Streaming is looking a lot more like traditional cable television after a landmark sports streaming alliance between ESPN, Warner Bros. Discovery, and Fox Corp. … Disney also sets a date for the market debut of the direct-to-consumer version of ESPN. … And the NFL continues to find new places on the calendar to play games.

—Eric Fisher

|

|

|

Streaming has arguably never looked more like the traditional cable bundle, thanks to a landmark deal between three media titans.

Disney-owned ESPN, Warner Bros. Discovery, and Fox Corp.—normally fierce competitors across the media landscape—are teaming up on a shared, multisport streaming service that will bring together content from 14 linear networks owned by the three companies, as well as ESPN+, and feature live sports involving nearly every major North American pro and college sports property, and international competitions such as the World Cup, golf and tennis majors, and Formula One.

The move represents one of the most dramatic steps to date in response to cord cutting that continues to batter the industry, with fewer than half of U.S. households now subscribing to traditional cable TV, and subscription fatigue increasingly afflicting streaming. It’s also a further recognition of how important live sports are to the

entire media business. Just as live sports dominate linear television, other streaming networks such as Netflix are increasingly leaning into sports to attract and retain consumers, and a Netflix-ESPN+ bundle was recently suggested by an activist Disney investor.

Disney CEO Bob Iger called the effort with WBD and Fox no less than “a major win for sports fans, and an important step forward for the media business.”

But the step still leaves many more questions than answers, most notably: Why now, particularly given both Disney and WBD are potentially nearing major equity transactions that would fundamentally reshape their sports operations?

“There is no product serving sports fans that are not within the cable TV bundle,” said Fox CEO Lachlan Murdoch early Wednesday during a company earnings call, referencing “cord-nevers” that are a fundamental target of the new venture. “There’s tens of millions of them. This is a very large market and a large opportunity that we can address without undermining the traditional bundle.”

The Great Unknowns

The as-yet-unnamed service is scheduled to debut this fall with its own dedicated management team, and each of the companies will own one-third of the joint venture, though revenues will be divided disproportionately, in part because ESPN and Fox have NFL rights, and WBD does not. The service will essentially act as a new distribution partner, paying the trio of corporate parents for licensing rights to their sports content, and carriage fees paid to the networks are likely to be similar to what they are elsewhere.

But among the other questions surrounding the new service:

- How much will it cost? No price point was initially revealed, but numerous reports have suggested a likely range of $35 to $50 per month, something that would vault it to among the most expensive streaming services on the market. That range, however, is less than YouTube TV, which offers most of the channels included in the new streaming service (and many others) beginning at $72.99 per month, after a promotional period. A key part of the pricing strategy will likely be to slot in between a stand-alone streaming network and a full, multichannel service like YouTube TV.

- Why weren’t NBC Sports parent Comcast and CBS Sports parent Paramount involved? Multiple reports suggested there was a lack of perceived incremental benefit to including them relative to the additional cost and complexity that expanding the group would have created. Disney, WBD, and Fox collectively control the vast majority of the total U.S. sports rights market, and it’s also unclear how receptive Paramount and particularly Comcast would have been to the concept of unbundling its sports content from its entertainment properties such as Peacock.

- Does this really provide one-stop shopping for sports fans? No. In addition to the lack of NBC Sports and CBS Sports content, the service will not have programming such as MLS matches shown on Apple TV+, pro wrestling on Netflix, several league-owned networks, broadcast operators such as Scripps Sports and CW Sports, or Amazon’s rising sports portfolio. Content from any regional sports network is also not included.

- Does this elevate Fox in the streaming space? Without a doubt, as the company’s ad-supported Tubi was something of an afterthought in the streaming world, particularly because Fox has steadfastly resisted using significant amounts of live sports to elevate that service.

- Does this project negate ESPN’s plans to offer a full, direct-to-consumer version of the network? No, and Disney now plans to make that standalone streaming version of the network available by fall 2025. (More below.)

- Will this service change the way the linear networks pursue future sports rights? It’s likely too soon to say, but the upcoming NBA rights negotiations will provide a key window into that dynamic, with the newer streaming players such as Netflix and Amazon eagerly eyeing a chance for that top-tier content.

“We’ve done lots of sensitivity analysis and we would not be launching this product if we thought it was going to significantly affect our pay TV affiliate partners, and that’s very important to us,” Murdoch said.

|

|

|

|

|

Gary A. Vasquez-USA TODAY Sports

|

There is now a set target date for the Walt Disney Co. to offer a full, direct-to-consumer version of ESPN, with the company now planning on a fall 2025 rollout. But ESPN will essentially preempt itself by a year by offering the network in a new sports-centric streaming service.

Disney revealed the largely expected target date—likely coinciding with the start of college and pro football next year—for the stand-alone version of ESPN late Wednesday as it reported quarterly earnings for its fiscal first quarter of 2024. But years of anticipation of fully decoupling the network from the traditional cable bundle has now materially changed with Tuesday’s news of ESPN’s involvement in a landmark streaming joint venture with Warner Bros. Discovery and Fox Corp., bundling the three networks’ sports content in a new, as-yet-unnamed offering.

Like his Fox counterpart Lachlan Murdoch, Disney CEO Bob Iger said “cord-nevers” and other price-conscious consumers are a key target for the new service.

“We know a lot of people have signed up for multichannel TV,” Iger said, adding that the service will be offered at a price “more attractive than the big fat bundle.”

The service developed with Fox and WBD, however, will not have additional features Disney plans for the separate version of ESPN, including integration with the ESPN Bet sportsbook, interactive statistics, and a potential merchandising component. Iger touted the forthcoming product as “unlike anything available in the market today.”

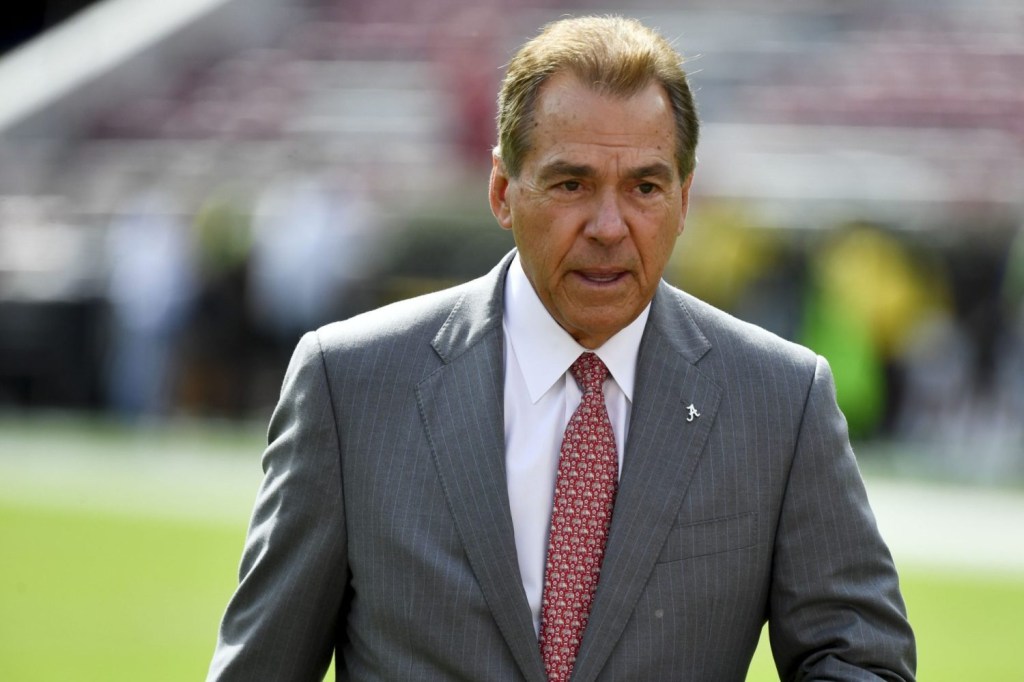

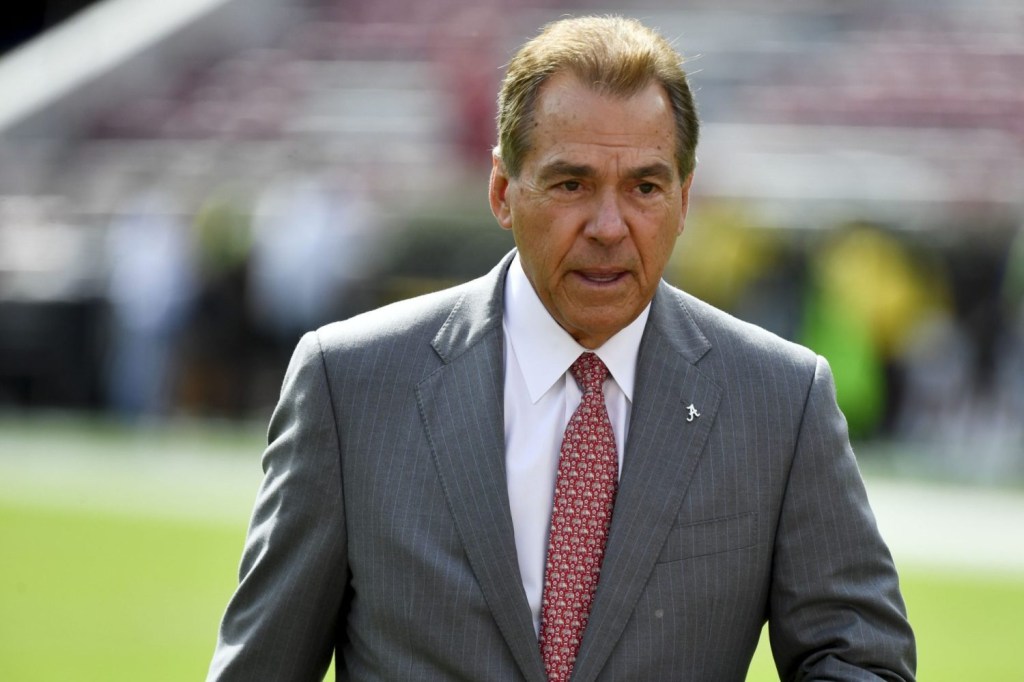

Iger, meanwhile, also confirmed the long-anticipated news that former Alabama head coach Nick Saban is joining ESPN as an on-air commentator.

Sports Results

Core financial results at Disney’s sports operations were mixed, retreating somewhat from prior escalation reported in November, with the latest quarter coinciding with the heart of pro and college football season.

Overall sports revenue for Disney rose 4% to $4.84 billion, while the operating loss for the quarter narrowed 37% from $164 million to $103 million. The entirety of the sports operating loss, however, can be attributed to the company’s Star holding in India, of which Disney is now selling a controlling interest. Domestically, ESPN posted operating income of $255 million for the quarter, more than six times the $41 million figure for the fiscal 2023 first quarter, representing a marked upswing in profitability given revenue rose just 1% to $4.08 billion.

ESPN+ subscriptions, however, retreated for the second time in three quarters, falling 3% to 25.2 million. Average revenue per user for the streaming service rose 14% to $6.09.

The figures highlighted another solid quarter for Disney in which overall revenue was flat at $23.5 billion but operating income rose 27% to $3.9 billion, and total direct-to-consumer losses reduced by 86% from $984 million in the comparable period a year ago to $138 million. Disney is now projecting profitability across its entire DTC business by the end of its fiscal 2024.

|

|

|

|

|

Bill Streicher-USA TODAY Sports

|

The NFL continues to show unprecedented creativity in finding new dates to play games, further expanding the league’s calendar.

After the 2023 season featured the establishment of Black Friday as a new day on the league calendar, a bulked-up Christmas lineup to great ratings success, and even an unintentional shift of a playoff game to the afternoon of the Martin Luther King Jr. holiday, the opening week of the ’24 season will include the NFL’s first regular-season game in Brazil on Friday, Sept. 6, involving the Philadelphia Eagles (as the designated team).

The league’s intent to play in Brazil had been previously announced, and the South American trip represents another step in the NFL’s growing international ambitions. But the inclusion of the Eagles and specific placement of the game on a Friday—a day after the season-opening game involving the Super Bowl LVIII winner—is new.

“It’s an unusual approach, and different than we’ve ever done,” said NFL commissioner Roger Goodell during his Super Bowl state-of-the-league press conference. “We think this is giving us an ability to access more fans not just in [the U.S.], but on a global basis.”

The NFL has traditionally avoided playing on Fridays and Saturdays during the high school and college football regular seasons, in keeping with terms of the Sports Broadcasting Act of 1961. That long-standing rule explains why Saturday NFL games do not appear on the schedule until mid-December each year, and the Black Friday game also worked around the statute by starting at 3 p.m., ahead of a prohibition of airing “all or a substantial part” of pro football games on Fridays after 6 p.m.

The applicable window of that federal act, however, begins with the second Friday of September each year, extending to the second Saturday in December. The Brazil game is situated in front of that, and now it sets up a blockbuster opening week of the upcoming NFL season that will include prime-time games on Sept. 5, 6, 8, and 9. Aiding the effort is the early placement of Labor Day, falling on Sept. 2 this year, which means the NFL’s opening week and the first Friday of September will coincide for the first time since 2019.

The NFL’s other designated teams for international games in 2024 include the Carolina Panthers in Germany, as well as the Chicago Bears, Jacksonville Jaguars, and Minnesota Vikings in England. Their opponents for those games, similar to the Eagles’ foe in Brazil, will be released with the full NFL schedule in the spring.

|

|

|

|

- Between comments made by Las Vegas Mayor Carolyn Goodman on Tuesday’s episode of Front Office Sports Today and a lawsuit filed by a Nevada teachers union, the Oakland A’s plan for relocation continues to get more complicated.

- So what do you think? Would a Hard Knocks–style Netflix series on MLB teams interest you? Let us know.

- Fast man on campus: Georgia quarterback Carson Beck recently purchased a $270,000 Lamborghini Urus Performante.

|

|

| Saban will also contribute to ESPN’s NFL draft coverage. |

| An exclusive poll dives into the prospect of a PPV Super Bowl. |

| The company is attempting to mix “Hard Knocks” with baseball. |

|

|

Front Office Sports has teamed up with the Pac-12 Conference to provide a VIP experience to the Pac-12 men’s basketball tournament in Las Vegas from March 13 to March 16, 2024.

One lucky winner will receive two (2) all tournament passes with club access to the tournament at T-Mobile Arena. The winner will also receive a hotel room for four (4) nights in Las Vegas, a food and beverage voucher, and two (2) tickets to a Cirque du Soleil show. For more information on the Pac-12 men’s basketball tournament, visit Pac-12.com. Deadline for entry is Feb. 25. See Official

Rules for details.

|

|

ENTER HERE

|

|

|