| From | IRS Newswire <[email protected]> |

| Subject | FS-2024-02: Here’s who needs to file a tax return in 2024 |

| Date | February 2, 2024 5:34 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&gt;

IRS.gov Banner

IRS Newswire ##line "Date"##

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia Center [ [link removed] ]

Noticias en Espa?ol [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News Home [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact My Local Office [ [link removed] ]

Filing Options [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

News [ [link removed] ]

Taxpayer Advocate [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

*Issue Number:*? ? FS-2024-02

*Inside This Issue?*

________________________________________________________________________

*Here?s who needs to file a tax return in 2024*

Most U.S. citizens [ [link removed] ] and permanent residents [ [link removed] ] who work in the United States need to file a tax return if they make more than a certain amount for the year.

The IRS has a variety of information available on IRS.gov to help taxpayers, including a special ?free help [ [link removed] ]? page. Here are some specific details to help people if they need to file a tax return.

*Factors that affect whether someone needs to file a tax return*

Here are some of the things that affect whether someone must file a tax return.

*Gross income.* Gross income means all income a person received in the form of money, goods, property and services that aren't exempt from tax. This includes any income from sources outside the United States or from the sale of a main home, even if you can exclude part or all of it.

*Required filing threshold.* People need to see if their gross income is over the required filing threshold. Filing statuses [ [link removed] ] have different income thresholds, so individuals may need to consider their potential filing status as well.

There are five filing statuses:

* Single

* Head of household

* Married filing jointly

* Married filing separate

* Qualifying surviving spouse

Find details on tax filing requirements with Publication 501, Dependents, Standard Deduction, and Filing Information [ [link removed] ].

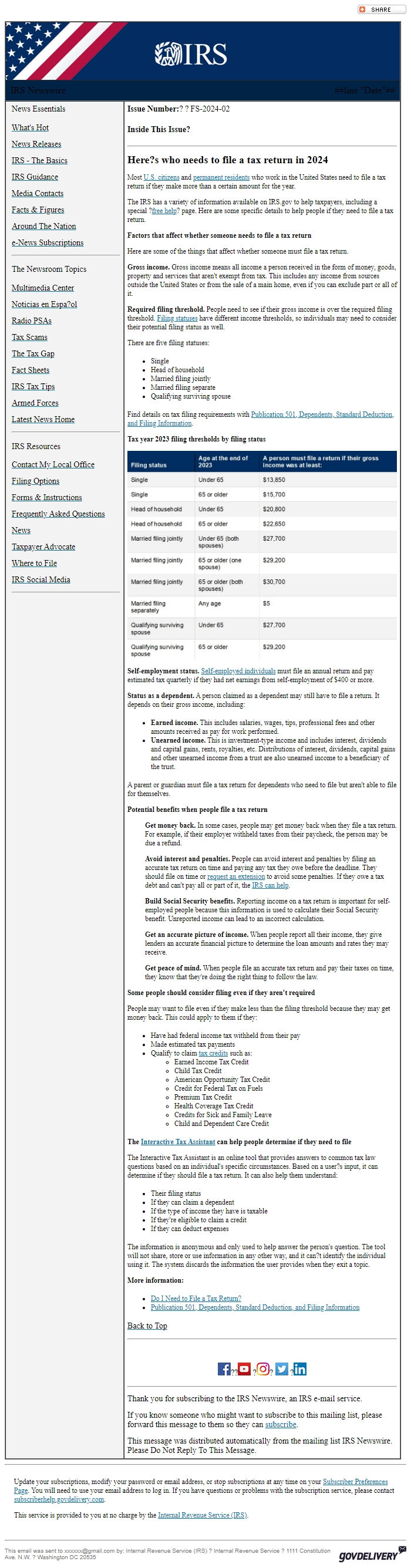

*Tax year 2023 filing thresholds by filing status*

*Tax year 2023 filing thresholds by filing status*

*Self-employment status.* Self-employed individuals [ [link removed] ] must file an annual return and pay estimated tax quarterly if they had net earnings from self-employment of $400 or more.

*Status as a dependent.* A person claimed as a dependent may still have to file a return. It depends on their gross income, including:

* *Earned income.* This includes salaries, wages, tips, professional fees and other amounts received as pay for work performed.

* *Unearned income.* This is investment-type income and includes interest, dividends and capital gains, rents, royalties, etc. Distributions of interest, dividends, capital gains and other unearned income from a trust are also unearned income to a beneficiary of the trust.

A parent or guardian must file a tax return for dependents who need to file but aren't able to file for themselves.

*Potential benefits when people file a tax return*

*Get money back.* In some cases, people may get money back when they file a tax return. For example, if their employer withheld taxes from their paycheck, the person may be due a refund.

*Avoid interest and penalties.* People can avoid interest and penalties by filing an accurate tax return on time and paying any tax they owe before the deadline. They should file on time or request an extension [ [link removed] ] to avoid some penalties. If they owe a tax debt and can't pay all or part of it, the IRS can help [ [link removed] ].

*Build Social Security benefits.* Reporting income on a tax return is important for self-employed people because this information is used to calculate their Social Security benefit. Unreported income can lead to an incorrect calculation.

*Get an accurate picture of income.* When people report all their income, they give lenders an accurate financial picture to determine the loan amounts and rates they may receive.

*Get peace of mind.* When people file an accurate tax return and pay their taxes on time, they know that they're doing the right thing to follow the law.

*Some people should consider filing even if they aren't required*

People may want to file even if they make less than the filing threshold because they may get money back. This could apply to them if they:

* Have had federal income tax withheld from their pay

* Made estimated tax payments

* Qualify to claim tax credits [ [link removed] ] such as:

* Earned Income Tax Credit

* Child Tax Credit

* American Opportunity Tax Credit

* Credit for Federal Tax on Fuels

* Premium Tax Credit

* Health Coverage Tax Credit

* Credits for Sick and Family Leave

* Child and Dependent Care Credit

*The Interactive Tax Assistant [ [link removed] ] can help people determine if they need to file*

The Interactive Tax Assistant is an online tool that provides answers to common tax law questions based on an individual's specific circumstances. Based on a user?s input, it can determine if they should file a tax return. It can also help them understand:

* Their filing status

* If they can claim a dependent

* If the type of income they have is taxable

* If they're eligible to claim a credit

* If they can deduct expenses

The information is anonymous and only used to help answer the person's question. The tool will not share, store or use information in any other way, and it can?t identify the individual using it. The system discards the information the user provides when they exit a topic.

*More information:*

* Do I Need to File a Tax Return? [ [link removed] ]

* Publication 501, Dependents, Standard Deduction, and Filing Information [ [link removed] ]

Back to Top [ #Fifteenth ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe [ [link removed] ].

This message was distributed automatically from the mailing list IRS Newswire. Please Do Not Reply To This Message.

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&gt;

IRS.gov Banner

IRS Newswire ##line "Date"##

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia Center [ [link removed] ]

Noticias en Espa?ol [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News Home [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact My Local Office [ [link removed] ]

Filing Options [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

News [ [link removed] ]

Taxpayer Advocate [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

*Issue Number:*? ? FS-2024-02

*Inside This Issue?*

________________________________________________________________________

*Here?s who needs to file a tax return in 2024*

Most U.S. citizens [ [link removed] ] and permanent residents [ [link removed] ] who work in the United States need to file a tax return if they make more than a certain amount for the year.

The IRS has a variety of information available on IRS.gov to help taxpayers, including a special ?free help [ [link removed] ]? page. Here are some specific details to help people if they need to file a tax return.

*Factors that affect whether someone needs to file a tax return*

Here are some of the things that affect whether someone must file a tax return.

*Gross income.* Gross income means all income a person received in the form of money, goods, property and services that aren't exempt from tax. This includes any income from sources outside the United States or from the sale of a main home, even if you can exclude part or all of it.

*Required filing threshold.* People need to see if their gross income is over the required filing threshold. Filing statuses [ [link removed] ] have different income thresholds, so individuals may need to consider their potential filing status as well.

There are five filing statuses:

* Single

* Head of household

* Married filing jointly

* Married filing separate

* Qualifying surviving spouse

Find details on tax filing requirements with Publication 501, Dependents, Standard Deduction, and Filing Information [ [link removed] ].

*Tax year 2023 filing thresholds by filing status*

*Tax year 2023 filing thresholds by filing status*

*Self-employment status.* Self-employed individuals [ [link removed] ] must file an annual return and pay estimated tax quarterly if they had net earnings from self-employment of $400 or more.

*Status as a dependent.* A person claimed as a dependent may still have to file a return. It depends on their gross income, including:

* *Earned income.* This includes salaries, wages, tips, professional fees and other amounts received as pay for work performed.

* *Unearned income.* This is investment-type income and includes interest, dividends and capital gains, rents, royalties, etc. Distributions of interest, dividends, capital gains and other unearned income from a trust are also unearned income to a beneficiary of the trust.

A parent or guardian must file a tax return for dependents who need to file but aren't able to file for themselves.

*Potential benefits when people file a tax return*

*Get money back.* In some cases, people may get money back when they file a tax return. For example, if their employer withheld taxes from their paycheck, the person may be due a refund.

*Avoid interest and penalties.* People can avoid interest and penalties by filing an accurate tax return on time and paying any tax they owe before the deadline. They should file on time or request an extension [ [link removed] ] to avoid some penalties. If they owe a tax debt and can't pay all or part of it, the IRS can help [ [link removed] ].

*Build Social Security benefits.* Reporting income on a tax return is important for self-employed people because this information is used to calculate their Social Security benefit. Unreported income can lead to an incorrect calculation.

*Get an accurate picture of income.* When people report all their income, they give lenders an accurate financial picture to determine the loan amounts and rates they may receive.

*Get peace of mind.* When people file an accurate tax return and pay their taxes on time, they know that they're doing the right thing to follow the law.

*Some people should consider filing even if they aren't required*

People may want to file even if they make less than the filing threshold because they may get money back. This could apply to them if they:

* Have had federal income tax withheld from their pay

* Made estimated tax payments

* Qualify to claim tax credits [ [link removed] ] such as:

* Earned Income Tax Credit

* Child Tax Credit

* American Opportunity Tax Credit

* Credit for Federal Tax on Fuels

* Premium Tax Credit

* Health Coverage Tax Credit

* Credits for Sick and Family Leave

* Child and Dependent Care Credit

*The Interactive Tax Assistant [ [link removed] ] can help people determine if they need to file*

The Interactive Tax Assistant is an online tool that provides answers to common tax law questions based on an individual's specific circumstances. Based on a user?s input, it can determine if they should file a tax return. It can also help them understand:

* Their filing status

* If they can claim a dependent

* If the type of income they have is taxable

* If they're eligible to claim a credit

* If they can deduct expenses

The information is anonymous and only used to help answer the person's question. The tool will not share, store or use information in any other way, and it can?t identify the individual using it. The system discards the information the user provides when they exit a topic.

*More information:*

* Do I Need to File a Tax Return? [ [link removed] ]

* Publication 501, Dependents, Standard Deduction, and Filing Information [ [link removed] ]

Back to Top [ #Fifteenth ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe [ [link removed] ].

This message was distributed automatically from the mailing list IRS Newswire. Please Do Not Reply To This Message.

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery