February 23, 2024

Permission to republish original opeds and cartoons granted.

E.J. Antoni: Understated by Feds, Through-the-Roof Housing Inflation Is Crushing Would-Be Homeowners

|

|

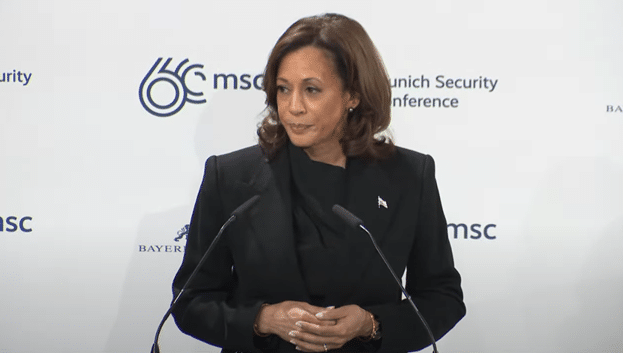

Most of the Country Doesn’t Trust Kamala Harris to Handle the Presidency if Biden Isn’t Capable, What About Michelle Obama?

By Manzanita Miller

If President Joe Biden is unable to continue fulfilling his duties as president either within the next nine months or after the general election if he manages reelection, Vice President Kamala Harris is legally next in line to take over the Oval Office. However, Harris has extremely low approval ratings that make her an untenable alternative to Biden and could throw a wrench in Democrat plans to hold onto the White House.

There is also a possibility, as floated by Americans for Limited Government President Rick Manning, that the Democratic Party could attempt to shuttle Harris into a Supreme Court position, leaving the path to the Democratic nomination open for another candidate.

From a public approval stance, Harris has huge problems when it comes to trust in her ability to perform the duties of the presidency, even though she is legally next in line to do so now. Her approval ratings have remained low since Biden took office, and they have not improved.

A recent Morning Consult poll finds Americans say 51% to 37% that if Biden is unable to fulfill the duties of the presidency, they would not trust in Harris to do so. While it is a slim margin, what stands out is the vast share of the country who places almost no trust in Harris, compared to those who place a great deal of trust in her. A full 42% of the country says they don’t trust Harris ‘much at all’ to handle the duties of the presidency, compared to just 26% who trust Harris ‘a lot’.

Core constituencies of the Democratic Party trust Harris more than the GOP does, but she still struggles with these groups, many of which trust her not ‘much at all’ according to the poll. For example, college-educated voters who generally skew Democrat distrust Harris’s ability to handle the White House. A full 40% of college-educated voters do not trust Harris ‘much at all’ to handle the job of president, while just 24% trust her ‘a lot’.

Among upper income voters, again a group which skews Democrat, 39% of voters trust Harris ‘not much at all’ to handle the duties of the White House, compared to 32% who trust her ‘a lot’.

The same poll finds Harris has a negative approval rating, with 46% of voters saying they have an unfavorable view of her compared to 39% who have a favorable view. Unfortunately for Harris, those with an unfavorable view feel so strongly – a full 42% of the country has a strongly unfavorable view of Harris.

Harris suffers from extremely low public trust ratings and would make a largely unpopular president should anything prevent Biden from completing his duties as president.

This fact has prevented Democrats from shuttling Biden aside and replacing him with Harris as the Democratic nominee for president despite growing concerns about Biden’s mental and physical capacity. This leaves Democrats in a conundrum – they have banked their hopes of retaining the White House on Biden, and Kamala does not offer a viable alternative.

As ALG President Rick Manning recently mused, it is possible the Democratic Party will attempt to shuttle Kamala onto the Supreme Court, clearing a path for Former First Lady Michelle Obama to, possibly, run for president.

Ms. Obama is broadly popular as a former first lady, with 60% of the country holding a favorable view of her, while just 26% dislike her according to recent YouGov data. However, popularity as a former first lady is one metric, and does not necessarily translate to trust in her abilities to fulfill the duties of the presidency.

Among Democrats, there is evidence that Ms. Obama is seen as a better alternative to both Biden and Harris. One early January poll by Noble Predictive Insights found that Democrats and Democrat-leaning independents would favor a Michelle Obama presidency over a Joe Biden presidency by 4 points, 24% to 20%. Harris came in with just 7% of the vote. However, there are no large-scale polls looking at how Ms. Obama would fair against Trump – yet.

Manzanita Miller is an associate analyst at Americans for Limited Government Foundation.

![]()

Understated by Feds, Through-the-Roof Housing Inflation Is Crushing Would-Be Homeowners

By E.J. Antoni

Business headlines say that inflation is down, yet countless Americans are struggling, particularly with finding somewhere affordable to live.

How do we reconcile these seemingly contradictory notions? First, lower inflation means prices are rising slower, but still rising. Second, housing inflation is being undercounted by official government metrics as much as 4-to-1.

The consumer price index from the Bureau of Labor Statistics is designed to measure the cost increase of a common basket of goods. Surprisingly, though, it doesn’t include the cost of housing.

The CPI tries to capture consumption, but not anything considered an investment, which would include a home and any improvements to it, like installing a swimming pool. Similarly, things like the chlorine tablets used to maintain the swimming pool are also excluded since they’re considered part of an investment.

This isn’t a trivial fact, because when the price of those tablets skyrocketed more than 200% in 2022, that increase was nowhere to be found in the CPI. This is just one example of how the index undercounted the increase in the cost of living for many Americans.

While it doesn’t directly measure the cost of homeownership, the CPI does try to estimate it by looking at renter surveys. Basically, the Bureau of Labor Statistics uses the responses in these surveys to estimate not only the change in the cost of renting, but also the change in the cost of homeownership through a category called “owner’s equivalent rent.”

If the cost of rent increases at the same rate as the cost of homeownership, then this methodology should theoretically create an accurate measurement of the increased cost of housing overall. The problem today is that the cost of homeownership has risen much faster than rents over the past three years.

Although rents are at a record high today, the premium to own a home vs. renting one has never been so large before. According to the CPI, rents have gone up 19.5% over the last three years, and the more-encompassing shelter component of the CPI has risen 19.4% over the same time.

According to the National Association of Realtors, however, the median sales price of existing homes is up 23.7% in the past three years. And interest rates on mortgages have more than doubled in that time, increasing the monthly mortgage payment even more.

The Federal Reserve Bank of Atlanta compiles a monthly homeownership affordability index, which estimates the cost to own a median-price home and compares that with the median household income. The index looks at not just how much a homeowner would need to pay in principal and interest, but also homeowners’ insurance, taxes, and personal mortgage insurance.

In January 2021, the median price of a home was just under $300,000, while the interest rate on a 30-year mortgage was 2.7%. All in all, it costs $1,600 a month to afford a home, which is 28% of the median household income. That’s one of the most affordable ratios since the Atlanta Fed started keeping track of this metric in 2006.

By November 2023 (the most recent period for which figures are available), things had deteriorated. In just under three years, the price of a median home shot up to $363,000, while interest rates were 7.4%. Taxes and insurance also skyrocketed, helping drive the monthly cost of homeownership to an eye-opening $2,831.

That’s a 77% increase in just three years or four times the increase in rent counted by the Bureau of Labor Statistics. It now takes 43.9% of the median household income to afford a median-price home. But note that this is before-tax income. After taxes, it takes well over half of the median household income to own a median-price home.

The stratospheric cost of homeownership has led many American families to cut corners wherever possible. That’s why 18 million Americans today are doing without homeowners insurance. The untenable cost of living has forced them to roll the dice on their financial futures.

But neither the exorbitant cost of owning a home, nor the drop in insurance coverage is incorporated in the CPI. This undercounting of inflation is a key reason why so many people disapprove of the economy despite the official metrics improving. Flawed statistics won’t help cover your unaffordable mortgage.

To view online: https://www.washingtontimes.com/news/2024/feb/13/government-is-undercounting-housing-inflation/