| From | Joanna Ain, Prosperity Now <[email protected]> |

| Subject | This Week: The Expanded Child Tax Credit is moving! |

| Date | January 30, 2024 3:16 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

No images? Click here [link removed]

John,

The latest update on the expanded Child Tax Credit: it’s up for a vote in the House this week. We need Congress to hear from you ASAP to prioritize this progress for children and families.

Tell Congress: Pass the Expanded Child Tax Credit [[link removed]]

We know the essential elements that an expanded Child Tax Credit [[link removed]] needs in order to be rooted in justice—refundability, monthly payments, increased amount, and inclusion of kids regardless of what tax ID number they use.

But we can’t let perfect get in the way of our progress [[link removed]]. Our families and children are suffering today, and we can’t wait for Congress to create a perfectly equitable tax system for all that would include an expanded Child Tax Credit with everything we want.

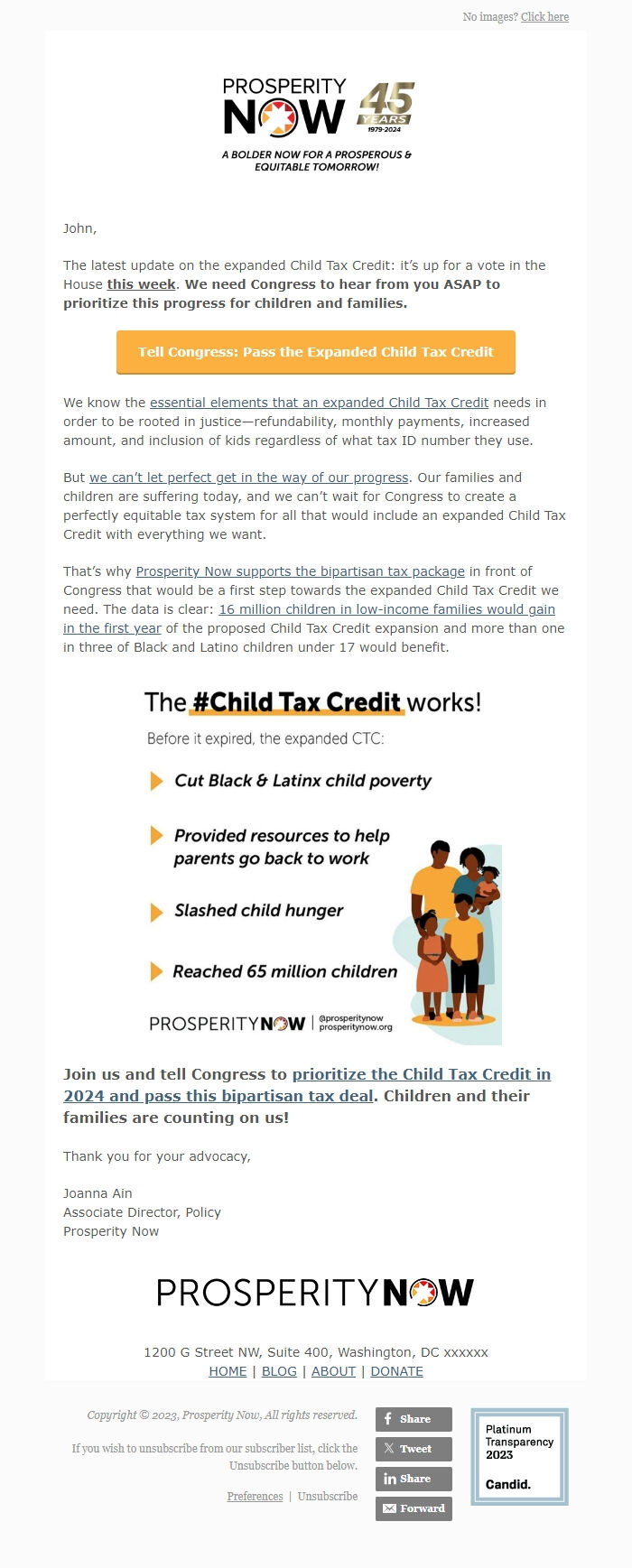

That’s why Prosperity Now supports the bipartisan tax package [[link removed]] in front of Congress that would be a first step towards the expanded Child Tax Credit we need. The data is clear: 16 million children in low-income families would gain in the first year [[link removed]] of the proposed Child Tax Credit expansion and more than one in three of Black and Latino children under 17 would benefit.

Join us and tell Congress to prioritize the Child Tax Credit in 2024 and pass this bipartisan tax deal [[link removed]]. Children and their families are counting on us!

Thank you for your advocacy,

Joanna Ain

Associate Director, Policy

Prosperity Now

1200 G Street NW, Suite 400, Washington, DC xxxxxx

HOME [[link removed]] | BLOG [[link removed]] | ABOUT [[link removed]] | DONATE [[link removed]]

Share [link removed] Tweet [link removed] Share [[link removed]] Forward [link removed]

Copyright © 2023, Prosperity Now, All rights reserved.

If you wish to unsubscribe from our subscriber list, click the Unsubscribe button below.

Preferences [link removed] | Unsubscribe [link removed]

John,

The latest update on the expanded Child Tax Credit: it’s up for a vote in the House this week. We need Congress to hear from you ASAP to prioritize this progress for children and families.

Tell Congress: Pass the Expanded Child Tax Credit [[link removed]]

We know the essential elements that an expanded Child Tax Credit [[link removed]] needs in order to be rooted in justice—refundability, monthly payments, increased amount, and inclusion of kids regardless of what tax ID number they use.

But we can’t let perfect get in the way of our progress [[link removed]]. Our families and children are suffering today, and we can’t wait for Congress to create a perfectly equitable tax system for all that would include an expanded Child Tax Credit with everything we want.

That’s why Prosperity Now supports the bipartisan tax package [[link removed]] in front of Congress that would be a first step towards the expanded Child Tax Credit we need. The data is clear: 16 million children in low-income families would gain in the first year [[link removed]] of the proposed Child Tax Credit expansion and more than one in three of Black and Latino children under 17 would benefit.

Join us and tell Congress to prioritize the Child Tax Credit in 2024 and pass this bipartisan tax deal [[link removed]]. Children and their families are counting on us!

Thank you for your advocacy,

Joanna Ain

Associate Director, Policy

Prosperity Now

1200 G Street NW, Suite 400, Washington, DC xxxxxx

HOME [[link removed]] | BLOG [[link removed]] | ABOUT [[link removed]] | DONATE [[link removed]]

Share [link removed] Tweet [link removed] Share [[link removed]] Forward [link removed]

Copyright © 2023, Prosperity Now, All rights reserved.

If you wish to unsubscribe from our subscriber list, click the Unsubscribe button below.

Preferences [link removed] | Unsubscribe [link removed]

Message Analysis

- Sender: Prosperity Now

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor