Email

Legislative update

| From | Rep. Paul Anderson <[email protected]> |

| Subject | Legislative update |

| Date | February 22, 2024 10:06 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing this email?? [ [link removed] ]View it as a Web page [ [link removed] ].

Anderrson

Homeschool

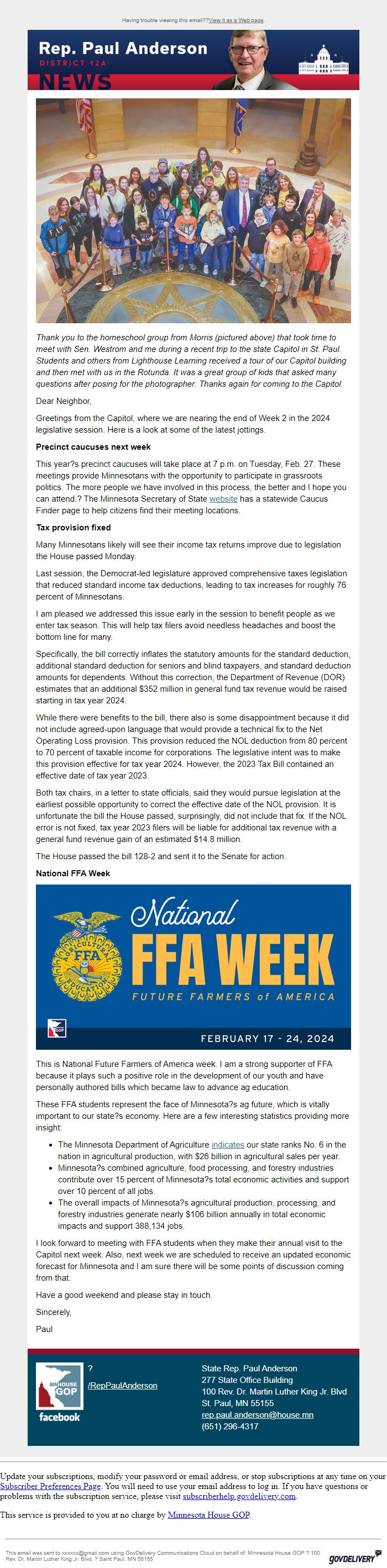

"Thank you to the homeschool group from Morris (pictured above) that took time to meet with Sen. Westrom and me during a recent trip to the state Capitol in St. Paul. Students and others from Lighthouse Learning received a tour of our Capitol building and then met with us in the Rotunda. It was a great group of kids that asked many questions after posing for the photographer. Thanks again for coming to the Capitol."

Dear Neighbor,

Greetings from the Capitol, where we are nearing the end of Week 2 in the 2024 legislative session. Here is a look at some of the latest jottings.

*Precinct caucuses next week*

This year?s precinct caucuses will take place at 7 p.m. on Tuesday, Feb. 27. These meetings provide Minnesotans with the opportunity to participate in grassroots politics. The more people we have involved in this process, the better and I hope you can attend.? The Minnesota Secretary of State website [ [link removed] ] has a statewide Caucus Finder page to help citizens find their meeting locations.

*Tax provision fixed*

Many Minnesotans likely will see their income tax returns improve due to legislation the House passed Monday.

Last session, the Democrat-led legislature approved comprehensive taxes legislation that reduced standard income tax deductions, leading to tax increases for roughly 76 percent of Minnesotans.

I am pleased we addressed this issue early in the session to benefit people as we enter tax season. This will help tax filers avoid needless headaches and boost the bottom line for many.

Specifically, the bill correctly inflates the statutory amounts for the standard deduction, additional standard deduction for seniors and blind taxpayers, and standard deduction amounts for dependents. Without this correction, the Department of Revenue (DOR) estimates that an additional $352 million in general fund tax revenue would be raised starting in tax year 2024.

While there were benefits to the bill, there also is some disappointment because it did not include agreed-upon language that would provide a technical fix to the Net Operating Loss provision. This provision reduced the NOL deduction from 80 percent to 70 percent of taxable income for corporations. The legislative intent was to make this provision effective for tax year 2024. However, the 2023 Tax Bill contained an effective date of tax year 2023.

Both tax chairs, in a letter to state officials, said they would pursue legislation at the earliest possible opportunity to correct the effective date of the NOL provision. It is unfortunate the bill the House passed, surprisingly, did not include that fix. If the NOL error is not fixed, tax year 2023 filers will be liable for additional tax revenue with a general fund revenue gain of an estimated $14.8 million.

The House passed the bill 128-2 and sent it to the Senate for action.

*National FFA Week*

FFA Week 2024

This is National Future Farmers of America week. I am a strong supporter of FFA because it plays such a positive role in the development of our youth and have personally authored bills which became law to advance ag education.

These FFA students represent the face of Minnesota?s ag future, which is vitally important to our state?s economy. Here are a few interesting statistics providing more insight:

* The Minnesota Department of Agriculture indicates [ [link removed] ] our state ranks No. 6 in the nation in agricultural production, with $26 billion in agricultural sales per year.

* Minnesota?s combined agriculture, food processing, and forestry industries contribute over 15 percent of Minnesota?s total economic activities and support over 10 percent of all jobs.

* The overall impacts of Minnesota?s agricultural production, processing, and forestry industries generate nearly $106 billion annually in total economic impacts and support 388,134 jobs.

I look forward to meeting with FFA students when they make their annual visit to the Capitol next week. Also, next week we are scheduled to receive an updated economic forecast for Minnesota and I am sure there will be some points of discussion coming from that.

Have a good weekend and please stay in touch.

Sincerely,

Paul

Facebook logo

?

/RepPaulAnderson [ [link removed] ]

State Rep. Paul Anderson

277 State Office Building

100 Rev. Dr. Martin Luther King Jr. Blvd

St. Paul, MN 55155

[email protected]

(651) 296-4317

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by Minnesota House GOP [ [link removed] ].

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Minnesota House GOP ? 100 Rev. Dr. Martin Luther King Jr. Blvd. ? Saint Paul, MN 55155 GovDelivery logo [ [link removed] ]

Anderrson

Homeschool

"Thank you to the homeschool group from Morris (pictured above) that took time to meet with Sen. Westrom and me during a recent trip to the state Capitol in St. Paul. Students and others from Lighthouse Learning received a tour of our Capitol building and then met with us in the Rotunda. It was a great group of kids that asked many questions after posing for the photographer. Thanks again for coming to the Capitol."

Dear Neighbor,

Greetings from the Capitol, where we are nearing the end of Week 2 in the 2024 legislative session. Here is a look at some of the latest jottings.

*Precinct caucuses next week*

This year?s precinct caucuses will take place at 7 p.m. on Tuesday, Feb. 27. These meetings provide Minnesotans with the opportunity to participate in grassroots politics. The more people we have involved in this process, the better and I hope you can attend.? The Minnesota Secretary of State website [ [link removed] ] has a statewide Caucus Finder page to help citizens find their meeting locations.

*Tax provision fixed*

Many Minnesotans likely will see their income tax returns improve due to legislation the House passed Monday.

Last session, the Democrat-led legislature approved comprehensive taxes legislation that reduced standard income tax deductions, leading to tax increases for roughly 76 percent of Minnesotans.

I am pleased we addressed this issue early in the session to benefit people as we enter tax season. This will help tax filers avoid needless headaches and boost the bottom line for many.

Specifically, the bill correctly inflates the statutory amounts for the standard deduction, additional standard deduction for seniors and blind taxpayers, and standard deduction amounts for dependents. Without this correction, the Department of Revenue (DOR) estimates that an additional $352 million in general fund tax revenue would be raised starting in tax year 2024.

While there were benefits to the bill, there also is some disappointment because it did not include agreed-upon language that would provide a technical fix to the Net Operating Loss provision. This provision reduced the NOL deduction from 80 percent to 70 percent of taxable income for corporations. The legislative intent was to make this provision effective for tax year 2024. However, the 2023 Tax Bill contained an effective date of tax year 2023.

Both tax chairs, in a letter to state officials, said they would pursue legislation at the earliest possible opportunity to correct the effective date of the NOL provision. It is unfortunate the bill the House passed, surprisingly, did not include that fix. If the NOL error is not fixed, tax year 2023 filers will be liable for additional tax revenue with a general fund revenue gain of an estimated $14.8 million.

The House passed the bill 128-2 and sent it to the Senate for action.

*National FFA Week*

FFA Week 2024

This is National Future Farmers of America week. I am a strong supporter of FFA because it plays such a positive role in the development of our youth and have personally authored bills which became law to advance ag education.

These FFA students represent the face of Minnesota?s ag future, which is vitally important to our state?s economy. Here are a few interesting statistics providing more insight:

* The Minnesota Department of Agriculture indicates [ [link removed] ] our state ranks No. 6 in the nation in agricultural production, with $26 billion in agricultural sales per year.

* Minnesota?s combined agriculture, food processing, and forestry industries contribute over 15 percent of Minnesota?s total economic activities and support over 10 percent of all jobs.

* The overall impacts of Minnesota?s agricultural production, processing, and forestry industries generate nearly $106 billion annually in total economic impacts and support 388,134 jobs.

I look forward to meeting with FFA students when they make their annual visit to the Capitol next week. Also, next week we are scheduled to receive an updated economic forecast for Minnesota and I am sure there will be some points of discussion coming from that.

Have a good weekend and please stay in touch.

Sincerely,

Paul

Facebook logo

?

/RepPaulAnderson [ [link removed] ]

State Rep. Paul Anderson

277 State Office Building

100 Rev. Dr. Martin Luther King Jr. Blvd

St. Paul, MN 55155

[email protected]

(651) 296-4317

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by Minnesota House GOP [ [link removed] ].

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Minnesota House GOP ? 100 Rev. Dr. Martin Luther King Jr. Blvd. ? Saint Paul, MN 55155 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery