| From | Heritage Action <[email protected]> |

| Subject | Saturday Summary: Finish the Job, IMPEACH MAYORKAS |

| Date | February 3, 2024 1:03 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Fellow Conservative,

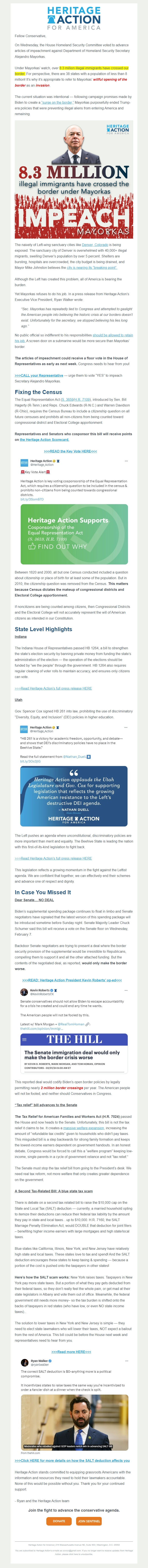

On Wednesday, the House Homeland Security Committee voted to advance articles of impeachment against Department of Homeland Security Secretary Alejandro Mayorkas.

Under Mayorkas’ watch, over 8.3 million illegal immigrants have crossed our border. For perspective, there are 38 states with a population of less than 8 million!

It’s why it’s appropriate to refer to Mayorkas’ willful opening of the border as an invasion.

The current situation was intentional — following campaign promises made by Biden to create a “surge on the border,” <[link removed]> Mayorkas purposefully ended Trump-era policies that were preventing illegal aliens from entering America and remaining.

The naivety of Left-wing sanctuary cities like Denver, Colorado <[link removed]> is being exposed. The sanctuary city of Denver is overwhelmed with 40,000+ illegal migrants, swelling Denver’s population by over 5 percent. Shelters are bursting, hospitals are overcrowded, the city budget is being drained, and Mayor Mike Johnston believes the city is nearing its “breaking point”. <[link removed]>

Although the Left has created this problem, all of America is bearing the burden.

Yet Mayorkas refuses to do his job. In a press release from Heritage Action’s Executive Vice President, Ryan Walker wrote:

“Sec. Mayorkas has repeatedly lied to Congress and attempted to gaslight the American people into believing the historic crisis at our borders doesn’t exist. Unfortunately for the secretary, we stopped believing his lies long ago.”

No public official so indifferent to his responsibilities should be allowed to retain his job. <[link removed]> A screen door on a submarine would be more secure than Mayorkas’ border.

The articles of impeachment could receive a floor vote in the House of Representatives as early as next week. Congress needs to hear from you!

>>>CALL your Representative <[link removed]> — urge them to vote “YES” to impeach Secretary Alejandro Mayorkas.

Fixing the Census

The Equal Representation Act (S. 3659 <[link removed]>/H.R. 7109 <[link removed]>), introduced by Sen. Bill Hagerty (R-Tenn.) and Reps. Chuck Edwards (R-N.C.) and Warren Davidson (R-Ohio), requires the Census Bureau to include a citizenship question on all future censuses and prohibits all non-citizens from being counted toward congressional district and Electoral College apportionment.

Representatives and Senators who cosponsor this bill will receive points on the Heritage Action Scorecard. <[link removed]>

>>>READ the Key Vote HERE<<< <[link removed]>

Between 1820 and 2000, all but one Census conducted included a question about citizenship or place of birth for at least some of the population. But in 2010, the citizenship question was removed from the Census. This matters because Census dictates the makeup of congressional districts and Electoral College apportionment.

If noncitizens are being counted among citizens, then Congressional Districts and the Electoral College will not accurately represent the will of American citizens as intended in our Constitution.

State Level Highlights

Indiana

The Indiana House of Representatives passed HB 1264, a bill to strengthen the state’s election security by banning private money from funding the state’s administration of the election — the operation of the elections should be funded by “we the people” through the government. HB 1264 also requires regular cleaning of voter rolls to maintain accuracy, and ensures only citizens can vote.

>>>Read Heritage Action’s full press release

HERE <[link removed]>

Utah

Gov. Spencer Cox signed HB 261 into law, prohibiting the use of discriminatory “Diversity, Equity, and Inclusion” (DEI) policies in higher education.

The Left pushes an agenda where unconstitutional, discriminatory policies are more important than merit and equality. The Beehive State is leading the nation with this first-of-its-kind legislation to fight back.

>>>Read Heritage Action’s full press release HERE <[link removed]>

This legislation reflects a growing momentum in the fight against the Leftist agenda. We are confident that together, we can effectively end their schemes and advance one of respect and dignity.

In Case You Missed It

Dear Senate… NO DEAL

Biden’s supplemental spending package continues to float in limbo and Senate negotiators have signaled that the latest version of this spending package will be introduced sometime before Sunday night. Senate Majority Leader Chuck Schumer said this bill will receive a vote on the Senate floor on Wednesday, February 7.

Backdoor Senate negotiators are trying to present a deal where the border security provision of the supplemental would be irresistible to Republicans, compelling them to support it and all the other attached funding. But the contents of the negotiated deal, as reported, would only make the border worse.

>>>READ: Heritage Action President

Kevin Roberts’ op-ed<<< <[link removed]>

This reported deal would codify Biden’s open border policies by legally permitting nearly 2 million border crossings per year. The American people will not be fooled, and neither should Conservatives in Congress.

“Tax relief” bill advances to the Senate

The Tax Relief for American Families and Workers Act (H.R. 7024) passed the House and now heads to the Senate. Unfortunately, this bill is not the tax relief it claims to be. It creates a massive welfare expansion <[link removed]>, increasing the amount of “refundable tax credits” given to households who didn’t pay taxes. This misguided bill is a step backwards for strong family formation and keeps the lowest-income earners dependent on government handouts. In an honest debate, Congress would be forced to call this a “welfare program” keeping low-income, single parents in a cycle of government reliance and not “tax relief.”

The Senate must stop the tax relief bill from going to the President’s desk. We need real tax reform, not more welfare that only creates greater dependence on the government.

A Second Tax-Related Bill: A blue state tax scam

There is debate on a second tax-related bill to raise the $10,000 cap on the State and Local Tax (SALT) deduction — currently, a married household opting to

itemize their deductions can reduce their federal tax liability by the amount they pay in state and local taxes…up to $10,000. H.R. 7160, the SALT Marriage Penalty Elimination Act, would DOUBLE that deduction for joint filers – benefiting higher income earners with large mortgages and high state/local taxes.

Blue states like California, Illinois, New York, and New Jersey have relatively high state and local taxes. These states love to tax and spend! And the SALT deduction encourages these states to keep taxing & spending — because a portion of the cost is pushed onto the taxpayers in other states!

Here’s how the SALT scam works: New York raises taxes. Taxpayers in New York pay more state taxes. But a portion of what they pay gets deducted from their federal taxes, so they don’t really feel the whole pain, or get mad at their state legislators in Albany and vote them out of office. Meanwhile, the federal government still needs more money– so the tax burden is shifted onto the backs of taxpayers in red states (who have low, or even NO state income taxes)..

The solution to lower taxes in New York and New Jersey is simple — they need to elect state lawmakers who will lower their taxes, NOT expect a bailout from the rest of America. This bill could be before the House next week and representatives need to hear from you.

>>>Read more HERE<<< <[link removed]>

>>>Click HERE for more details on how the SALT deduction affects you <[link removed]>

Heritage Action stands committed to equipping grassroots Americans with the information and resources they need to hold their lawmakers accountable. None of this would be possible without you. Thank you for your continued support.

- Ryan and the Heritage Action team

Join the fight to advance the conservative agenda.

<[link removed]> <[link removed]>

-

On Wednesday, the House Homeland Security Committee voted to advance articles of impeachment against Department of Homeland Security Secretary Alejandro Mayorkas.

Under Mayorkas’ watch, over 8.3 million illegal immigrants have crossed our border. For perspective, there are 38 states with a population of less than 8 million!

It’s why it’s appropriate to refer to Mayorkas’ willful opening of the border as an invasion.

The current situation was intentional — following campaign promises made by Biden to create a “surge on the border,” <[link removed]> Mayorkas purposefully ended Trump-era policies that were preventing illegal aliens from entering America and remaining.

The naivety of Left-wing sanctuary cities like Denver, Colorado <[link removed]> is being exposed. The sanctuary city of Denver is overwhelmed with 40,000+ illegal migrants, swelling Denver’s population by over 5 percent. Shelters are bursting, hospitals are overcrowded, the city budget is being drained, and Mayor Mike Johnston believes the city is nearing its “breaking point”. <[link removed]>

Although the Left has created this problem, all of America is bearing the burden.

Yet Mayorkas refuses to do his job. In a press release from Heritage Action’s Executive Vice President, Ryan Walker wrote:

“Sec. Mayorkas has repeatedly lied to Congress and attempted to gaslight the American people into believing the historic crisis at our borders doesn’t exist. Unfortunately for the secretary, we stopped believing his lies long ago.”

No public official so indifferent to his responsibilities should be allowed to retain his job. <[link removed]> A screen door on a submarine would be more secure than Mayorkas’ border.

The articles of impeachment could receive a floor vote in the House of Representatives as early as next week. Congress needs to hear from you!

>>>CALL your Representative <[link removed]> — urge them to vote “YES” to impeach Secretary Alejandro Mayorkas.

Fixing the Census

The Equal Representation Act (S. 3659 <[link removed]>/H.R. 7109 <[link removed]>), introduced by Sen. Bill Hagerty (R-Tenn.) and Reps. Chuck Edwards (R-N.C.) and Warren Davidson (R-Ohio), requires the Census Bureau to include a citizenship question on all future censuses and prohibits all non-citizens from being counted toward congressional district and Electoral College apportionment.

Representatives and Senators who cosponsor this bill will receive points on the Heritage Action Scorecard. <[link removed]>

>>>READ the Key Vote HERE<<< <[link removed]>

Between 1820 and 2000, all but one Census conducted included a question about citizenship or place of birth for at least some of the population. But in 2010, the citizenship question was removed from the Census. This matters because Census dictates the makeup of congressional districts and Electoral College apportionment.

If noncitizens are being counted among citizens, then Congressional Districts and the Electoral College will not accurately represent the will of American citizens as intended in our Constitution.

State Level Highlights

Indiana

The Indiana House of Representatives passed HB 1264, a bill to strengthen the state’s election security by banning private money from funding the state’s administration of the election — the operation of the elections should be funded by “we the people” through the government. HB 1264 also requires regular cleaning of voter rolls to maintain accuracy, and ensures only citizens can vote.

>>>Read Heritage Action’s full press release

HERE <[link removed]>

Utah

Gov. Spencer Cox signed HB 261 into law, prohibiting the use of discriminatory “Diversity, Equity, and Inclusion” (DEI) policies in higher education.

The Left pushes an agenda where unconstitutional, discriminatory policies are more important than merit and equality. The Beehive State is leading the nation with this first-of-its-kind legislation to fight back.

>>>Read Heritage Action’s full press release HERE <[link removed]>

This legislation reflects a growing momentum in the fight against the Leftist agenda. We are confident that together, we can effectively end their schemes and advance one of respect and dignity.

In Case You Missed It

Dear Senate… NO DEAL

Biden’s supplemental spending package continues to float in limbo and Senate negotiators have signaled that the latest version of this spending package will be introduced sometime before Sunday night. Senate Majority Leader Chuck Schumer said this bill will receive a vote on the Senate floor on Wednesday, February 7.

Backdoor Senate negotiators are trying to present a deal where the border security provision of the supplemental would be irresistible to Republicans, compelling them to support it and all the other attached funding. But the contents of the negotiated deal, as reported, would only make the border worse.

>>>READ: Heritage Action President

Kevin Roberts’ op-ed<<< <[link removed]>

This reported deal would codify Biden’s open border policies by legally permitting nearly 2 million border crossings per year. The American people will not be fooled, and neither should Conservatives in Congress.

“Tax relief” bill advances to the Senate

The Tax Relief for American Families and Workers Act (H.R. 7024) passed the House and now heads to the Senate. Unfortunately, this bill is not the tax relief it claims to be. It creates a massive welfare expansion <[link removed]>, increasing the amount of “refundable tax credits” given to households who didn’t pay taxes. This misguided bill is a step backwards for strong family formation and keeps the lowest-income earners dependent on government handouts. In an honest debate, Congress would be forced to call this a “welfare program” keeping low-income, single parents in a cycle of government reliance and not “tax relief.”

The Senate must stop the tax relief bill from going to the President’s desk. We need real tax reform, not more welfare that only creates greater dependence on the government.

A Second Tax-Related Bill: A blue state tax scam

There is debate on a second tax-related bill to raise the $10,000 cap on the State and Local Tax (SALT) deduction — currently, a married household opting to

itemize their deductions can reduce their federal tax liability by the amount they pay in state and local taxes…up to $10,000. H.R. 7160, the SALT Marriage Penalty Elimination Act, would DOUBLE that deduction for joint filers – benefiting higher income earners with large mortgages and high state/local taxes.

Blue states like California, Illinois, New York, and New Jersey have relatively high state and local taxes. These states love to tax and spend! And the SALT deduction encourages these states to keep taxing & spending — because a portion of the cost is pushed onto the taxpayers in other states!

Here’s how the SALT scam works: New York raises taxes. Taxpayers in New York pay more state taxes. But a portion of what they pay gets deducted from their federal taxes, so they don’t really feel the whole pain, or get mad at their state legislators in Albany and vote them out of office. Meanwhile, the federal government still needs more money– so the tax burden is shifted onto the backs of taxpayers in red states (who have low, or even NO state income taxes)..

The solution to lower taxes in New York and New Jersey is simple — they need to elect state lawmakers who will lower their taxes, NOT expect a bailout from the rest of America. This bill could be before the House next week and representatives need to hear from you.

>>>Read more HERE<<< <[link removed]>

>>>Click HERE for more details on how the SALT deduction affects you <[link removed]>

Heritage Action stands committed to equipping grassroots Americans with the information and resources they need to hold their lawmakers accountable. None of this would be possible without you. Thank you for your continued support.

- Ryan and the Heritage Action team

Join the fight to advance the conservative agenda.

<[link removed]> <[link removed]>

-

Message Analysis

- Sender: Heritage Foundation

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Marketo