Email

📈 Is the US Economy Sprinting Too Fast?

| From | Irving Wilkinson <[email protected]> |

| Subject | 📈 Is the US Economy Sprinting Too Fast? |

| Date | February 9, 2024 2:45 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good morning,

Ever wondered if too much of a good thing might be a bit risky? That question is buzzing around as we peek into the current US economy.

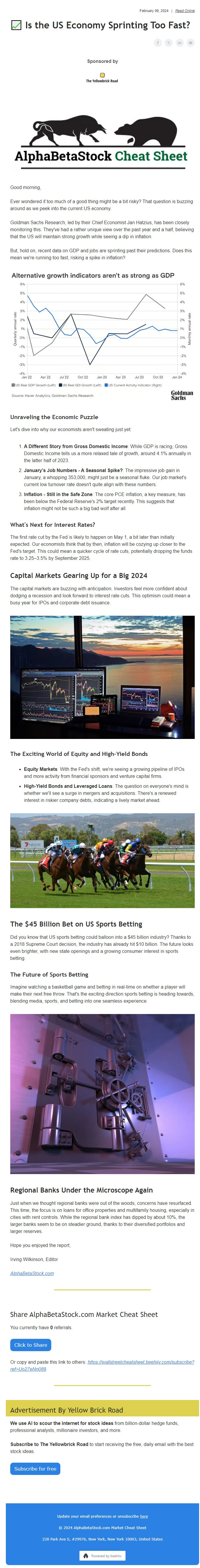

Goldman Sachs Research, led by their Chief Economist Jan Hatzius, has been closely monitoring this. They've had a rather unique view over the past year and a half, believing that the US will maintain strong growth while seeing a dip in inflation.

But, hold on, recent data on GDP and jobs are sprinting past their predictions. Does this mean we're running too fast, risking a spike in inflation?

View image: ([link removed])

Caption:

### **Unraveling the Economic Puzzle**

Let's dive into why our economists aren't sweating just yet:

1. **A Different Story from Gross Domestic Income**: While GDP is racing, Gross Domestic Income tells us a more relaxed tale of growth, around 4.1% annually in the latter half of 2023.

2. **January's Job Numbers - A Seasonal Spike?**: The impressive job gain in January, a whopping 353,000, might just be a seasonal fluke. Our job market's current low turnover rate doesn't quite align with these numbers.

3. **Inflation - Still in the Safe Zone**: The core PCE inflation, a key measure, has been below the Federal Reserve's 2% target recently. This suggests that inflation might not be such a big bad wolf after all.

### **What's Next for Interest Rates?**

The first rate cut by the Fed is likely to happen on May 1, a bit later than initially expected. Our economists think that by then, inflation will be cozying up closer to the Fed's target. This could mean a quicker cycle of rate cuts, potentially dropping the funds rate to 3.25–3.5% by September 2025.

## **Capital Markets Gearing Up for a Big 2024**

The capital markets are buzzing with anticipation. Investors feel more confident about dodging a recession and look forward to interest rate cuts. This optimism could mean a busy year for IPOs and corporate debt issuance.

View image: ([link removed])

Caption:

### **The Exciting World of Equity and High-Yield Bonds**

* **Equity Markets**: With the Fed's shift, we're seeing a growing pipeline of IPOs and more activity from financial sponsors and venture capital firms.

* **High-Yield Bonds and Leveraged Loans**: The question on everyone's mind is whether we'll see a surge in mergers and acquisitions. There's a renewed interest in riskier company debts, indicating a lively market ahead.

View image: ([link removed])

Caption:

## **The $45 Billion Bet on US Sports Betting**

Did you know that US sports betting could balloon into a $45 billion industry? Thanks to a 2018 Supreme Court decision, the industry has already hit $10 billion. The future looks even brighter, with new state openings and a growing consumer interest in sports betting.

### **The Future of Sports Betting**

Imagine watching a basketball game and betting in real-time on whether a player will make their next free throw. That's the exciting direction sports betting is heading towards, blending media, sports, and betting into one seamless experience.

View image: ([link removed])

Caption:

## **Regional Banks Under the Microscope Again**

Just when we thought regional banks were out of the woods, concerns have resurfaced. This time, the focus is on loans for office properties and multifamily housing, especially in cities with rent controls. While the regional bank index has dipped by about 10%, the larger banks seem to be on steadier ground, thanks to their diversified portfolios and larger reserves.

Hope you enjoyed the report,

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

----------

## Advertisement By Yellow Brick Road

----------**We use AI to scour the internet for stock ideas** from billion-dollar hedge funds, professional analysts, millionaire investors, and more.

**Subscribe to The Yellowbrick Road** to start receiving the free, daily email with the best stock ideas.

Subscribe for free ([link removed])

##

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good morning,

Ever wondered if too much of a good thing might be a bit risky? That question is buzzing around as we peek into the current US economy.

Goldman Sachs Research, led by their Chief Economist Jan Hatzius, has been closely monitoring this. They've had a rather unique view over the past year and a half, believing that the US will maintain strong growth while seeing a dip in inflation.

But, hold on, recent data on GDP and jobs are sprinting past their predictions. Does this mean we're running too fast, risking a spike in inflation?

View image: ([link removed])

Caption:

### **Unraveling the Economic Puzzle**

Let's dive into why our economists aren't sweating just yet:

1. **A Different Story from Gross Domestic Income**: While GDP is racing, Gross Domestic Income tells us a more relaxed tale of growth, around 4.1% annually in the latter half of 2023.

2. **January's Job Numbers - A Seasonal Spike?**: The impressive job gain in January, a whopping 353,000, might just be a seasonal fluke. Our job market's current low turnover rate doesn't quite align with these numbers.

3. **Inflation - Still in the Safe Zone**: The core PCE inflation, a key measure, has been below the Federal Reserve's 2% target recently. This suggests that inflation might not be such a big bad wolf after all.

### **What's Next for Interest Rates?**

The first rate cut by the Fed is likely to happen on May 1, a bit later than initially expected. Our economists think that by then, inflation will be cozying up closer to the Fed's target. This could mean a quicker cycle of rate cuts, potentially dropping the funds rate to 3.25–3.5% by September 2025.

## **Capital Markets Gearing Up for a Big 2024**

The capital markets are buzzing with anticipation. Investors feel more confident about dodging a recession and look forward to interest rate cuts. This optimism could mean a busy year for IPOs and corporate debt issuance.

View image: ([link removed])

Caption:

### **The Exciting World of Equity and High-Yield Bonds**

* **Equity Markets**: With the Fed's shift, we're seeing a growing pipeline of IPOs and more activity from financial sponsors and venture capital firms.

* **High-Yield Bonds and Leveraged Loans**: The question on everyone's mind is whether we'll see a surge in mergers and acquisitions. There's a renewed interest in riskier company debts, indicating a lively market ahead.

View image: ([link removed])

Caption:

## **The $45 Billion Bet on US Sports Betting**

Did you know that US sports betting could balloon into a $45 billion industry? Thanks to a 2018 Supreme Court decision, the industry has already hit $10 billion. The future looks even brighter, with new state openings and a growing consumer interest in sports betting.

### **The Future of Sports Betting**

Imagine watching a basketball game and betting in real-time on whether a player will make their next free throw. That's the exciting direction sports betting is heading towards, blending media, sports, and betting into one seamless experience.

View image: ([link removed])

Caption:

## **Regional Banks Under the Microscope Again**

Just when we thought regional banks were out of the woods, concerns have resurfaced. This time, the focus is on loans for office properties and multifamily housing, especially in cities with rent controls. While the regional bank index has dipped by about 10%, the larger banks seem to be on steadier ground, thanks to their diversified portfolios and larger reserves.

Hope you enjoyed the report,

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

----------

## Advertisement By Yellow Brick Road

----------**We use AI to scour the internet for stock ideas** from billion-dollar hedge funds, professional analysts, millionaire investors, and more.

**Subscribe to The Yellowbrick Road** to start receiving the free, daily email with the best stock ideas.

Subscribe for free ([link removed])

##

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a