|

John,

While congressional Republicans and high-priced Wall Street lobbyists are demanding even more corporate tax breaks, we’re demanding Congress raise the corporate tax rate from 21% to at least 28% and the stock buybacks tax from 1% to 4%.

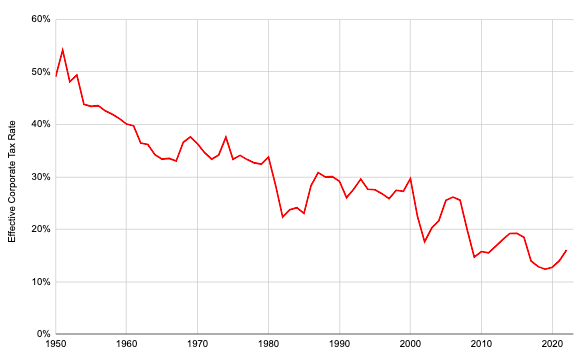

Corporate taxes are near a record low, dropping steadily over the last 70 years:[1]

This collapse in corporate tax revenue means less money to invest in critical programs for working people, and less money for infrastructure and public education, which billion-dollar corporations utilize every day to help deliver their goods and to educate their future workforce.

We’re fighting back against greedy corporations, and demanding policies that put working people first. Donate today to fight for a tax code and economy that works for everyday people, not just the rich and corporations.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Thank you for fighting by our side,

Maura Quint

Campaign Director

Americans for Tax Fairness Action Fund

[1] National Data -- National Income and Product Accounts

-- David's email --

John,

Whether protecting and expanding corporate loopholes, or ensuring their CEOs and other wealthy shareholders pay a discounted rate on their wealth gains, billion-dollar corporations and their lobbyists have rigged our tax code to benefit the rich and powerful.

Just last year, instead of investing their windfall profits in workers’ wages, these mega-corporations spent billions of dollars on stock buybacks:[1]

Google = $61.5 billion

Meta = $19.8 billion

T-Mobile = $13.1 billion

Raytheon = $12.9 billion

Comcast = $11.3 billion

General Motors = $11.1 billion

Many of these corporations also have outrageously low tax rates such as General Electric, which paid a -6% federal income tax rate on $7 billion in profits (yes a negative tax rate!); and General Motors, which paid just 4% in taxes on $6 billion in profits.

Compare this to the 13.6% tax rate that the average American household paid in a recent year and you begin to appreciate the scale of tax loopholes and special breaks these corporations have secured from their corporate-bought politicians.

In fact, in too many cases corporations aren’t just paying lower tax rates than working families―they’re paying fewer dollars!

This is why we’re fighting to increase the corporate tax rate from 21% to at least 28%, and to raise the stock buybacks tax from 1% to 4%. It’s time for corporations to pay their fair share in taxes!

We’re fighting back against corporate greed in our tax code, demanding an economy that works for working people. Donate today to hold greedy corporations, and their billionaire owners, accountable.

Corporate priorities couldn’t be clearer. Even as General Motors was claiming last year that it couldn’t afford to pay striking UAW workers what they deserved, the company was spending $11 BILLION on stock buybacks to make their wealthy shareholders even wealthier.

Corporations are also using obscene profits to enrich their already rich CEOs instead of investing in their workers, who made those profits possible. Research shows that over the last 45 years, CEO pay has soared 1,209% compared to just a 15% increase for the average worker.[4]

Donate today to fight back against Republican and Wall Street attempts to further cut the taxes of billion-dollar corporations.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Together, we’re shining a spotlight on corporate greed and rallying the American people against policies that reward wealth over work.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] 2024 Corporate Tax Dodgers

[2] The rich now own a record share of stocks

[3] Distribution of Household Wealth in the U.S. since 1989

[4] Despite slight decline, CEOs made 344 times as much as the typical worker in 2022

|