| From | Civic Action <[email protected]> |

| Subject | The Tapback: Give me one reason |

| Date | February 7, 2024 1:14 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Logo for The Tapback from Civic Action [[link removed]]

GIVE ME ONE REASON

It’s heartening to see President Biden publicly push big grocery chains to lower prices [[link removed]] , especially because he’s calling out the root of the problem for what it is: “ price gouging, junk fees, greedflation, shrinkflation .” After all, nobody can really stop buying groceries when prices go up, and it’s documented that the industry has kept its profit margins unusually high since the pandemic. And just like one company raising prices without public backlash can encourage other companies to raise prices, the opposite is also true: public pressure to lower prices from the Presidential bully pulpit can make a real-world difference.

But perhaps most extraordinary is that one of the largest grocery chains in the nation has taken the opportunity to argue that a key way to advance the President's goal of lowering grocery prices would be to… allow them to merge with another of the largest grocery chains . That's right: Kroger’s “Chief Sustainability Officer” is now trying to make the case that President Biden should ensure federal approval of their merger with Albertsons/Safeway because that would somehow result in lower prices. Yup. That’s totally a credible argument. One hundred percent in good faith. Because, sure, lower prices are definitely a thing that has been known to result from giant mergers that sharply reduce competition.

Make it make sense.

Three Numbers [[link removed]]

375 members of Congress [[link removed]] voted in favor of a bill which would expand [[link removed]] the Child Tax Credit and renew several billion dollars of corporate tax cuts . Despite the overwhelming vote in the House, the bill faces an uncertain path in the Senate, as some key Senators object to the idea that the children of immigrant parents may continue to receive Child Tax Credit benefits , as has been the case since 2017.

353,000 new jobs [[link removed]] were created in January, as the “ Biden jobs boom [[link removed]] ” continues . This was about twice as many new jobs as had been expected, continuing a long series of incorrect predictions about the strength of the US economy by people whose job is to make such predictions.

$56 billion [[link removed]] in compensation to Elon Musk for his role as CEO of Telsa was ruled [[link removed]] illegal by a Delaware judge, who found the massive pay package was unfair to shareholders because it was determined by a board that was too close to Musk. The case was brought several years ago by the drummer [[link removed]] in a metal band who owned just 9 shares of Tesla stock.

A Chart [[link removed]]

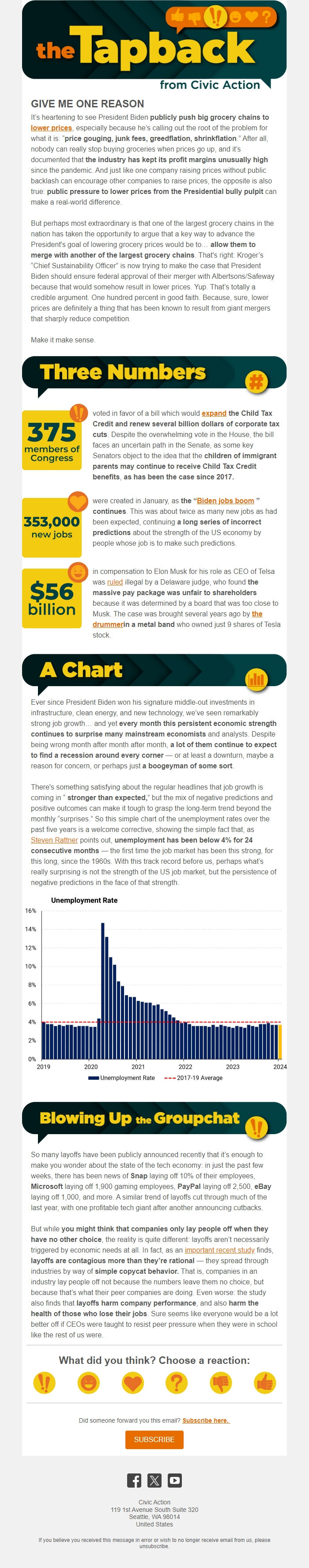

Ever since President Biden won his signature middle-out investments in infrastructure, clean energy, and new technology, we’ve seen remarkably strong job growth… and yet every month this persistent economic strength continues to surprise many mainstream economists and analysts. Despite being wrong month after month after month, a lot of them continue to expect to find a recession around every corner — or at least a downturn, maybe a reason for concern, or perhaps just a boogeyman of some sort .

There's something satisfying about the regular headlines that job growth is coming in “ stronger than expected, ” but the mix of negative predictions and positive outcomes can make it tough to grasp the long-term trend beyond the monthly “surprises.” So this simple chart of the unemployment rates over the past five years is a welcome corrective, showing the simple fact that, as Steven Rattner [[link removed]] points out, unemployment has been below 4% for 24 consecutive months — the first time the job market has been this strong, for this long, since the 1960s. With this track record before us, perhaps what’s really surprising is not the strength of the US job market, but the persistence of negative predictions in the face of that strength.

[link removed] [[link removed]]

Blowing up the Groupchat [[link removed]]

So many layoffs have been publicly announced recently that it’s enough to make you wonder about the state of the tech economy: in just the past few weeks, there has been news of Snap laying off 10% of their employees, Microsoft laying off 1,900 gaming employees, PayPal laying off 2,500, eBay laying off 1,000, and more. A similar trend of layoffs cut through much of the last year, with one profitable tech giant after another announcing cutbacks.

But while you might think that companies only lay people off when they have no other choice , the reality is quite different: layoffs aren’t necessarily triggered by economic needs at all. In fact, as an important recent study [[link removed]] finds, layoffs are contagious more than they’re rational — they spread through industries by way of simple copycat behavior. That is, companies in an industry lay people off not because the numbers leave them no choice, but because that’s what their peer companies are doing. Even worse: the study also finds that layoffs harm company performance , and also harm the health of those who lose their jobs . Sure seems like everyone would be a lot better off if CEOs were taught to resist peer pressure when they were in school like the rest of us were.

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

GIVE ME ONE REASON

It’s heartening to see President Biden publicly push big grocery chains to lower prices [[link removed]] , especially because he’s calling out the root of the problem for what it is: “ price gouging, junk fees, greedflation, shrinkflation .” After all, nobody can really stop buying groceries when prices go up, and it’s documented that the industry has kept its profit margins unusually high since the pandemic. And just like one company raising prices without public backlash can encourage other companies to raise prices, the opposite is also true: public pressure to lower prices from the Presidential bully pulpit can make a real-world difference.

But perhaps most extraordinary is that one of the largest grocery chains in the nation has taken the opportunity to argue that a key way to advance the President's goal of lowering grocery prices would be to… allow them to merge with another of the largest grocery chains . That's right: Kroger’s “Chief Sustainability Officer” is now trying to make the case that President Biden should ensure federal approval of their merger with Albertsons/Safeway because that would somehow result in lower prices. Yup. That’s totally a credible argument. One hundred percent in good faith. Because, sure, lower prices are definitely a thing that has been known to result from giant mergers that sharply reduce competition.

Make it make sense.

Three Numbers [[link removed]]

375 members of Congress [[link removed]] voted in favor of a bill which would expand [[link removed]] the Child Tax Credit and renew several billion dollars of corporate tax cuts . Despite the overwhelming vote in the House, the bill faces an uncertain path in the Senate, as some key Senators object to the idea that the children of immigrant parents may continue to receive Child Tax Credit benefits , as has been the case since 2017.

353,000 new jobs [[link removed]] were created in January, as the “ Biden jobs boom [[link removed]] ” continues . This was about twice as many new jobs as had been expected, continuing a long series of incorrect predictions about the strength of the US economy by people whose job is to make such predictions.

$56 billion [[link removed]] in compensation to Elon Musk for his role as CEO of Telsa was ruled [[link removed]] illegal by a Delaware judge, who found the massive pay package was unfair to shareholders because it was determined by a board that was too close to Musk. The case was brought several years ago by the drummer [[link removed]] in a metal band who owned just 9 shares of Tesla stock.

A Chart [[link removed]]

Ever since President Biden won his signature middle-out investments in infrastructure, clean energy, and new technology, we’ve seen remarkably strong job growth… and yet every month this persistent economic strength continues to surprise many mainstream economists and analysts. Despite being wrong month after month after month, a lot of them continue to expect to find a recession around every corner — or at least a downturn, maybe a reason for concern, or perhaps just a boogeyman of some sort .

There's something satisfying about the regular headlines that job growth is coming in “ stronger than expected, ” but the mix of negative predictions and positive outcomes can make it tough to grasp the long-term trend beyond the monthly “surprises.” So this simple chart of the unemployment rates over the past five years is a welcome corrective, showing the simple fact that, as Steven Rattner [[link removed]] points out, unemployment has been below 4% for 24 consecutive months — the first time the job market has been this strong, for this long, since the 1960s. With this track record before us, perhaps what’s really surprising is not the strength of the US job market, but the persistence of negative predictions in the face of that strength.

[link removed] [[link removed]]

Blowing up the Groupchat [[link removed]]

So many layoffs have been publicly announced recently that it’s enough to make you wonder about the state of the tech economy: in just the past few weeks, there has been news of Snap laying off 10% of their employees, Microsoft laying off 1,900 gaming employees, PayPal laying off 2,500, eBay laying off 1,000, and more. A similar trend of layoffs cut through much of the last year, with one profitable tech giant after another announcing cutbacks.

But while you might think that companies only lay people off when they have no other choice , the reality is quite different: layoffs aren’t necessarily triggered by economic needs at all. In fact, as an important recent study [[link removed]] finds, layoffs are contagious more than they’re rational — they spread through industries by way of simple copycat behavior. That is, companies in an industry lay people off not because the numbers leave them no choice, but because that’s what their peer companies are doing. Even worse: the study also finds that layoffs harm company performance , and also harm the health of those who lose their jobs . Sure seems like everyone would be a lot better off if CEOs were taught to resist peer pressure when they were in school like the rest of us were.

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Message Analysis

- Sender: Civic Action

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- EveryAction