| From | Roosevelt Institute <[email protected]> |

| Subject | Roosevelt Rundown: A Pro-Corporate Tax Code Is Anti-Family |

| Date | January 24, 2024 7:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Taxing corporations improves the lives of families and children.

The Roosevelt Rundown features our top stories of the week.

View this in your browser and share with your friends. ([link removed])

[link removed]

** How Cutting Taxes Hurts Social Welfare Policy

------------------------------------------------------------

[link removed]

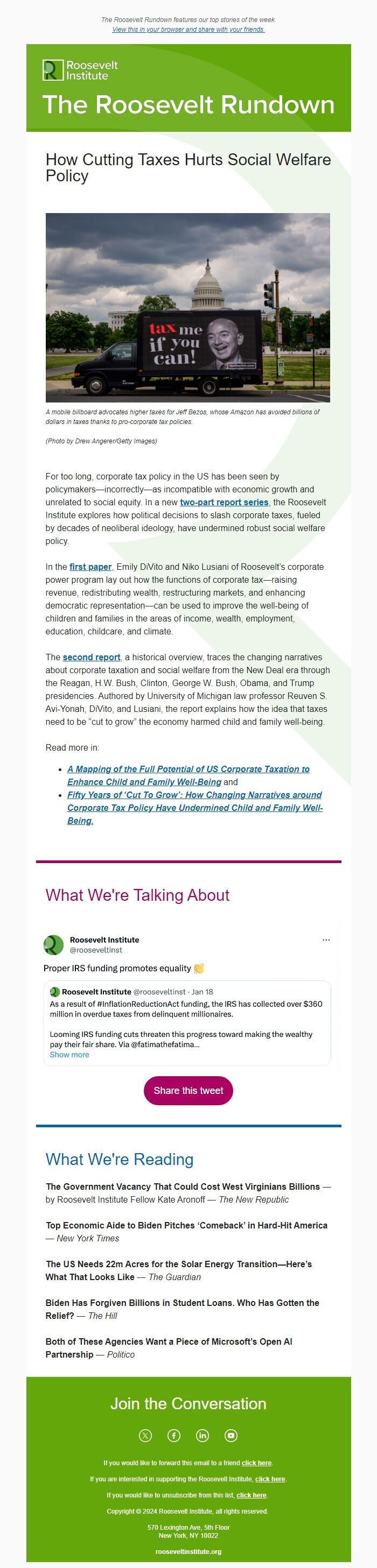

A mobile billboard advocates higher taxes for Jeff Bezos, whose Amazon has avoided billions of dollars in taxes thanks to pro-corporate tax policies.

(Photo by Drew Angerer/Getty Images)

For too long, corporate tax policy in the US has been seen by policymakers—incorrectly—as incompatible with economic growth and unrelated to social equity. In a new two-part report series ([link removed]) , the Roosevelt Institute explores how political decisions to slash corporate taxes, fueled by decades of neoliberal ideology, have undermined robust social welfare policy.

In the first paper ([link removed]) , Emily DiVito and Niko Lusiani of Roosevelt’s corporate power program lay out how the functions of corporate tax—raising revenue, redistributing wealth, restructuring markets, and enhancing democratic representation—can be used to improve the well-being of children and families in the areas of income, wealth, employment, education, childcare, and climate.

The second report ([link removed]) , a historical overview, traces the changing narratives about corporate taxation and social welfare from the New Deal era through the Reagan, H.W. Bush, Clinton, George W. Bush, Obama, and Trump presidencies. Authored by University of Michigan law professor Reuven S. Avi-Yonah, DiVito, and Lusiani, the report explains how the idea that taxes need to be “cut to grow” the economy harmed child and family well-being.

Read more in:

* A Mapping of the Full Potential of US Corporate Taxation to Enhance Child and Family Well-Being ([link removed]) and

* Fifty Years of ‘Cut To Grow’: How Changing Narratives around Corporate Tax Policy Have Undermined Child and Family Well-Being. ([link removed])

** What We're Talking About

------------------------------------------------------------

[link removed]

Share this tweet ([link removed])

** What We're Reading

------------------------------------------------------------

The Government Vacancy That Could Cost West Virginians Billions ([link removed]) — by Roosevelt Institute Fellow Kate Aronoff — The New Republic

Top Economic Aide to Biden Pitches ‘Comeback’ in Hard-Hit America ([link removed]) — New York Times

The US Needs 22m Acres for the Solar Energy Transition—Here’s What That Looks Like ([link removed]) — The Guardian

Biden Has Forgiven Billions in Student Loans. Who Has Gotten the Relief? ([link removed]) — The Hill

Both of These Agencies Want a Piece of Microsoft’s Open AI Partnership ([link removed]) — Politico

============================================================

Join the Conversation

** Twitter ([link removed])

** Facebook ([link removed])

** LinkedIn ([link removed])

** YouTube ([link removed])

If you would like to forward this email to a friend ** click here ([link removed])

.

If you are interested in supporting the Roosevelt Institute, ** click here ([link removed])

.

If you would like to unsubscribe from this list, ** click here ([link removed])

.

Copyright © 2024 Roosevelt Institute, all rights reserved.

570 Lexington Ave, 5th Floor

New York, NY 10022

rooseveltinstitute.org

The Roosevelt Rundown features our top stories of the week.

View this in your browser and share with your friends. ([link removed])

[link removed]

** How Cutting Taxes Hurts Social Welfare Policy

------------------------------------------------------------

[link removed]

A mobile billboard advocates higher taxes for Jeff Bezos, whose Amazon has avoided billions of dollars in taxes thanks to pro-corporate tax policies.

(Photo by Drew Angerer/Getty Images)

For too long, corporate tax policy in the US has been seen by policymakers—incorrectly—as incompatible with economic growth and unrelated to social equity. In a new two-part report series ([link removed]) , the Roosevelt Institute explores how political decisions to slash corporate taxes, fueled by decades of neoliberal ideology, have undermined robust social welfare policy.

In the first paper ([link removed]) , Emily DiVito and Niko Lusiani of Roosevelt’s corporate power program lay out how the functions of corporate tax—raising revenue, redistributing wealth, restructuring markets, and enhancing democratic representation—can be used to improve the well-being of children and families in the areas of income, wealth, employment, education, childcare, and climate.

The second report ([link removed]) , a historical overview, traces the changing narratives about corporate taxation and social welfare from the New Deal era through the Reagan, H.W. Bush, Clinton, George W. Bush, Obama, and Trump presidencies. Authored by University of Michigan law professor Reuven S. Avi-Yonah, DiVito, and Lusiani, the report explains how the idea that taxes need to be “cut to grow” the economy harmed child and family well-being.

Read more in:

* A Mapping of the Full Potential of US Corporate Taxation to Enhance Child and Family Well-Being ([link removed]) and

* Fifty Years of ‘Cut To Grow’: How Changing Narratives around Corporate Tax Policy Have Undermined Child and Family Well-Being. ([link removed])

** What We're Talking About

------------------------------------------------------------

[link removed]

Share this tweet ([link removed])

** What We're Reading

------------------------------------------------------------

The Government Vacancy That Could Cost West Virginians Billions ([link removed]) — by Roosevelt Institute Fellow Kate Aronoff — The New Republic

Top Economic Aide to Biden Pitches ‘Comeback’ in Hard-Hit America ([link removed]) — New York Times

The US Needs 22m Acres for the Solar Energy Transition—Here’s What That Looks Like ([link removed]) — The Guardian

Biden Has Forgiven Billions in Student Loans. Who Has Gotten the Relief? ([link removed]) — The Hill

Both of These Agencies Want a Piece of Microsoft’s Open AI Partnership ([link removed]) — Politico

============================================================

Join the Conversation

** Twitter ([link removed])

** Facebook ([link removed])

** LinkedIn ([link removed])

** YouTube ([link removed])

If you would like to forward this email to a friend ** click here ([link removed])

.

If you are interested in supporting the Roosevelt Institute, ** click here ([link removed])

.

If you would like to unsubscribe from this list, ** click here ([link removed])

.

Copyright © 2024 Roosevelt Institute, all rights reserved.

570 Lexington Ave, 5th Floor

New York, NY 10022

rooseveltinstitute.org

Message Analysis

- Sender: Roosevelt Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp