| From | Jerrick Adams <[email protected]> |

| Subject | Oklahoma bill barring public agencies from requiring donor information advances |

| Date | March 24, 2020 6:48 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

The bill would bar any public agency from requiring a nonprofit 501(c) group to provide any personal affiliation information about its donors.

------------------------------------------------------------

mailto:[email protected]?&subject=&body=[link removed] [blank] [link removed] [blank] [link removed] [blank] [link removed]

------------------------------------------------------------

Welcome to _The Disclosure Digest_, a weekly look at state and federal disclosure policies for nonprofit organizations and their donors.

_Ballotpedia is monitoring the impact of the outbreak on U.S. politics and elections and providing comprehensive coverage to our readers. View the latest updates here ([link removed]) ._

** OKLAHOMA LAWMAKERS ADVANCE BILL BARRING PUBLIC AGENCIES FROM REQUIRING DONOR INFORMATION FROM 501(C)S

------------------------------------------------------------

On March 3, the Oklahoma State Senate voted unanimously to approve SB1491 ([link removed]) , which would bar public agencies from requiring 501(c) nonprofits to provide them with personal information about their donors.

** WHAT DOES THE BILL PROPOSE?

------------------------------------------------------------

SB1491 would bar any public agency from requiring a nonprofit 501(c) group to provide the agency with personal affiliation information about its donors. The legislation would also prohibit a public agency from publicly disclosing any such information it might have and exempt personal affiliation information from disclosure under the state's open records law.

The legislation defines "public agencies" and "personal affiliation information" as follows:

* _"Public agency" definition_: any state or local governmental unit.

* _"Personal affiliation information" definition_: any "list, record, register, registry, roll, roster, or other compilation of data of any kind that directly or indirectly identifies a person as a member, supporter or volunteer of, or donor of financial or nonfinancial support to, any entity organized under Section 501(c) of the Internal Revenue Code."

Under SB1491, a knowing violation of these provisions would constitute a misdemeanor punishable by a maximum $1,000 fine, imprisonment for up to 90 days, or both.

** WHAT IS THE POLITICAL CONTEXT, AND WHAT COMES NEXT?

------------------------------------------------------------

Oklahoma is a Republican trifecta ([link removed]) , meaning Republicans control the governorship and majorities in both chambers of the state legislature.

On March 4, the Senate sent SB1491 to the Oklahoma House of Representatives ([link removed]) where it was read for the first time. On March 17, it was read for a second time and referred to the House Judiciary Committee.

** HAVE OTHER STATES CONSIDERED SIMILAR LEGISLATION? WHAT WERE THE REACTIONS?

------------------------------------------------------------

Michigan lawmakers approved a similar bill, SB1176 ([link removed]))/mileg.aspx?page=getObject&objectName=2018-SB-1176) , in 2018. Governor Rick Snyder (R) vetoed it; the legislature did not override the veto.

* In an op-ed for The Detroit News ([link removed]) , Sean Parnell, vice-president of public policy for the Philanthropy Roundtable, wrote:

“

Michiganians are no stranger to anonymous giving, whether it’s the tens of millions of dollars given to support the Kalamazoo Promise or the numerous small anonymous gifts made through sites like GoFundMe.com. The Personal Privacy Protection Act ensures these and countless other acts of kindness can remain private if the giver wishes, while doing nothing to undermine Michigan’s laws regarding disclosure of campaign donations or punishing fraud by nonprofits. If Michigan wants to continue to encourage philanthropic giving, passage of this bill should be a priority.

”

* Opposing the bill, the Campaign Legal Center's Erin Cholpak wrote ([link removed]) ,

“

While other states have been working to close loopholes that have allowed the increasing role of dark money in election campaigns, SB 1176 would codify those loopholes as enforceable law in Michigan. … And even if SB 1176 ultimately exempts campaign finance disclosure requirements from its broad disclosure ban, the bill will still make it easier for Michigan lawmakers to hide any conflicts of interest and could facilitate a rise of pay-to-play politics by shielding such arrangements from public scrutiny.

”

------------------------------------------------------------

[link removed]

------------------------------------------------------------

** THE BIG PICTURE

------------------------------------------------------------

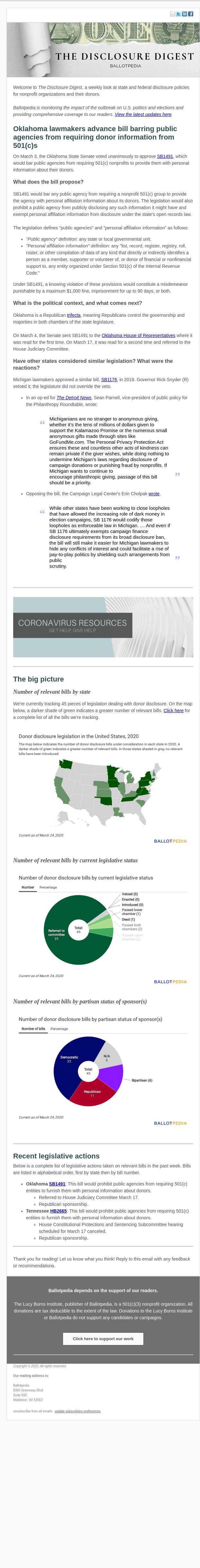

** _NUMBER OF RELEVANT BILLS BY STATE_

------------------------------------------------------------

We're currently tracking 45 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here ([link removed]) for a complete list of all the bills we're tracking.

** _NUMBER OF RELEVANT BILLS BY CURRENT LEGISLATIVE STATUS_

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY PARTISAN STATUS OF SPONSOR(S)_

------------------------------------------------------------

------------------------------------------------------------

** RECENT LEGISLATIVE ACTIONS

------------------------------------------------------------

Below is a complete list of legislative actions taken on relevant bills in the past week. Bills are listed in alphabetical order, first by state then by bill number.

* OKLAHOMA SB1491 ([link removed]) : This bill would prohibit public agencies from requiring 501(c) entities to furnish them with personal information about donors.

* Referred to House Judiciary Committee March 17.

* Republican sponsorship.

* TENNESSEE HB2665 ([link removed]) : This bill would prohibit public agencies from requiring 501(c) entities to furnish them with personal information about donors.

* House Constitutional Protections and Sentencing Subcommittee hearing scheduled for March 17 canceled.

* Republican sponsorship.

------------------------------------------------------------

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations.

============================================================

BALLOTPEDIA DEPENDS ON THE SUPPORT OF OUR READERS.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

** Click here to support our work ([link removed])

-------------------------

_Copyright © 2020, All rights reserved._

OUR MAILING ADDRESS IS:

Ballotpedia

8383 Greenway Blvd

Suite 600

Middleton, WI 53562

** unsubscribe from all emails ( [link removed] )

** update subscription preferences ( [link removed] )

------------------------------------------------------------

mailto:[email protected]?&subject=&body=[link removed] [blank] [link removed] [blank] [link removed] [blank] [link removed]

------------------------------------------------------------

Welcome to _The Disclosure Digest_, a weekly look at state and federal disclosure policies for nonprofit organizations and their donors.

_Ballotpedia is monitoring the impact of the outbreak on U.S. politics and elections and providing comprehensive coverage to our readers. View the latest updates here ([link removed]) ._

** OKLAHOMA LAWMAKERS ADVANCE BILL BARRING PUBLIC AGENCIES FROM REQUIRING DONOR INFORMATION FROM 501(C)S

------------------------------------------------------------

On March 3, the Oklahoma State Senate voted unanimously to approve SB1491 ([link removed]) , which would bar public agencies from requiring 501(c) nonprofits to provide them with personal information about their donors.

** WHAT DOES THE BILL PROPOSE?

------------------------------------------------------------

SB1491 would bar any public agency from requiring a nonprofit 501(c) group to provide the agency with personal affiliation information about its donors. The legislation would also prohibit a public agency from publicly disclosing any such information it might have and exempt personal affiliation information from disclosure under the state's open records law.

The legislation defines "public agencies" and "personal affiliation information" as follows:

* _"Public agency" definition_: any state or local governmental unit.

* _"Personal affiliation information" definition_: any "list, record, register, registry, roll, roster, or other compilation of data of any kind that directly or indirectly identifies a person as a member, supporter or volunteer of, or donor of financial or nonfinancial support to, any entity organized under Section 501(c) of the Internal Revenue Code."

Under SB1491, a knowing violation of these provisions would constitute a misdemeanor punishable by a maximum $1,000 fine, imprisonment for up to 90 days, or both.

** WHAT IS THE POLITICAL CONTEXT, AND WHAT COMES NEXT?

------------------------------------------------------------

Oklahoma is a Republican trifecta ([link removed]) , meaning Republicans control the governorship and majorities in both chambers of the state legislature.

On March 4, the Senate sent SB1491 to the Oklahoma House of Representatives ([link removed]) where it was read for the first time. On March 17, it was read for a second time and referred to the House Judiciary Committee.

** HAVE OTHER STATES CONSIDERED SIMILAR LEGISLATION? WHAT WERE THE REACTIONS?

------------------------------------------------------------

Michigan lawmakers approved a similar bill, SB1176 ([link removed]))/mileg.aspx?page=getObject&objectName=2018-SB-1176) , in 2018. Governor Rick Snyder (R) vetoed it; the legislature did not override the veto.

* In an op-ed for The Detroit News ([link removed]) , Sean Parnell, vice-president of public policy for the Philanthropy Roundtable, wrote:

“

Michiganians are no stranger to anonymous giving, whether it’s the tens of millions of dollars given to support the Kalamazoo Promise or the numerous small anonymous gifts made through sites like GoFundMe.com. The Personal Privacy Protection Act ensures these and countless other acts of kindness can remain private if the giver wishes, while doing nothing to undermine Michigan’s laws regarding disclosure of campaign donations or punishing fraud by nonprofits. If Michigan wants to continue to encourage philanthropic giving, passage of this bill should be a priority.

”

* Opposing the bill, the Campaign Legal Center's Erin Cholpak wrote ([link removed]) ,

“

While other states have been working to close loopholes that have allowed the increasing role of dark money in election campaigns, SB 1176 would codify those loopholes as enforceable law in Michigan. … And even if SB 1176 ultimately exempts campaign finance disclosure requirements from its broad disclosure ban, the bill will still make it easier for Michigan lawmakers to hide any conflicts of interest and could facilitate a rise of pay-to-play politics by shielding such arrangements from public scrutiny.

”

------------------------------------------------------------

[link removed]

------------------------------------------------------------

** THE BIG PICTURE

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY STATE_

------------------------------------------------------------

We're currently tracking 45 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here ([link removed]) for a complete list of all the bills we're tracking.

** _NUMBER OF RELEVANT BILLS BY CURRENT LEGISLATIVE STATUS_

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY PARTISAN STATUS OF SPONSOR(S)_

------------------------------------------------------------

------------------------------------------------------------

** RECENT LEGISLATIVE ACTIONS

------------------------------------------------------------

Below is a complete list of legislative actions taken on relevant bills in the past week. Bills are listed in alphabetical order, first by state then by bill number.

* OKLAHOMA SB1491 ([link removed]) : This bill would prohibit public agencies from requiring 501(c) entities to furnish them with personal information about donors.

* Referred to House Judiciary Committee March 17.

* Republican sponsorship.

* TENNESSEE HB2665 ([link removed]) : This bill would prohibit public agencies from requiring 501(c) entities to furnish them with personal information about donors.

* House Constitutional Protections and Sentencing Subcommittee hearing scheduled for March 17 canceled.

* Republican sponsorship.

------------------------------------------------------------

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations.

============================================================

BALLOTPEDIA DEPENDS ON THE SUPPORT OF OUR READERS.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

** Click here to support our work ([link removed])

-------------------------

_Copyright © 2020, All rights reserved._

OUR MAILING ADDRESS IS:

Ballotpedia

8383 Greenway Blvd

Suite 600

Middleton, WI 53562

** unsubscribe from all emails ( [link removed] )

** update subscription preferences ( [link removed] )

Message Analysis

- Sender: Ballotpedia

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Litmus