the “David Dodge” rule.

The Trudeau government is already expected to break this rule.

In 2023/24, federal debt interest costs are expected to reach 10.2% of projected revenues.

In other words, more than 10 cents of every dollar the federal government receives in revenue will go towards debt interest.

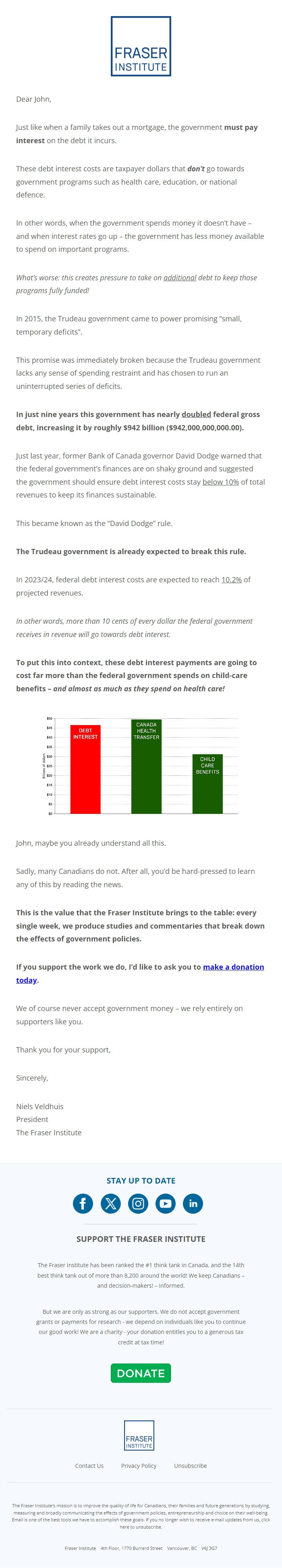

To put this into context, these debt interest payments are going to cost far more than the federal government spends on child-care benefits – and almost as much as they spend on health care!

John, maybe you already understand all this.

Sadly, many Canadians do not. After all, you’d be hard-pressed to learn any of this by reading the news.

This is the value that the Fraser Institute brings to the table: every single week, we produce studies and commentaries that break down the effects of government policies.

If you support the work we do, I’d like to ask you to make a donation today [[link removed][campaignid]].

We of course never accept government money – we rely entirely on supporters like you.

Thank you for your support,

Sincerely,

Niels Veldhuis

President

The Fraser Institute

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Just like when a family takes out a mortgage, the government must pay interest on the debt it incurs.

These debt interest costs are taxpayer dollars that don’t go towards government programs such as health care, education, or national defence.

In other words, when the government spends money it doesn’t have – and when interest rates go up – the government has less money available to spend on important programs.

What’s worse: this creates pressure to take on additional debt to keep those programs fully funded!

In 2015, the Trudeau government came to power promising “small, temporary deficits”.

This promise was immediately broken because the Trudeau government lacks any sense of spending restraint and has chosen to run an uninterrupted series of deficits.

In just nine years this government has nearly doubled federal gross debt, increasing it by roughly $942 billion ($942,000,000,000.00).

Just last year, former Bank of Canada governor David Dodge warned that the federal government’s finances are on shaky ground and suggested the government should ensure debt interest costs stay below 10% of total revenues to keep its finances sustainable.

This became known as the “David Dodge” rule.

The Trudeau government is already expected to break this rule.

In 2023/24, federal debt interest costs are expected to reach 10.2% of projected revenues.

In other words, more than 10 cents of every dollar the federal government receives in revenue will go towards debt interest.

To put this into context, these debt interest payments are going to cost far more than the federal government spends on child-care benefits – and almost as much as they spend on health care!

John, maybe you already understand all this.

Sadly, many Canadians do not. After all, you’d be hard-pressed to learn any of this by reading the news.

This is the value that the Fraser Institute brings to the table: every single week, we produce studies and commentaries that break down the effects of government policies.

If you support the work we do, I’d like to ask you to make a donation today [[link removed][campaignid]].

We of course never accept government money – we rely entirely on supporters like you.

Thank you for your support,

Sincerely,

Niels Veldhuis

President

The Fraser Institute

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor