|

John,

As corporations make their periodic financial reports to shareholders this winter, we’re learning more each day about how billion-dollar corporations are abusing tax loopholes to avoid paying their fair share.

Fresh off of a fight with striking UAW workers, General Motors is reporting nearly $6 billion in domestic profits in 2023 on which they paid an effective tax rate of just 4%. The statutory corporate rate is 21%; in a recent year, an average American household paid 13.6%

Before conceding to workers’ demands, GM had claimed that they couldn’t afford to pay workers more in the very year it was spending $11 billion on stock buybacks to enrich their already wealthy shareholders.[1] I guess they actually could afford the new union contract after all!

General Electric reported $7 billion in profits and had a tax rate of -6%. You read that right, GE had a negative tax rate on billions of dollars in profits while spending $1.2 billion on stock buybacks. Why should GE have a negative tax rate when the average American household is paying more than 13%?

Meanwhile, Elon Musk’s Tesla reported more than $3 billion in profits and paid just 1.5% in taxes.

You seeing a trend here?

Billion dollar corporations are taking advantage of tax loopholes, then turning around and using their windfall tax breaks to further enrich their CEOs and shareholders.

When Republicans cut the corporate tax rate from 35% down to just 21% at the end of 2017, they handed massive tax breaks to wealthy corporations. Now, Republicans are coming back for even more.

Power our campaign to hold corporations accountable and fight back against Republican attempts to further cut corporate taxes. Rush a donation today!

While congressional Republicans and high-priced Wall Street lobbyists are demanding even more corporate tax breaks, President Biden is proposing that we raise the corporate tax rate from 21% to 28% and the stock buybacks tax from 1% to 4%.

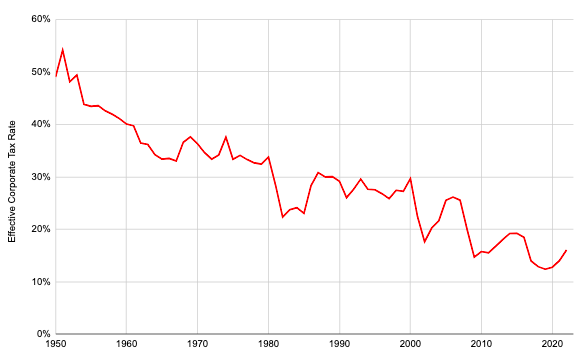

Corporate taxes are near a record low, dropping steadily over the last 70 years:

At the same time, even as workers’ wages are rising, so too are the prices of food, transportation, and rent―the primary expenses of working people.[2]

In fact, a new report shows how corporate price gouging, not inflation, is driving these rising prices.[3] According to the report from Groundwork Collaborative, corporate profits drove 53% of inflation during quarters 2 and 3 last year.

This is further evidence that corporations will do anything to enrich those at the top while leaving working people and our communities behind.

Power our campaign to demand greedy corporations pay their fair share in taxes. Donate today!

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Together, we’re fighting for an economy and a tax system that works for working people, not just the wealthy and corporations.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] National Data -- National Income and Product Accounts

[2] Wage hikes lighten the burden of inflation, but it still weighs on some workers

[3] Inflation Revelation: How Outsized Corporate Profits Drive Rising Costs

|