|

Tell Congress:

“Greedy tax dodging corporations must pay their fair share in taxes.”

|

John,

Large profitable corporations are using their windfall tax breaks to further enrich CEOs and wealthy shareholders, not invest in workers who make their profits possible.

In fact, research shows that over the last 45 years, CEO pay has soared 1,209% compared to just a 15% increase for the average worker.[1]

While congressional Republicans are demanding even more corporate tax breaks, which pad the pockets of their millionaire and billionaire benefactors, we’re fighting alongside our allies to hold greedy tax dodging corporations accountable. President Biden is proposing that we raise the corporate tax rate from 21% to 28% and close loopholes that encourage billion-dollar corporations to hide profits and ship jobs offshore.

Add your name now and tell Congress that it’s time for large profitable corporations to pay their fair share.

We will not accept more tax breaks for corporations while working families can barely scrape by.

Thank you for taking action today,

Maura Quint

Campaign Director

Americans for Tax Fairness Action Fund

[1] Despite slight decline, CEOs made 344 times as much as the typical worker in 2022

-- David's email --

John,

Corporations are raking in record profits while paying outrageously low tax rates. And they’re using their tax savings to channel even more money to already wealthy CEOs and shareholders instead of boosting workers’ wages. Over the last 45 years, CEO pay has soared 1,209% compared to just a 15% increase for the average worker.[1]

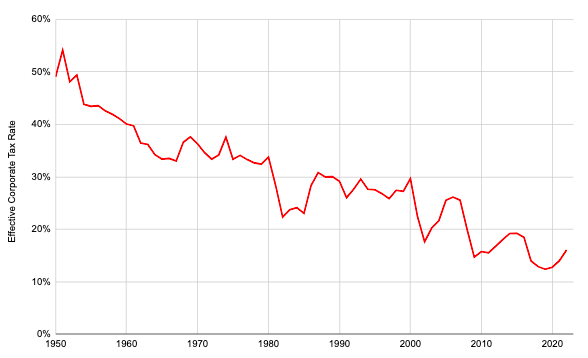

But that is only part of the story. As greedy corporations find new ways to enrich those at the top, they are simultaneously convincing politicians to cut their taxes further and further. Just look at this chart, which shows how corporate tax rates have plummeted over the last 70 years:[2]

Recent corporate earnings reports paint a dire picture of corporations with sky-high profits paying little in taxes―or even getting money back (negative tax rates):

General Electric = $7 billion in profits; -6% federal income tax rate

T-Mobile = $11 billion in profits; 0.4% federal income tax rate

General Motors = $6 billion in profits; 4% federal income tax rate

Tesla = $3 billion in profits; 1.5% federal income tax rate

Billion dollar corporations are taking advantage of loopholes to pay tax rates far below the statutory corporate rate of 21%, and even lower than the 13.6% rate that the average American household paid in a recent year.

And when corporations pay nothing in taxes (instead, getting fat refunds) they’re not just paying lower tax rates than working families―they’re paying fewer dollars!

In the midst of these massive corporate tax handouts, congressional Republicans are coming back for even more.

Take action now. Add your name and tell Congress that greedy tax-dodging corporations need to pay their fair share in taxes.

While congressional Republicans and high-priced Wall Street lobbyists are demanding even more corporate tax breaks for their billionaire benefactors, President Biden is proposing that we raise the corporate tax rate from 21% to 28% and the stock buyback tax from 1% to 4%.

Stock buybacks are a gimmick used by corporations to artificially inflate their stock price by buying up their own shares, further enriching CEOs and wealthy shareholders. Because over 90% of all corporate stock is owned by the wealthiest 10% of Americans―and over half is owned by the top 1%―whenever corporations use this market maneuver they’re almost exclusively further enriching the already rich.[3][4]

Corporate priorities couldn’t be clearer. Even as General Motors was claiming last year that it couldn’t afford to pay striking UAW workers what they deserved, the company was spending $11 BILLION on stock buybacks to make their wealthy shareholders even wealthier.

We’re fighting for a tax system that rewards work and makes large profitable corporations pay their fair share.

Sign now to tell Congress that greedy tax dodging corporations must pay their fair share in taxes.

Together, we’re demanding an economy and a tax system that puts working people first, not billionaires and corporations.

Thank you for all that you do,

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] Despite slight decline, CEOs made 344 times as much as the typical worker in 2022

[2] National Data -- National Income and Product Accounts

[3] The rich now own a record share of stocks

[4] Distribution of Household Wealth in the U.S. since 1989

|