Fellow Conservative,

This week brought new information about COVID-19 and with that, new challenges. The team at Heritage Action is thankful for each of you and appreciates everything you are doing for the safety and well-being of our great nation.

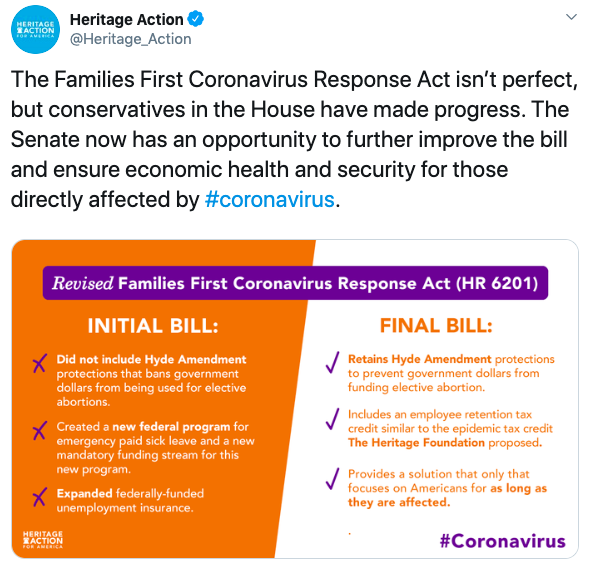

To better understand the past week in Washington and our work to advance conservative solutions, we created a day-by-day timeline of events from this past week in Congress.

But before we jump in, do you have questions about the effects of the virus and the actions the government is taking? Check out this easy guide to frequently asked questions (FAQ) about COVID-19 and the proper conservative policy response.